Securing adequate health insurance is a critical concern for everyone, but the process can be particularly complex for individuals living with HIV in California. Navigating the intricacies of insurance premiums, coverage options, and potential financial assistance programs requires a clear understanding of California’s legal framework and the factors influencing premium costs. This exploration delves into the specifics of insurance coverage for HIV-related care in the state, aiming to provide clarity and empower individuals to make informed decisions about their healthcare.

California has robust legal protections against discrimination based on HIV status in health insurance. However, the cost of premiums and the extent of coverage can still vary significantly depending on several factors, including the type of insurance plan, pre-existing conditions, medication adherence, and the individual’s overall health. Understanding these factors is key to accessing affordable and comprehensive healthcare.

California Insurance Laws and HIV

California has robust legal protections in place to prevent discrimination against individuals with HIV/AIDS in the insurance marketplace. These laws aim to ensure fair access to health insurance and prevent individuals from being denied coverage or charged higher premiums solely based on their HIV status. This legal framework is built upon federal laws and augmented by specific state regulations.

Legal Framework Governing Insurance Practices Related to HIV/AIDS in California

California’s insurance regulations are primarily governed by the California Insurance Code and the Department of Insurance (DOI). These regulations prohibit insurers from discriminating against individuals based on their HIV status in several key areas, including eligibility for coverage, premium rates, and the scope of benefits provided. The DOI actively enforces these regulations, investigating complaints and taking action against insurers found to be in violation. The overarching principle is to ensure equal access to affordable and comprehensive health insurance for all Californians, regardless of their HIV status. This is further supported by the Americans with Disabilities Act (ADA), which prohibits discrimination in employment and other areas based on disability, including HIV/AIDS.

State Regulations Concerning Discrimination in Health Insurance Based on HIV Status

California’s insurance regulations specifically prohibit insurers from using HIV status as a factor in determining eligibility for health insurance, setting premium rates, or limiting the scope of benefits offered. This means insurers cannot deny coverage, charge higher premiums, or exclude specific treatments solely because an applicant or enrollee has HIV. Moreover, insurers are prohibited from requiring HIV testing as a condition for coverage unless it is medically necessary for a specific treatment or procedure. These regulations are designed to prevent insurers from engaging in practices that could effectively deny access to health care for individuals with HIV.

Legal Precedents and Court Cases Shaping Insurance Practices for Individuals with HIV in CA

While specific court cases directly addressing California insurance practices concerning HIV are not readily available in easily accessible public databases without extensive legal research, the broader legal framework around discrimination based on disability (including HIV) has been shaped by landmark cases at the federal level. These cases, such as those involving the ADA, have established precedents that California courts would likely follow, reinforcing the state’s strong anti-discrimination protections. The DOI’s enforcement actions also set important precedents within the state, clarifying the application of regulations and deterring discriminatory practices. These enforcement actions, while not court cases, effectively shape the insurance landscape by clarifying expectations and establishing consequences for non-compliance.

Insurance Coverage Options for HIV-Related Treatments in California

The following table provides a simplified overview of insurance coverage options. Specific benefits and costs will vary depending on the insurer, plan, and individual circumstances. It is crucial to consult directly with insurers and review individual policy documents for accurate and detailed information.

| Coverage Type | Typical Coverage | Potential Exclusions (Rare, but possible) | Notes |

|---|---|---|---|

| Individual Health Insurance Plans (ACA Marketplace) | Comprehensive coverage for HIV medications, treatment, and related services. | Certain experimental treatments may require pre-authorization. | Coverage is largely mandated under the Affordable Care Act (ACA). |

| Employer-Sponsored Health Insurance | Similar to individual plans, often with varying levels of coverage depending on the employer’s plan design. | Specific medications or services might be subject to formularies or pre-authorization. | Coverage is dependent on the employer’s chosen health plan. |

| Medicare | Comprehensive coverage for HIV medications and related care for eligible individuals aged 65 and older or those with qualifying disabilities. | Some limitations may apply depending on the specific Medicare plan. | Medicare Part D covers prescription drugs. |

| Medicaid | Comprehensive coverage for HIV medications and related care for eligible low-income individuals. | Coverage may vary depending on state Medicaid program rules. | Eligibility criteria vary by state and income level. |

Available Insurance Options and Coverage for HIV Treatment in CA

California offers a range of health insurance options that provide comprehensive coverage for HIV-related care, ensuring access to vital medications, medical services, and support programs. Understanding these options is crucial for individuals living with HIV to navigate the healthcare system effectively and receive the best possible care.

Types of Health Insurance Plans Covering HIV Care in California

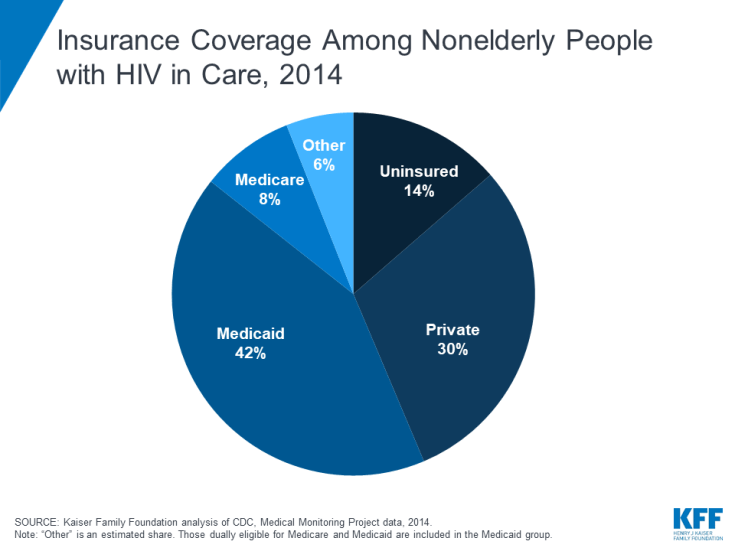

California residents have access to several types of health insurance plans, each offering varying levels of coverage. These include employer-sponsored plans, individual market plans purchased through Covered California (the state’s health insurance marketplace), and government-sponsored programs like Medi-Cal (California’s Medicaid program). Employer-sponsored plans often offer comprehensive benefits, while individual market plans and Medi-Cal provide varying levels of coverage depending on the specific plan and the individual’s eligibility. All plans complying with the Affordable Care Act (ACA) must cover essential health benefits, which include HIV medications and related care.

Coverage Provided by Different Insurance Plans

Most health insurance plans in California cover a wide range of HIV-related services. This typically includes antiretroviral therapy (ART), medications to prevent opportunistic infections, regular medical checkups, lab tests, and other necessary medical services. Many plans also cover mental health services, substance abuse treatment, and support programs, recognizing the holistic nature of HIV care. The specific services covered and the extent of coverage can vary depending on the plan’s design and the individual’s specific needs. For example, some plans may have prior authorization requirements for certain medications or procedures.

The Affordable Care Act and HIV Coverage in CA

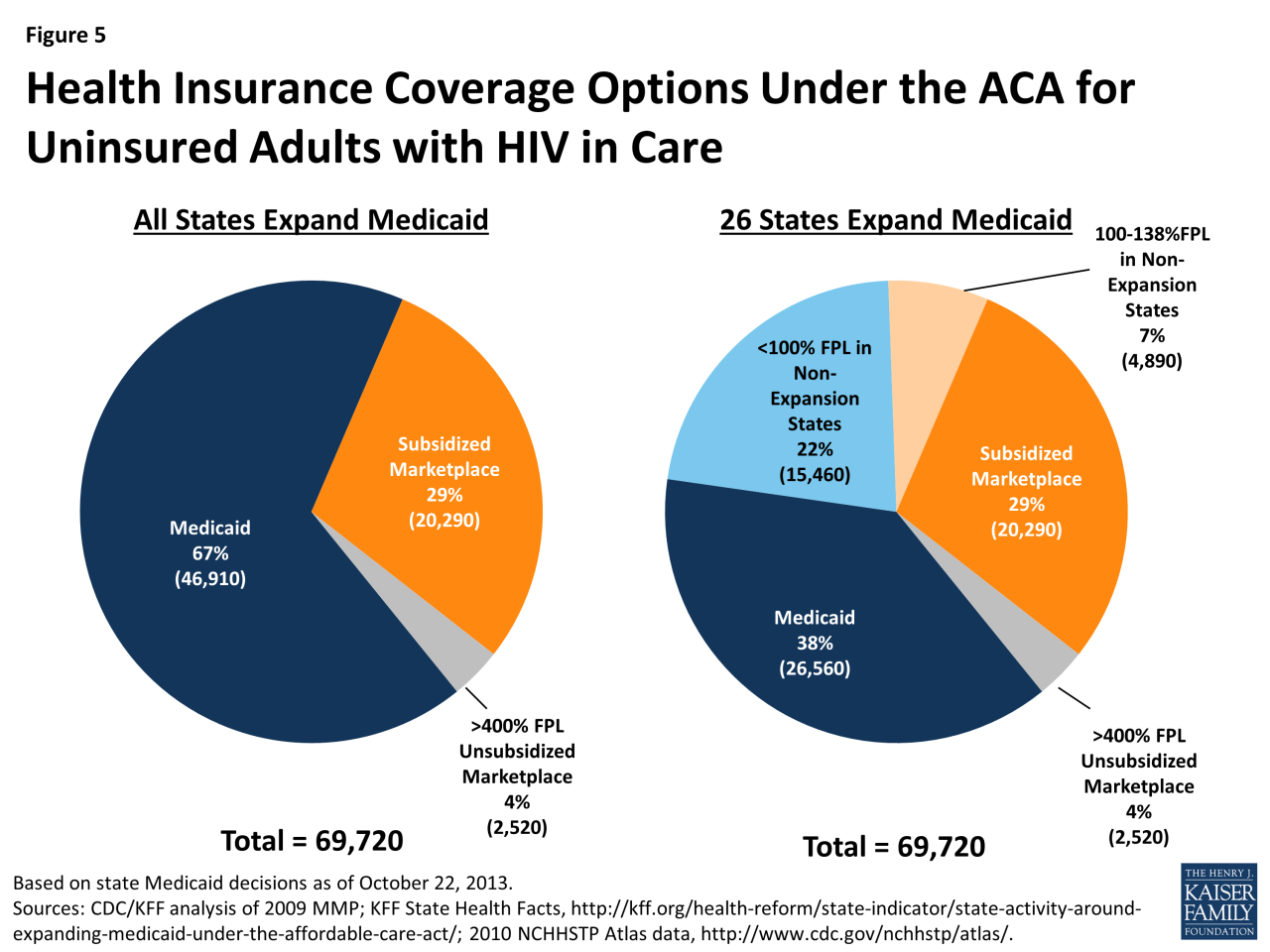

The Affordable Care Act (ACA) has significantly improved access to health insurance and HIV care in California. The ACA prohibits health insurers from denying coverage based on pre-existing conditions, including HIV. It also mandates that all plans covering essential health benefits include HIV-related medications and services. This ensures that individuals with HIV have access to the care they need, regardless of their health status or ability to pay. The ACA’s impact has been substantial in reducing the number of uninsured Californians with HIV and improving health outcomes for this population. The marketplace, Covered California, offers subsidies to make plans more affordable for those who qualify.

Comparison of Insurance Plans Regarding HIV Treatment

Understanding the benefits and limitations of different insurance plans is essential for making informed decisions.

- Employer-Sponsored Plans: Often offer comprehensive coverage, including a wide range of medications and services. However, coverage can depend on the specific employer’s plan design and may not always be portable if employment changes.

- Individual Market Plans (Covered California): Provide varying levels of coverage depending on the plan chosen. Subsidies are available to lower costs for those who qualify based on income. Plan options may change annually.

- Medi-Cal: Provides comprehensive coverage for low-income individuals and families. Eligibility requirements are based on income and other factors. While it covers HIV treatment, access to certain specialists or medications may be limited compared to private insurance.

Illustrative Examples of Premium Costs and Coverage Scenarios

Understanding the cost of health insurance and the coverage provided for individuals with HIV in California requires considering several factors, including the specific insurance plan, the individual’s age, health status, and medication regimen. The following examples illustrate potential scenarios.

Premium Costs and Coverage for an Individual with HIV

Let’s consider a 35-year-old individual, Alex, diagnosed with HIV, who is currently on a stable antiretroviral therapy (ART) regimen. Alex is otherwise healthy and maintains a healthy lifestyle. Under a Covered California plan (a state-run marketplace), Alex might find a Silver plan with a monthly premium of approximately $600. This plan would likely cover the majority of Alex’s HIV-related medical expenses, including doctor visits, lab tests, medications (with some co-pays or cost-sharing), and hospitalizations if needed. A more comprehensive Gold plan could offer lower cost-sharing but a higher monthly premium, potentially around $900. Conversely, a Bronze plan might have a lower premium (around $400), but with significantly higher out-of-pocket expenses for medical services. The specific costs would vary depending on the chosen plan and the specific provider network.

Cost Savings from Financial Assistance Programs

Now, consider another individual, Maria, a 40-year-old with HIV, who is also on ART but has higher out-of-pocket expenses due to a less comprehensive insurance plan. Maria’s monthly premium is $750, and her co-pays and deductibles leave her with substantial expenses. However, Maria qualifies for financial assistance through the federal government’s Affordable Care Act (ACA) subsidies. These subsidies reduce Maria’s monthly premium to $200, and significantly lower her out-of-pocket costs, including cost-sharing for medications. The ACA subsidy, based on Maria’s income, covers a substantial portion of her premium and cost-sharing, effectively making her HIV treatment more affordable. This reduction could save her hundreds of dollars per month.

Navigating Insurance Challenges and Finding Solutions

Imagine David, a 50-year-old individual recently diagnosed with HIV. David is struggling to understand the complexities of the insurance system and is unsure which plan best suits his needs. He is also concerned about the potential costs of his medication. David could benefit from assistance from a health insurance navigator or counselor. These professionals can help David understand his options, compare plans, and apply for financial assistance programs. Furthermore, contacting organizations dedicated to HIV/AIDS care can provide valuable support and resources, helping David navigate the system effectively and access the necessary financial and medical assistance. David could also leverage online tools and resources provided by Covered California to compare plans and estimate his out-of-pocket costs.

Epilogue

Ultimately, obtaining affordable and comprehensive health insurance for those living with HIV in California requires proactive engagement with the system. By understanding California’s legal protections, the factors influencing premium costs, and the available resources and support programs, individuals can navigate the complexities of the insurance system and secure the care they need. Advocacy groups and government agencies provide invaluable assistance in this process, ensuring access to quality healthcare for all Californians, regardless of their HIV status.

Quick FAQs

What if my HIV status is disclosed to my employer after applying for insurance?

California law strictly prohibits discrimination based on HIV status in employment and insurance. Disclosing your HIV status to your employer should not negatively impact your insurance application or employment. However, it’s advisable to consult with an attorney or an HIV advocacy group if you encounter any discriminatory practices.

Can I be denied insurance coverage because of my HIV?

No. The Affordable Care Act and California law prohibit insurance companies from denying coverage based on pre-existing conditions, including HIV. However, the cost of your premiums might be affected by other factors.

Are there specific plans that better cover HIV-related care?

While all ACA-compliant plans must cover essential health benefits, including HIV treatment, some plans might offer better coverage for specific medications or services. It is crucial to carefully compare plans and their formularies before enrolling.

Where can I find help navigating the insurance application process?

Several organizations, including Covered California and local HIV/AIDS service organizations, offer assistance with navigating the insurance application process and finding financial assistance programs. Their websites and contact information are readily available online.