Navigating the complexities of health insurance and taxes can be daunting. Understanding whether your health insurance premiums are tax deductible is crucial for optimizing your financial well-being. This guide unravels the intricacies of premium deductibility, exploring eligibility criteria, relevant tax laws, and the processes involved for both employees and the self-employed. We’ll also delve into the impact of Health Savings Accounts (HSAs) and highlight state-specific regulations to provide a comprehensive overview.

From deciphering the components of your premium to mastering the steps for claiming deductions, we aim to empower you with the knowledge needed to confidently manage your healthcare costs and tax obligations. We’ll examine various scenarios, illustrating when deductions are permissible and when they are not, ensuring a clear understanding of the financial implications.

Understanding Health Insurance Premiums

Health insurance premiums are the monthly or annual payments you make to maintain your health insurance coverage. Understanding the components of your premium and the factors influencing its cost is crucial for making informed decisions about your healthcare plan. This section will break down the key aspects of health insurance premiums.

Components of a Health Insurance Premium

Several factors contribute to the total cost of your health insurance premium. These include the insurer’s administrative costs, the cost of claims paid out to policyholders, the provider network’s negotiated rates, and the insurer’s profit margin. A significant portion of your premium goes towards covering the healthcare services used by all policyholders. The complexity of medical care and the rising cost of treatments play a substantial role in premium determination. Additionally, the insurer’s operational expenses, including salaries, marketing, and technology, are factored into the premium.

Factors Influencing Premium Costs

Numerous factors influence the cost of your health insurance premium. Your age, location, family size, and health status are all key considerations. Older individuals generally pay higher premiums due to statistically higher healthcare utilization. Geographic location impacts premiums because healthcare costs vary across regions. Larger families often lead to higher premiums, reflecting the increased likelihood of healthcare needs. Pre-existing health conditions can also significantly affect premium costs, as insurers assess the potential for higher claims. Finally, the type of plan chosen significantly impacts the premium.

Types of Health Insurance Plans and Associated Premiums

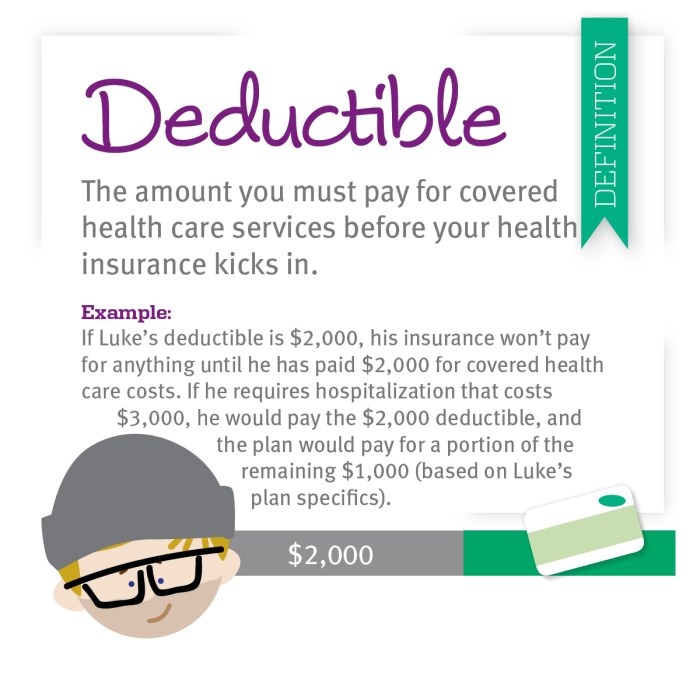

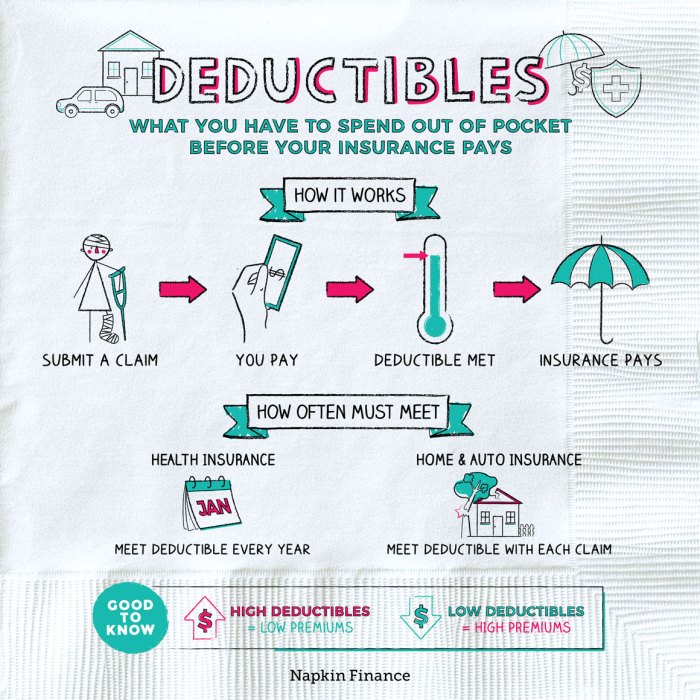

Several types of health insurance plans exist, each with varying premium structures. Health Maintenance Organizations (HMOs) typically have lower premiums but require you to see in-network doctors. Preferred Provider Organizations (PPOs) offer more flexibility in choosing doctors, but premiums are usually higher. Point of Service (POS) plans blend aspects of both HMOs and PPOs, offering a compromise between cost and choice. High Deductible Health Plans (HDHPs) feature lower premiums but require you to pay a higher deductible before insurance coverage begins. Catastrophic plans are designed for young adults and offer minimal coverage except for catastrophic events.

Comparison of Premium Costs for Various Plans

The following table provides a simplified example of how premium costs can vary between different plan types. Note that these are illustrative examples and actual premiums vary widely based on location, age, and other factors.

| Plan Type | Monthly Premium (Individual) | Monthly Premium (Family) | Annual Deductible (Individual) |

|---|---|---|---|

| HMO | $300 | $800 | $1,000 |

| PPO | $450 | $1200 | $2,000 |

| POS | $375 | $950 | $1,500 |

| HDHP | $200 | $500 | $5,000 |

Tax Deductibility of Health Insurance Premiums

The tax deductibility of health insurance premiums can significantly reduce your tax burden, offering considerable financial relief. Understanding the eligibility criteria and the process for claiming this deduction is crucial for maximizing your tax benefits. This section details the requirements and procedures for claiming this deduction, ensuring you can accurately and effectively utilize this tax advantage.

Eligibility Criteria for Deducting Health Insurance Premiums

Eligibility for deducting health insurance premiums varies depending on the specific tax laws of your country or region. Generally, the premiums paid for qualified health insurance plans are deductible. However, the specific rules regarding who qualifies and what types of plans are eligible differ. For example, in some jurisdictions, self-employed individuals and those who are not covered by an employer-sponsored plan might be eligible to deduct a portion or all of their health insurance premiums. It’s crucial to consult the relevant tax code and guidelines for your specific location to determine your eligibility. Factors like your employment status, the type of health insurance plan, and the amount of premiums paid all play a significant role in determining deductibility.

Tax Laws and Regulations Concerning Premium Deductions

Tax laws concerning health insurance premium deductions are complex and vary by jurisdiction. These laws often specify the types of plans that qualify for deductions, such as plans meeting minimum essential coverage requirements. There are often limitations on the amount of premiums that can be deducted, sometimes capped at a certain percentage of income or a fixed dollar amount. Furthermore, the rules can differ depending on whether the insurance is for the taxpayer, their spouse, or their dependents. Penalties for incorrect deductions can be significant, highlighting the importance of understanding and adhering to the relevant regulations. It is advisable to consult a tax professional for personalized guidance to ensure compliance.

Documentation Required to Claim the Deduction

To successfully claim a deduction for health insurance premiums, you will typically need to provide supporting documentation. This usually includes Form 1095-B (or a similar form depending on your location) from your insurance provider, detailing the premiums paid during the tax year. Additionally, you may need copies of your insurance policy, receipts for premium payments, and your tax return. Accurate and complete documentation is essential to support your claim and avoid potential delays or complications during the tax processing. Maintaining organized records throughout the year simplifies the process significantly.

Step-by-Step Guide on Claiming the Deduction

Claiming the deduction involves a series of steps. First, gather all necessary documentation as mentioned above. Second, accurately complete the relevant sections of your tax return, specifying the amount of premiums paid and providing the required supporting documentation. Third, carefully review your completed return to ensure accuracy before filing. Fourth, file your tax return by the designated deadline to avoid penalties. Finally, retain copies of your filed return and supporting documents for your records. While the specific process might vary slightly depending on your location and tax system, these steps provide a general framework for claiming the deduction. Consulting a tax professional is always recommended to ensure compliance and maximize your tax benefits.

State-Specific Regulations

While the federal government offers some guidelines on health insurance premium deductibility, the specifics often vary significantly from state to state. Understanding these variations is crucial for accurately calculating your tax liability. State tax codes influence which premiums are deductible, the extent of the deduction, and who qualifies. These differences highlight the importance of consulting your state’s specific tax regulations.

State-specific rules regarding health insurance premium deductibility significantly impact an individual’s tax liability. A higher deduction can lead to lower taxable income and, consequently, lower taxes owed. Conversely, limited or no deductibility increases the tax burden. The differences aren’t always minor; they can represent hundreds or even thousands of dollars in annual tax savings or additional costs. Therefore, being aware of your state’s regulations is paramount.

Deduction Rules in Selected States

The following provides a comparison of health insurance premium deductibility rules in three states: California, New York, and Texas. It’s important to note that these rules are subject to change, and this information should not be considered professional tax advice. Always consult a tax professional or refer to the most up-to-date state tax codes for accurate information.

- California: California generally allows taxpayers to deduct health insurance premiums paid for themselves, their spouses, and their dependents if they are self-employed or if the premiums are not reimbursed by an employer. Specific requirements may exist regarding the type of health insurance plan and documentation needed. The deduction is typically taken as an itemized deduction on Schedule A of Form 1040. For example, a self-employed individual in California paying $10,000 annually in premiums might see a significant reduction in their taxable income, depending on their overall tax bracket and other deductions.

- New York: Similar to California, New York allows deductions for self-employed individuals and those whose premiums are not reimbursed by an employer. However, New York may have additional stipulations regarding the type of health insurance plan that qualifies for the deduction. The rules might also differ based on the taxpayer’s filing status (single, married filing jointly, etc.). For instance, a freelancer in New York with a high income might benefit greatly from deducting their health insurance premiums, potentially lowering their tax liability substantially.

- Texas: Texas generally does not allow a state-level deduction for health insurance premiums. Taxpayers in Texas rely solely on federal deductions available under the Affordable Care Act (ACA) or other federal tax provisions. This means a self-employed individual in Texas will have fewer options for deducting their health insurance premiums compared to residents of California or New York. The lack of a state-level deduction can significantly impact their overall tax liability.

Impact on Tax Liability

The differences in state regulations directly affect a taxpayer’s bottom line. A self-employed individual in California, with the ability to deduct their premiums, will likely pay less in state taxes compared to an individual in Texas with no state-level deduction. The impact is even more pronounced for higher-income individuals with substantial premium payments. For example, a high-income self-employed individual in California might reduce their state tax liability by several thousand dollars annually through the deduction, while a similarly situated individual in Texas would have no such state-level benefit. The potential tax savings vary depending on the individual’s income, tax bracket, and the amount of their health insurance premiums.

Final Conclusion

Successfully navigating the tax implications of health insurance premiums requires careful consideration of individual circumstances and applicable regulations. While the possibility of deducting premiums offers significant tax advantages, understanding the eligibility requirements and the necessary documentation is paramount. This guide serves as a starting point; consulting with a tax professional is recommended for personalized advice tailored to your specific situation to ensure you maximize your tax benefits and comply with all relevant laws.

Questions Often Asked

What if I have both employer-sponsored insurance and a private policy? Can I deduct both?

Generally, you can only deduct premiums for health insurance if you or your spouse are self-employed or if you itemize deductions and meet specific criteria. Deductibility often hinges on whether the plan is considered a qualified health plan under the Affordable Care Act. It’s unlikely you could deduct both premiums unless specific circumstances apply. Consult a tax professional for guidance.

Are there penalties for incorrectly claiming a premium deduction?

Yes, claiming a deduction you’re not entitled to can result in penalties, including interest and potential audits. Accurate record-keeping and a thorough understanding of the rules are crucial to avoid these consequences.

Can I deduct premiums paid for my dependents?

The deductibility of premiums for dependents depends on your specific circumstances and the type of coverage. Generally, if you are self-employed and pay for your dependents’ health insurance, you may be able to deduct these premiums. However, the rules can be complex, so it’s best to seek professional tax advice.