Understanding insurance premiums is crucial for anyone seeking financial protection. This seemingly simple concept underpins the entire insurance industry, influencing everything from the type of coverage you choose to your overall financial well-being. This guide delves into the intricacies of insurance premiums, exploring their definition, calculation, and impact on your financial landscape.

From the fundamental definition of what constitutes an insurance premium to the complex factors driving its calculation, we will unpack the various aspects that determine the cost of your insurance. We’ll examine how different insurance types vary in their premium structures, the influence of personal factors, and the methods available for payment. Ultimately, this exploration aims to empower you with the knowledge necessary to make informed decisions about your insurance needs.

Defining Insurance Premiums

Insurance premiums are the recurring payments made by policyholders to an insurance company in exchange for coverage against potential financial losses. These payments form the foundation of the insurance industry, enabling insurers to fulfill their obligations to policyholders when covered events occur.

Insurance Premiums: Their Fundamental Purpose

The primary purpose of insurance premiums is to create a pool of funds that the insurer can use to pay out claims to policyholders who experience covered losses. This pooling of risk is the core principle behind insurance; many individuals contribute relatively small amounts (premiums) to protect against potentially catastrophic losses that could individually bankrupt them. The more premiums collected, the greater the insurer’s capacity to meet its financial commitments.

Insurance Premiums and Insurer Solvency

Insurance premiums are crucial for maintaining an insurer’s solvency. The premiums received, along with investment income on the accumulated funds, constitute the insurer’s primary source of revenue. This revenue must be sufficient to cover claims payouts, administrative expenses, and maintain adequate reserves to ensure the insurer can meet its future obligations. Insufficient premium income can lead to insolvency, impacting the ability of the insurer to pay claims and jeopardizing the financial security of its policyholders. Effective risk management and actuarial science are essential in determining appropriate premium levels to ensure both profitability and solvency.

The Interplay Between Premiums and Risk Assessment

Insurance premiums are directly linked to risk assessment. Insurers use a variety of factors to assess the risk associated with insuring a particular individual or property. These factors might include age, health status (for health insurance), driving record (for auto insurance), location (for home insurance), and the value of the asset being insured. Higher-risk individuals or properties generally command higher premiums because the probability of a claim is greater. Conversely, lower-risk individuals or properties may qualify for lower premiums reflecting the reduced likelihood of a claim. Sophisticated statistical models and actuarial analyses are employed to accurately calculate premiums that reflect the assessed risk.

Comparative Analysis of Insurance Premiums Across Different Types

The following table provides a comparison of average annual premiums across different insurance types. It’s important to note that these are illustrative examples and actual premiums will vary significantly based on individual circumstances and coverage options.

| Insurance Type | Average Annual Premium (USD) | Factors Influencing Premium | Typical Coverage |

|---|---|---|---|

| Auto Insurance | $1500 | Driving record, vehicle type, location, age | Liability, collision, comprehensive |

| Homeowners Insurance | $1200 | Home value, location, coverage level, security features | Dwelling, liability, personal property |

| Health Insurance | $7000 | Age, health status, plan type, location | Hospitalization, doctor visits, prescription drugs |

| Life Insurance | $1000 | Age, health status, coverage amount, policy type | Death benefit payout to beneficiaries |

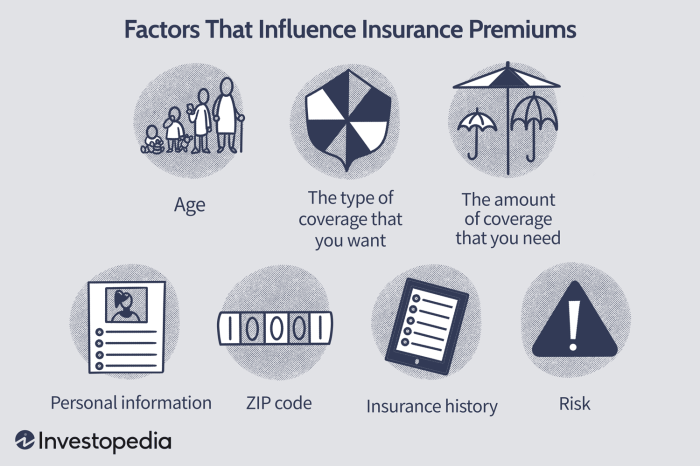

Factors Influencing Premium Calculation

Insurance premiums aren’t plucked from thin air; they’re meticulously calculated based on a complex interplay of factors. Insurers use sophisticated models to assess risk and price policies accordingly, ensuring the financial stability of the company while offering fair rates to customers. This assessment involves a detailed analysis of various aspects related to both the insured individual and the type of insurance being offered.

Demographic Factors and Premium Rates

Demographics play a significant role in determining insurance premiums. Age, location, and health status are key elements that insurers carefully consider. Older individuals, for instance, generally pay higher premiums for health insurance due to a statistically higher likelihood of needing medical care. Similarly, those living in areas with higher crime rates might face increased premiums for home or auto insurance. Pre-existing health conditions can also significantly influence health insurance premiums, reflecting the increased risk of future claims. For example, someone with a history of heart disease will likely pay more than someone with a clean bill of health. Geographic location influences premiums due to factors such as the frequency and severity of natural disasters (e.g., hurricanes, earthquakes) or the prevalence of certain illnesses.

Lifestyle Choices and Premium Costs

Lifestyle choices significantly impact insurance costs. For example, smokers often pay higher premiums for life and health insurance because smoking increases the risk of various health problems. Similarly, individuals with poor driving records (speeding tickets, accidents) will typically pay more for auto insurance. Maintaining a healthy lifestyle, such as regular exercise and a balanced diet, can lead to lower health insurance premiums, as insurers recognize the reduced risk associated with such habits. Homeowners who install security systems or take other preventative measures to reduce the risk of theft or damage may also qualify for lower premiums.

The Role of Actuarial Science in Premium Setting

Actuarial science is the backbone of premium calculation. Actuaries are highly trained professionals who use statistical methods and mathematical models to assess risk. They analyze vast amounts of data – historical claims data, demographic information, and economic trends – to predict the likelihood and cost of future claims. This analysis allows them to develop sophisticated models that accurately reflect the risk associated with different insurance policies and customer profiles. Essentially, actuaries translate complex data into premium rates that are both actuarially sound and commercially viable.

Flowchart Illustrating Premium Calculation Steps

The process of calculating insurance premiums can be visualized using a flowchart. Imagine a flowchart starting with “Data Collection” (gathering information on the applicant, including demographics, health history, driving record, etc.). This feeds into “Risk Assessment” (using actuarial models to quantify the risk associated with the applicant). The “Risk Assessment” box then connects to “Premium Calculation” (applying pre-determined pricing models and risk scores to determine the premium amount). Finally, an arrow leads to “Policy Issuance” (the final step of issuing the insurance policy with the calculated premium). This simplified flowchart represents the core steps involved, although the actual process is far more complex and involves numerous iterations and refinements.

Premium Payment Methods and Structures

Choosing how to pay your insurance premiums is a significant decision impacting your budget and financial planning. Understanding the various methods and structures available allows you to select the option best suited to your individual circumstances and financial capabilities. This section will explore the different ways to pay premiums, highlighting the advantages and disadvantages of each approach.

Premium payment options generally fall into two broad categories: lump-sum payments and installment payments. Each method offers unique benefits and drawbacks that should be carefully considered before committing to a specific payment plan. Factors such as your cash flow, risk tolerance, and the overall cost of the insurance policy will heavily influence your decision.

Payment Methods

Insurers typically offer a range of payment methods to accommodate diverse preferences. Common options include annual payments, semi-annual payments, quarterly payments, and monthly payments. Annual payments offer the potential for discounts, while monthly payments provide greater flexibility for budget management. Some insurers may also accept payments via electronic funds transfer (EFT), credit cards, or debit cards, offering further convenience.

Comparison of Premium Payment Plans

Paying premiums in a single lump sum (annual payment) often results in a lower overall cost due to discounts offered by many insurance providers. This method, however, requires a significant upfront capital outlay. Conversely, installment plans (monthly, quarterly, or semi-annual) spread the cost over time, reducing the financial burden of a single large payment. However, installment plans typically involve a slightly higher overall cost due to the administrative fees associated with processing multiple payments. The choice depends on your financial comfort level and preference for managing cash flow. For example, a homeowner’s insurance policy with an annual premium of $1200 might offer a 5% discount for annual payment, resulting in a cost of $1140. The same policy paid monthly might cost $105 per month, totaling $1260 over the year.

Premium Discounts and Incentives

Many insurance companies incentivize prompt and efficient premium payments by offering discounts. These discounts can vary widely depending on the insurer, the type of insurance, and the payment method chosen. Common incentives include discounts for annual payments, automatic payments (e.g., EFT), or bundling multiple insurance policies (e.g., home and auto). Some insurers might also offer loyalty discounts for long-term policyholders with a consistent payment history.

Handling Late or Missed Premium Payments

Late or missed premium payments can have significant consequences. Insurers typically issue grace periods, allowing a short window to make the overdue payment without penalty. However, if payment remains outstanding after the grace period, penalties may be applied, including late payment fees and potential policy cancellation. In some cases, insurers might temporarily suspend coverage until the outstanding payment is received. Maintaining a consistent payment schedule is crucial to avoid such complications and ensure uninterrupted insurance coverage.

Advantages and Disadvantages of Premium Payment Options

The following table summarizes the pros and cons of different premium payment methods:

| Payment Method | Advantages | Disadvantages |

|---|---|---|

| Annual Payment | Lower overall cost (due to discounts), less administrative hassle | Requires significant upfront capital |

| Semi-Annual Payment | Balances upfront cost with payment frequency | Higher overall cost than annual payment |

| Quarterly Payment | More frequent payments than semi-annual, less upfront capital needed than annual | Higher overall cost than annual payment |

| Monthly Payment | Easier budget management, smaller payments | Highest overall cost due to administrative fees |

Premium Adjustments and Renewals

Insurance premiums aren’t static; they adjust over time based on various factors related to both the policyholder and the broader insurance market. Understanding these adjustments is crucial for managing insurance costs effectively. This section details the processes and factors influencing premium changes at renewal.

Premium adjustments reflect a continuous reassessment of the risk associated with a particular policy. Insurers use a complex actuarial process to calculate premiums, taking into account a wide range of data and statistical models. This ensures that premiums accurately reflect the likelihood of a claim and the potential cost of that claim.

Policy Performance and Premium Adjustments

Premium adjustments often reflect the policyholder’s claims history. A history of claims can lead to higher premiums in the next renewal period, as it signals a higher risk profile to the insurer. Conversely, a clean claims history might result in a premium reduction, rewarding responsible behavior. This is a key element of the principle of actuarial fairness, where premiums are adjusted to reflect individual risk profiles.

Risk Profile Changes and Premium Renewals

Changes in a policyholder’s risk profile significantly impact premium renewals. For example, a driver adding a young, inexperienced driver to their car insurance policy will likely see their premiums increase. Similarly, a homeowner undertaking significant renovations might see a temporary premium increase until the work is complete and inspected, as the risk of damage or accidents increases during construction. Conversely, improving home security systems or implementing safety measures could lead to premium reductions.

Factors Leading to Premium Increases or Decreases

Several factors contribute to premium adjustments. These include:

- Claims History: Frequent or high-value claims typically result in increased premiums.

- Changes in Risk Profile: As mentioned above, factors such as adding drivers, changing address to a higher-risk area, or significant home renovations can all influence premiums.

- Changes in the Insurance Market: Broader economic conditions, inflation, increased frequency of specific types of claims (e.g., weather-related events), and changes in regulatory requirements can all lead to adjustments across the board.

- Competition: The level of competition within the insurance market can also impact premiums. Increased competition might lead to lower premiums, while reduced competition can lead to increases.

Examples of Premium Adjustments

Consider a homeowner’s insurance policy. If the homeowner experiences a minor claim, such as a broken window, the premium increase might be minimal. However, a significant claim, like a fire, could result in a substantial premium increase at renewal. Conversely, a driver with a spotless driving record for several years might qualify for a discount or lower premium.

Scenario: Premium Adjustment Example

Imagine Sarah, a homeowner with a clean claims history for five years. She recently added a swimming pool to her property. At her next renewal, her insurer adjusted her premium upward. The rationale behind this change is clear: a swimming pool increases the risk of accidents and potential liability claims. The insurer’s risk assessment model incorporates this increased risk, leading to a higher premium to reflect the added exposure. This is a fair and transparent adjustment based on a demonstrable change in Sarah’s risk profile.

Concluding Remarks

Navigating the world of insurance premiums can feel overwhelming, but understanding the core principles empowers you to make informed choices. By grasping the factors influencing premium calculations, the various payment options, and the potential for adjustments, you can effectively manage your insurance costs and secure the coverage you need. This guide serves as a foundational resource, encouraging further exploration and proactive engagement with your insurance provider to ensure optimal protection.

FAQ Section

What happens if I miss a premium payment?

Consequences vary by insurer and policy, but typically include late fees, policy cancellation, or suspension of coverage. Contact your insurer immediately if you anticipate a missed payment to explore options.

Can I negotiate my insurance premiums?

While not always possible, some insurers may be open to negotiation, especially if you have a clean driving record (for auto insurance) or excellent health history (for health insurance). It’s worth inquiring.

How often are premiums reviewed and adjusted?

Premium reviews and adjustments vary by insurer and policy type. Some policies are reviewed annually, while others might have longer review periods. Your policy documents will specify the review schedule.

What is the difference between a deductible and a premium?

A premium is the regular payment you make to maintain your insurance coverage. A deductible is the amount you pay out-of-pocket before your insurance coverage kicks in for a claim.