Securing your family’s financial future often hinges on a seemingly simple document: your life insurance premium quote. Understanding its intricacies, however, can be surprisingly complex. This guide navigates the often-murky waters of life insurance costs, empowering you to make informed decisions about protecting your loved ones.

From deciphering the jargon to comparing quotes from various providers, we’ll equip you with the knowledge to confidently choose a policy that aligns with your needs and budget. We’ll explore the factors that influence premiums, the different types of policies available, and strategies for managing your payments effectively. By the end, you’ll be well-prepared to navigate the world of life insurance with greater understanding and assurance.

Understanding Life Insurance Premium Quotes

Securing life insurance involves understanding the factors that determine your premium cost. This understanding empowers you to make informed decisions about the type and level of coverage that best suits your needs and budget. The premium you pay is calculated based on a variety of individual circumstances and policy choices.

Factors Influencing Life Insurance Premium Costs

Several key factors contribute to the cost of your life insurance premiums. These factors are assessed by insurance companies to determine the level of risk associated with insuring you. A higher perceived risk generally translates to higher premiums. The most significant factors include age, health, lifestyle, policy type, and the amount of coverage desired.

Types of Life Insurance Policies and Premium Structures

Life insurance policies are categorized into different types, each with its own premium structure. The primary distinctions lie in the length of coverage and the investment features included. Understanding these differences is crucial for selecting a policy that aligns with your financial goals and risk tolerance.

Term life insurance provides coverage for a specific period (term), offering a lower premium compared to permanent policies. Whole life insurance provides lifelong coverage and includes a cash value component that grows over time, resulting in higher premiums. Universal life insurance offers lifelong coverage with flexible premiums and a cash value component, but the premium amount can fluctuate depending on market performance and the policy’s cash value.

Impact of Age, Health, and Lifestyle on Premium Quotes

Age significantly impacts life insurance premiums. Younger individuals generally receive lower premiums due to a lower statistical risk of mortality. As age increases, so does the premium. Health is another crucial factor. Individuals with pre-existing health conditions or unhealthy lifestyles typically face higher premiums due to the increased risk of early mortality. Lifestyle factors such as smoking, excessive alcohol consumption, and dangerous hobbies can also affect premium costs. For instance, a 30-year-old non-smoker in excellent health will likely receive a lower premium than a 50-year-old smoker with a history of heart disease.

Premium Comparison: Term, Whole, and Universal Life Insurance

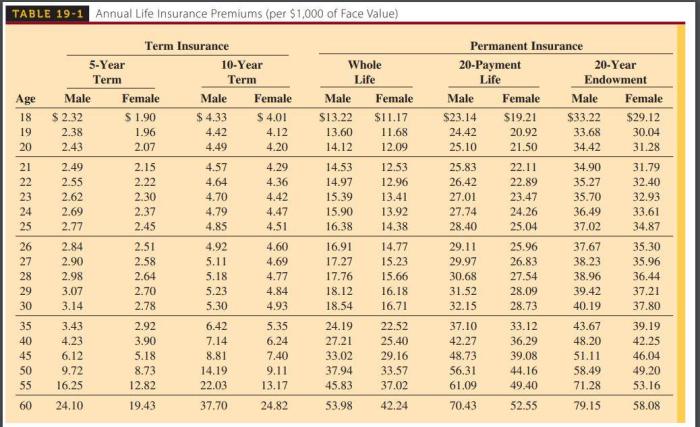

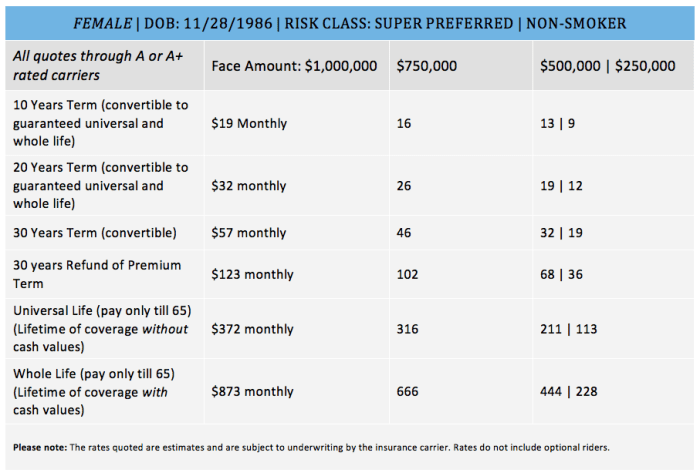

The following table provides a simplified comparison of premiums for three common types of life insurance policies. Note that these are illustrative examples and actual premiums will vary based on individual circumstances and the specific insurer.

| Policy Type | Premium Structure | Coverage Period | Example Monthly Premium (USD) for $250,000 Coverage, 35-year-old male, non-smoker) |

|---|---|---|---|

| Term Life (20-year) | Fixed, level premium for the term | 20 years | $25 |

| Whole Life | Fixed, level premium for life | Lifelong | $100 |

| Universal Life | Flexible, adjustable premium | Lifelong | $50 – $150 (variable) |

Obtaining a Life Insurance Premium Quote

Securing a life insurance premium quote is the crucial first step in protecting your loved ones’ financial future. Understanding the process and the information required will empower you to make informed decisions and find the best coverage for your needs. This section will guide you through obtaining accurate quotes and comparing offers from various insurers.

The Online Quote Process

Getting a life insurance quote online is typically straightforward and convenient. Most insurers offer online quote tools that require you to input specific personal and health-related information. The process usually involves answering a series of questions through an online form. This allows the insurer’s system to quickly assess your risk profile and provide a preliminary quote. After submitting the form, you’ll usually receive your quote instantly or within a short timeframe via email. Some insurers may require a follow-up phone call to clarify certain details or confirm information.

Key Information Needed for Accurate Quotes

Providing accurate information is vital for receiving a precise life insurance premium quote. Inaccurate information can lead to an inaccurate assessment of risk, resulting in either an inappropriately high or low premium. Key information typically requested includes your age, gender, health status (including any pre-existing conditions), smoking habits, desired coverage amount, and the length of the policy term (e.g., term life insurance for 10 years, 20 years, or whole life insurance). Additionally, some insurers may ask about your occupation, family history of certain diseases, and lifestyle choices.

The Importance of Comparing Quotes from Multiple Insurers

Comparing quotes from multiple insurers is essential to ensure you’re getting the best possible value for your money. Life insurance premiums can vary significantly between companies, even for individuals with similar profiles. This variation stems from differences in underwriting practices, risk assessment methodologies, and the types of policies offered. By comparing several quotes, you can identify the insurer offering the most competitive premium for the desired level of coverage. This proactive approach can save you a substantial amount of money over the life of the policy.

A Step-by-Step Guide to Obtaining Quotes

To effectively compare quotes, follow these steps:

- Identify your needs: Determine the type of life insurance (term, whole, universal, etc.) and the desired coverage amount. Consider your financial goals and the needs of your beneficiaries.

- Gather your information: Collect all the necessary personal and health information, including your age, gender, height, weight, health history, and lifestyle details. Have this readily available to expedite the quote process.

- Visit multiple insurer websites: Explore the websites of several reputable life insurance companies. Many offer online quote tools that allow for quick and easy quote generation.

- Complete online quote forms: Carefully and accurately complete each insurer’s online quote form, ensuring all information is correct. Inconsistent information across quotes will make comparison difficult.

- Compare quotes: Once you receive your quotes, carefully compare the premiums, policy terms, and benefits offered by each insurer. Consider factors beyond just the premium, such as the insurer’s financial strength and customer service ratings.

- Contact insurers for clarification: If you have any questions or require further clarification on any aspect of a quote, don’t hesitate to contact the insurer directly. They can provide additional details and address any concerns.

Deciphering Life Insurance Quote Components

Understanding the components of a life insurance quote is crucial for making an informed decision. A quote isn’t just a single number; it’s a detailed breakdown of costs and benefits. This section will clarify the key elements you’ll find in your quote, enabling you to compare policies effectively.

Death Benefit

The death benefit is the core of a life insurance policy. It represents the sum of money your beneficiaries will receive upon your death. This amount is typically a fixed sum, although some policies offer variable death benefits based on market performance (though these are riskier and not always recommended). For example, a $500,000 death benefit means your loved ones will receive $500,000 after your passing, provided all policy conditions are met. The death benefit is the primary factor to consider when determining the appropriate coverage amount, reflecting your financial responsibilities and the needs of your dependents.

Cash Value

Certain life insurance policies, particularly whole life policies, accumulate cash value over time. This cash value grows tax-deferred and can be borrowed against or withdrawn under specific conditions. It’s essentially a savings component built into the policy. The cash value growth rate depends on the policy’s design and the insurer’s investment performance. For instance, a whole life policy might build a significant cash value over 20 years, providing a source of funds for retirement or other financial needs. However, remember that accessing the cash value can impact the death benefit.

Premium Payment Period

The premium payment period specifies the duration you’ll pay premiums for your life insurance policy. Common options include level term (fixed premiums for a set period), whole life (premiums paid throughout your life), or limited-pay whole life (premiums paid for a shorter, specified period, such as 10 or 20 years). A shorter premium payment period usually means higher premiums during the payment period. Choosing the right payment period depends on your financial goals and risk tolerance. For example, a 20-year limited-pay whole life policy offers the advantage of being paid off within 20 years, eliminating future premium payments, although individual premiums will be higher than a level term policy.

Fees and Charges

Several fees and charges can be associated with life insurance policies. Understanding these is vital for accurate cost comparison.

- Mortality and Expense Charges: These reflect the insurer’s costs for managing the policy and paying death benefits. They are usually built into the premium.

- Administrative Fees: Some policies may include annual administrative fees.

- Surrender Charges: If you cancel the policy early, surrender charges may apply. These charges typically decrease over time.

- Policy Loans Interest: If you borrow against your cash value, you’ll pay interest on the loan.

It’s crucial to carefully review the policy’s fee schedule to fully understand the total cost of ownership. These fees can significantly affect the overall cost of your insurance over time. For example, a seemingly low premium could be offset by high surrender charges if you cancel early.

Factors Affecting Premium Quote Accuracy

The accuracy of your life insurance premium quote is paramount in ensuring you receive the appropriate coverage at a fair price. Several factors can influence the precision of a quote, ranging from the information you provide to the methodology used by the insurer. Understanding these factors is crucial for making informed decisions about your life insurance needs.

Inaccurate or incomplete information significantly impacts the accuracy of a life insurance premium quote. For instance, providing incorrect details about your age, health history (including pre-existing conditions and current medications), lifestyle habits (smoking, alcohol consumption, and risky activities), or occupation can lead to a quote that is either too low (risking inadequate coverage) or too high (resulting in unnecessary expense). Even seemingly minor omissions can have a substantial effect on the final premium. For example, failing to disclose a family history of heart disease could lead to a lower initial quote, only to be significantly adjusted upward after a medical examination during the underwriting process.

Impact of Inaccurate or Incomplete Information

Providing inaccurate information, whether intentional or unintentional, can lead to several problems. Firstly, an inaccurate quote may result in insufficient coverage. A lower-than-expected premium may reflect a lower death benefit than needed to meet your family’s financial obligations. Conversely, an inflated premium due to inaccurate information represents a financial burden that could have been avoided. Secondly, misrepresenting information is a breach of contract and can invalidate your policy if discovered later. Insurers have rigorous verification processes, and inaccurate information will be detected during underwriting. This could lead to policy cancellation or increased premiums retroactively applied. Finally, inaccurate information undermines the trust between the policyholder and the insurer, compromising the relationship.

Accuracy of Online vs. Agent Quotes

Online quotes offer a convenient and quick way to obtain a preliminary estimate of life insurance premiums. However, they typically rely on self-reported information and may not account for nuanced health factors or lifestyle details. Agent-obtained quotes, on the other hand, involve a more thorough assessment, including a discussion with a professional who can guide you through the process and clarify any uncertainties. While online quotes can provide a useful starting point, they should not be considered definitive. The accuracy of an online quote depends entirely on the accuracy of the information provided. Agent-obtained quotes generally provide a more accurate representation of your premium because they involve a more comprehensive review of your circumstances.

Verifying Quote Accuracy

Verifying the accuracy of a life insurance quote involves a multi-step process. First, carefully review all the details provided in the quote, comparing them to the information you initially supplied. Check for any discrepancies in your age, health history, occupation, and lifestyle details. Second, contact the insurance provider or agent to clarify any uncertainties or inconsistencies. Ask specific questions about the factors influencing the premium, such as the underwriting class assigned. Third, compare quotes from multiple insurers. This helps you understand the range of premiums available and identifies any significant discrepancies that might warrant further investigation. Finally, review the policy documents thoroughly before signing, ensuring the details align with the initial quote.

Underwriting’s Influence on Final Premium Cost

Underwriting is a crucial step in the life insurance process. It involves a comprehensive review of your health history, lifestyle, and other relevant factors to assess your risk profile. The underwriter’s assessment directly impacts the final premium cost. Factors considered include medical history (pre-existing conditions, family history), lifestyle choices (smoking, alcohol consumption, risky hobbies), and occupation. For instance, a person with a history of heart disease or who smokes heavily will likely receive a higher premium than a healthy, non-smoking individual. The underwriting process may involve medical examinations, blood tests, and further questioning to gather complete and accurate information for risk assessment. This comprehensive review ensures the premium accurately reflects the individual’s risk profile, ensuring fair pricing for both the insurer and the policyholder.

Managing Life Insurance Premiums

Effectively managing your life insurance premiums is crucial for maintaining coverage and avoiding financial strain. Understanding various payment options and the potential consequences of missed payments allows for proactive planning and peace of mind. This section details strategies for managing premiums, adjusting payment plans, and understanding the implications of non-payment.

Strategies for Managing Premium Payments

Several strategies can simplify premium payments and improve financial management. These include setting up automatic payments, budgeting specifically for premiums, and exploring potential premium discounts. Careful planning ensures consistent coverage.

- Automatic Payments: Automating premium payments through bank drafts or electronic transfers eliminates the risk of missed payments and simplifies budgeting. This method ensures consistent coverage without requiring manual intervention.

- Budgeting: Integrating life insurance premiums into your monthly budget ensures that the cost is accounted for and reduces the likelihood of unexpected financial burdens. Treat it like any other essential expense, such as rent or utilities.

- Premium Discounts: Inquire about potential discounts offered by your insurer. Some companies offer discounts for paying annually or semi-annually, or for bundling policies (e.g., combining life insurance with other products).

Adjusting Premium Payments Based on Financial Circumstances

Life’s circumstances can change, impacting your ability to maintain premium payments. Fortunately, several options exist to adjust payment schedules and manage premiums during financial hardship.

- Extended Payment Options: Contact your insurer to explore options for extending the payment period. This may involve paying smaller amounts over a longer timeframe, though it might result in slightly higher overall costs due to interest.

- Reduced Coverage: As a last resort, you may consider reducing your coverage amount to lower your premiums. This should only be considered after careful evaluation of your needs and financial situation. A financial advisor can assist with this assessment.

- Policy Loans: Some policies offer the option to borrow against the policy’s cash value to cover premiums. However, it’s important to understand the interest implications and potential impact on the policy’s death benefit.

Consequences of Missing Premium Payments

Missing premium payments can have significant consequences, impacting your coverage and potentially leading to financial difficulties. Understanding these consequences is vital for responsible policy management.

- Policy Lapse: The most significant consequence is the lapse of your policy. This means your coverage terminates, leaving your beneficiaries without the financial protection the policy provided. The grace period (if applicable) is crucial to understand and utilize.

- Reinstatement Challenges: Reinstatement after a lapse can be difficult and may involve proving insurability, paying back premiums with interest, and potentially facing higher premiums in the future.

- Financial Penalties: Late payment fees and penalties can add up significantly, increasing your financial burden. It is important to maintain regular communication with your insurer to address any payment difficulties proactively.

Benefits of Reviewing and Adjusting Policies Periodically

Regularly reviewing and adjusting your life insurance policy ensures it continues to meet your evolving needs and financial situation. Proactive adjustments can prevent future issues and optimize your coverage.

- Needs Assessment: Periodically reassess your life insurance needs. Major life events like marriage, childbirth, or career changes can significantly impact your insurance requirements.

- Premium Optimization: Review your policy’s premium structure and explore opportunities to optimize costs while maintaining adequate coverage. This might involve switching to a different policy type or insurer.

- Beneficiary Updates: Ensure your beneficiaries are up-to-date. Changes in family dynamics or relationships may require adjusting the beneficiaries listed on your policy.

Conclusive Thoughts

Obtaining and understanding your life insurance premium quote is a crucial step in securing your family’s financial well-being. By carefully considering the factors influencing premiums, comparing quotes from multiple insurers, and regularly reviewing your policy, you can ensure you have the appropriate coverage at a manageable cost. Remember, proactive planning and informed decision-making are key to achieving peace of mind.

Popular Questions

What is the difference between term and whole life insurance?

Term life insurance provides coverage for a specific period (term), while whole life insurance offers lifelong coverage and builds cash value.

How often are life insurance premiums reviewed?

It’s recommended to review your life insurance policy and premiums annually, or whenever there’s a significant life change (marriage, children, career shift).

Can I change my premium payment frequency?

Most insurers offer various payment options, such as monthly, quarterly, semi-annually, or annually. Contact your insurer to explore available options.

What happens if I miss a premium payment?

Missing payments can lead to policy lapse. Most insurers offer grace periods, but prolonged non-payment will result in policy cancellation.

What is underwriting and how does it affect my quote?

Underwriting is the process where the insurer assesses your risk profile (health, age, lifestyle) to determine your premium. Higher risk profiles typically result in higher premiums.