Securing your family’s future through life insurance is a crucial step, but navigating the complexities of premiums can feel daunting. Understanding how much life insurance will cost is a key first step in this important process. This guide delves into the world of life insurance premium estimators, equipping you with the knowledge to confidently estimate your premiums and make informed decisions about protecting your loved ones.

We’ll explore various estimator types, factors influencing premium calculations (like age, health, and lifestyle choices), and provide a step-by-step guide on using these tools effectively. Learn how to interpret the results, compare estimates from different sources, and take the next steps towards securing the right life insurance coverage for your unique circumstances. Ultimately, this guide aims to demystify the process, empowering you to make informed choices about your financial future.

Understanding Life Insurance Premium Estimators

Life insurance premium estimators are valuable tools for individuals seeking to understand the cost of life insurance coverage before committing to a policy. These estimators provide a quick and convenient way to obtain a preliminary estimate of premiums based on various factors, allowing potential customers to compare options and make informed decisions. Understanding how these estimators work and their limitations is crucial for effective use.

Life insurance premium estimators function by taking user-provided information, such as age, health status, desired coverage amount, and policy type, and applying actuarial calculations to estimate the likely premium cost. The accuracy of the estimate depends on the completeness and accuracy of the input data and the sophistication of the estimator’s algorithms.

Types of Life Insurance Policies and Premium Calculation

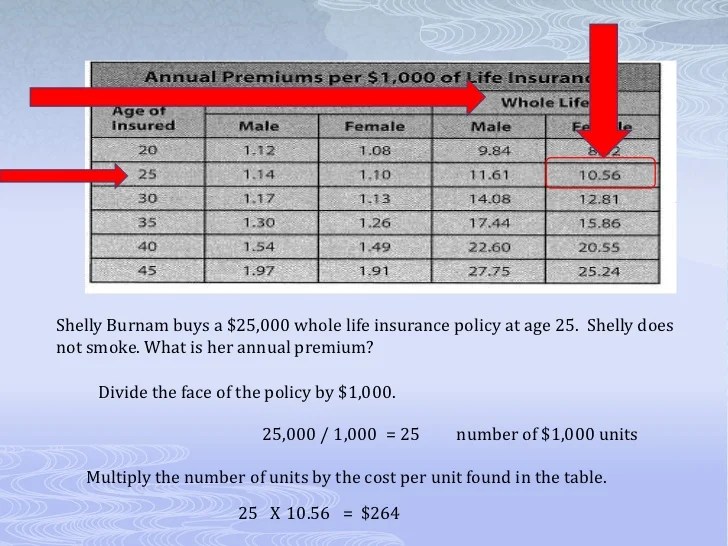

Several types of life insurance policies exist, each with its own premium calculation method. Term life insurance, for example, provides coverage for a specific period (term), and premiums are generally lower than for permanent policies due to the limited coverage duration. Whole life insurance, conversely, offers lifelong coverage and typically involves higher premiums due to the extended protection. Universal life and variable life insurance policies offer flexibility in premium payments and death benefits, leading to varying premium calculations depending on the policy’s features and the investment performance in the case of variable life. Premiums are calculated based on factors including age, health, lifestyle (smoking, hobbies), desired coverage amount, and policy features. Actuarial tables, which reflect statistical probabilities of death at various ages and health conditions, form the basis of these calculations. For instance, a younger, healthier individual will generally receive a lower premium than an older individual with pre-existing health conditions for the same coverage amount.

Online vs. Offline Premium Estimation Methods

Online life insurance premium estimators offer convenience and accessibility. Users can input their information and receive an immediate estimate without needing to contact an agent. However, online estimators might provide less personalized advice and may not account for all individual circumstances. Offline methods, such as consulting with an insurance agent, offer a more personalized approach. Agents can consider specific health conditions, family history, and other factors that may influence premiums, potentially leading to a more accurate estimate. They can also explain the nuances of different policies and help customers choose the most suitable coverage. While online methods offer speed and convenience, offline methods provide a more in-depth and personalized assessment.

Comparison of Life Insurance Premium Estimators

The accuracy and features of life insurance premium estimators vary significantly. The following table compares some popular options (Note: Accuracy is relative and depends on individual circumstances; ease of use is subjective):

| Estimator Name | Accuracy | Features | Ease of Use |

|---|---|---|---|

| Company A’s Online Estimator | Moderate; provides a general range | Covers multiple policy types, allows for various coverage amounts, considers age and health | High; intuitive interface |

| Company B’s Online Estimator | High; uses detailed health questionnaires | Detailed health questions, various policy options, allows for add-ons | Moderate; requires more detailed input |

| Company C’s Agent-Assisted Estimator | High; personalized assessment | Comprehensive policy options, personalized advice, considers individual circumstances | Moderate; requires interaction with an agent |

| Generic Online Estimator (Unbranded) | Low; provides a very broad estimate | Basic policy types, limited customization | High; simple interface |

Factors Influencing Life Insurance Premiums

Several key factors interact to determine the cost of your life insurance premiums. Understanding these factors allows you to make informed decisions about the type and amount of coverage you need. This section will detail the major elements influencing premium calculations.

Age

Age is a significant factor in determining life insurance premiums. Statistically, the older you are, the higher your risk of death. Insurance companies base their pricing models on actuarial tables reflecting mortality rates at different ages. Therefore, younger applicants typically qualify for lower premiums than older applicants seeking the same coverage. For example, a 30-year-old might receive a significantly lower premium than a 50-year-old, even with identical health profiles and policy details.

Health and Lifestyle

Your health and lifestyle choices directly impact your life expectancy and, consequently, your insurance premium. Insurance companies assess your health through medical questionnaires and sometimes medical examinations. Pre-existing conditions like diabetes, heart disease, or cancer will typically result in higher premiums, reflecting the increased risk. Lifestyle factors such as smoking, excessive alcohol consumption, and a lack of physical activity also increase premiums because they contribute to higher mortality rates. A smoker, for instance, might pay considerably more than a non-smoker for the same coverage.

Coverage Amount and Policy Term Length

The amount of coverage you choose significantly affects your premium. A larger death benefit necessitates a higher premium because the insurance company assumes a greater financial obligation. Similarly, the length of your policy term influences the cost. A whole life policy, providing lifelong coverage, will generally have higher premiums than a term life policy, offering coverage for a specified period (e.g., 10, 20, or 30 years). The longer the term, the higher the premium, as the insurer bears the risk for a longer duration. A $500,000 whole life policy will cost substantially more than a $250,000 20-year term policy.

Risk Factors and Premium Costs

Various other factors contribute to the overall risk assessment and, thus, the premium. These can include occupation (high-risk jobs may lead to higher premiums), family history of certain diseases, and even your hobbies (e.g., skydiving or extreme sports). For example, a construction worker might pay more than an office worker for the same coverage due to the inherent risks associated with their profession. Similarly, a family history of heart disease might result in a higher premium compared to someone with a family history free of such conditions.

Interpreting the Results of a Life Insurance Premium Estimator

A life insurance premium estimator provides a valuable starting point for understanding the potential cost of your life insurance. However, it’s crucial to remember that the estimated premium is just that – an estimate. Several factors can influence the final premium offered by an insurance company, so it’s important to interpret the results with a degree of caution and further investigation.

Understanding Estimated Premium Amounts

The estimated premium amount displayed by an online calculator represents a preliminary cost based on the information you provided. This figure gives you a general idea of what you might expect to pay, but it shouldn’t be considered a firm quote. For example, an estimator might show a monthly premium of $50 for a $250,000 policy, but the final premium could vary depending on the factors discussed below.

Additional Factors Influencing Final Premiums

Several factors beyond those included in the estimator can affect the final premium offered by an insurance company. These include:

- Underwriting Process: The insurance company’s underwriting process involves a more thorough review of your health history, lifestyle, and occupation. This review can lead to adjustments to the initial estimate. For example, a smoker may receive a higher premium than a non-smoker, even if the estimator didn’t explicitly request smoking status.

- Specific Policy Details: The type of policy (term life, whole life, universal life, etc.) and specific features (e.g., riders for accidental death or critical illness) significantly impact the premium. A term life insurance policy, which covers a specified period, will typically be cheaper than a whole life policy offering lifelong coverage.

- Company-Specific Risk Assessment: Different insurance companies use different algorithms and risk assessment models, resulting in variations in premium pricing. One company might assess a particular risk factor more heavily than another.

- Financial Health of the Insurer: The financial stability of the insurance company itself can subtly influence pricing. Companies with higher ratings might offer slightly different premiums than those with lower ratings.

Comparing Premium Estimates from Different Estimators

To get a comprehensive understanding of potential premiums, it’s recommended to use several different online premium estimators. Compare the results, paying attention to the specific inputs required by each estimator and the resulting premium amounts. Discrepancies in estimates highlight the importance of obtaining a formal quote from an insurance agent. Note that the range of estimates provides a better picture of the potential cost than any single estimate.

Impact of Input Variables on Estimated Premiums

The following table illustrates how different input variables can affect the estimated premium. These values are illustrative examples and will vary widely depending on the specific estimator and the insurer.

| Input Variable | Premium Impact |

|---|---|

| Age (30 vs. 40) | A 40-year-old will generally pay a significantly higher premium than a 30-year-old, reflecting increased risk. For example, a $250,000 policy might cost $30 per month for a 30-year-old and $60 per month for a 40-year-old. |

| Health Status (Excellent vs. Poor) | Individuals with pre-existing health conditions or poor health will typically face higher premiums. A person with excellent health might pay $40 per month, while someone with a pre-existing condition might pay $80 per month for the same coverage. |

| Smoking Status (Smoker vs. Non-Smoker) | Smokers generally pay substantially more than non-smokers. A non-smoker might pay $50 per month, whereas a smoker could pay $100 per month for the same coverage. |

| Policy Type (Term vs. Whole Life) | A term life policy covering a 20-year period will be considerably cheaper than a whole life policy with lifelong coverage. For instance, a term policy might cost $35 per month while a whole life policy could cost $120 per month. |

Visual Representation of Premium Factors

Understanding how various factors influence life insurance premiums is crucial for making informed decisions. Visual aids can significantly enhance this understanding by clearly demonstrating the relationships between these factors and the resulting premium costs. The following examples illustrate how age and health status impact premiums.

Age and Premium Costs

Imagine a graph charting the relationship between age and life insurance premiums. The x-axis represents age, ranging from, say, 18 to 65. The y-axis represents the annual premium cost. The graph would show a generally upward-sloping curve, starting relatively flat in younger adulthood, then gradually increasing in steepness as age increases. This reflects the increased risk of mortality associated with older age. The curve isn’t perfectly linear; it might accelerate more sharply after a certain age (perhaps around 50), reflecting a more significant increase in mortality risk in later life. This visual representation clearly demonstrates how premium costs rise significantly with age due to the increased probability of a claim being filed by the insurance company. For instance, a 25-year-old might pay significantly less than a 55-year-old for the same coverage amount.

Health Status and Premium Costs

A bar chart effectively illustrates the impact of health conditions on premiums. Let’s consider two groups: smokers and non-smokers. Two bars would be displayed side-by-side. The taller bar would represent the premium cost for smokers, while the shorter bar would represent the cost for non-smokers. A clear legend would accompany the chart, labeling each bar (“Smoker” and “Non-Smoker”). The difference in bar heights would visually represent the significant premium difference. For example, a smoker might pay 50% or more than a non-smoker with identical age and coverage. This visual effectively demonstrates the higher risk associated with smoking and its subsequent impact on the premium. Other health conditions, such as pre-existing illnesses, could be added as additional bars to further illustrate the influence of health on premiums. Each bar’s height would directly correlate with the increased risk associated with that particular health factor.

Final Review

Choosing the right life insurance policy is a significant financial decision. While life insurance premium estimators provide valuable preliminary estimates, remember that they are just starting points. By understanding the factors influencing premiums and utilizing the resources available, you can confidently navigate the process, compare quotes from multiple insurers, and ultimately secure a policy that provides the appropriate level of protection for you and your family, aligning with your individual financial goals. Armed with this knowledge, you can approach the process with confidence and clarity.

Helpful Answers

What is the difference between term life and whole life insurance, and how does it affect premiums?

Term life insurance covers a specific period (term), typically offering lower premiums but no cash value. Whole life insurance provides lifelong coverage with a cash value component, resulting in higher premiums.

Can I get an accurate premium estimate without providing my medical history?

While some basic estimators provide rough estimates, accurate premium calculations usually require disclosing your health information. More detailed estimators will offer more accurate results with this information.

How often should I review my life insurance needs and premiums?

It’s recommended to review your life insurance needs and premiums annually, or whenever there are significant life changes (marriage, birth of a child, career advancement, etc.).

Are online life insurance premium estimators secure?

Reputable online estimators use secure encryption to protect your personal information. However, it’s crucial to use only trusted and established websites.