Navigating the complexities of homeownership often involves understanding the intricacies of mortgage premium insurance (MPI). This crucial insurance protects lenders in case of borrower default, but the question of its tax deductibility remains a significant concern for many homeowners. This guide delves into the nuances of MPI tax deductions, exploring the varying rules across different countries and the factors influencing eligibility for these deductions.

We’ll examine the different types of MPI, how income levels, loan-to-value ratios, and mortgage types affect deductibility, and provide a step-by-step guide to claiming deductions. Through illustrative examples and a clear explanation of relevant tax laws, this guide aims to empower homeowners with the knowledge needed to confidently manage their tax obligations related to MPI.

Factors Affecting MPI Tax Deductibility

Mortgage premium insurance (MPI), while helping secure a mortgage, presents a tax implication often dependent on several key factors. Understanding these factors is crucial for accurately determining the tax deductibility of your MPI payments. This section details how income level, loan-to-value ratio, and mortgage type influence the tax treatment of MPI.

Income Level’s Impact on MPI Tax Deductions

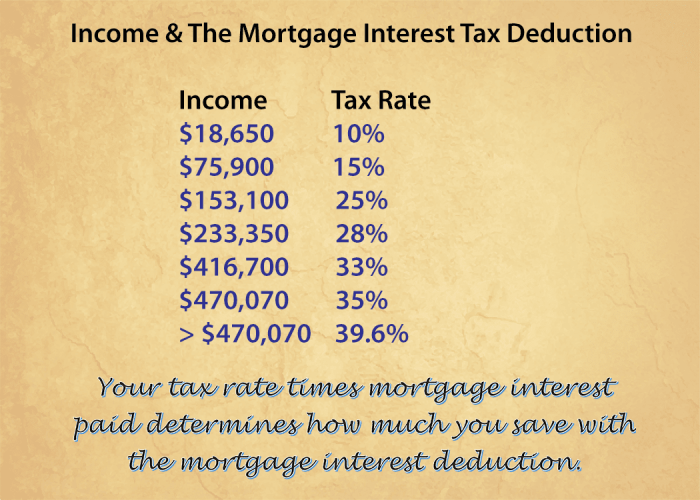

The impact of income level on MPI tax deductions is indirect, primarily affecting the overall tax bracket and thus the benefit derived from any deduction. Higher-income individuals, falling into higher tax brackets, will generally realize a larger tax savings from deducting MPI than lower-income individuals in lower tax brackets. This is because the tax savings are a function of the taxpayer’s marginal tax rate. For instance, a taxpayer in a 35% tax bracket will save $35 on every $100 of MPI deducted, whereas a taxpayer in a 12% bracket will only save $12. The deduction itself isn’t income-dependent, but the *value* of the deduction is.

Loan-to-Value Ratio’s Role in Deductibility

The loan-to-value (LTV) ratio, representing the loan amount as a percentage of the property’s value, significantly influences MPI’s tax treatment. MPI is typically required when the LTV exceeds a certain threshold (often 80%), indicating a higher risk for the lender. In many jurisdictions, MPI is only required for loans with a high LTV ratio. Therefore, a lower LTV ratio usually means no MPI is required, resulting in no MPI payment to deduct. Conversely, higher LTV ratios necessitate MPI, opening the possibility for a tax deduction if applicable tax laws allow.

Mortgage Type and MPI Tax Implications

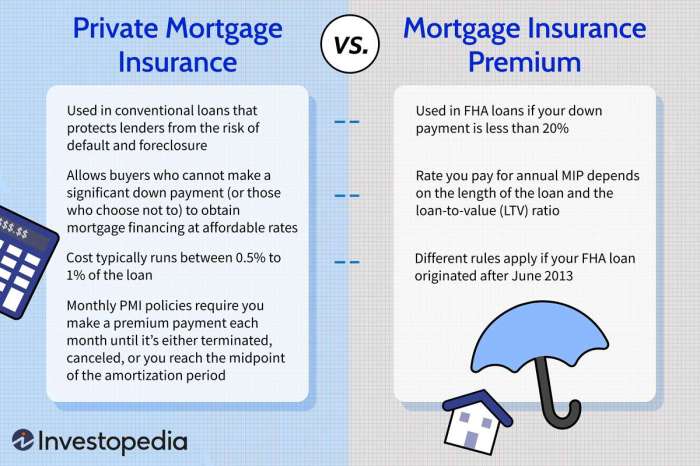

The type of mortgage directly impacts the tax implications of MPI. For example, the rules surrounding deductibility might differ between conventional mortgages, FHA loans, and VA loans. Some mortgage types might have specific requirements or restrictions concerning MPI and its tax deductibility. A conventional mortgage with a high LTV might allow for MPI deduction under certain circumstances, while an FHA loan might have different rules. It’s essential to consult tax laws and regulations specific to your mortgage type and jurisdiction to understand the applicable rules.

Flowchart for Determining MPI Deductibility

The decision-making process for determining MPI deductibility can be represented by a flowchart.

[Illustrative Flowchart Description]

The flowchart would begin with a starting point: “Is MPI required on your mortgage?”. A “Yes” branch would lead to “Is your mortgage type eligible for MPI deduction under applicable tax laws?”, with a “Yes” branch leading to “MPI is potentially deductible; consult tax professional for confirmation and specific rules” and a “No” branch leading to “MPI is not deductible”. A “No” branch from the initial question would lead directly to “MPI is not deductible”. Each step would have clear yes/no decisions based on the criteria previously discussed. This flowchart simplifies the process by systematically evaluating the factors influencing MPI tax deductibility.

Documentation and Claiming MPI Tax Deductions

Successfully claiming a mortgage premium insurance (MPI) tax deduction requires careful record-keeping and a clear understanding of the process. This section details the necessary steps, documentation, and common pitfalls to avoid when filing your tax return. Accurate and complete documentation is crucial for a smooth and successful claim.

Claiming MPI Deductions on Tax Returns: A Step-by-Step Guide

Claiming your MPI deduction involves integrating it into your overall tax return. This is typically done on the relevant forms used to report mortgage interest and other related expenses. The specific form will vary depending on your country and tax system. However, the general process involves gathering your documentation (detailed below), accurately calculating the deductible amount, and entering the information correctly on your tax form. Consult your tax advisor or relevant tax authority’s instructions for specific guidance.

Necessary Documentation for MPI Deduction Claims

Supporting documentation is essential for verifying your MPI deduction claim. Without proper documentation, your claim may be rejected or delayed. The required documents will vary depending on your specific situation and the requirements of your tax authority. However, generally, you will need proof of your MPI payments, proof of your mortgage, and proof of your ownership of the property.

Common Errors to Avoid When Claiming MPI Tax Deductions

Several common errors can lead to rejection or delays in processing your MPI tax deduction. These include inaccurate calculations of the deductible amount, failing to properly document your expenses, and submitting incomplete or illegible forms. Another common error is claiming a deduction for MPI when it is not actually deductible under your specific circumstances or tax laws. Carefully review your tax laws and seek professional advice if needed to avoid these pitfalls.

Required Documents for MPI Tax Deduction Claims

| Document | Purpose | Where to Obtain | Potential Issues |

|---|---|---|---|

| Mortgage Premium Insurance Premiums Receipts | Proof of payment of MPI premiums. | Your mortgage lender or insurance provider. | Missing or illegible receipts; discrepancies between receipts and tax return entries. |

| Mortgage Agreement | Verifies the existence of the mortgage and the terms, including the MPI component. | Your mortgage lender. | Failure to provide a copy showing MPI details; outdated agreement. |

| Property Ownership Documentation | Confirms your ownership of the property secured by the mortgage. | Land registry or similar authority. | Incorrect or incomplete ownership details; failure to prove ownership. |

| Tax Return Forms | The official forms used to report your income and deductions. | Your country’s tax authority website. | Incomplete or inaccurate information; incorrect form used. |

Illustrative Examples of MPI Tax Deduction Scenarios

Understanding how Mortgage Premium Insurance (MPI) affects your taxes can significantly impact your overall financial planning. The deductibility of MPI varies depending on several factors, including your tax bracket and the specific details of your mortgage. The following examples illustrate how MPI deductions are calculated and the potential tax savings involved.

MPI Deduction Calculation Examples

Let’s explore a few scenarios to demonstrate how MPI tax deductions are calculated. Remember that the actual tax savings will depend on your individual tax rate. For simplicity, we’ll assume a consistent annual MPI payment.

Scenario 1: Full MPI Deductibility

Imagine Sarah purchased a home with a down payment of less than 20% of the home’s value, requiring her to pay MPI. Her annual MPI payment is $2,000, and her marginal tax rate is 25%. In this scenario, let’s assume MPI is fully deductible. This means Sarah can deduct the full $2,000 from her taxable income. Her tax savings would be $2,000 * 0.25 = $500. She effectively reduces her tax burden by $500.

Scenario 2: Partial MPI Deductibility

Now consider David, who also paid MPI. His annual MPI payment is $1,500, but due to certain limitations, only 50% of his MPI is considered deductible. This means he can only deduct $1,500 * 0.50 = $750. If David’s marginal tax rate is 30%, his tax savings would be $750 * 0.30 = $225. This illustrates that the amount of tax savings directly correlates with both the deductible portion of the MPI and the individual’s tax bracket.

Scenario 3: No MPI Deductibility

In contrast, consider a situation where Maria’s MPI is not deductible, perhaps due to exceeding the income limits for deductibility or other stipulations within her tax jurisdiction. Regardless of her MPI payment amount (let’s say $1,800) and her tax rate (let’s say 28%), she receives no tax benefit from her MPI payments. This highlights the importance of understanding the specific rules and regulations governing MPI deductibility in your area.

Illustrative MPI Deduction Scenarios

| Scenario | Mortgage Details | MPI Amount (Annual) | Tax Deduction Amount |

|---|---|---|---|

| Sarah (Full Deductibility) | Down payment < 20%, $300,000 mortgage | $2,000 | $500 (25% tax bracket) |

| David (Partial Deductibility) | Down payment < 20%, $250,000 mortgage, 50% deductibility | $1,500 | $225 (30% tax bracket, 50% deductible) |

| Maria (No Deductibility) | Down payment < 20%, $400,000 mortgage, MPI not deductible | $1,800 | $0 |

| John (Full Deductibility, Higher Tax Bracket) | Down payment < 20%, $350,000 mortgage | $2,500 | $750 (30% tax bracket) |

Potential Changes and Future Implications

The deductibility of mortgage premium insurance (MPI) is subject to change, influenced by evolving tax laws, economic shifts, and government policy decisions. Understanding these potential changes and their long-term implications is crucial for both homeowners and the financial sector. Predicting the future with certainty is impossible, but analyzing current trends and historical precedents allows for informed speculation on the future of MPI tax deductions.

The deductibility of MPI, currently allowed in some jurisdictions, could be altered in several ways. Changes in government priorities, such as increased focus on fiscal responsibility or adjustments to housing policies, could lead to a reassessment of tax benefits for homeowners. Furthermore, economic conditions significantly impact the availability of tax breaks.

Changes in Tax Laws Affecting MPI Deductibility

Legislative changes are the most direct route to altering MPI deductibility. For example, a government might decide to phase out the deduction entirely as part of broader tax reform aimed at simplifying the tax code or generating additional revenue. Alternatively, adjustments could be made to the eligibility criteria, potentially limiting the deduction to lower-income homeowners or those purchasing homes in specific regions. Such changes could be implemented gradually, providing a transition period for taxpayers, or introduced abruptly, leading to immediate consequences for those claiming the deduction. Historical examples, such as changes in deductions for other home-related expenses, can offer insight into potential timelines and impacts of future modifications. For instance, the gradual reduction of deductions for state and local taxes in certain jurisdictions demonstrates a possible approach to phasing out tax benefits.

Long-Term Implications of Different Tax Policies on MPI

Different tax policies regarding MPI deductibility have significant long-term consequences. Eliminating the deduction would likely reduce the affordability of homeownership for some, potentially slowing down the housing market. Conversely, maintaining or expanding the deduction could stimulate the housing market and boost homeownership rates, but might also increase the national debt if the revenue loss is not offset elsewhere. The long-term impact depends on the interplay of various factors, including the overall economic climate, interest rates, and the availability of alternative financing options. A comprehensive analysis would require modeling the effects of different scenarios on various economic indicators, including housing prices, consumer spending, and overall economic growth.

Impacts of Economic Factors on MPI Tax Deductions

Economic factors play a significant role in influencing MPI tax deduction policies. During periods of economic recession, governments may be more inclined to maintain or even expand tax deductions for homeownership to stimulate the economy. Conversely, during periods of economic expansion, when government revenue is higher, there may be less political pressure to maintain such deductions. Inflation can also affect the value and effectiveness of the deduction. A significant increase in inflation might erode the real value of the deduction over time, rendering it less beneficial to homeowners. The interplay between economic indicators and government policy decisions makes predicting the future of MPI deductibility challenging but crucial for informed financial planning.

Potential Future Scenarios and Their Implications

The following scenarios illustrate potential future developments and their likely implications:

- Scenario 1: Complete Elimination of MPI Deduction: This would likely reduce homeownership affordability, potentially impacting lower- and middle-income families most significantly. The housing market could experience a slowdown, with a decrease in demand and potentially lower housing prices.

- Scenario 2: Restriction of MPI Deduction to Low-Income Homebuyers: This would target support towards those most in need of assistance with homeownership, but could potentially create complexities in administration and verification of income levels.

- Scenario 3: Maintenance of the Status Quo: This would offer predictability and stability for homeowners, but may not address concerns about the long-term fiscal sustainability of the deduction.

- Scenario 4: Introduction of a Tax Credit Instead of a Deduction: This could provide a more targeted and potentially more effective form of support for homebuyers, depending on the design and implementation of the credit.

Wrap-Up

Understanding whether your mortgage premium insurance is tax deductible is crucial for effective financial planning. While the specifics vary significantly based on location and individual circumstances, this guide has provided a framework for navigating the complexities of MPI tax deductions. By understanding the key factors influencing deductibility and following the steps Artikeld for claiming deductions, homeowners can maximize their tax savings and manage their finances more efficiently. Remember to consult with a qualified tax professional for personalized advice tailored to your specific situation.

Questions Often Asked

What is the difference between PMI and MPI?

While often used interchangeably, PMI (Private Mortgage Insurance) is typically associated with conventional loans, while MPI (Mortgage Premium Insurance) is a broader term encompassing various types of insurance protecting lenders.

Can I deduct MPI if I itemize deductions?

In the US, MPI is generally not deductible as an itemized deduction. Deductibility depends on specific circumstances and may vary by country.

What documents do I need to claim MPI tax deductions?

You’ll generally need your mortgage documents, insurance policy details, and tax forms related to your mortgage payments. Specific requirements vary by country and tax authority.

What happens if I make a mistake on my MPI tax deduction claim?

Errors can lead to delays in processing or even penalties. It’s crucial to accurately report the information and keep supporting documentation. Consult a tax professional if unsure.