Securing your family’s future through life insurance is a crucial financial decision, but understanding the complexities of life insurance premium computation can feel daunting. This guide unravels the intricacies of how life insurance premiums are calculated, providing a clear and accessible explanation of the factors that influence this vital cost. We’ll explore the various elements – from your age and health to the type of policy you choose – that ultimately determine the price you pay for this essential protection.

Understanding life insurance premium computation empowers you to make informed choices, ensuring you find the right coverage at a price that fits your budget. By exploring the key variables involved, we aim to demystify the process and help you navigate the world of life insurance with greater confidence.

Understanding Policy Features and Premium Costs

Choosing a life insurance policy involves understanding the intricate relationship between the policy’s features and the resulting premium costs. This section will clarify how different aspects of your policy influence the amount you pay.

The death benefit and premium amount are fundamentally linked. A higher death benefit, meaning a larger payout to your beneficiaries upon your death, generally results in a higher premium. This is because the insurance company assumes a greater financial risk. Conversely, a lower death benefit corresponds to a lower premium. The specific relationship depends on various factors, including your age, health, and the type of policy.

Death Benefit and Premium Relationship

The premium you pay is essentially the price you pay for the insurance company’s promise to pay out a specified death benefit. A simple analogy is buying car insurance: a more expensive car requires a higher premium because the potential cost of repair or replacement is greater. Similarly, a larger death benefit implies a higher risk for the insurer, thus a higher premium. For example, a $500,000 death benefit policy will typically cost more than a $250,000 policy for the same individual.

Impact of Riders on Premium Costs

Riders are optional add-ons to your life insurance policy that enhance coverage. Common riders include accidental death benefit (paying out double or triple the death benefit if death is accidental), critical illness riders (providing a payout upon diagnosis of a specified critical illness), and long-term care riders (offering coverage for long-term care expenses). Adding riders increases the overall premium because the insurance company is assuming additional financial obligations. For instance, an accidental death benefit rider will typically increase your premium by a percentage of your base premium. The exact increase depends on the terms of the rider and the insurance company.

Premiums for Different Policy Lengths

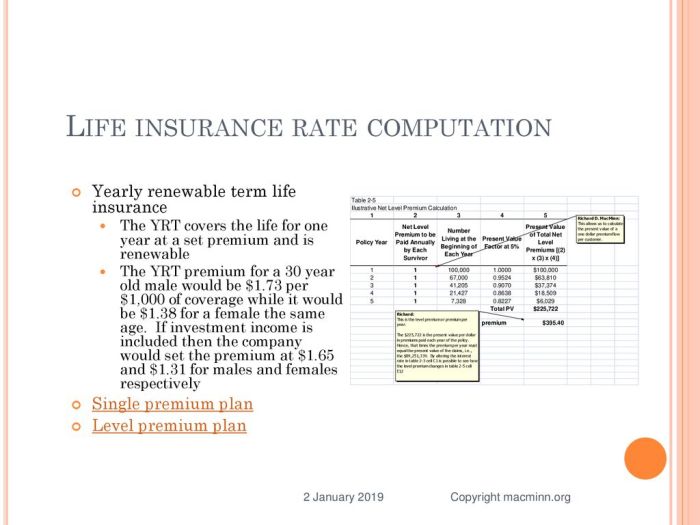

Term life insurance premiums vary significantly based on the policy length. A 10-year term policy will generally have lower annual premiums than a 20-year term policy, all other factors being equal. This is because the insurance company is covering a shorter period of risk with the shorter-term policy. The longer the term, the higher the cumulative premium paid, but the longer the coverage period. For example, a healthy 30-year-old might find a 10-year term policy significantly cheaper per year than a 20-year or whole life policy.

Factors Contributing to Premium Increases Over Time

While some policies have level premiums (remaining constant throughout the policy term), others can increase over time. Several factors contribute to these increases. One common factor is the increasing probability of death as you age. Insurance companies adjust premiums to reflect this increased risk. Also, changes in mortality rates and overall economic conditions can impact premium adjustments. Furthermore, some policies have premium increases built into the policy structure itself. For example, certain types of universal life insurance policies may have adjustable premiums that fluctuate based on the policy’s performance.

Cash Value Accumulation and Premiums in Whole Life Policies

Whole life insurance policies build cash value over time. This cash value accumulation impacts premiums in the following ways:

- Higher Initial Premiums: Whole life policies typically have higher initial premiums than term life policies because a portion of each premium payment goes towards building cash value.

- Potential for Dividends: Some whole life policies pay dividends, which are essentially a return of a portion of the premium. These dividends can be used to reduce future premiums or increase the policy’s cash value.

- Loan Options: Policyholders can borrow against the accumulated cash value, but interest will accrue on the loan. While this can provide access to funds, it doesn’t reduce the overall premium.

- Tax Advantages: The cash value grows tax-deferred, meaning you won’t pay taxes on the growth until you withdraw it. This tax advantage is factored into the premium calculation.

- Level Premiums (Generally): Unlike term life insurance, whole life policies usually offer level premiums for the life of the insured, providing predictable expenses.

External Factors Affecting Premiums

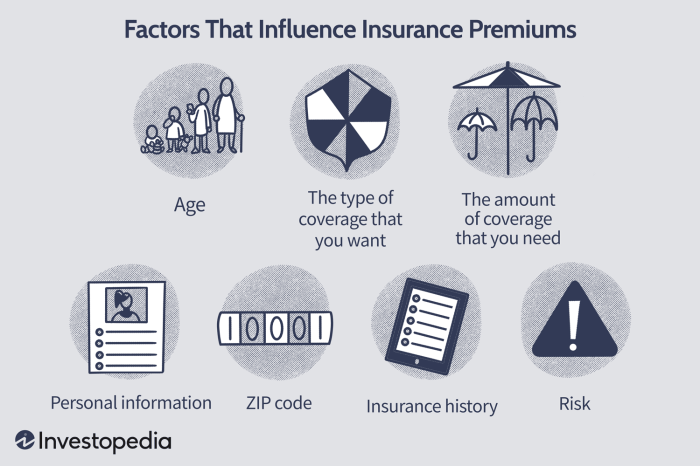

Life insurance premiums aren’t set in stone; several external factors significantly influence their calculation and overall cost. Understanding these influences allows for a more informed approach to securing life insurance coverage. These factors often interact, creating a complex interplay that determines the final premium.

Inflation’s Impact on Life Insurance Premiums

Inflation erodes the purchasing power of money over time. As the cost of goods and services increases, the future value of the death benefit promised by a life insurance policy also diminishes. To compensate for this, insurance companies often adjust their premiums to account for projected inflation rates. Higher inflation generally leads to higher premiums to ensure the death benefit maintains its intended value in the future. For example, if inflation is consistently high at 5% annually, insurers may need to increase premiums to offset the decreasing real value of the payout in future years. This ensures that the policy remains financially viable for both the policyholder and the insurer.

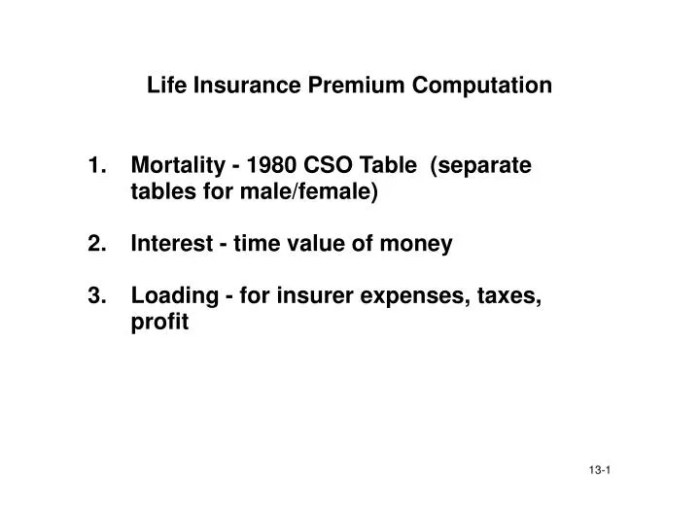

Interest Rate Fluctuations and Premium Calculations

Interest rates play a crucial role in the financial health of insurance companies. Insurers invest a significant portion of the premiums they receive to generate investment income. Higher interest rates allow for greater investment returns, which can potentially lower the premiums required from policyholders. Conversely, lower interest rates reduce investment income, potentially leading to higher premiums to maintain the insurer’s solvency and ability to pay out death benefits. For instance, during periods of low interest rates, like those seen in the aftermath of the 2008 financial crisis, some insurers experienced pressure to increase premiums to maintain profitability.

Government Regulations and Premium Costs

Government regulations, such as reserve requirements and solvency standards, significantly impact premium calculations. These regulations are designed to protect policyholders and ensure the financial stability of insurance companies. Stricter regulations might necessitate higher premiums to maintain adequate reserves and meet regulatory compliance standards. Conversely, less stringent regulations could potentially lead to lower premiums, but this might come at the cost of reduced consumer protection. Changes in legislation related to reserve requirements or capital adequacy ratios can directly influence an insurer’s cost of doing business and, subsequently, the premiums charged.

Economic Conditions and Premium Rates

Broad economic conditions influence both the demand for and the cost of providing life insurance. During economic downturns, individuals may be less likely to purchase life insurance due to reduced disposable income. However, insurers might also face increased claims due to higher mortality rates associated with economic hardship. Conversely, during periods of economic expansion, demand for life insurance might increase, but insurers may also face higher costs for investment management and reinsurance. The 2008 financial crisis, for example, demonstrated the impact of economic downturns on the insurance industry, resulting in some companies adjusting their premium structures in response to reduced investment returns and increased claims.

Ending Remarks

Ultimately, life insurance premium computation is a multifaceted process influenced by a range of personal and external factors. While the specifics can be complex, understanding the core elements – your health, age, lifestyle, policy type, and the insurer’s risk assessment – allows for a more informed decision. By carefully considering these factors and seeking professional advice when needed, you can confidently secure the financial protection your family deserves at a premium that aligns with your financial capabilities.

FAQ Insights

What is the difference between term life insurance and whole life insurance premiums?

Term life insurance premiums are generally lower than whole life insurance premiums because term life insurance provides coverage for a specific period, while whole life insurance offers lifelong coverage and builds cash value.

Can I lower my life insurance premiums after the policy is issued?

In some cases, yes. Improving your health or making lifestyle changes (like quitting smoking) might allow you to qualify for a lower rate. Contact your insurer to explore this possibility.

How often do life insurance premiums increase?

This depends on the type of policy. Term life insurance premiums typically remain level for the policy term, while whole life premiums may increase over time, although this increase is usually predictable.

What happens if I miss a life insurance premium payment?

Your policy may lapse, meaning your coverage ends. Most insurers offer a grace period, but it’s crucial to contact them immediately if you encounter payment difficulties.