Irrevocable life insurance trusts (ILITs) offer a powerful estate planning tool, but understanding the intricacies of premium payments is crucial for maximizing their benefits. This guide navigates the complexities of ILIT premium payment strategies, tax implications, and estate planning considerations, providing a clear and concise overview for those seeking to leverage this sophisticated financial instrument.

We’ll explore various funding methods, from direct contributions to loans, analyzing the tax consequences of each approach. We’ll also examine best practices for managing and documenting payments, ensuring compliance and minimizing potential liabilities. By understanding these key aspects, you can effectively utilize an ILIT to protect your assets and secure your family’s financial future.

Defining Irrevocable Life Insurance Trusts (ILITs)

An Irrevocable Life Insurance Trust (ILIT) is a powerful estate planning tool designed to hold and manage life insurance policies outside of your estate. This separation offers significant benefits in terms of minimizing estate taxes and protecting assets for beneficiaries. The core purpose is to ensure that the death benefit from the life insurance policy passes directly to your beneficiaries, avoiding probate and potential estate taxes.

Fundamental Structure and Purpose of an ILIT

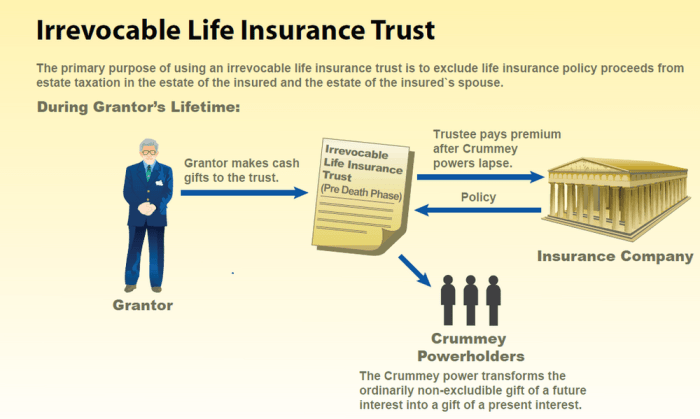

An ILIT is established by transferring ownership of a life insurance policy to the trust. The grantor (the person setting up the trust) relinquishes all control over the policy and its assets. This irrevocability is crucial for the tax advantages. The trust then becomes the policy owner, and the named beneficiaries receive the death benefit upon the grantor’s death. The primary purpose is to keep the life insurance death benefit out of the probate process and reduce or eliminate estate taxes. This ensures that the full benefit reaches the designated beneficiaries without delays or reductions due to estate administration.

Legal and Tax Implications of Establishing an ILIT

Establishing an ILIT involves legal and tax considerations. From a legal standpoint, it requires careful drafting by an estate planning attorney to ensure the trust’s provisions are legally sound and comply with all relevant state and federal laws. Tax implications are significant. The life insurance death benefit is generally excluded from the grantor’s estate for federal estate tax purposes, provided the grantor does not retain any control over the trust or the policy. This can result in substantial tax savings for high-net-worth individuals. However, the premiums paid into the policy while the trust is in place may still be subject to gift tax, depending on the amount and the grantor’s lifetime gift tax exemption.

Types of ILITs and Their Variations

There isn’t a single type of ILIT. Variations exist depending on the specific needs and goals of the grantor. For example, some ILITs may be designed to provide income to beneficiaries during the grantor’s lifetime, while others focus solely on providing a death benefit. The complexity of an ILIT can vary widely, from simple trusts with straightforward provisions to more sophisticated trusts with complex provisions for asset management and distribution. One common variation is the use of a Crummey trust provision, which allows for annual gifts to the trust without incurring gift taxes, up to the annual gift tax exclusion amount.

Comparison of ILITs with Other Estate Planning Tools

ILITs are often compared to other estate planning tools, such as life insurance owned individually or within a revocable living trust. Unlike individually owned life insurance, the death benefit in an ILIT is not included in the grantor’s taxable estate. Compared to a revocable living trust, an ILIT offers greater protection against creditors and offers more control over asset distribution to beneficiaries after death. The irrevocable nature of the ILIT is a key differentiator, providing greater certainty in estate planning.

Key Features of an ILIT

| Feature | Description | Premium Payment Method | Tax Implications |

|---|---|---|---|

| Irrevocability | Grantor relinquishes control over the trust and the policy. | Grantor can fund via outright gifts, Crummey trust contributions, or other methods. | Death benefit excluded from grantor’s estate; premiums may be subject to gift tax. |

| Beneficiary Designation | Specific beneficiaries are named to receive the death benefit. | Can be funded through various methods aligned with estate and tax planning goals. | Beneficiaries receive the death benefit tax-free (generally). |

| Asset Protection | Trust assets are protected from creditors and lawsuits against the grantor. | Strategic funding ensures alignment with the grantor’s overall financial plan. | Proper structuring minimizes tax liabilities for both grantor and beneficiaries. |

| Probate Avoidance | The death benefit avoids probate, ensuring quicker distribution to beneficiaries. | Flexible options allow for adaptation to changing financial circumstances. | Tax efficiency is a primary goal in choosing the premium payment strategy. |

Premium Payment Strategies for ILITs

Funding an Irrevocable Life Insurance Trust (ILIT) requires careful consideration of premium payment strategies. The chosen method significantly impacts the trust’s longevity and the tax implications for both the grantor and beneficiaries. This section details various approaches, their tax consequences, and best practices for effective management.

Methods for Funding ILIT Premium Payments

Several methods exist for funding ILIT premium payments, each with its own set of advantages and disadvantages. The most common approaches involve direct contributions from the grantor’s personal funds or utilizing loans. A less common, but potentially viable option, is using funds from a separate trust or other assets held outside the ILIT.

Tax Consequences of Different Premium Payment Strategies

The tax implications of ILIT premium payments are complex and depend heavily on the funding source. For example, premiums paid directly from the grantor’s personal funds are not typically deductible, though the death benefit is generally received income tax-free by the beneficiaries. Conversely, interest paid on loans used to fund premiums might be tax-deductible, depending on the loan’s purpose and the applicable tax laws. Careful tax planning with a qualified professional is crucial to minimize tax liabilities.

Best Practices for Managing and Documenting ILIT Premium Payments

Maintaining meticulous records of all ILIT premium payments is paramount. This includes documenting the payment source, date, amount, and any associated receipts or documentation. This diligent record-keeping is essential for tax purposes and ensures the trust’s compliance with all relevant regulations. Regular reviews of the payment schedule and the trust’s overall financial health are also highly recommended.

Sample Premium Payment Schedule for an ILIT

A sample premium payment schedule might look like this:

| Year | Premium Amount | Payment Source | Payment Date |

|---|---|---|---|

| 2024 | $10,000 | Personal Funds | January 15, 2024 |

| 2025 | $10,500 | Personal Funds | January 15, 2025 |

| 2026 | $11,025 | Personal Funds | January 15, 2026 |

Note: This is a simplified example and the actual amounts and payment dates will vary depending on the specific insurance policy and the grantor’s financial situation. Inflation and potential increases in premiums are not factored into this example.

Comparison of Pros and Cons of Different Premium Payment Sources

Understanding the advantages and disadvantages of different funding sources is crucial for informed decision-making.

The following table summarizes the pros and cons of using personal funds versus loans:

| Feature | Personal Funds | Loans |

|---|---|---|

| Pros |

|

|

| Cons |

|

|

Estate Planning Considerations for ILITs

Irrevocable Life Insurance Trusts (ILITs) play a crucial role in comprehensive estate planning, offering significant advantages in asset protection, tax efficiency, and probate avoidance. Understanding their intricacies and strategic implementation is paramount for high-net-worth individuals and families seeking to preserve their wealth and legacy.

The Role of an ILIT in Overall Estate Planning

An ILIT acts as a separate legal entity, holding life insurance policies outside of the grantor’s estate. This prevents the life insurance death benefit from being included in the taxable estate, thus reducing estate taxes and avoiding probate delays. The ILIT’s structure allows for the controlled distribution of assets to beneficiaries according to the grantor’s wishes, providing flexibility and minimizing potential family disputes. Properly structured, an ILIT can significantly enhance the efficiency and effectiveness of an overall estate plan, especially for individuals with substantial assets.

Beneficiary Designation in an ILIT

Precise and unambiguous beneficiary designations are critical to the successful operation of an ILIT. Ambiguous wording or omissions can lead to protracted legal battles and unintended consequences. The trust document should clearly specify the beneficiaries, their respective shares, and the conditions under which distributions will be made. Consideration should be given to potential changes in family circumstances, such as divorce, remarriage, or the birth of children, and the trust document should be drafted to accommodate such eventualities. Professional legal advice is essential to ensure that the beneficiary designations align perfectly with the grantor’s intentions and comply with all applicable laws.

ILITs Versus Other Estate Planning Vehicles

While other estate planning tools, such as wills, living trusts, and family limited partnerships, serve valuable purposes, an ILIT offers unique advantages. Unlike a will, which is subject to probate, an ILIT avoids this process, ensuring faster and more efficient distribution of assets. Compared to a revocable living trust, an ILIT offers greater asset protection from creditors and potential lawsuits. Family limited partnerships can also offer tax benefits but often involve more complex management structures than an ILIT. The choice between these vehicles depends on individual circumstances, financial goals, and risk tolerance. A comprehensive analysis is needed to determine the most appropriate strategy.

Hypothetical Case Study: Preserving Family Wealth

John and Mary, a successful couple with a substantial estate, established an ILIT to protect their wealth and ensure a smooth transfer of assets to their children. They funded the trust with a large life insurance policy. Upon John’s death, the death benefit, exceeding $10 million, passed directly to the ILIT, avoiding inclusion in his taxable estate and significant estate taxes. The ILIT then distributed the funds to their children according to a predetermined schedule Artikeld in the trust document, ensuring the long-term financial security of their family and minimizing potential disputes amongst heirs. Without the ILIT, a substantial portion of the death benefit would have been lost to estate taxes, significantly diminishing the inheritance received by their children.

Flowchart: Setting Up and Funding an ILIT

A flowchart depicting the process would visually represent the following steps: 1. Consult with estate planning attorney; 2. Draft and execute the trust document; 3. Fund the trust with life insurance policy; 4. Name trustees and beneficiaries; 5. Maintain ongoing compliance and administration. The flowchart would use boxes and arrows to show the sequential nature of these steps, highlighting the crucial role of legal counsel at each stage. It would also show feedback loops, indicating the potential need for adjustments based on changing circumstances or legal requirements.

Concluding Remarks

Effective management of irrevocable life insurance trust premium payments is paramount to realizing the full potential of an ILIT. By carefully considering the various funding strategies, tax implications, and estate planning considerations discussed herein, individuals can create a robust and efficient plan that safeguards their assets and minimizes tax burdens. Proactive planning and professional guidance are essential to navigate the complexities of ILITs and ensure a smooth and successful implementation.

FAQ Guide

What happens if I miss an ILIT premium payment?

Missing a premium payment can lead to the lapse of the life insurance policy, undermining the trust’s purpose. Consult with your trustee and financial advisor immediately to explore options for remediation.

Can I change the beneficiary of an ILIT after it’s established?

Generally, no. The irrevocable nature of the trust means beneficiary changes are typically not permitted after establishment. Careful planning and beneficiary selection are crucial during the trust’s creation.

What are the potential penalties for improperly structuring ILIT premium payments?

Improper structuring can result in significant tax penalties, including gift and estate taxes. Professional guidance is essential to ensure compliance with all applicable regulations.

How often should I review my ILIT and its premium payment strategy?

Regular review, at least annually, is recommended to ensure the strategy remains aligned with your financial goals and evolving tax laws. Life changes may necessitate adjustments to your plan.