Navigating the complexities of health insurance and tax deductions can feel like traversing a maze. The question, “Is health insurance premium deductible?” is a common one, with the answer often depending on individual circumstances. This guide unravels the intricacies of deducting health insurance premiums, exploring scenarios for self-employed individuals, employees with employer-sponsored plans, and the impact of HSAs and FSAs. We’ll clarify the rules, provide practical examples, and help you understand how to maximize your tax benefits.

Understanding health insurance premium deductibility is crucial for both minimizing your tax burden and making informed decisions about your health coverage. Whether you’re self-employed, employed by a company, or considering different health savings options, this guide offers a clear and concise explanation of the applicable rules and regulations, along with practical examples to illustrate key concepts. We aim to empower you with the knowledge to navigate this often-confusing aspect of personal finance.

Deductibility of Health Insurance Premiums

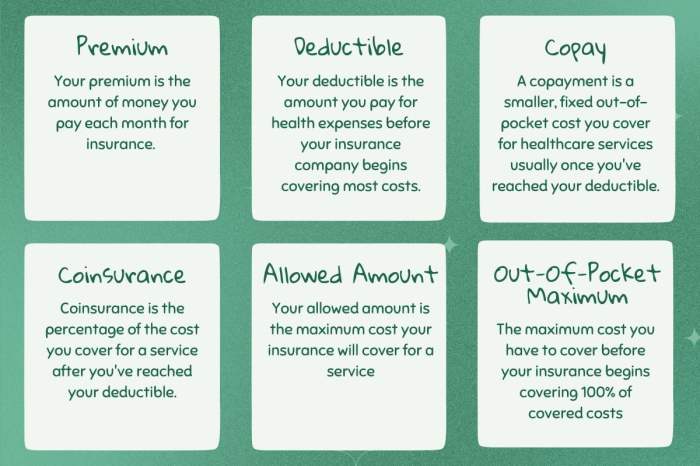

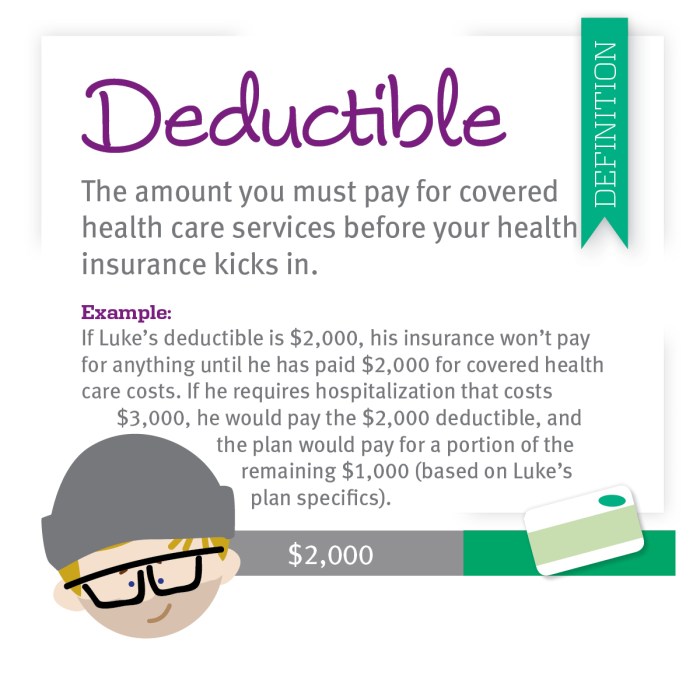

The deductibility of health insurance premiums varies significantly depending on the country, the type of insurance plan, and the individual’s tax situation. Generally, the goal of allowing premium deductions is to incentivize individuals to obtain health insurance and reduce the overall cost of healthcare. However, the specific rules and regulations governing these deductions are complex and often subject to change.

Generally, health insurance premiums are considered deductible in many countries if the insurance covers medical expenses. This typically means the policy must provide coverage for hospital stays, doctor visits, surgeries, and other related medical costs. However, premiums for supplemental insurance policies that only cover non-essential expenses (such as cosmetic surgery or wellness programs not related to treating an illness) are usually not deductible. Furthermore, the deductibility may be subject to limitations, such as income thresholds or a maximum amount that can be deducted.

Examples of Deductible and Non-Deductible Premiums

Deductible premiums commonly include those for comprehensive health insurance plans covering essential medical services. For example, an individual with a traditional health insurance policy that covers hospitalization, doctor visits, and prescription drugs would likely be able to deduct the premiums paid, subject to the applicable tax laws of their country. Conversely, premiums for policies that primarily cover dental care, vision care, or other non-essential medical expenses are often not deductible. For instance, a standalone vision insurance plan purchased separately might not qualify for a premium deduction in many jurisdictions. Another example of a non-deductible premium would be a policy solely focused on covering alternative therapies not considered standard medical treatment under the prevailing healthcare system.

Comparative Analysis of Deductibility Rules

Deductibility rules regarding health insurance premiums differ considerably across various countries and regions. These differences stem from varying healthcare systems, tax policies, and social welfare programs. The following table offers a simplified comparison – specific regulations are constantly updated, so consulting official tax resources is crucial for accurate and up-to-date information.

| Country/Region | Deductibility Rules | Income Limits | Supporting Legislation |

|---|---|---|---|

| United States | Premiums for self-employed individuals and those whose employer doesn’t offer coverage are often deductible as an above-the-line deduction. Specific rules apply to those enrolled in a health savings account (HSA). | Varies depending on the type of plan and income; some plans have income limitations for eligibility. | Internal Revenue Code Section 213 |

| Canada | Generally, medical expenses, including premiums for some private health insurance plans, can be claimed as a medical expense tax credit. The credit is non-refundable. | No specific income limits for the medical expense tax credit. | Income Tax Act |

| United Kingdom | Generally, premiums for private health insurance are not tax deductible. However, some employers may offer private health insurance as a benefit, and this may be tax-advantaged for the employee. | Not applicable | Income Tax Acts |

| Germany | Health insurance is mandatory in Germany, and contributions are usually deducted directly from salary. Deductibility is thus integrated into the payroll system, not a separate tax deduction. | Not applicable (mandatory contribution) | Sozialgesetzbuch V (SGB V) |

Impact of Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs)

Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs) are valuable tools that can significantly impact your healthcare finances, often complementing your health insurance plan and offering tax advantages. Understanding how these accounts interact with your health insurance premiums is key to maximizing their benefits. Both offer pre-tax contributions, reducing your taxable income, but they differ in their eligibility requirements and how the funds can be used.

HSAs and FSAs allow you to set aside pre-tax dollars to pay for eligible medical expenses. This reduces your taxable income, lowering your overall tax burden. However, their impact on the deductibility of health insurance premiums themselves is indirect. The premiums are generally deductible only under specific circumstances, as discussed previously, and the presence of an HSA or FSA doesn’t alter that fundamental rule. Instead, HSAs and FSAs influence your overall healthcare costs, potentially freeing up funds that might otherwise have been used to cover deductibles and out-of-pocket expenses.

HSA Characteristics

HSAs offer significant tax advantages. Contributions are tax-deductible, earnings grow tax-free, and withdrawals for qualified medical expenses are tax-free. This triple tax advantage makes them a powerful tool for long-term healthcare savings.

- Benefit: Triple tax advantage: contributions, growth, and qualified withdrawals are all tax-free.

- Benefit: Funds roll over year to year, accumulating over time.

- Drawback: Eligibility is limited to individuals enrolled in high-deductible health plans (HDHPs).

- Drawback: There are annual contribution limits.

Example: Suppose John contributes $3,850 to his HSA (the maximum for 2023 for individuals). If John is in the 22% tax bracket, this contribution reduces his taxable income by $3,850, saving him $847 in taxes (3850 * 0.22). He can then use these HSA funds to pay for eligible medical expenses, further reducing his out-of-pocket costs.

FSA Characteristics

FSAs, unlike HSAs, are not investment accounts. They are employer-sponsored plans where pre-tax dollars are set aside for medical expenses.

- Benefit: Reduces taxable income, lowering your tax liability.

- Benefit: Easy access to funds for medical expenses.

- Drawback: Funds typically do not roll over to the next year; any unused funds are forfeited.

- Drawback: Contribution limits are generally lower than HSA limits.

Example: Mary contributes $2,850 to her FSA. Assuming a 22% tax bracket, she saves $627 in taxes (2850 * 0.22). She uses this money to pay for her daughter’s dental bills, reducing her overall healthcare expenses.

Comparison of HSA and FSA

While both HSAs and FSAs offer tax advantages, their structures and suitability differ. Choosing between them depends on individual circumstances and healthcare needs.

| Feature | HSA | FSA |

|---|---|---|

| Tax Advantages | Triple tax advantage | Pre-tax contributions only |

| Rollover | Funds roll over | Funds typically do not roll over |

| Eligibility | High-deductible health plan (HDHP) required | Offered by many employers |

| Contribution Limits | Annual limits | Annual limits, generally lower than HSA |

Specific Circumstances and Exceptions

The deductibility of health insurance premiums isn’t always straightforward. Several specific circumstances and exceptions can affect whether you can deduct premiums, even if you generally meet the eligibility criteria. Understanding these nuances is crucial for accurate tax filing. This section will clarify some common situations.

Long-Term Care Insurance Premiums

Deductibility of long-term care insurance premiums depends on your age and the policy’s features. Generally, you can deduct the amount you paid for long-term care insurance premiums, but there are limits. The amount you can deduct depends on your age at the time of purchase. The IRS provides specific tables outlining these limits based on age. For example, a 50-year-old individual might be able to deduct a higher amount than a 65-year-old, reflecting the higher likelihood of needing long-term care later in life. It’s important to consult the IRS Publication 502 for the most current age-based limits and to ensure the policy qualifies for this deduction.

Premiums Paid by a Dependent

If you pay health insurance premiums for a dependent, the deductibility depends on the dependent’s status and your filing status. You can generally claim the deduction if the dependent is claimed as a qualifying child or qualifying relative on your tax return and meets certain income requirements. However, the dependent must not be claimed as a dependent on another person’s return. The premiums paid for the dependent’s coverage are deductible only if they meet the same criteria for the taxpayer. The specific rules and requirements can be complex and are best understood by referencing the current IRS guidelines. Failure to meet all these conditions may result in the loss of the deduction.

Other Special Circumstances and Exceptions

Several other factors can impact the deductibility of health insurance premiums. Understanding these exceptions is vital for accurate tax reporting.

- Premiums Paid Under a Qualified Medical Savings Account (MSA): Premiums paid through a qualified MSA are not deductible. This is because the MSA itself provides tax advantages.

- Premiums Paid After Medicare Eligibility: Medicare Part B and Part D premiums generally aren’t deductible, unless you itemize deductions and meet specific requirements. The rules are complex and may vary year to year.

- Premiums Paid for COBRA Coverage: Premiums paid for COBRA coverage may be deductible if you itemize deductions and meet specific requirements. However, this is generally a complex area, requiring careful consideration of applicable rules and regulations.

- Premiums Paid by Self-Employed Individuals: Self-employed individuals can deduct the full amount of health insurance premiums they pay for themselves, their spouse, and their dependents. This is a significant tax benefit often overlooked. This deduction is taken above the line, reducing adjusted gross income.

Illustrative Examples

Understanding the deductibility of health insurance premiums can be complex, depending on your employment status and other factors. Let’s clarify this with some real-world examples.

These examples illustrate scenarios where individuals either successfully deduct or cannot deduct health insurance premiums. The key difference lies in whether the premiums are paid by a self-employed individual or an employee with employer-sponsored insurance.

Self-Employed Individual Successfully Deducting Premiums

Sarah, a freelance graphic designer, is self-employed. In 2024, she paid $7,200 in health insurance premiums for herself and her family. Because she is self-employed, she can deduct the full amount of her health insurance premiums from her business income on her tax return, reducing her taxable income and therefore her tax liability. To do this, she itemizes her deductions instead of using the standard deduction. She accurately tracks all her business expenses, including her health insurance premiums, maintaining detailed records for tax purposes. Her adjusted gross income (AGI) is significantly reduced, resulting in tax savings. This deduction is taken on Schedule C (Profit or Loss from Business) of her Form 1040. She is careful to ensure her expenses are legitimate business expenses.

Employee with Employer-Sponsored Insurance: No Deduction

Imagine Mark, an accountant employed by a large firm. His employer offers a comprehensive health insurance plan as part of his compensation package. Mark pays a portion of the premium through payroll deductions, while his employer covers the rest. In this scenario, Mark cannot deduct the premiums he pays. This is because the cost of the health insurance is considered part of his overall compensation package, and he’s already benefiting from a tax advantage due to the employer’s contribution. To visualize this, imagine a pie chart representing Mark’s total compensation. A significant slice represents his salary, another substantial slice is the employer’s contribution to his health insurance, and a smaller slice represents Mark’s payroll deduction. The employer’s contribution is not taxed as income to Mark, representing a significant tax advantage. The portion Mark pays is considered part of his overall compensation and therefore isn’t deductible separately. His taxable income is calculated based on his total compensation package, including the employer-sponsored insurance.

Final Thoughts

Successfully navigating the landscape of health insurance premium deductibility requires careful consideration of your specific circumstances. While general rules apply, individual situations often present unique challenges. This guide has aimed to provide a comprehensive overview, covering various scenarios and offering a practical understanding of the relevant tax implications. Remember to consult with a qualified tax professional for personalized advice tailored to your individual financial situation to ensure accurate reporting and maximize your tax benefits.

FAQ Guide

Can I deduct health insurance premiums if I’m covered under my spouse’s plan?

Generally, no. Deductions typically apply to premiums you pay directly.

What if I overcontribute to my HSA?

You may be subject to penalties. Consult a tax professional for guidance.

Are there penalties for claiming deductions I’m not eligible for?

Yes, potentially including interest and additional taxes. Accurate record-keeping is essential.

Where can I find the specific forms needed to claim these deductions?

The relevant forms (like Schedule A and Form 8889) are available on the IRS website.