Navigating the complexities of homeownership often involves understanding the nuances of mortgage insurance premiums (MIP). For many aspiring homeowners, the question of whether these premiums are tax-deductible is paramount. This guide delves into the intricacies of MIP deductibility, providing clarity on IRS guidelines, eligibility criteria, and the potential impact on your tax liability. We’ll explore various scenarios, helping you determine if you can claim this deduction and maximize your tax savings.

Understanding MIP deductibility is crucial for responsible financial planning. This guide will not only clarify the current rules but also offer insights into potential future changes, empowering you to make informed decisions about your mortgage and taxes. We’ll examine how factors such as loan type, homeownership status, and interaction with other deductions influence the deductibility of your MIP.

Mortgage Insurance Premium Basics

Mortgage insurance premiums (MIPs) are essentially insurance policies protecting lenders against potential losses if a borrower defaults on their mortgage loan. They are a significant factor in the overall cost of homeownership, particularly for borrowers with lower down payments. Understanding the nuances of MIPs is crucial for making informed financial decisions.

Types of Mortgage Insurance Premiums

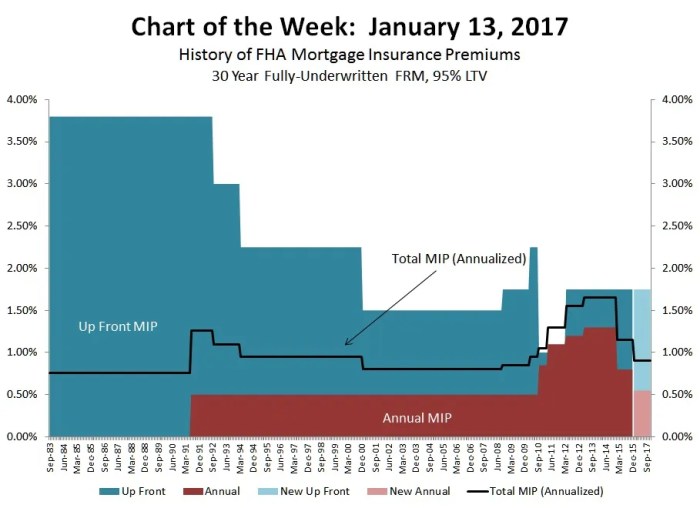

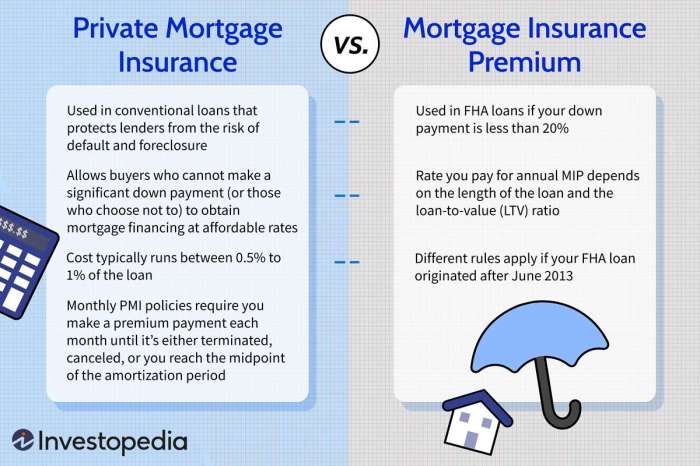

There are several types of MIPs, each with its own features and implications. The most common types are those associated with Federal Housing Administration (FHA) loans and those associated with loans where the down payment is less than 20%. FHA MIPs are paid by the borrower throughout the loan term, either as an upfront premium paid at closing or as an annual premium added to the monthly mortgage payment (or a combination of both). For conventional loans with less than 20% down payment, Private Mortgage Insurance (PMI) is required. PMI is typically paid monthly and can be canceled once the borrower’s equity reaches 20% of the home’s value. Variations exist within each type, depending on the lender and the specific terms of the loan. For instance, some lenders may offer different payment structures or premium rates based on the borrower’s credit score and other risk factors.

Who Pays MIP and When

The borrower is always responsible for paying the MIP. For FHA loans, the upfront MIP is usually paid at closing, while the annual MIP is added to the monthly mortgage payment. For conventional loans with PMI, the monthly premiums are added to the borrower’s monthly mortgage payment. The timing of the payments is clearly Artikeld in the loan documents. It’s important to note that the responsibility for paying MIP continues until the loan is paid off or the borrower’s equity reaches a certain threshold (usually 20% for conventional loans).

MIP Comparison Across Loan Types

The following table compares MIPs across different loan types. Note that these are examples and actual rates can vary depending on several factors, including the lender, the borrower’s credit score, and the loan-to-value ratio.

| Loan Type | MIP Percentage (Approximate) | Payment Frequency | Deductibility |

|---|---|---|---|

| FHA Loan | 1.75% upfront + 0.85% annual (rates vary) | Upfront at closing, annual with monthly mortgage payment | Generally not deductible |

| Conventional Loan ( <20% down) | Varies depending on LTV and credit score | Monthly | Generally not deductible |

| VA Loan | Typically none | N/A | N/A |

| USDA Loan | Guarantee Fee | Monthly or upfront | Generally not deductible |

Tax Deductibility Rules

The deductibility of mortgage insurance premiums (MIP) is a complex issue governed by Internal Revenue Service (IRS) guidelines. Understanding these rules is crucial for homeowners to accurately calculate their tax liability. The ability to deduct MIP can significantly reduce your tax burden, but it’s not automatic for everyone.

The current IRS guidelines generally allow for the deduction of MIP paid on a qualified mortgage loan if the taxpayer itemizes their deductions. This is a significant difference from other mortgage-related deductions, which may be available even when using the standard deduction. The specifics, however, hinge on several critical factors.

Conditions for MIP Deductibility

To claim a deduction for MIP, several conditions must be met. The mortgage must be a qualified mortgage loan, meaning it meets specific criteria established by the IRS. These criteria often relate to loan-to-value ratios, loan terms, and the type of mortgage. Furthermore, the MIP must be paid on a loan used to acquire, build, or substantially rehabilitate a qualified residence. This residence must be the taxpayer’s primary residence. Finally, the deduction is limited to the amount of MIP actually paid during the tax year. Exceeding the actual amount paid is not permitted.

Itemized Deductions versus Standard Deductions

The choice between itemizing deductions and taking the standard deduction significantly impacts the deductibility of MIP. If a taxpayer chooses to itemize, they can include the MIP deduction as part of their total itemized deductions. However, if they opt for the standard deduction, they cannot deduct the MIP. The decision to itemize versus using the standard deduction depends on the total amount of itemized deductions compared to the standard deduction amount. If the sum of itemized deductions, including the MIP deduction, exceeds the standard deduction, itemizing is beneficial. Otherwise, taking the standard deduction is more advantageous. For example, a homeowner with significant medical expenses or charitable contributions might find itemizing more advantageous, even with the inclusion of the MIP.

Flowchart for Determining MIP Deductibility

The following flowchart illustrates the decision-making process for determining if MIP is deductible:

[Imagine a flowchart here. The flowchart would start with a diamond: “Is the mortgage a qualified mortgage loan?” A “Yes” branch leads to another diamond: “Did the taxpayer itemize deductions?” A “Yes” branch leads to a rectangle: “MIP is deductible (up to the amount paid).” A “No” branch leads to a rectangle: “MIP is not deductible.” A “No” branch from the first diamond leads directly to a rectangle: “MIP is not deductible.” A “No” branch from the second diamond also leads to a rectangle: “MIP is not deductible.”]

Impact of Homeownership Status

The tax deductibility of mortgage insurance premiums (MIP) isn’t solely dependent on the amount paid; your homeownership history significantly influences how the IRS views these payments. First-time homebuyers often face different rules compared to those purchasing a second or subsequent home. Understanding these distinctions is crucial for accurately calculating your tax liability.

The primary difference in tax treatment stems from the underlying purpose of MIP. It’s designed to protect lenders against potential losses if a borrower defaults on their mortgage. The IRS recognizes this protective function, but the specific tax benefits afforded depend on factors like the type of mortgage and the borrower’s prior homeownership experience. This impacts whether the MIP can be claimed as an itemized deduction or if it falls under other tax provisions.

MIP Deductibility for First-Time Homebuyers

For first-time homebuyers, the deductibility of MIP is generally more straightforward. While the MIP itself isn’t directly deductible as a separate item, it might indirectly contribute to a reduction in overall tax liability through the standard deduction or itemized deductions related to homeownership. This indirect impact is often linked to the overall mortgage interest deduction. A higher mortgage, often necessitating MIP, can lead to a larger mortgage interest deduction, resulting in a greater tax benefit. However, it’s crucial to remember that this isn’t a direct deduction of the MIP itself, but a consequence of the increased mortgage interest associated with using MIP.

MIP Deductibility for Repeat Homebuyers

Repeat homebuyers, having previously owned a home, may find the tax treatment of MIP to be more complex. The same indirect impact through mortgage interest deduction applies. However, there might be additional limitations or nuances depending on the specific circumstances of their previous homeownership. Factors such as the type of mortgage (e.g., FHA, VA, conventional) and the length of time between home purchases could influence the eligibility for certain tax benefits. It’s advisable for repeat homebuyers to consult a tax professional to ensure they’re maximizing their tax advantages.

Deductibility Rules Based on Homeownership Status

The following bulleted list summarizes the key deductibility rules:

- First-Time Homebuyers: MIP is not directly deductible. However, a larger mortgage (often requiring MIP) may lead to a higher mortgage interest deduction, indirectly reducing tax liability.

- Repeat Homebuyers: MIP is not directly deductible. The indirect benefit through mortgage interest deduction remains, but additional factors related to previous homeownership and mortgage type may influence the overall tax implications. Professional tax advice is recommended.

Interaction with Other Tax Deductions

The deductibility of your mortgage insurance premium (MIP) doesn’t exist in a vacuum; it interacts with other tax deductions related to homeownership, primarily the deduction for mortgage interest. Understanding these interactions is crucial for accurately calculating your tax liability. Improperly accounting for these overlapping deductions could lead to either an overpayment or underpayment of taxes.

The interaction between MIP and mortgage interest deductions is primarily one of limitation, not exclusion. Both are itemized deductions, meaning they’re only considered if you choose to itemize instead of taking the standard deduction. Since both deductions reduce your taxable income, they effectively work together to lower your overall tax burden. However, the total amount of itemized deductions you can claim is capped by your total eligible expenses, meaning if one deduction is particularly high, it might reduce the benefit of another.

MIP Deduction Limits Due to Other Tax Factors

Several factors can affect the deductibility of your MIP. High itemized deductions in other areas might make itemizing less beneficial than taking the standard deduction. For example, if you have significant charitable contributions or state and local tax (SALT) deductions, the combined total of these, along with your mortgage interest and MIP deductions, might still be lower than the standard deduction amount. In such cases, you might not benefit from deducting the MIP at all, as you would gain more by claiming the standard deduction. Furthermore, the amount of your mortgage interest deduction itself can indirectly influence the benefit of your MIP deduction. A very large mortgage interest deduction could push your total itemized deductions above the standard deduction, making the additional MIP deduction more valuable. Conversely, a smaller mortgage interest deduction might not be sufficient to make itemizing worthwhile, thus minimizing the impact of the MIP deduction.

Examples of Combined Impact on Tax Liability

Let’s consider two hypothetical taxpayers:

Taxpayer A has a large mortgage with significant mortgage interest payments and a relatively high MIP. They also itemize other deductions, such as state and local taxes and charitable contributions. The combined total of their itemized deductions, including mortgage interest and MIP, exceeds the standard deduction. In this scenario, both the mortgage interest and MIP deductions significantly reduce Taxpayer A’s tax liability.

Taxpayer B has a smaller mortgage and lower mortgage interest payments, coupled with a lower MIP. Their other itemized deductions are minimal. In this case, the total amount of their itemized deductions, including mortgage interest and MIP, might fall below the standard deduction. This means Taxpayer B might find it more beneficial to take the standard deduction, effectively rendering the MIP deduction irrelevant for their tax calculation. The MIP deduction, in this instance, offers no additional tax benefit.

Last Recap

Successfully navigating the landscape of MIP deductibility requires a thorough understanding of IRS regulations and your specific financial situation. While the possibility of deducting MIP offers significant tax advantages, careful consideration of all applicable rules and conditions is essential. This guide has provided a comprehensive overview, empowering you to approach your tax obligations with confidence and potentially reduce your overall tax burden. Remember to consult with a tax professional for personalized advice tailored to your circumstances.

Query Resolution

What is the difference between PMI and MIP?

PMI (Private Mortgage Insurance) is purchased from a private insurer and is generally required for conventional loans with less than 20% down payment. MIP (Mortgage Insurance Premium) is required for FHA loans and some other government-backed loans. Key differences lie in the insurer and the specific requirements.

Can I deduct MIP if I itemize but take the standard deduction for other items?

Yes, you can itemize only the MIP deduction if you choose to itemize deductions overall. The choice to itemize for one deduction doesn’t automatically force you to itemize all deductions.

If my MIP is not deductible, does that affect my ability to deduct mortgage interest?

No, the deductibility of mortgage interest is generally separate from the deductibility of MIP. You can still deduct mortgage interest even if your MIP is not deductible.

What form do I use to claim the MIP deduction?

The MIP deduction is claimed on Schedule A (Form 1040), Itemized Deductions.