Insurance return premiums: a concept often shrouded in policy jargon, yet potentially offering significant financial benefits. This guide unravels the complexities surrounding insurance return premiums, exploring how they work, the factors influencing their amounts, and the crucial considerations for consumers. We’ll delve into various policy types, tax implications, and provide practical examples to illuminate this often-overlooked aspect of insurance.

Understanding insurance return premiums empowers policyholders to make informed decisions, maximizing their financial returns and ensuring they receive the full value of their insurance coverage. This guide serves as a practical resource, equipping readers with the knowledge to navigate the intricacies of return premiums and make the most of their insurance investments.

Factors Influencing Return Premium Amounts

The amount of premium returned to a policyholder after the termination of an insurance policy, often referred to as a return premium, is influenced by several key factors. Understanding these factors is crucial for both policyholders and insurance providers to accurately assess the financial implications of policy cancellations or adjustments. This section will detail the primary determinants of return premium calculations.

Policy Duration

The length of time a policy has been active significantly impacts the return premium. Generally, shorter policy durations result in higher return premiums, as a smaller portion of the premium has been consumed by the insurer’s operational costs and risk exposure. For example, if a one-year policy is cancelled after only three months, a larger portion of the initial premium will be returned compared to a policy cancelled after eleven months. Conversely, longer policy durations typically lead to smaller return premiums, as a greater proportion of the premium has been utilized to cover administrative expenses and potential claims payouts. The exact calculation often involves a pro-rata adjustment, taking into account the unexpired portion of the policy term.

Policyholder’s Claims History

A policyholder’s claims history can influence the return premium, although this is less common than the impact of policy duration. Some insurance policies may incorporate clauses that adjust the return premium based on the number and value of claims filed during the policy period. For instance, a policyholder with a history of multiple or substantial claims might receive a smaller return premium compared to a policyholder with a clean claims record. This is because the insurer has incurred higher costs associated with handling and settling those claims. However, this is not a universal practice, and the specific impact of claims history on return premiums varies significantly depending on the insurer and the type of insurance policy.

Insurance Company Practices

Return premium calculations vary considerably across different insurance companies. Each insurer has its own set of rules, procedures, and formulas for determining the amount returned. These variations stem from differences in their internal cost structures, risk assessment methodologies, and business strategies. For instance, one company might use a strictly pro-rata method, while another might employ a more complex calculation that considers factors beyond policy duration. Furthermore, the specific terms and conditions Artikeld in the individual insurance policy also play a significant role in determining the final return premium amount. Comparing quotes and reviewing policy documents from multiple insurers is therefore essential for policyholders to understand the potential return premium they might receive in different scenarios.

Tax Implications of Return Premiums

Receiving a return of premium on an insurance policy can have tax implications, varying significantly depending on the type of policy, the reason for the return, and your specific jurisdiction. Understanding these implications is crucial for accurate tax reporting and avoiding potential penalties. This section Artikels the general principles and provides examples, but consulting a tax professional is always recommended for personalized advice.

The tax treatment of returned premiums hinges on whether the return is considered a refund of premiums already paid or a gain on an investment. Refunds are generally not taxed, while gains are taxable income. The line between these two can be blurry, particularly with certain types of insurance products.

Tax Treatment of Returned Premiums as Refunds

Refunds of premiums paid are generally not considered taxable income. This applies when the premium is returned because the policy was cancelled before coverage began or because the insurer made an error in calculating the premium. The amount returned simply reduces the total premium paid for tax purposes. For example, if you paid $1,000 in premiums and received a $200 refund due to cancellation, your deductible premium for tax purposes would be $800.

Tax Treatment of Returned Premiums as Income

In contrast, if the return of premium is considered a gain or profit from an investment-related insurance product, such as a participating whole life insurance policy with dividends or a return-of-premium rider, then the returned amount may be subject to income tax. This is because the return represents a profit beyond the initial premium paid. The specific tax rate will depend on your individual tax bracket and applicable tax laws in your jurisdiction. For instance, if a $1,000 premium resulted in a $1,200 return, the $200 difference would be considered taxable income.

Tax Laws and Regulations Pertaining to Return of Premium Payments

Tax laws regarding returned premiums vary significantly by country and even within different states or provinces. In the United States, for example, the Internal Revenue Service (IRS) provides guidance on the taxability of insurance proceeds, often differentiating between life insurance and other types of insurance. Similar specific regulations exist in other countries, often within their respective tax codes or revenue agency guidelines. These regulations usually specify which types of insurance returns are considered taxable and how to calculate the taxable amount. It’s vital to consult the relevant tax authority’s publications and guidance for your specific location.

Examples of Tax Calculation on Returned Premiums

Let’s consider two simplified examples. In the first, a policyholder in the United States receives a $500 refund for a cancelled auto insurance policy. This refund is not taxable income. In the second example, a policyholder in Canada receives a $1,000 return of premium from a participating whole life insurance policy, exceeding the initial premium paid. This excess amount is considered taxable income and will be added to their other income for the year, taxed at their marginal tax rate. The specific tax calculation will depend on the policy details and the policyholder’s tax bracket.

Best Practices for Managing Tax Implications of Insurance Return Premiums

Maintaining accurate records of all insurance premiums paid and any returns received is crucial. This documentation is essential for tax reporting purposes. When receiving a return of premium, it’s advisable to carefully review the accompanying documentation to understand whether the return is considered a refund or a taxable gain. Consulting a qualified tax advisor can provide personalized guidance on the tax implications specific to your situation and help ensure compliance with relevant tax laws and regulations. They can help you navigate the complexities of different insurance products and ensure you accurately report the returns on your tax forms.

Consumer Considerations and Understanding

Choosing an insurance policy with a return of premium (ROP) option can be a smart financial move, but it requires careful consideration. Understanding the nuances of these policies and comparing them effectively is crucial to making an informed decision that aligns with your individual financial goals and risk tolerance. This section provides a guide to help you navigate the complexities of ROP policies.

Guide to Understanding and Comparing Insurance Policies with Return of Premium Options

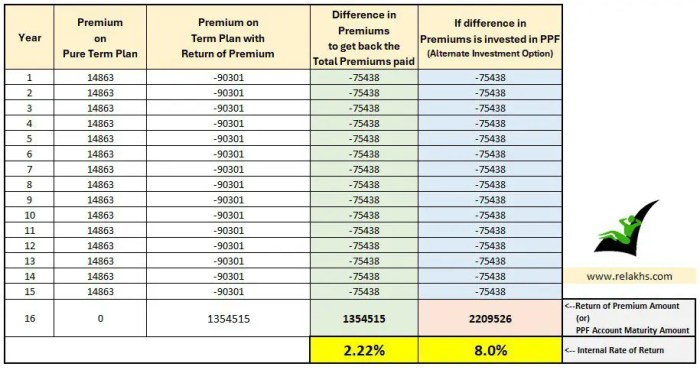

To effectively compare insurance policies offering return of premium options, focus on several key aspects. First, carefully examine the policy’s terms and conditions, paying close attention to the specific conditions that must be met to qualify for the premium return. These often include factors like maintaining the policy for a specified duration without claims or lapses. Second, compare the overall cost of the policy, including premiums and any associated fees, with policies that do not offer ROP. A higher premium for a policy with ROP may not always be financially advantageous. Finally, consider the potential return amount and the timeframe over which it will be returned. Some policies offer a lump sum at the end of the term, while others may offer partial returns at specific intervals. A thorough comparison, considering these elements, allows for a rational choice.

Key Factors to Consider When Choosing a Policy with Return of Premium

Several crucial factors influence the decision-making process when selecting an insurance policy with a return of premium feature. The total premium paid over the policy’s term plays a significant role; a higher premium initially might mean a larger return, but this needs to be weighed against the potential for a lower overall return on investment compared to a lower-premium, non-ROP policy. The length of the policy term directly impacts the potential return. Longer-term policies generally offer higher returns, but also involve a higher commitment. The conditions for receiving the return are critical; policies often stipulate no claims or lapses to qualify for a full return, so consider your risk profile and claims history. Finally, compare the guaranteed return with the potential investment returns from alternative financial products to determine the overall financial advantage of the ROP option.

Questions to Ask Your Insurance Provider About Return Premiums

Before committing to a policy with a return of premium, a comprehensive understanding of its details is essential. This requires asking your insurance provider specific questions. The exact percentage of the premium returned should be clarified, along with any conditions that could affect the amount returned (e.g., partial returns due to claims). A detailed explanation of the calculation method used to determine the return amount should be obtained. The timeframe for the return should be confirmed – is it a lump sum at the end of the term, or are there staged returns? Finally, inquire about any fees or charges associated with the policy that might impact the net return.

Calculating Potential Return of Premium Based on Different Policy Scenarios

Calculating the potential return on premium requires careful consideration of the policy specifics. Let’s consider two hypothetical scenarios.

Scenario 1: A 10-year term life insurance policy with a 100% return of premium if no claims are made. The annual premium is $1,000. The total premium paid over 10 years is $10,000. If no claims are filed, the policyholder receives a $10,000 return at the end of the term.

Scenario 2: A 20-year term life insurance policy with an 80% return of premium, also contingent on no claims. The annual premium is $500. The total premium paid is $10,000. At the end of 20 years, assuming no claims, the policyholder receives $8,000.

The formula for calculating potential return is: Potential Return = (Premium Percentage Return) x (Total Premiums Paid)

These scenarios illustrate how varying policy terms (premium amounts, return percentages, and policy durations) directly influence the final return amount. Remember that these are simplified examples and actual returns may vary based on the specific policy conditions.

Illustrative Examples of Return Premium Scenarios

Understanding return premium scenarios requires examining specific policy details and how they interact with the insurer’s calculations. The following examples illustrate different situations and the resulting return premium amounts. Remember that these are simplified examples and actual return premiums can vary depending on the specific insurer and policy terms.

Scenario 1: Unused Coverage in a Term Life Insurance Policy

This scenario involves a 10-year term life insurance policy with a death benefit of $500,000 and an annual premium of $2,000. The policyholder, a 35-year-old male, decided to cancel the policy after five years due to a change in financial circumstances. The insurer’s policy terms allow for a return of a portion of the premium, typically a pro-rata refund of the unused portion. In this case, the insurer returned 50% of the total premiums paid, amounting to $5,000 ($2,000/year * 5 years * 50%). This return premium reduced the overall cost of insurance over the five-year period.

Scenario 2: Return of Premium Rider on a Whole Life Insurance Policy

This example focuses on a whole life insurance policy with a death benefit of $1,000,000 and an annual premium of $10,000. The policy included a Return of Premium (ROP) rider, a supplemental benefit that guarantees the return of all premiums paid if the policy is surrendered after a specific period (in this case, 20 years). After 20 years, the policyholder surrendered the policy. The insurer returned the full $200,000 ($10,000/year * 20 years) in premiums paid, effectively negating the cost of insurance over the policy’s duration. This is a significant benefit, especially considering the long-term nature of whole life insurance.

Scenario 3: Overpayment on a Homeowners Insurance Policy

This scenario describes a homeowner who overpaid their annual homeowners insurance premium by $500 due to an administrative error. The insurer, upon discovering the error, issued a return premium of $500 to the homeowner. This overpayment resulted in a direct reduction of the overall cost of the homeowners insurance for that year. This example highlights the importance of carefully reviewing insurance bills and contacting the insurer if any discrepancies are found. While not a typical ‘return of premium’ in the sense of unused coverage, it demonstrates how adjustments can reduce the net cost of insurance.

Wrap-Up

Securing financial value from your insurance policy shouldn’t be a mystery. By understanding the nuances of insurance return premiums – from identifying eligible policies and influencing factors to navigating tax implications – consumers can optimize their insurance choices. This guide has provided a framework for evaluating return premium options, empowering you to make informed decisions and ultimately maximize the financial benefits of your insurance coverage. Remember to always carefully review your policy documents and consult with a financial advisor for personalized guidance.

FAQs

What happens if I cancel my policy before the return premium period ends?

Typically, you forfeit the right to a return premium if you cancel your policy before the specified term. The exact conditions are Artikeld in your policy document.

Are return premiums taxable income?

The taxability of return premiums varies depending on your jurisdiction and the specific terms of your policy. Consult a tax professional for personalized advice.

Can I get a return premium even if I made a claim?

This depends on your policy’s terms and conditions. Some policies may still offer a partial return premium even after a claim, while others may reduce or eliminate the return based on claim payouts.

How frequently are return premiums paid out?

The frequency of payout varies by insurer and policy type. Some policies pay out upon policy maturity, while others may offer periodic payments.