The question of whether an insurance premium constitutes a capital expenditure or an operating expense is a nuanced one, impacting financial reporting, tax liabilities, and overall business strategy. Understanding the intricacies of this classification requires a thorough examination of accounting principles, the nature of the insurance policy, and the underlying asset it might protect. This guide delves into the key factors that determine the appropriate classification, providing clarity and practical examples to navigate this often-complex area.

This exploration will examine various scenarios, from short-term insurance policies covering operational needs to long-term policies integral to the acquisition and protection of significant assets. We will analyze how policy duration, the type of asset insured, and the overall accounting treatment influence the final classification, ultimately demonstrating the implications for both the balance sheet and income statement.

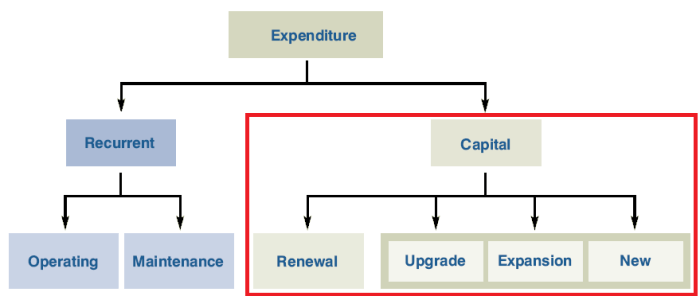

Defining Capital Expenditure

Capital expenditure (CapEx) represents investments a business makes to acquire or upgrade long-term assets. These assets are expected to benefit the company for more than one accounting period, contributing to its future revenue generation and operational efficiency. Understanding CapEx is crucial for financial planning, investment decisions, and accurate financial reporting.

Capital expenditure is fundamentally different from operational expenditure (OpEx), which covers day-to-day business expenses. The key differentiator lies in the asset’s lifespan and its contribution to the company’s long-term value. While OpEx is immediately expensed, CapEx is depreciated or amortized over the asset’s useful life.

Criteria for Classifying Capital Expenditures

The classification of an expense as CapEx or OpEx depends primarily on the asset’s useful life and its impact on the company’s future operations. Generally, expenses related to assets with a lifespan exceeding one year are considered CapEx. This includes expenses incurred for purchasing, constructing, or significantly improving the asset. Conversely, expenses that maintain the current operational capacity without enhancing the asset’s value or extending its life are classified as OpEx. For example, routine maintenance is OpEx, while a major overhaul extending the asset’s life is CapEx.

Examples of Capital Expenditures

Several examples illustrate the concept of capital expenditure. Purchasing land for a new factory, constructing a new building, acquiring machinery, purchasing software licenses with a long-term use, and major renovations to existing facilities all qualify as capital expenditures. These investments are intended to increase the company’s productive capacity or improve its operational efficiency over an extended period. The purchase of a new delivery truck for a logistics company is another clear example; the truck’s value will be spread across several years of operation, unlike the cost of routine fuel or maintenance.

Comparison of Capital and Operating Expenditures

| Feature | Capital Expenditure (CapEx) | Operating Expenditure (OpEx) |

|---|---|---|

| Definition | Investments in long-term assets | Expenses related to day-to-day operations |

| Asset Life | Longer than one year | One year or less |

| Accounting Treatment | Capitalized (added to the balance sheet) and depreciated/amortized over time | Expensed immediately on the income statement |

| Impact on Financial Statements | Affects both the balance sheet (through asset acquisition) and the income statement (through depreciation/amortization) | Affects only the income statement |

| Examples | Purchase of equipment, building construction, land acquisition | Rent, utilities, salaries, marketing expenses |

Insurance Premium Classification

Insurance premiums, the payments made to secure insurance coverage, are accounted for differently depending on the nature of the insurance policy and its benefit to the business. Understanding this distinction is crucial for accurate financial reporting and compliance. Generally, premiums are treated as expenses, but in specific circumstances, they may be capitalized as assets.

The general accounting treatment of insurance premiums is to expense them over the period the coverage applies. This aligns with the matching principle in accounting, ensuring that the cost of insurance is recognized in the same period as the revenue it protects. However, this isn’t always the case.

Factors Influencing Insurance Premium Classification

Several factors determine whether an insurance premium is classified as a capital or operating expense. The primary factor is the nature of the benefit derived from the insurance policy. If the insurance policy protects a long-term asset or provides a future economic benefit extending beyond one accounting period, it’s more likely to be capitalized. Conversely, if the policy covers short-term risks or operational expenses, it is typically expensed. The length of the policy’s term also plays a role; longer-term policies are more likely to be considered for capitalization. Finally, the materiality of the premium amount can influence the decision; small premiums are generally expensed regardless of their nature.

Examples of Capitalized Insurance Premiums

Several types of insurance policies frequently result in premiums being treated as capital expenditures.

One example is insurance on a newly constructed building. The insurance protects the significant asset during its construction phase and for several years thereafter. The premium paid for this long-term protection is often capitalized as part of the building’s overall cost, being amortized over the building’s useful life. This is because the insurance directly contributes to the asset’s value and future benefit. Similarly, premiums for long-term insurance policies on machinery or equipment with long useful lives are also typically capitalized. The protection afforded ensures the continued operation and value of the assets, justifying the capitalization.

Another instance is insurance covering the construction of a large infrastructure project. The insurance policy protects the significant investment during the long construction period and might include coverage for delays or unforeseen events. The premium for such extensive coverage would be considered a capital expenditure, adding to the overall cost of the project and amortized over its lifespan. This is justified because the insurance directly contributes to the successful completion and long-term value of the project.

Key considerations for capitalization include: The premium’s materiality, the asset’s useful life, and the direct relationship between the insurance and the long-term asset’s value and protection. The decision to capitalize insurance premiums should be made on a case-by-case basis, taking these factors into account. Professional accounting guidance should always be consulted for accurate classification.

Long-Term vs. Short-Term Insurance Policies

The duration of an insurance policy significantly influences its accounting treatment, specifically regarding its classification as a capital or operating expense. Generally, shorter-term policies are expensed immediately, while longer-term policies often require a more nuanced approach, involving the allocation of the premium cost over the policy’s lifespan. This distinction stems from the fundamental difference in the benefit received and the time period over which that benefit is realized.

The accounting implications of classifying premiums for long-term versus short-term policies are significant. Misclassifying a premium can distort a company’s financial statements, affecting key metrics like profitability and asset valuation. Accurate classification ensures a true and fair representation of the company’s financial position. The matching principle in accounting dictates that expenses should be recognized in the same period as the revenues they help generate. For short-term policies, this is straightforward. For long-term policies, however, a systematic allocation is necessary to comply with this principle.

Accounting Treatment of Insurance Premiums Based on Policy Duration

The following table summarizes the accounting treatment of insurance premiums for policies of varying durations. It highlights the key differences in expense recognition and balance sheet presentation.

| Policy Duration | Expense Recognition | Balance Sheet Treatment (Asset/Liability) | Example |

|---|---|---|---|

| Short-Term (e.g., one year or less) | Expensed in the period the policy covers. | No asset or liability is recognized. | A one-year property insurance policy. The entire premium is expensed during the year. |

| Long-Term (e.g., multiple years) | Premiums are amortized (systematically allocated) over the policy’s life. | Prepaid insurance (an asset) is initially recognized, which is then reduced each period as the expense is recognized. | A five-year liability insurance policy. The premium is initially recorded as a prepaid insurance asset. Each year, one-fifth of the premium is expensed, reducing the prepaid insurance asset. |

Tax Implications

The tax treatment of insurance premiums hinges significantly on their classification as either capital or revenue expenditures. This classification directly impacts a business’s tax liability and can have a substantial effect on the overall financial picture. Misclassifying insurance premiums can lead to incorrect deductions, penalties, and ultimately, a skewed representation of a company’s true financial health.

The classification of insurance premiums as capital expenditure versus revenue expenditure affects the timing and manner in which the cost is recognized for tax purposes. Capital expenditures are typically not fully deductible in the year they are incurred. Instead, they are depreciated or amortized over their useful life, providing a tax benefit over several years. Revenue expenditures, on the other hand, are usually fully deductible in the year they are incurred, offering an immediate tax reduction.

Depreciation and Amortization of Capitalized Insurance Premiums

If insurance premiums are classified as capital expenditures, they are typically subject to depreciation or amortization. This means the cost is spread out over the useful life of the asset being insured. For example, insurance premiums paid for a long-term insurance policy covering a building would be amortized over the building’s useful life. The annual amortization expense reduces taxable income, resulting in lower tax liability in each of those years compared to a full deduction in the year of purchase. The specific depreciation or amortization method used will depend on the applicable tax laws and regulations. The straight-line method is a common approach, where the cost is evenly spread over the asset’s useful life. However, other methods, such as the declining balance method, may also be used, leading to different tax implications depending on the method chosen.

Scenario Illustrating Tax Liability Differences

Let’s consider a small business, “Acme Corp,” that purchased a new piece of machinery for $100,000. They also purchased a five-year insurance policy for the machinery costing $5,000.

Scenario 1: Insurance premium classified as revenue expenditure. Acme Corp deducts the full $5,000 insurance premium in the year of purchase. This immediately reduces their taxable income by $5,000, resulting in a lower tax liability for that year.

Scenario 2: Insurance premium classified as capital expenditure. Acme Corp capitalizes the $5,000 insurance premium and amortizes it over the five-year life of the policy. This means they deduct $1,000 ($5,000/5 years) each year for five years. While the total tax deduction remains the same over the five years, the tax benefit is spread out. The immediate tax savings are lower in the first year compared to Scenario 1, but the business benefits from consistent tax deductions over the life of the policy. The tax savings in the initial years might be less, but the impact on cash flow could be advantageous.

The difference in tax liability between these two scenarios depends on the applicable tax rate and the business’s overall financial situation. A higher tax rate would magnify the difference between the immediate deduction and the spread-out amortization. Furthermore, the business’s overall financial situation and its ability to utilize tax deductions strategically will influence the optimal classification choice. Professional tax advice should always be sought to ensure compliance and maximize tax benefits.

Illustrative Examples

Understanding the classification of insurance premiums as either capital or operating expenditures requires careful consideration of the specific policy and its purpose. The following examples illustrate how different circumstances lead to different classifications.

Example 1: Building Insurance Premium

This example concerns a newly constructed office building. The owner purchased a comprehensive insurance policy covering the building itself against fire, theft, and other potential damages. The premium paid for this policy is classified as a capital expenditure. This is because the insurance protects the building, a capital asset, throughout its useful life. The cost of the insurance is directly related to the acquisition and protection of the building and is therefore capitalized and amortized over the building’s useful life, rather than expensed immediately. The premium payment contributes to the overall cost of the building and enhances its value by mitigating risk.

Example 2: Product Liability Insurance Premium

A manufacturer of consumer electronics purchases a product liability insurance policy. This policy protects the company against financial losses arising from claims related to defects or injuries caused by their products. This premium is classified as an operating expense. The insurance protects against potential losses related to the ongoing operations of the business, not a specific capital asset. The cost is directly associated with the day-to-day running of the business and its revenue-generating activities. Therefore, it’s expensed in the period it covers.

Example 3: Key Person Life Insurance Premium

A small business owner purchases a life insurance policy on a key employee, whose expertise is crucial to the company’s success. The policy’s payout would help the business cover the costs of replacing the employee or mitigate the financial impact of their loss. This premium is classified as a capital expenditure. The insurance protects a crucial intangible asset – the employee’s expertise – which contributes to the long-term value of the business. The cost is therefore capitalized and amortized over the policy term, reflecting its contribution to the long-term financial health of the business.

Visual Representation of Insurance Premium Flow Through Financial Statements

The visual representation would be a flowchart. It would show two branches, one for capital expenditure classification and one for operating expense classification.

Capital Expenditure Classification: The flowchart would show the insurance premium initially recorded as an asset on the balance sheet. Over time, the asset is amortized (reduced) through depreciation expense on the income statement, ultimately reducing retained earnings on the balance sheet.

Operating Expense Classification: The flowchart would show the insurance premium directly recorded as an expense on the income statement, reducing net income and subsequently reducing retained earnings on the balance sheet. There would be no initial asset recording.

The flowchart would clearly illustrate the different paths the insurance premium takes depending on its classification, ultimately impacting the balance sheet and income statement differently. The key difference is the initial recognition of the premium as an asset (capital expenditure) versus a direct expense (operating expense).

Last Word

Determining whether an insurance premium is a capital expenditure requires a careful assessment of the specific circumstances. While generally, premiums for short-term operational coverage are considered operating expenses, those directly tied to the acquisition or protection of long-term assets are often classified as capital expenditures. This classification significantly impacts financial reporting and tax obligations. Understanding the nuances discussed here empowers businesses to make informed decisions and maintain accurate financial records, ensuring compliance and effective financial management.

FAQ Summary

What is the difference between capital and operating expenditures?

Capital expenditures (CapEx) are investments in long-term assets that benefit the business for multiple periods. Operating expenditures (OpEx) are expenses incurred in the normal course of business operations within a single accounting period.

Can premiums for liability insurance ever be considered capital expenditures?

Generally, liability insurance premiums are considered operating expenses. However, if the liability insurance is specifically tied to a capital asset acquisition (e.g., insuring a newly constructed building during construction), a portion might be capitalized.

How does the IRS view the classification of insurance premiums?

The IRS follows generally accepted accounting principles (GAAP) for determining the appropriate classification of insurance premiums. Proper documentation is crucial to support the chosen classification.

What if the insurance policy covers multiple assets, some capital and some operational?

In such cases, the premium should be allocated proportionally based on the value or usage of the assets covered. Proper allocation requires careful consideration and potentially professional accounting advice.