Level premium permanent insurance offers a unique blend of life insurance coverage and long-term savings. Unlike term life insurance, which provides coverage for a specific period, permanent insurance offers lifelong protection, coupled with a cash value component that grows tax-deferred over time. This comprehensive guide delves into the intricacies of level premium permanent insurance, exploring its various types, cost implications, suitability, potential drawbacks, and illustrative examples to help you make informed decisions about your financial future.

We will examine the key differences between whole life, universal life, and variable life insurance policies, highlighting the unique features and benefits of each. Understanding the nuances of premium structures, death benefits, and cash value accumulation is crucial for determining which type of permanent insurance best aligns with your individual financial goals and risk tolerance. We’ll also explore the potential tax advantages and disadvantages associated with these policies, providing a clear and concise overview of this complex financial instrument.

Definition and Characteristics of Level Premium Permanent Insurance

Level premium permanent insurance represents a category of life insurance policies designed to provide lifelong coverage, as the name suggests. Unlike term life insurance, which covers a specific period, permanent life insurance offers coverage that continues as long as premiums are paid, or until the policy’s death benefit is paid out. This type of insurance also typically builds a cash value component that grows over time.

Core Features of Level Premium Permanent Insurance Policies

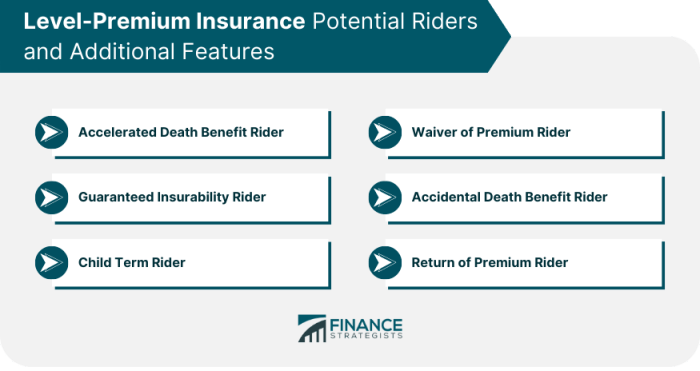

Level premium permanent insurance policies share several key characteristics. Premiums remain consistent throughout the policy’s duration, providing predictable budgeting for the policyholder. The policy offers a guaranteed death benefit, payable to beneficiaries upon the insured’s death. Furthermore, a cash value component accumulates within the policy, which can be accessed through loans or withdrawals under specific conditions. This cash value grows tax-deferred, offering potential long-term financial benefits. Finally, many policies include a variety of riders that can be added to customize coverage.

Differences Between Level Premium Permanent and Term Life Insurance

The primary distinction between level premium permanent and term life insurance lies in the duration of coverage. Term life insurance provides coverage for a specified period (e.g., 10, 20, or 30 years), after which the policy expires unless renewed. Level premium permanent insurance, conversely, offers lifelong coverage, provided premiums are paid. Additionally, term life insurance typically has lower premiums than permanent life insurance, reflecting its limited coverage duration. Permanent insurance builds cash value, a feature absent in term life insurance. Finally, term life insurance is generally purchased to address specific short-term financial needs, while permanent insurance is often used for long-term financial planning and estate preservation.

Comparison of Various Types of Permanent Life Insurance

Several types of permanent life insurance exist, each with its unique features. Whole life insurance offers a fixed premium and death benefit, providing lifelong coverage with guaranteed cash value growth. Universal life insurance provides more flexibility, allowing adjustments to premiums and death benefits within certain limits. Variable life insurance offers a variable death benefit and cash value growth depending on the performance of underlying investment accounts.

| Policy Type | Premium Structure | Death Benefit | Cash Value Accumulation |

|---|---|---|---|

| Whole Life | Fixed, level premium | Fixed, guaranteed | Guaranteed minimum, grows at a fixed rate |

| Universal Life | Flexible, adjustable premiums | Adjustable within limits | Growth depends on the credited interest rate |

| Variable Life | Fixed or flexible premiums | Variable, depends on investment performance | Variable, depends on investment performance |

Cost and Value Analysis of Level Premium Permanent Insurance

Understanding the cost and value proposition of level premium permanent insurance requires a nuanced approach, considering both the immediate premiums and the long-term growth potential of the cash value component. While initial premiums might seem higher than term life insurance, the enduring nature and benefits of permanent insurance offer a different financial landscape.

Factors Influencing the Cost of Level Premium Permanent Insurance

Several key factors determine the cost of level premium permanent insurance. Age is a primary driver; younger applicants generally receive lower premiums due to their longer life expectancy. Health status also plays a crucial role; individuals with pre-existing conditions or higher risk profiles will typically face higher premiums. The amount of coverage desired significantly impacts cost; larger death benefits necessitate higher premiums. Finally, the type of permanent insurance chosen (e.g., whole life, universal life) influences the premium structure, with variations in cash value accumulation and flexibility impacting the overall cost. For example, whole life insurance generally has a fixed premium and guaranteed cash value growth, while universal life policies offer more flexibility in premium payments and cash value growth potential, but may also come with higher costs in the long run if not managed properly.

Long-Term Cost Implications of Level Premium Permanent Insurance

While initial premiums might be substantial, the long-term cost implications are multifaceted. The fixed premium structure eliminates the risk of rising premiums as one ages, a key advantage over term life insurance. However, the total cost over the policy’s lifetime will significantly exceed that of term insurance, even with the cash value accumulation. It is crucial to compare the total cost over a specified time horizon with other insurance options to fully understand the trade-offs. For example, a 30-year-old purchasing a $500,000 whole life policy might pay significantly more in total premiums over their lifetime compared to someone who purchased a series of renewable term life insurance policies for the same coverage. The key is to weigh the cost against the guaranteed lifelong coverage and the potential for cash value growth.

Cash Value Growth Over Time

The cash value component of level premium permanent insurance grows tax-deferred over time, earning interest based on the policy’s credited rate of return. This growth is typically slower than investments in the stock market, but offers a degree of stability and security. For instance, let’s consider a hypothetical scenario: a $100,000 whole life policy with a 3% annual credited rate of return. After 10 years, the cash value might accumulate to approximately $134,392, assuming consistent premium payments and no withdrawals. After 20 years, the cash value could potentially reach around $180,611. These are illustrative examples and actual growth will depend on the specific policy terms and credited interest rates. It’s essential to consult policy documents for precise projections.

Hypothetical Scenario Demonstrating Long-Term Financial Benefits

Imagine a 35-year-old professional, Sarah, who purchases a $500,000 level premium permanent life insurance policy. She consistently pays the premiums for 30 years. Beyond the death benefit, Sarah utilizes the cash value component for various financial goals. After 20 years, she borrows against the accumulated cash value to fund her child’s college education. She later uses a portion of the cash value for retirement income, supplementing her other savings. Upon retirement, she still retains the $500,000 death benefit for her family. This scenario highlights how the policy serves not only as life insurance but also as a long-term savings and investment vehicle. The specific financial benefits will depend on various factors, including the credited interest rate, loan interest rates, and the timing and amount of withdrawals.

Risks and Potential Drawbacks of Level Premium Permanent Insurance

While level premium permanent insurance offers lifelong coverage and cash value accumulation, it’s crucial to understand its potential drawbacks. These policies, unlike term life insurance, involve higher premiums and less flexibility, making a thorough understanding of the associated risks essential before committing. Comparing these risks to other insurance types helps clarify the trade-offs involved.

Understanding the intricacies of policy fees and charges is paramount to making an informed decision. High upfront and ongoing fees can significantly impact the overall value and return on investment of the policy. These costs, often hidden within complex policy documents, can erode the cash value accumulation over time, potentially diminishing the benefits the policy promises. This section will detail these risks and compare them to alternative insurance solutions.

High Premiums and Limited Flexibility

Level premium permanent insurance policies typically come with significantly higher premiums compared to term life insurance. This is because they provide lifelong coverage and build cash value. The higher premiums can strain household budgets, especially in the early years of the policy. Furthermore, the inflexibility of these policies means it can be difficult or costly to adjust coverage amounts or make changes to the policy later on. This contrasts sharply with term life insurance, where premiums are typically lower and policies can be adjusted or renewed more easily. For example, a 30-year-old purchasing a $500,000 level premium whole life policy might pay significantly more annually than someone purchasing a comparable term life policy, even though the term policy’s coverage ends after a specific period.

Potential for Lower Returns Than Other Investments

The cash value component of level premium permanent insurance is designed to grow over time. However, the rate of return on this cash value may not always outperform other investment options, such as mutual funds or stocks. This is because the growth is typically tied to the insurance company’s investment performance, which may be less volatile but also less potentially lucrative than other, riskier investment strategies. For instance, a guaranteed interest rate on a cash value policy might lag behind the returns of a well-managed stock portfolio over a long period, although it offers the security of a guaranteed return.

High Fees and Charges

Various fees and charges are associated with level premium permanent insurance policies, including administrative fees, mortality charges, and surrender charges. These fees can significantly impact the overall cost of the policy and reduce the net cash value accumulation. Surrender charges, in particular, can be substantial if the policy is canceled before a certain period. For example, a policy might impose a 10% surrender charge for the first five years, decreasing gradually thereafter. These fees are often not clearly explained and require careful scrutiny of the policy documents.

Potential for Misunderstanding and Misrepresentation

The complexity of level premium permanent insurance policies can lead to misunderstandings about their features, benefits, and costs. This can be exacerbated by misrepresentation by some insurance agents who prioritize sales over client education. This is a significant risk, as a poorly understood policy can result in financial losses and unmet expectations. For example, an agent might emphasize the cash value growth without adequately highlighting the impact of fees and charges on the overall return.

Potential Downsides of Level Premium Permanent Insurance

Understanding the potential downsides is crucial for informed decision-making. A comprehensive overview of these drawbacks will help in assessing the suitability of this type of insurance.

- High initial and ongoing premiums compared to term life insurance.

- Limited flexibility in adjusting coverage or making changes to the policy.

- Potential for lower returns on cash value compared to other investment options.

- Significant fees and charges that can erode cash value accumulation.

- Complexity of the policy that can lead to misunderstandings and misrepresentation.

- Risk of insufficient coverage later in life if needs change.

Epilogue

Level premium permanent insurance presents a powerful tool for securing your family’s financial future and building long-term wealth. However, careful consideration of the various policy types, associated costs, and potential risks is essential before making a commitment. By understanding the intricacies of premium structures, cash value growth, and tax implications, you can make an informed decision that aligns with your individual financial goals and risk profile. Remember to consult with a qualified financial advisor to determine if level premium permanent insurance is the right choice for your specific circumstances.

FAQ Explained

What are the tax implications of withdrawing cash value from a level premium permanent insurance policy?

Withdrawals from the cash value may be subject to income tax on the earnings portion, depending on the specific policy and the amount withdrawn. Consult a tax professional for detailed information.

Can I borrow against the cash value of my policy?

Yes, most permanent life insurance policies allow policyholders to borrow against the accumulated cash value. Interest charges usually apply.

What happens to the cash value if I surrender my policy?

Surrendering a policy typically results in receiving the cash value, minus any surrender charges that may apply. The amount received will be less than the total premiums paid, especially in the early years of the policy.

How does the death benefit work in a level premium permanent insurance policy?

The death benefit is a predetermined amount paid to the beneficiary upon the death of the insured. This amount remains level throughout the policy’s duration.