Level premium permanent insurance offers a unique financial tool: a steadily growing cash value reserve. Unlike term life insurance, which provides coverage for a specified period, permanent insurance offers lifelong coverage and a reserve that builds over time. This reserve, fueled by your premiums and investment earnings, can be a valuable asset, providing opportunities for loans, withdrawals, or even supplementing your death benefit. Understanding how this reserve accumulates is crucial to harnessing its full potential.

This exploration will delve into the mechanics of level premium permanent insurance, examining the factors that influence reserve growth, the various ways you can access the funds, and comparing it to other insurance types. We’ll illustrate reserve accumulation with hypothetical examples, clarifying the benefits and potential drawbacks to help you make informed decisions about your financial future.

Defining Level Premium Permanent Insurance

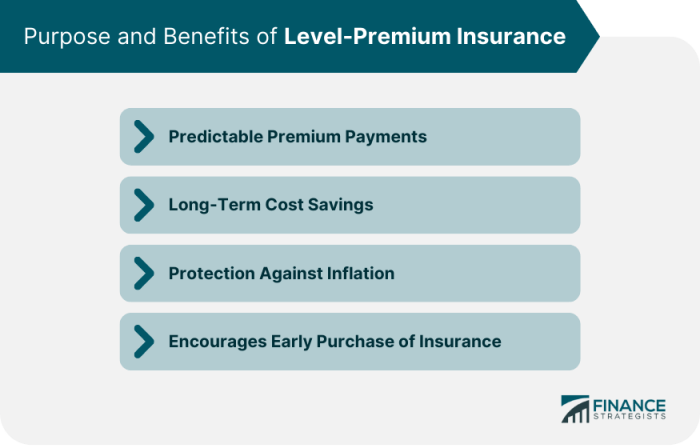

Level premium permanent insurance offers lifelong coverage and a cash value component that grows tax-deferred. Unlike term life insurance, which covers a specific period, permanent insurance provides coverage for your entire life, as long as premiums are paid. This makes it a valuable tool for long-term financial planning and estate preservation.

Level premium permanent insurance, as the name suggests, maintains a consistent premium payment throughout the policy’s duration. This predictability is a key advantage for budgeting and financial stability. The premiums are designed to cover the cost of the death benefit and to fund the growth of the cash value component.

Policy Structure Components

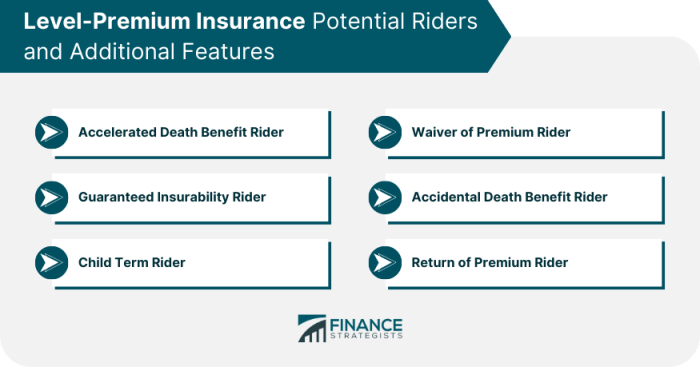

A typical level premium permanent insurance policy comprises several key components. These components work together to provide the coverage and cash value accumulation promised by the policy. The primary components include the death benefit, the cash value, the premium, and various policy riders (optional add-ons that modify the policy’s coverage). The death benefit is the amount paid to the beneficiaries upon the insured’s death. The cash value is the accumulated savings component that grows over time, and it can be borrowed against or withdrawn. Premiums are the regular payments made to maintain the policy, and riders can add extra features, such as accelerated death benefits or long-term care coverage.

Premium Function Over Time

The premiums for level premium permanent insurance remain constant throughout the policy’s life. This is in contrast to other types of life insurance where premiums may increase over time. Each premium payment contributes towards both the cost of insurance (mortality risk) and the accumulation of cash value. As the insured ages, the cost of insurance increases, but this is offset by the growing cash value component, thus maintaining a level premium. For example, a 30-year-old purchasing a policy will have a lower cost of insurance than a 60-year-old, but the constant premium covers this difference.

Types of Permanent Life Insurance

Several types of permanent life insurance policies exist, each with its own features and benefits. These variations cater to different needs and financial goals. Whole life insurance is the most common type, offering a fixed death benefit and a guaranteed cash value growth rate. Universal life insurance offers more flexibility, allowing policyholders to adjust their premiums and death benefit within certain limits. Variable universal life insurance provides even greater flexibility, with the cash value invested in market-linked sub-accounts, potentially offering higher returns but also greater risk. Variable life insurance is similar, but the cash value is invested in separate accounts managed by the insurance company. Each type is designed to meet varying levels of risk tolerance and financial objectives.

The Accumulation of Reserves

The reserve fund in a permanent life insurance policy acts as a crucial component, ensuring the policy’s longevity and fulfilling its promised benefits. It’s essentially a pool of money built up over time to guarantee the insurer’s ability to pay out the death benefit and any other policy benefits, regardless of when the insured passes away. Understanding how this reserve accumulates is key to comprehending the value and functionality of permanent life insurance.

The reserve grows through a combination of premium payments and investment earnings. Each premium payment contributes directly to the reserve, while the insurer invests a portion of the reserve in various financial instruments, aiming for growth. This growth, along with further premium contributions, compounds over the life of the policy, creating a steadily increasing reserve. Think of it like a savings account with added benefits – the interest earned further fuels the growth.

Reserve Growth Factors

Several factors influence the speed at which the reserve accumulates. The most significant is the premium amount – higher premiums naturally lead to faster reserve growth. The policy’s type also plays a role; policies with higher cash value components typically see faster reserve growth. Furthermore, the insurer’s investment performance directly impacts the rate of accumulation. Successful investments lead to higher returns, boosting the reserve more rapidly. Finally, the insured’s age and health at the time of policy purchase influence premium costs, and thus the reserve accumulation rate. Younger, healthier individuals generally pay lower premiums, leading to a slower initial reserve build-up compared to older individuals with higher risk profiles.

Reserve Growth Comparison Across Permanent Life Insurance Types

Different types of permanent life insurance – such as whole life, universal life, and variable life – exhibit varying reserve growth patterns. Whole life insurance generally offers a fixed premium and a predictable rate of reserve growth, often displayed in a guaranteed cash value schedule. Universal life insurance, on the other hand, provides more flexibility with premium payments and potentially higher returns based on the insurer’s investment performance. This flexibility, however, may lead to unpredictable reserve growth, dependent on the investment choices made within the policy. Variable life insurance, similarly, links the cash value growth to the performance of the underlying investment funds selected by the policyholder, resulting in a fluctuating reserve accumulation rate that reflects market conditions. The illustration below depicts a simplified comparison, highlighting the potential differences:

| Policy Type | Reserve Growth Pattern | Factors Influencing Growth |

|---|---|---|

| Whole Life | Steady, predictable growth | Fixed premium, guaranteed interest rate |

| Universal Life | Variable growth, depending on investment performance and premium payments | Investment performance, flexible premiums |

| Variable Life | Highly variable growth, directly linked to market performance of chosen funds | Market performance of underlying investments |

Reserve Usage and Policy Benefits

The accumulated reserve in a level premium permanent life insurance policy serves as a crucial funding source for various policy benefits, offering flexibility and financial security to the policyholder. Understanding how this reserve functions is key to maximizing the value of the policy.

The reserve’s primary function is to guarantee the payment of the death benefit. This is the core promise of the insurance policy: a predetermined sum payable to the beneficiary upon the insured’s death. The insurer invests the reserve, aiming for growth that offsets mortality risk and administrative costs, ensuring the death benefit is always available. The size of the death benefit is typically fixed, but some policies allow for adjustments within specified limits.

Policy Loans and Withdrawals

Policyholders can access a portion of their accumulated reserve through policy loans or withdrawals. Policy loans allow borrowing against the cash value, with the loan accruing interest. Crucially, the loan does not reduce the death benefit unless the loan plus accumulated interest exceeds the cash value at the time of the insured’s death. Withdrawals, on the other hand, directly reduce the cash value and may impact the death benefit depending on the policy’s terms. Both options offer liquidity but come with potential financial implications.

Tax Implications of Accessing the Reserve

The tax implications of accessing the reserve depend on the method used and the specific policy. Policy loans are generally tax-free, as the loan itself isn’t considered income. However, interest accrued on the loan must be paid, and failure to do so can lead to the policy lapsing. Withdrawals, conversely, can be subject to income tax on the amount exceeding the policy’s cost basis (the premiums paid). Furthermore, withdrawals may also trigger early withdrawal penalties depending on the policy’s terms and the policyholder’s age. Careful consideration of tax implications is essential before accessing the reserve.

Comparison of Accessing the Reserve: Loans vs. Withdrawals

| Feature | Policy Loan | Withdrawal |

|---|---|---|

| Impact on Death Benefit | Generally does not reduce death benefit unless loan plus interest exceeds cash value | Reduces cash value and may reduce death benefit depending on policy terms |

| Tax Implications | Interest accrued is taxable; loan principal is not | Amount exceeding cost basis is taxable; potential for early withdrawal penalties |

| Flexibility | Typically allows for repayment flexibility | Usually a one-time or limited-time transaction |

| Cost | Interest charges apply | May involve penalties depending on policy terms |

Illustrative Examples of Reserve Growth

Understanding how the reserve in a level premium permanent insurance policy grows over time is crucial for appreciating its long-term value. This section provides a hypothetical example to illustrate this growth, highlighting the interplay between premiums, investment returns, and potential withdrawals.

The following scenario demonstrates reserve accumulation over a 20-year period. It’s important to remember that actual results will vary depending on the specific policy terms, investment performance, and any withdrawals made.

Hypothetical Reserve Growth Scenario

Let’s consider a hypothetical level premium permanent insurance policy with an initial annual premium of $5,000. We’ll assume a consistent annual investment growth rate of 5% (before fees and expenses, which would reduce the actual growth). This growth rate is an assumption and may not reflect actual market performance.

| Year | Beginning Balance | Premium Paid | Investment Growth | Ending Balance |

|---|---|---|---|---|

| 1 | $0 | $5,000 | $250 | $5,250 |

| 2 | $5,250 | $5,000 | $512.50 | $10,762.50 |

| 3 | $10,762.50 | $5,000 | $788.13 | $16,550.63 |

| 4 | $16,550.63 | $5,000 | $1,077.53 | $22,628.16 |

| 5 | $22,628.16 | $5,000 | $1,414.06 | $29,042.22 |

| … | … | … | … | … |

| 20 | $163,861.64 | $5,000 | $10,193.08 | $179,054.72 |

Note: This table shows a simplified illustration. Actual policy calculations would involve more complex factors, including mortality charges and expense charges, which would reduce the growth.

Visual Representation of Reserve Growth

Imagine a line graph. The horizontal axis represents the years (1 to 20), and the vertical axis represents the reserve balance. The line starts at zero and gradually curves upwards, reflecting the compounding effect of the annual premiums and investment growth. The curve would be steeper in later years due to the compounding effect – the investment growth is calculated on an increasingly larger base each year. If withdrawals were made, the line would show a temporary dip, but would generally continue its upward trajectory, assuming continued premium payments and positive investment returns. The overall visual impression would be one of steady, accelerating growth over the 20-year period.

Factors Affecting Reserve Growth

The growth of the reserve in a level premium permanent life insurance policy isn’t a static process; it’s dynamically influenced by several interacting economic and policy-specific factors. Understanding these influences is crucial for both insurers and policyholders to accurately project future benefits and costs. These factors can significantly impact the final death benefit received by the beneficiary.

Interest Rates

Interest rates play a pivotal role in reserve accumulation. The insurer invests premiums received to generate investment income, which directly contributes to reserve growth. Higher interest rates generally lead to faster reserve growth, as the invested funds earn more. Conversely, lower interest rates result in slower growth. For example, a hypothetical scenario: If an insurer earns 5% annually on invested premiums versus 3%, the difference in reserve accumulation over 20 years would be substantial, leading to a larger death benefit in the higher interest rate scenario. This impact is particularly pronounced over longer policy durations.

Mortality Charges

Mortality charges represent the insurer’s assessment of the risk of death within the insured population. A portion of the premium is allocated to cover anticipated death claims. While mortality charges don’t directly contribute to reserve growth, they indirectly affect it. Lower mortality charges, reflecting improved life expectancy or a healthier insured pool, allow more premium dollars to be allocated towards reserve accumulation, leading to faster growth. Conversely, higher mortality charges leave less for investment and reserve building. For instance, an insurer anticipating lower mortality rates due to advancements in healthcare might allocate less to mortality charges, boosting reserve growth and potentially the final death benefit.

Policy Fees and Expenses

Policy fees and administrative expenses reduce the amount of premium available for investment and reserve growth. These costs include things like underwriting expenses, commissions paid to agents, and ongoing administrative overhead. Higher fees and expenses directly decrease the amount available for investment, leading to slower reserve growth. A policy with high fees might show significantly less reserve accumulation compared to a similar policy with lower fees, ultimately impacting the final death benefit. Insurers with efficient operations tend to have lower expenses, resulting in higher reserve growth for their policyholders.

Last Word

Level premium permanent insurance, with its capacity to accumulate a substantial cash value reserve, offers a compelling long-term financial strategy. While understanding the intricacies of reserve growth and access requires careful consideration of factors like interest rates, fees, and mortality charges, the potential benefits – from financial security to supplemental income – are significant. By carefully weighing the advantages and disadvantages, and seeking professional advice when necessary, you can determine if this type of insurance aligns with your individual financial goals and risk tolerance.

Answers to Common Questions

What are the common reasons people choose level premium permanent insurance?

Many choose it for lifelong coverage, the potential for cash value growth, and the ability to borrow against the policy’s reserve.

Can I withdraw from my reserve without penalty?

Withdrawals are possible, but they may impact the policy’s cash value and death benefit. Consult your policy documents for specific terms and conditions.

How does the interest rate affect my reserve growth?

Higher interest rates generally lead to faster reserve growth, while lower rates result in slower growth. The specific rate applied to your policy may vary depending on the type of insurance and the insurer’s investment performance.

What happens to the reserve if I die?

The death benefit typically includes the accumulated cash value in the reserve, providing a larger payout to your beneficiaries.