Navigating the world of insurance can feel like deciphering a complex code, particularly when it comes to understanding the interplay between insurance premiums and deductibles. These two key components of any insurance policy significantly impact your out-of-pocket expenses and overall financial protection. This guide will unravel the intricacies of premiums and deductibles, empowering you to make informed decisions that align with your individual financial circumstances and risk tolerance.

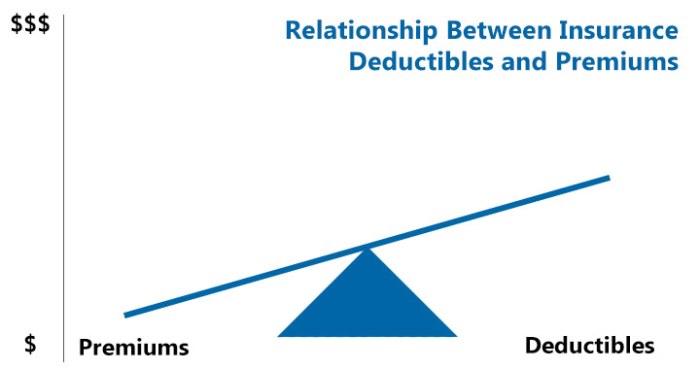

We’ll explore the fundamental definitions of premiums and deductibles, examining how various factors influence premium costs and the inverse relationship between premiums and deductibles. Through practical examples and scenarios, we’ll illuminate the decision-making process involved in selecting the optimal balance between these two critical elements, ultimately guiding you towards choosing an insurance plan that best suits your needs.

Defining Insurance Premium and Deductible

Understanding the interplay between insurance premiums and deductibles is crucial for making informed decisions about your insurance coverage. Both are key components of any insurance policy, and their relationship directly impacts your financial responsibility in the event of a covered claim. This section will clarify the meaning and function of each.

Insurance Premium Explained

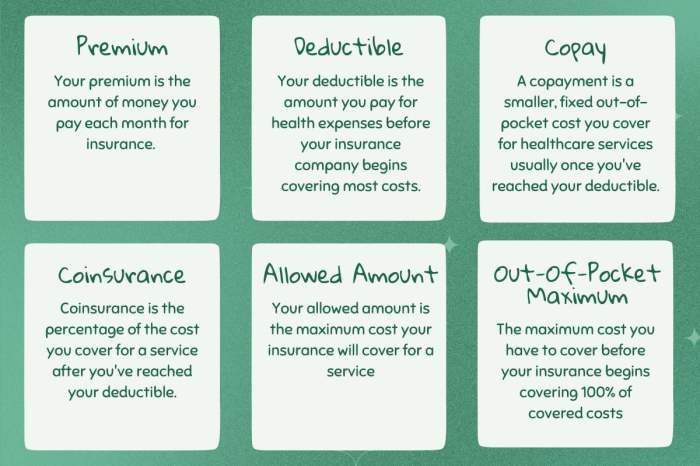

An insurance premium is the amount of money you pay regularly (typically monthly, quarterly, or annually) to maintain your insurance coverage. Think of it as your ongoing payment for the protection the insurance policy provides. The premium amount is determined by several factors, including the type of insurance (e.g., auto, home, health), the level of coverage you choose, your risk profile (e.g., driving record, health history), and the insurer’s assessment of risk within your geographic area. A higher level of coverage generally translates to a higher premium, reflecting the increased financial responsibility the insurer undertakes. Premiums are essentially the insurer’s compensation for assuming the risk of covering potential losses.

Deductible Explained

A deductible is the amount of money you, the policyholder, are responsible for paying out-of-pocket before your insurance coverage kicks in. It’s the initial cost you bear before the insurance company begins to pay for covered expenses. For example, if you have a $1,000 deductible on your car insurance and you’re involved in an accident resulting in $5,000 in damages, you’d pay the first $1,000, and your insurance company would cover the remaining $4,000. The deductible acts as a buffer, helping to keep premiums lower. Higher deductibles typically result in lower premiums, while lower deductibles usually mean higher premiums. The deductible applies only to covered claims; it does not affect the premium payments themselves.

Comparison of Premiums and Deductibles

| Term | Definition | Impact on Policyholder | Impact on Insurer |

|---|---|---|---|

| Premium | Regular payment for insurance coverage. | Recurring cost; higher premiums for greater coverage or higher risk. | Source of revenue; higher premiums increase profitability. |

| Deductible | Amount paid out-of-pocket before insurance coverage begins. | Initial cost in case of a claim; higher deductibles reduce premiums. | Lower payouts per claim; higher deductibles can lead to fewer claims. |

Factors Influencing Premium Costs

Insurance premiums, the price you pay for coverage, aren’t arbitrarily set. Several interconnected factors contribute to the final cost, reflecting the insurer’s assessment of the risk involved in insuring you. Understanding these factors empowers you to make informed choices about your insurance coverage and potentially reduce your premiums.

Several key factors significantly impact the calculation of your insurance premiums. These factors are analyzed individually and often in combination to create a comprehensive risk profile for each policyholder. The higher the perceived risk, the higher the premium.

Driving Record

Your driving history is a primary factor in determining car insurance premiums. A clean record with no accidents or traffic violations results in lower premiums. Conversely, accidents, especially those deemed your fault, significantly increase premiums. The severity of the accident—property damage versus injury claims—further influences the premium increase. Multiple violations, such as speeding tickets or DUI convictions, lead to even higher premiums, reflecting the increased risk of future claims. Insurance companies utilize sophisticated algorithms that weigh the frequency and severity of incidents to assess risk. For example, a driver with two speeding tickets and one at-fault accident will likely face a much higher premium than a driver with a spotless record.

Age and Gender

Statistically, age and gender correlate with accident rates. Younger drivers, particularly those under 25, generally pay higher premiums due to their statistically higher accident involvement. Insurance companies recognize this increased risk. Similarly, historical data often reveals differences in accident rates between genders, although this varies across different regions and policy types. These factors are used in actuarial calculations to assess risk and determine premiums, although the use of gender in pricing is increasingly under scrutiny and regulated in some jurisdictions.

Location

Where you live significantly influences your insurance premiums. Areas with high crime rates, frequent accidents, or severe weather events (like hurricanes or hailstorms) typically have higher premiums. Insurance companies assess the risk of theft, vandalism, or property damage in different geographic locations. For example, someone living in a high-crime urban area will likely pay more for home and auto insurance than someone residing in a rural, low-crime area. This reflects the increased likelihood of claims in high-risk areas.

Credit Score

In many jurisdictions, your credit score can influence your insurance premiums. While the correlation isn’t always clear-cut, studies suggest a link between credit score and insurance claims. Insurers often use credit scores as a proxy for risk assessment, arguing that individuals with poor credit may be more likely to file claims or experience financial difficulties that delay claim payments. This practice is subject to debate and regulations vary by state and country.

Type of Coverage and Deductible

The type and amount of coverage you choose directly affect your premium. Comprehensive coverage, which protects against a broader range of events, will naturally cost more than a more limited policy. Similarly, choosing a higher deductible – the amount you pay out-of-pocket before your insurance coverage kicks in – lowers your premium. This is because you’re accepting more financial responsibility upfront, reducing the insurer’s potential payout. The relationship is straightforward: higher coverage and lower deductibles mean higher premiums; conversely, lower coverage and higher deductibles mean lower premiums.

Impact of Claims on Premiums and Deductibles

Filing an insurance claim impacts both your immediate out-of-pocket expenses and your future insurance premiums. Understanding this relationship is crucial for managing your insurance costs effectively. A claim essentially signifies a risk realized by the insurance company, leading to adjustments in your policy.

Filing a claim affects your out-of-pocket expenses primarily through your deductible. The deductible is the amount you must pay before your insurance coverage begins. If you file a claim, you’ll still be responsible for paying your deductible, even if the claim is approved. For example, if you have a $500 deductible and file a $2,000 claim, you will pay the $500 deductible upfront, and your insurance company will cover the remaining $1,500.

Claim History’s Influence on Future Premiums

Your claim history significantly influences how insurance companies calculate your future premiums. Insurers assess risk based on past behavior. A history of frequent claims suggests a higher likelihood of future claims, leading to increased premiums. Conversely, a clean claim history demonstrates lower risk and may result in lower premiums or even discounts. The specific impact varies by insurer and policy type, but the general principle remains consistent: more claims generally translate to higher premiums. For instance, an individual with three auto accident claims within a two-year period might see their premiums increase substantially compared to someone with no claims in the same timeframe.

Long-Term Financial Implications of Frequent Claims

The cumulative effect of frequent claims can have significant long-term financial implications. Each claim not only involves immediate out-of-pocket expenses (the deductible) but also contributes to higher premiums in subsequent years. This creates a cycle where higher premiums increase the financial burden of insurance, potentially making it difficult to afford coverage. Consider a scenario where an individual consistently files small claims. While each claim might seem insignificant individually, the cumulative effect of increased premiums over several years could far exceed the total value of the claims themselves. This highlights the importance of preventative measures and responsible claim filing.

Types of Insurance and Premium/Deductible Variations

Insurance premiums and deductibles vary significantly depending on the type of insurance coverage. Understanding these differences is crucial for making informed decisions about your insurance needs and budget. This section will explore the premium and deductible structures across several common insurance types, highlighting key variations.

Auto Insurance Premium and Deductible Variations

Auto insurance premiums are influenced by factors such as driving history, vehicle type, location, and coverage level. Deductibles, on the other hand, represent the amount you pay out-of-pocket before your insurance coverage kicks in. Higher deductibles typically result in lower premiums, and vice versa.

For example, a young driver with a poor driving record might face a significantly higher premium than an older driver with a clean record, even if they choose the same coverage level and deductible. Similarly, insuring a high-performance sports car will generally cost more than insuring a smaller, less expensive vehicle. A driver opting for a $1000 deductible might pay a lower premium than someone with a $500 deductible.

Homeowners Insurance Premium and Deductible Variations

Homeowners insurance premiums are determined by factors such as the value of the home, its location, the age and condition of the property, and the level of coverage selected. Deductibles function similarly to auto insurance, representing the amount the homeowner pays before insurance coverage begins.

A larger, more expensive home in a high-risk area (e.g., prone to wildfires or hurricanes) will typically command a higher premium than a smaller, less valuable home in a lower-risk area. Selecting a higher deductible (e.g., $2,000) will usually lower the premium compared to a lower deductible (e.g., $500). Comprehensive coverage, which includes broader protection against various perils, will generally result in a higher premium than a basic policy.

Health Insurance Premium and Deductible Variations

Health insurance premiums and deductibles are complex and vary widely based on several factors, including the plan type (e.g., HMO, PPO), the level of coverage, age, location, and the insurer. Deductibles in health insurance represent the amount you pay out-of-pocket for covered healthcare services before your insurance coverage begins to pay. Premiums are the monthly payments made to maintain the insurance coverage.

A comprehensive health insurance plan with a low deductible will usually have a higher premium than a high-deductible health plan (HDHP). For example, a family plan with a $1,000 deductible might have a significantly higher monthly premium than a similar plan with a $5,000 deductible. Choosing a plan with a higher deductible can significantly reduce your monthly premium, but increases your out-of-pocket expenses if you need healthcare services.

Premium and Deductible Variations: A Comparison

| Insurance Type | Premium Variation Factors | Deductible Variation Examples |

|---|---|---|

| Auto | Driving record, vehicle type, location, coverage level | $250, $500, $1000, $2500 |

| Homeowners | Home value, location, age/condition of home, coverage level | $500, $1000, $2000, $5000 |

| Health | Plan type, coverage level, age, location, insurer | $1000, $2000, $5000, $10000 (individual); $2000, $5000, $10000 (family) |

Illustrative Examples

Let’s visualize the impact of deductible choices on your out-of-pocket expenses and insurance premiums using simple scenarios. Understanding these examples will clarify the trade-off between premium cost and personal financial responsibility in case of a claim.

Imagine two scenarios, both involving a car accident resulting in $5,000 in repairs.

High Deductible, Lower Premium Scenario

Consider a plan with a $2,500 deductible and a monthly premium of $50. Imagine a bar graph. On the left, a tall bar represents the $50 monthly premium. To the right, a shorter bar represents the $2,500 deductible. A third, much longer bar shows the total out-of-pocket cost, the sum of the deductible and the premium cost over a year ($2,500 + ($50 x 12 months) = $3,100). The visual emphasizes the relatively small premium cost compared to the significant out-of-pocket expense when a claim is made. This highlights the risk transfer inherent in high-deductible plans; you pay less upfront but bear more of the financial burden if an accident occurs.

Low Deductible, Higher Premium Scenario

Now picture another plan with a $500 deductible and a monthly premium of $100. Again, we use a bar graph. This time, the left bar representing the monthly premium is taller than in the previous example. The right bar representing the deductible is much shorter. The total out-of-pocket cost bar ( $500 + ($100 x 12 months) = $1700) is also significantly shorter than in the high-deductible scenario. This visual clearly demonstrates that while the monthly premium is higher, the overall out-of-pocket cost in the event of a claim is substantially lower due to the reduced deductible. The trade-off is apparent: higher upfront cost for greater protection against significant out-of-pocket expenses.

Final Review

Ultimately, the choice between a higher premium with a lower deductible or vice versa is a personal one, dependent on individual risk tolerance and financial stability. By carefully considering the factors Artikeld in this guide – including your claim history, the type of insurance, and your personal financial situation – you can confidently select an insurance plan that provides the appropriate level of coverage while remaining financially manageable. Remember, understanding the nuances of insurance premiums and deductibles is crucial for securing comprehensive and cost-effective protection.

FAQ Overview

What happens if I don’t meet my deductible?

You are responsible for paying the full amount of covered medical expenses until you meet your deductible. After you meet your deductible, your insurance company will begin to cover the remaining costs based on your plan’s co-insurance percentage.

Can my deductible change from year to year?

Yes, deductibles can change annually. Your insurance company may adjust your deductible based on several factors, including changes in your coverage or claim history. Review your policy details carefully each year.

How does my driving record affect my auto insurance premium?

A poor driving record, including accidents and traffic violations, typically leads to higher auto insurance premiums as it increases the perceived risk to the insurer.

Does paying my premium on time affect my coverage?

Generally, failing to pay your premiums on time can lead to your coverage being cancelled or suspended. Consistent timely payments are essential to maintain active coverage.