Securing your future against the potentially crippling costs of long-term care is a crucial financial planning step. However, navigating the complexities of long-term care insurance premiums can be daunting. This guide unravels the intricacies of these premiums, examining the factors that influence their cost, comparing different payment structures, analyzing historical and projected trends, and offering strategies for effective management. Understanding these elements empowers you to make informed decisions about protecting your financial well-being and ensuring peace of mind for the future.

From the impact of age and health status on initial premiums to the long-term effects of inflation protection and benefit levels, we explore the numerous variables that determine your monthly or annual payments. We’ll also compare different insurance providers and payment options, providing a clearer picture of how these choices can impact your overall costs. Finally, we offer practical strategies for managing your premiums and mitigating the financial burden of long-term care.

Factors Influencing Long-Term Care Insurance Premiums

Securing long-term care insurance involves careful consideration of various factors that significantly impact premium costs. Understanding these elements is crucial for making informed decisions and choosing a policy that aligns with your financial capabilities and long-term care needs. This section will delve into the key determinants of long-term care insurance premiums.

Age at Policy Inception

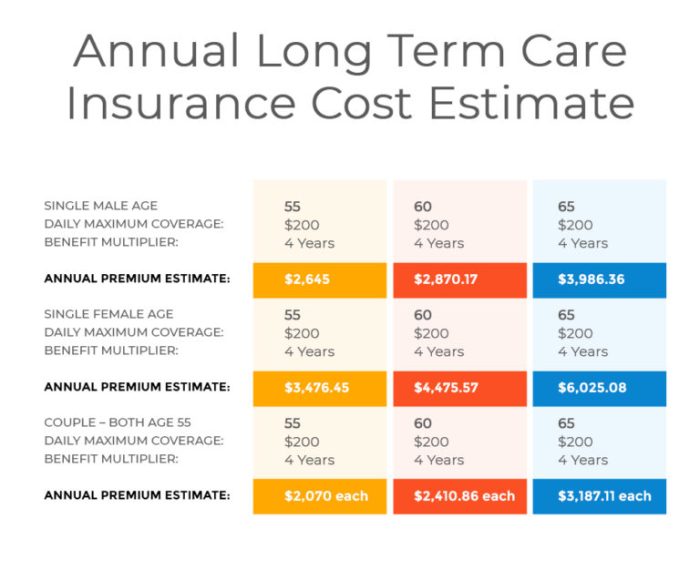

The age at which you purchase a long-term care insurance policy is a primary driver of premium costs. Younger individuals generally receive lower premiums due to their statistically lower risk of needing long-term care in the near future. Conversely, older applicants face substantially higher premiums reflecting the increased likelihood of needing care sooner. The following table illustrates projected premium increases over a 20-year period for various ages at policy inception. These figures are illustrative and will vary based on the insurer and specific policy details.

| Age | Initial Premium | Premium Year 10 | Premium Year 20 |

|---|---|---|---|

| 50 | $1,500 | $2,250 | $3,375 |

| 55 | $2,000 | $3,000 | $4,500 |

| 60 | $2,750 | $4,125 | $6,188 |

| 65 | $4,000 | $6,000 | $9,000 |

Health Status

An applicant’s health status plays a crucial role in premium calculations. Insurers carefully assess medical history and current health conditions to assess the risk of future long-term care needs. Pre-existing conditions, such as Alzheimer’s disease, Parkinson’s disease, stroke, or heart failure, can significantly increase premiums or even lead to policy denial. For example, an individual with a history of stroke might face significantly higher premiums than a healthy individual of the same age. The insurer’s underwriting process involves a thorough review of medical records and potentially a medical examination to accurately assess risk.

Policy Benefits

The level of benefits chosen directly impacts premium costs. Higher coverage amounts, longer benefit periods, and the inclusion of inflation protection all contribute to increased premiums.

The following bullet points compare premiums for different benefit levels, illustrating this relationship. These are illustrative examples and actual premiums will vary significantly based on other factors.

- Basic Coverage: $100/day benefit, 2-year benefit period, no inflation protection – Lower Premium

- Enhanced Coverage: $200/day benefit, 5-year benefit period, 3% annual inflation protection – Medium Premium

- Comprehensive Coverage: $300/day benefit, lifetime benefit period, 5% annual inflation protection – Highest Premium

Insurer’s Financial Strength and Claims Experience

The financial stability of the insurance company and its claims experience are also factors influencing premiums. Stronger insurers with a history of paying claims promptly tend to offer more competitive premiums, reflecting their lower risk profile. Conversely, insurers with weaker financial ratings or a high claims payout ratio may charge higher premiums to offset potential risks. Independent rating agencies provide assessments of insurer financial strength, enabling consumers to make informed choices.

Comparison of Long-Term Care Insurance Premium Structures

Choosing a long-term care insurance policy involves careful consideration of various factors, and understanding the different premium structures is crucial for making an informed decision. Premium structures significantly impact the overall cost and financial planning associated with securing long-term care coverage. This section will compare and contrast the most common premium payment options and highlight how underwriting practices and policy type influence the final premium.

Long-Term Care Insurance Premium Payment Options

The cost of long-term care insurance is presented in different payment structures, each with its own advantages and disadvantages. Selecting the right structure depends heavily on individual financial circumstances and risk tolerance.

| Payment Type | Description | Advantages | Disadvantages |

|---|---|---|---|

| Single Pay | The entire premium is paid upfront in a lump sum. | Lower overall cost due to no future premium increases; provides peace of mind knowing future costs are covered. | Requires a significant upfront investment; may not be feasible for everyone; no flexibility if financial circumstances change. |

| Level Premiums | Premiums remain constant throughout the policy term. | Predictable and consistent monthly payments; easier budgeting; provides stability. | Premiums may be higher than step-rate premiums initially; may not reflect future inflation or healthcare cost increases. |

| Step-Rate Premiums | Premiums increase periodically throughout the policy term. | Lower initial premiums compared to level premiums; premiums adjust to reflect potential future cost increases. | Premiums can become significantly higher over time; less predictable budgeting; potential for financial strain later in the policy term. |

Impact of Underwriting Practices on Premium Costs

Insurance companies employ different underwriting practices that significantly affect premium costs. These practices involve assessing the applicant’s health, lifestyle, and other risk factors to determine the level of risk associated with insuring them. For example, one company might offer a lower premium for a non-smoker in excellent health, while another might place more emphasis on family history of chronic illnesses, resulting in higher premiums for individuals with such history, even if they are currently healthy. A company with a more stringent underwriting process may have higher premiums but potentially offer better coverage terms. Conversely, a company with less stringent underwriting might have lower initial premiums but might also have higher rates of claims and potentially less comprehensive coverage.

Factors Contributing to Premium Variations Between Individual and Group Policies

Individual and group long-term care insurance policies often differ significantly in premium costs. Individual policies are tailored to the specific needs and risk profile of the applicant, resulting in premiums that reflect their unique circumstances. Group policies, offered through employers or associations, typically offer lower premiums due to economies of scale and a larger, more diverse pool of insured individuals. The risk is spread across a larger group, leading to lower individual premiums. However, group policies may offer less flexibility in terms of benefit options and coverage amounts compared to individual policies. Furthermore, group policies may not be available to everyone, and their availability and terms are subject to the policies of the group provider.

Long-Term Care Insurance Premium Trends and Projections

Understanding the historical trends and future projections of long-term care insurance premiums is crucial for individuals planning for their future healthcare needs. Premiums are not static; they fluctuate based on a variety of factors, making informed decision-making essential. This section analyzes past trends and explores the factors likely to shape future premium costs.

Historical Premium Trends (2014-2024)

Analyzing data from various insurance providers over the past decade reveals a consistent upward trend in long-term care insurance premiums. While precise figures vary by insurer and policy specifics, a general pattern of increasing costs is evident. A hypothetical line graph illustrating this trend would show a steadily rising line, perhaps with minor fluctuations year to year, but overall exhibiting a clear upward trajectory. The graph’s X-axis would represent the years from 2014 to 2024, and the Y-axis would represent the average annual premium cost, perhaps indexed to a base year like 2014 for easier comparison. The slope of the line would indicate the rate of premium increases, likely steeper in recent years reflecting increased healthcare costs and claims. For instance, a hypothetical example could show a 2014 average premium of $1,500 increasing to $2,500 by 2024, a significant rise. This increase is not uniform across all policies; factors such as age at purchase, benefit level, and policy features significantly influence the rate of premium growth.

Factors Influencing Future Premium Increases

Several factors are expected to contribute to future premium increases. Healthcare inflation is a primary driver. The cost of medical care, including nursing home services and home healthcare, consistently outpaces general inflation. This means the cost of providing the benefits covered by long-term care insurance policies is continuously rising, necessitating premium adjustments to maintain solvency. Changing demographics also play a significant role. The aging population in many developed countries means a larger pool of individuals requiring long-term care, increasing the insurer’s payout obligations. Increased longevity further exacerbates this issue, as individuals live longer and require care for extended periods. Additionally, improvements in medical technology, while beneficial for patients, often lead to higher treatment costs, further pressuring premiums. Finally, increased regulatory scrutiny and legal challenges could also lead to higher costs for insurers, which are often passed on to policyholders.

Hypothetical Scenario: Inflation Adjustment Options

Let’s consider a hypothetical scenario to illustrate the impact of different inflation adjustment options. Assume an individual purchases a long-term care policy in 2025 with an initial annual premium of $2,000. Three potential inflation adjustment options are: (1) No adjustment (premium remains constant); (2) Simple inflation adjustment (premium increases by the annual rate of inflation, say 3%); (3) Compound inflation adjustment (premium increases by the annual rate of inflation, compounded annually).

Under option (1), the premium remains at $2,000 throughout the policy’s duration. However, this is unlikely to be sustainable in the long term given the rising cost of healthcare. Under option (2), the premium would increase by 3% annually. After 5 years, the premium would be approximately $2,319. After 10 years, it would be approximately $2,687. Under option (3), the compounding effect would lead to significantly higher premiums. After 5 years, the premium would be approximately $2,319, but after 10 years, it would be approximately $2,720 – higher than the simple inflation model due to compounding. This illustrates how different inflation adjustment mechanisms can lead to substantially different premium trajectories over time, significantly impacting the long-term cost of the policy. Choosing a policy with a clear understanding of its inflation adjustment mechanism is crucial.

Final Conclusion

Planning for long-term care is a critical aspect of comprehensive financial security. While the cost of long-term care insurance premiums can seem significant, understanding the factors influencing these costs, exploring various payment options, and employing effective management strategies empowers individuals to make informed choices. By carefully considering your individual circumstances and future needs, you can secure the appropriate level of coverage while minimizing the financial burden. Proactive planning and a thorough understanding of long-term care insurance premiums are key to securing a financially stable and comfortable future.

Frequently Asked Questions

What is the average cost of long-term care insurance?

The average cost varies significantly based on age, health, coverage level, and other factors. It’s impossible to give a single average, but obtaining quotes from multiple insurers is crucial.

Can I cancel my long-term care insurance policy?

Yes, but policies usually have surrender charges that decrease over time. Review your policy’s terms and conditions carefully before canceling.

Are long-term care insurance premiums tax deductible?

In some cases, premiums may be partially tax deductible, depending on your individual circumstances and tax laws. Consult a tax advisor for personalized guidance.

What happens if my health deteriorates after purchasing a policy?

Most policies will still cover you, but your premiums may not increase. However, pre-existing conditions might affect eligibility for certain types of coverage.

How do I compare different long-term care insurance policies?

Compare coverage amounts, benefit periods, inflation protection, and payment options. Consider the insurer’s financial strength and customer reviews. Using an independent insurance broker can assist in this process.