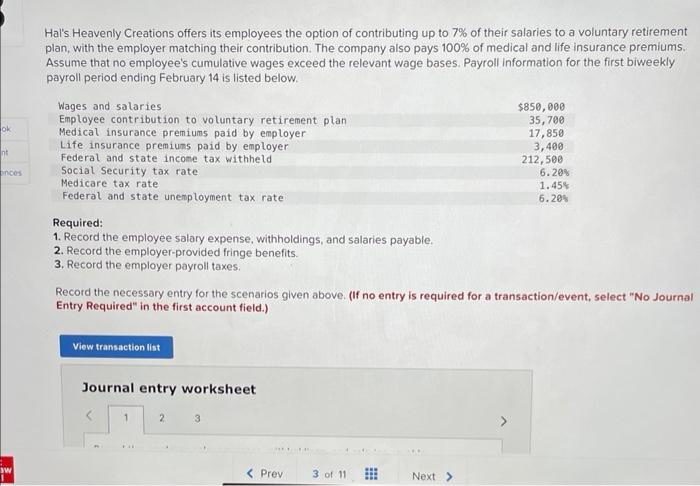

Navigating the world of insurance can feel like deciphering a complex code, particularly when it comes to understanding and managing insurance premiums paid. From the seemingly arbitrary fluctuations in cost to the various payment options and tax implications, the process can be daunting. This guide aims to demystify insurance premiums, offering insights into the factors that influence their cost, effective payment strategies, and methods for minimizing expenses.

We’ll explore how factors like age, driving history, credit score, and location significantly impact premiums across different insurance types, such as auto, health, and life insurance. Understanding these factors empowers you to make informed decisions and potentially reduce your overall insurance costs. We’ll also delve into various payment structures, tax implications, and strategies for optimizing your premium payments to ensure you’re getting the best value for your money.

Factors Influencing Insurance Premium Payments

Insurance premiums are the price you pay for coverage. Several factors influence how much you’ll pay, making it crucial to understand these elements to secure the best rates. These factors interact in complex ways, and the specific impact varies depending on the type of insurance.

Age and Insurance Premium Costs

Age significantly impacts insurance premiums across various types. Generally, younger drivers pay higher auto insurance premiums due to statistically higher accident rates. As drivers age and gain experience, their premiums often decrease. Health insurance premiums typically increase with age, reflecting the higher likelihood of needing medical care. Life insurance premiums are generally lower for younger individuals, as the risk of death is lower, and increase as the insured ages. For example, a 20-year-old might pay significantly less for life insurance than a 50-year-old, while the reverse is often true for health insurance. Auto insurance premiums also tend to decrease after a certain age, as older drivers may be perceived as less risky than younger or middle-aged drivers.

Driving History and Auto Insurance Premiums

Your driving record is a major determinant of your auto insurance costs. Accidents, speeding tickets, and other infractions lead to increased premiums. The severity of the infraction and the frequency of incidents significantly influence the premium increase.

| Driving Record Infraction | Premium Increase (Example Percentage) | Provider A | Provider B |

|---|---|---|---|

| At-fault accident | 20-40% | +30% | +35% |

| Speeding ticket (minor) | 5-15% | +10% | +8% |

| DUI/DWI | 50-100%+ | +75% | +90% |

| Multiple infractions within a year | Significant increase (varies widely) | +50%+ | +60%+ |

*Note: These are example percentages and actual increases vary greatly depending on the insurer, location, and other factors.*

Credit Score and Insurance Premium Rates

Many insurance companies use credit scores to assess risk, with higher credit scores generally leading to lower premiums. Insurers reason that individuals with good credit management tend to be more responsible overall, including in their driving habits and risk-taking behavior. For example, an individual with a credit score of 750 might receive a 10-15% discount compared to someone with a score of 600, depending on the insurer and type of insurance. This relationship is not uniform across all providers and jurisdictions, however. Some insurers place more weight on credit scores than others.

Location and Insurance Premium Costs

Geographic location significantly impacts insurance premiums. Urban areas typically have higher premiums for both auto and home insurance due to factors like higher population density, increased traffic congestion, and a greater risk of theft or damage. Rural areas generally have lower premiums because of these lower risks. For example, auto insurance premiums in a large city like New York City could be significantly higher than in a rural area of Montana, reflecting the increased likelihood of accidents and vehicle theft in the denser urban environment. Similarly, home insurance premiums might be higher in areas prone to natural disasters like hurricanes or wildfires.

Understanding Insurance Premium Payment Structures

Choosing the right payment method for your insurance premiums can significantly impact your budget and financial planning. Understanding the various options and associated fees is crucial for making informed decisions. This section details the different premium payment structures, associated costs, payment plans, and the process of changing payment methods.

Insurance Premium Payment Methods

Several methods exist for paying insurance premiums, each with its own set of advantages and disadvantages. Selecting the optimal method depends on individual financial circumstances and preferences.

- Monthly Payments: Offers flexibility and smaller, more manageable payments. However, it typically results in higher overall costs due to potential interest charges or administrative fees.

- Quarterly Payments: Provides a balance between affordability and convenience. Payments are larger than monthly payments but smaller than annual payments. Administrative fees may still apply.

- Annual Payments: The most cost-effective option as it avoids additional fees associated with more frequent payments. However, it requires a larger upfront payment, which may be challenging for some individuals.

- Electronic Funds Transfer (EFT): Automated payments directly from your bank account, offering convenience and eliminating the risk of missed payments. Some companies may offer discounts for using EFT.

- Credit Card Payments: Convenient but may incur additional processing fees charged by the insurance company or the credit card provider. Offers rewards points for some credit cards.

Fees and Charges Associated with Insurance Premium Payments

Various fees can be associated with insurance premium payments. Understanding these fees helps in budgeting and avoiding unexpected costs.

| Fee Type | Description | Typical Amount | Notes |

|---|---|---|---|

| Late Payment Fee | Charged for payments received after the due date. | $10 – $50 (varies by insurer) | Amount and policy implications vary by insurer and policy type. |

| Returned Payment Fee | Charged if a payment is returned due to insufficient funds. | $25 – $50 (varies by insurer) | Can result in policy cancellation in some cases. |

| Processing Fee | Charged for processing payments made via certain methods (e.g., credit card). | $2 – $5 (varies by insurer and payment method) | May be waived for EFT or other preferred methods. |

| Interest Charges | Applied to outstanding balances for installment payments. | Varies by insurer and interest rate | Typically only applies to payment plans. |

Insurance Premium Payment Plans

Insurance companies often offer payment plans to make premium payments more manageable. These plans usually involve dividing the annual premium into smaller installments.

For example, a company might offer a 6-month or 12-month installment plan with equal monthly payments. Some insurers may also offer plans tailored to specific customer needs, such as a plan with a higher initial payment followed by smaller subsequent payments.

Adjusting or Changing Insurance Premium Payment Methods

Changing your payment method usually involves contacting your insurance provider directly. The specific steps may vary depending on the insurer, but generally involve:

- Contacting customer service via phone, email, or online portal.

- Providing the necessary information for the new payment method (e.g., bank account details for EFT, credit card information).

- Verifying the change with the insurer.

- Receiving confirmation of the updated payment method.

Insurance Premium Payments and Tax Implications

Understanding the tax implications of your insurance premium payments can significantly impact your overall tax liability. Many insurance premiums are deductible under certain circumstances, potentially reducing your taxable income and your tax bill. This section details how these deductions work and what you need to know.

Tax Deductibility of Insurance Premiums

The tax deductibility of insurance premiums depends heavily on the type of insurance and your circumstances. Generally, premiums paid for health insurance, long-term care insurance, and self-employment insurance are often eligible for deductions. However, the specific rules and eligibility criteria vary depending on your country’s tax laws and your individual situation. For example, in the United States, self-employed individuals can deduct the cost of health insurance premiums as a business expense. Similarly, premiums for long-term care insurance might be partially deductible, subject to certain limitations on the amount of premiums that can be deducted annually. Always consult the relevant tax regulations for your specific location and circumstances.

Documentation Required for Tax Deductions

To claim tax deductions for insurance premium payments, you’ll need comprehensive documentation. This typically includes your insurance policy statements, receipts showing premium payments, and any tax forms specifically related to insurance deductions (e.g., Form 1040 Schedule C in the US for self-employed individuals). These documents should clearly indicate the dates of payments, the amounts paid, and the type of insurance covered. Maintaining organized records is crucial for a smooth tax filing process and to avoid potential complications during an audit.

Process of Claiming Tax Deductions

The process for claiming tax deductions for insurance premiums involves including the relevant information on your tax return. This generally entails reporting the deductible amounts on the appropriate schedules or forms. For instance, in the US, self-employed individuals report health insurance deductions on Schedule C (Profit or Loss from Business). Detailed instructions are typically provided within the tax forms themselves or in accompanying tax guides. Accurately completing the forms is essential to ensure your deduction is processed correctly. If you are unsure about any aspect of the process, consulting a tax professional is advisable.

Hypothetical Scenario: Self-Employed Individual

Let’s consider a self-employed graphic designer, Sarah.

- Income: Sarah earned $75,000 in 2024 from her graphic design business.

- Health Insurance Premiums: She paid $8,000 in health insurance premiums throughout the year.

- Tax Deduction: Sarah can deduct the $8,000 in health insurance premiums as a business expense on Schedule C of her US tax return (Form 1040).

- Taxable Income Reduction: This deduction reduces her taxable income from $75,000 to $67,000.

- Tax Savings: The exact tax savings will depend on her tax bracket, but the deduction will result in a reduction of her overall tax liability.

Outcome Summary

Effectively managing your insurance premiums requires a proactive approach encompassing understanding the influencing factors, choosing optimal payment methods, and exploring strategies for cost reduction. By carefully considering your individual circumstances, leveraging comparison tools, and proactively managing your insurance policies, you can significantly improve your financial well-being. Remember, informed decisions lead to better outcomes, and taking control of your insurance premiums is a crucial step towards achieving long-term financial security.

General Inquiries

What happens if I miss an insurance premium payment?

Missing a payment can result in late fees, suspension of coverage, and ultimately, policy cancellation. Contact your insurer immediately if you anticipate difficulty making a payment to explore options like payment plans.

Can I deduct insurance premiums from my taxes?

The deductibility of insurance premiums depends on the type of insurance and your circumstances. For example, self-employed individuals may be able to deduct health insurance premiums. Consult a tax professional for personalized guidance.

How often can I change my payment method?

Most insurers allow changes to your payment method, but there may be limitations or processing times. Check your policy or contact your insurer for specifics.

What is the difference between term life insurance and whole life insurance premiums?

Term life insurance premiums are generally lower than whole life insurance premiums because term life insurance provides coverage for a specific period, while whole life insurance provides lifelong coverage and builds cash value.