Navigating the complexities of tax deductions can feel like deciphering a secret code. However, understanding the potential for an insurance premium tax deduction can significantly impact your annual tax liability. This guide unravels the intricacies of this deduction, offering a clear and concise pathway to potentially saving you money. We’ll explore eligibility criteria, calculation methods, necessary documentation, and potential pitfalls to ensure you confidently claim what you’re entitled to.

From understanding which insurance premiums qualify for deduction to mastering the calculation process and navigating potential documentation issues, this guide serves as your comprehensive resource. We’ll also explore common mistakes and provide strategies for a smooth and successful claim, leaving no stone unturned in your quest for tax optimization.

Eligibility for Insurance Premium Tax Deduction

Securing an insurance premium tax deduction can significantly reduce your tax burden, but eligibility hinges on several key factors. Understanding these requirements is crucial for taxpayers to maximize their tax benefits. This section Artikels the criteria for eligibility, the types of insurance covered, and situations where deductions might be denied, providing a comparative overview across different jurisdictions where applicable.

Types of Insurance Premiums Qualifying for Deduction

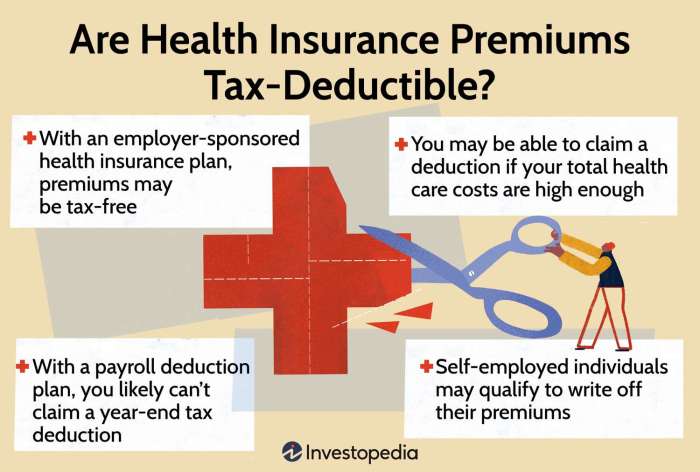

The types of insurance premiums eligible for tax deductions vary depending on the specific tax laws of a given country or state. Generally, however, health insurance premiums are frequently deductible. In some jurisdictions, premiums for long-term care insurance, disability insurance, and even certain types of life insurance may also qualify. It’s important to consult the relevant tax code or seek professional advice to determine which specific insurance premiums are deductible in your location. For instance, in the United States, the deduction for health insurance premiums often depends on whether the taxpayer is self-employed or participates in a specific health insurance marketplace plan.

Criteria for Individual Eligibility

Eligibility for an insurance premium tax deduction is usually dependent on factors such as income level, employment status, and the type of insurance policy. For example, self-employed individuals often have more expansive options for deducting insurance premiums compared to employees who may have employer-sponsored health insurance. Taxpayers must meet specific income thresholds in many jurisdictions to claim the deduction. Further, the insurance policy itself must meet certain criteria; for instance, it might need to be from a licensed insurer and cover qualifying medical expenses.

Situations Resulting in Deduction Denial

Several circumstances can lead to a denial of the insurance premium tax deduction. Failing to meet the income requirements is a common reason. Another frequent cause is purchasing insurance that doesn’t meet the specific requirements of the tax code. For example, using insurance funds for non-deductible expenses, such as cosmetic procedures not medically necessary, would disqualify those premiums from deduction. Submitting inaccurate or incomplete documentation during tax filing can also result in the denial of the deduction. Finally, claiming deductions for premiums already reimbursed by another source is also a ground for denial.

Comparative Eligibility Across Jurisdictions

Eligibility requirements for insurance premium tax deductions differ significantly across various countries and states. For instance, the United States offers different deductions based on the type of insurance and the taxpayer’s employment status, while Canada might have a more streamlined approach. The United Kingdom and Australia also have unique systems for tax deductions related to insurance premiums. These differences highlight the importance of consulting local tax regulations to accurately determine eligibility. A thorough understanding of the specific rules within your jurisdiction is critical to ensure you correctly claim the deduction.

Calculating the Deductible Amount

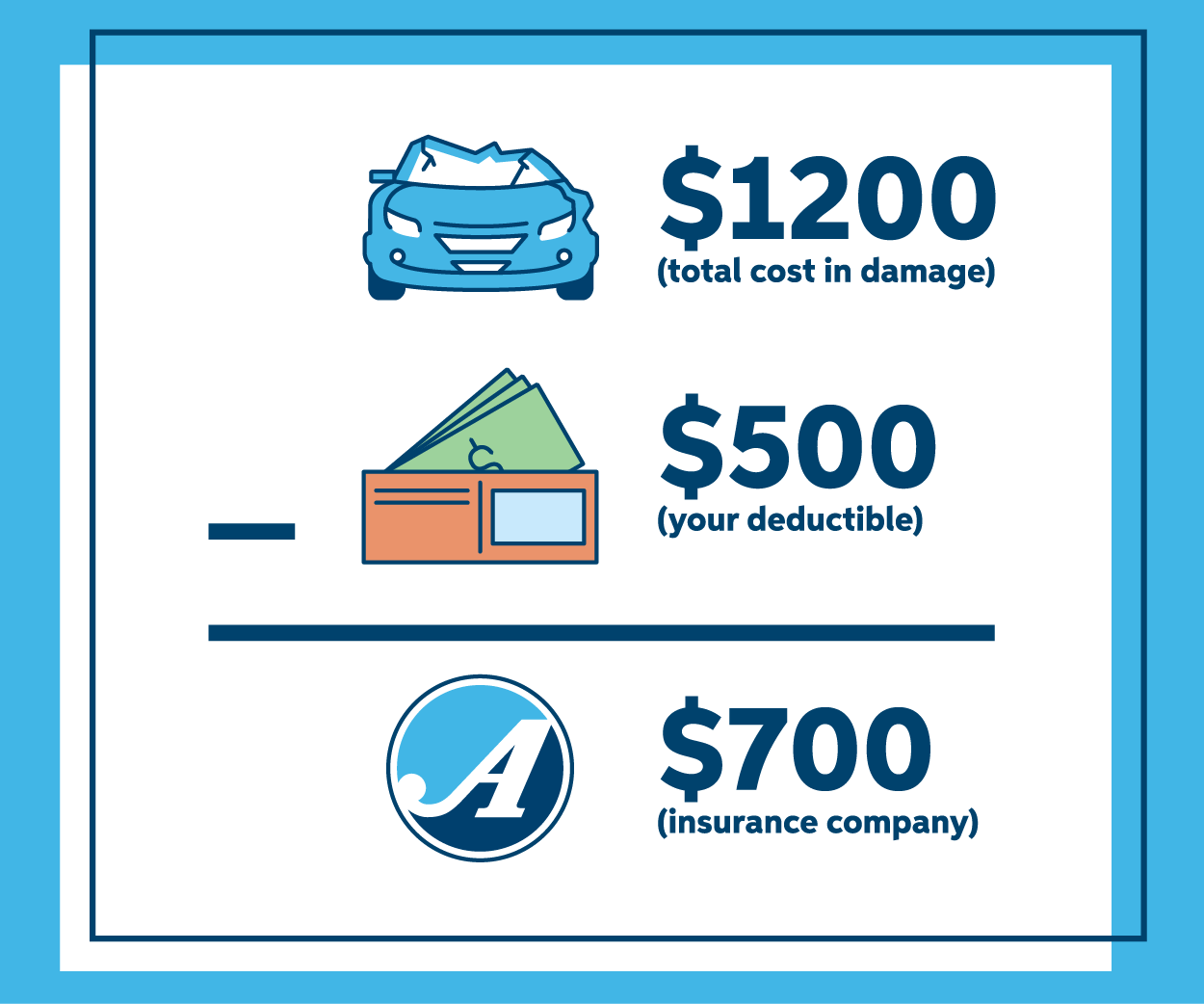

Determining the deductible amount for your insurance premium tax deduction involves understanding the applicable limits and correctly applying them to your premium payments. The exact calculation will depend on your country’s tax laws and the specific insurance policies you hold. This section provides a general framework and examples, but always refer to your local tax regulations for precise details.

The calculation typically involves identifying the eligible premiums and then applying the maximum deduction allowed. This maximum amount is often a percentage of your adjusted gross income (AGI) or a fixed monetary limit. Once you determine the eligible premiums and the applicable limit, the deductible amount is the lower of the two.

Deductible Amount Calculation Method

The calculation of the deductible amount is straightforward: It’s the smaller value between the total eligible insurance premiums paid and the maximum allowable deduction under the tax law. The formula can be represented as:

Deductible Amount = min(Eligible Premiums Paid, Maximum Allowable Deduction)

Examples of Deductible Amount Calculations

To illustrate, let’s consider three scenarios:

| Scenario | Premium Paid | Deductible Amount | Net Premium (Premium Paid – Deductible Amount) |

|---|---|---|---|

| Scenario 1: Premiums below limit | $500 | $500 | $0 |

| Scenario 2: Premiums exceed limit (Maximum Deduction = $750) | $1000 | $750 | $250 |

| Scenario 3: Partial Deduction (Maximum Deduction = $1200, some premiums ineligible) | $1500 (Only $1000 eligible) | $1000 | $500 |

Step-by-Step Guide to Calculating the Deduction

A step-by-step guide for calculating your insurance premium tax deduction:

1. Identify Eligible Premiums: Determine which insurance premiums qualify for the deduction. This usually excludes certain types of insurance, such as life insurance or those not related to health or specific government mandates.

2. Calculate Total Eligible Premiums: Sum up all your eligible insurance premiums paid during the tax year. Keep all receipts and documentation as proof.

3. Determine the Maximum Allowable Deduction: Consult your country’s tax laws to find the maximum amount you can deduct. This limit is often a percentage of your AGI or a fixed dollar amount.

4. Compare and Determine Deductible Amount: Compare the total eligible premiums (Step 2) with the maximum allowable deduction (Step 3). The lower of the two figures is your deductible amount.

5. Calculate Net Premium: Subtract the deductible amount from your total eligible premiums to find the portion of the premiums you cannot deduct.

Documentation and Proof of Payment

Submitting the correct documentation is crucial for a successful insurance premium tax deduction claim. Incomplete or inaccurate documentation can lead to delays or rejection of your claim, potentially costing you valuable tax benefits. This section Artikels the necessary documentation and explains the importance of accurate record-keeping.

To claim your insurance premium tax deduction, you’ll need to provide sufficient proof of payment for the premiums you paid. This demonstrates that you actually incurred the expense and are therefore eligible for the deduction. The tax authorities will need to verify the legitimacy of your claim and the provided documentation plays a key role in this process.

Acceptable Proof of Payment

Several forms of documentation are generally accepted as proof of payment for insurance premiums. It’s advisable to retain all relevant documents for at least six years, in case of an audit. This proactive approach minimizes potential issues.

- Official receipts: These are issued by the insurance company upon payment and clearly show the date, amount paid, type of insurance, and policy number. They are the most straightforward and widely accepted form of proof.

- Bank statements: Bank statements showing electronic fund transfers or debit card transactions to the insurance company are also acceptable. Ensure the statement clearly indicates the payment recipient (the insurance company), the date of the transaction, and the amount paid. Highlight the relevant transaction to avoid ambiguity.

- Cancelled checks: If you paid by check, a copy of the cancelled check, showing the payment details and bank stamp, serves as valid proof. Ensure all relevant details are clearly visible.

Issues Arising from Insufficient Documentation

Insufficient documentation can create significant problems during the tax claim process. The tax authorities may request additional information, delaying the processing of your return and potentially leading to penalties.

- Claim rejection: Without sufficient proof, your claim may be rejected entirely, meaning you will not receive the tax deduction.

- Audits: Incomplete documentation can trigger an audit, which involves a more thorough examination of your tax return and supporting documents. This can be time-consuming and stressful.

- Delays in processing: The tax authorities may require you to provide additional information, delaying the processing of your tax return and potentially affecting your refund timeline.

Consequences of Submitting Inaccurate or Incomplete Documentation

Submitting inaccurate or incomplete documentation can have serious consequences, potentially resulting in penalties and interest charges. Accuracy and completeness are paramount in ensuring a smooth tax filing process.

- Penalties: Intentional submission of false information can lead to significant penalties, while unintentional errors may still result in smaller penalties depending on the jurisdiction and severity of the error.

- Interest charges: Delays in processing due to incomplete documentation can result in interest charges on any tax owed.

- Legal repercussions: In cases of deliberate fraud or misrepresentation, more severe legal consequences may apply.

Tax Implications and Reporting

Understanding how the insurance premium tax deduction impacts your overall tax liability is crucial for effective tax planning. This deduction directly reduces your taxable income, resulting in a lower tax bill. The process of reporting this deduction is straightforward, but accurate record-keeping is essential.

The insurance premium tax deduction reduces your adjusted gross income (AGI). This, in turn, lowers your taxable income, potentially placing you in a lower tax bracket or reducing the amount of tax owed within your current bracket. The precise impact depends on your individual tax bracket and the amount of the deduction.

Deduction’s Impact on Different Tax Brackets

The benefit of the insurance premium tax deduction varies depending on the individual’s tax bracket. Higher tax bracket individuals will see a larger reduction in their tax liability compared to those in lower tax brackets because the tax savings are directly proportional to the marginal tax rate. For example, a taxpayer in the 22% tax bracket will save 22% of the deductible amount, while a taxpayer in the 32% bracket will save 32%. This highlights the importance of understanding your tax bracket before making financial decisions related to insurance premiums.

Reporting the Deduction on Tax Returns

Reporting the insurance premium deduction is generally done on Schedule A (Form 1040), Itemized Deductions. You’ll need to accurately record the total eligible premiums paid during the tax year. Remember to keep all supporting documentation, including receipts and insurance policy statements, in case of an audit. The IRS may request this documentation to verify the claimed deduction. Failure to provide sufficient documentation may result in the disallowance of the deduction.

Comparative Example of Tax Liability

Let’s illustrate the impact of the deduction with a comparative example. Consider two taxpayers, both with a taxable income of $70,000 before deductions. Taxpayer A does not utilize the insurance premium deduction, while Taxpayer B deducts $2,000 in eligible premiums. Assume a simplified tax system for illustrative purposes.

| Taxpayer | Taxable Income Before Deduction | Deduction Amount | Taxable Income After Deduction | Tax Liability (Simplified Example – 20% Tax Rate) |

|---|---|---|---|---|

| A | $70,000 | $0 | $70,000 | $14,000 |

| B | $70,000 | $2,000 | $68,000 | $13,600 |

In this simplified example, Taxpayer B, utilizing the deduction, saves $400 ($14,000 – $13,600) in taxes. This savings is a direct result of the reduced taxable income due to the insurance premium deduction. Note that actual tax liability will vary based on the specific tax rates and other applicable deductions and credits. This example serves to illustrate the principle of how the deduction affects the final tax bill.

Common Mistakes and Pitfalls

Claiming insurance premium tax deductions can be straightforward, but overlooking certain details can lead to delays or rejection of your claim. Understanding common errors and proactively addressing potential pitfalls is crucial for a successful deduction. This section highlights frequent mistakes and offers strategies to avoid them.

Incorrect Documentation

Incomplete or inaccurate documentation is a primary reason for claim rejection. This includes missing receipts, incorrect policy details, or failing to provide proof of payment. For instance, submitting a cancelled cheque without the bank statement showing the payment reflects poorly on your claim. To avoid this, meticulously gather all necessary documents – policy details, payment receipts, and tax identification numbers – before submitting your claim. Ensure all information is accurate and legible. Consider keeping a dedicated folder for all insurance-related paperwork to maintain organized records.

Exceeding the Deductible Limit

Many individuals mistakenly believe they can deduct the entire insurance premium amount. However, tax laws often stipulate a maximum deductible amount. For example, if the maximum deductible is 15% of your adjusted gross income, claiming more than this percentage will result in a partial or complete rejection. To avoid this, carefully review the applicable tax laws and regulations to determine the precise limits for your situation. Accurately calculate the deductible amount based on your income and the relevant regulations.

Incorrect Calculation of Deductible Amount

Errors in calculating the deductible amount are another frequent mistake. This could stem from misinterpreting the tax rules, using incorrect income figures, or failing to account for all applicable deductions. For instance, a common error is to include premiums for ineligible insurance types in the calculation. This could lead to an overstated deduction and potential penalties. Therefore, use a reliable calculation method and double-check your figures to prevent errors. Consult a tax professional if needed for complex situations.

Failing to Report the Deduction Accurately

Inaccuracies in reporting the deduction on your tax return can lead to audits and penalties. This involves incorrectly filling out the relevant tax forms or failing to include the deduction in the appropriate section. For example, entering the wrong amount or omitting the deduction altogether can result in significant financial consequences. To prevent this, carefully review your tax forms and ensure the reported deduction accurately reflects the calculated amount. If unsure about any aspect of the process, seek professional tax advice.

Claiming Deductions for Ineligible Premiums

Not all insurance premiums are eligible for tax deductions. For example, premiums for life insurance policies are generally not deductible, while health insurance premiums often are, depending on the specific circumstances and country regulations. Incorrectly claiming deductions for ineligible premiums will lead to rejection of your claim, or worse, penalties. Thoroughly understand the specific eligibility criteria for insurance premium tax deductions in your jurisdiction before filing your claim. Refer to official tax guidelines or seek professional advice if you are uncertain about the eligibility of your premiums.

Comparison of Deduction Methods

Claiming your insurance premium tax deduction can be approached in several ways, each with its own set of advantages and disadvantages. The optimal method depends largely on your individual circumstances, such as your overall tax bracket and the complexity of your insurance policies. Understanding these differences is crucial for maximizing your tax savings.

Direct Deduction from Gross Income

This method involves directly subtracting the eligible insurance premium amount from your gross income before calculating your taxable income. It’s a straightforward approach, particularly beneficial for those with simpler tax situations and a high number of eligible premiums.

- Advantage: Simplicity and ease of calculation. It’s a quick and easy way to reduce your taxable income.

- Disadvantage: May not be as advantageous for individuals with lower incomes or those who can benefit more from itemized deductions.

- Example: An individual with a high gross income and several eligible insurance premiums would likely find this method beneficial, as the direct reduction in taxable income would result in significant tax savings.

Itemized Deductions

This method involves listing all eligible deductions, including insurance premiums, on Schedule A of your tax return. It’s often more beneficial for individuals with a higher number of deductions that exceed the standard deduction amount.

- Advantage: Potential for greater tax savings if total itemized deductions exceed the standard deduction.

- Disadvantage: Requires more detailed record-keeping and can be more complex to calculate.

- Example: A taxpayer with significant medical expenses, charitable contributions, and eligible insurance premiums might find itemizing more advantageous, as the combined total of these deductions could surpass their standard deduction, resulting in a larger tax reduction.

Comparison of Direct Deduction vs. Itemized Deductions

The choice between direct deduction and itemized deductions hinges on the individual’s specific tax situation. If the total value of itemized deductions (including insurance premiums) is less than the standard deduction, the direct deduction method might be simpler and equally effective. However, if itemized deductions exceed the standard deduction, itemizing generally leads to greater tax savings.

- Consideration: Taxpayers should compare the total amount of deductions under both methods before making a decision. A simple calculation can help determine which method will yield a greater tax benefit.

- Professional Advice: Consulting a tax professional can be helpful in determining the most beneficial approach based on individual circumstances.

Ultimate Conclusion

Successfully claiming your insurance premium tax deduction requires careful planning and attention to detail. By understanding the eligibility requirements, accurately calculating the deductible amount, and maintaining meticulous documentation, you can significantly reduce your tax burden. This guide has equipped you with the knowledge to navigate this process confidently, ensuring you maximize your tax benefits and retain more of your hard-earned money. Remember to consult with a tax professional for personalized advice tailored to your specific circumstances.

Expert Answers

Can I deduct premiums for life insurance?

Generally, life insurance premiums are not deductible in most jurisdictions. However, there may be exceptions for specific types of life insurance policies or business-related insurance. Consult your tax regulations for details.

What if I overestimate my deduction?

Overestimating your deduction can result in an underpayment of taxes, potentially leading to penalties and interest charges. It’s crucial to accurately calculate your deductible amount based on your eligible premiums and applicable limits.

Where can I find the relevant tax forms?

The specific tax forms for claiming insurance premium tax deductions vary by country and jurisdiction. Consult your national or regional tax authority’s website for the appropriate forms and instructions.

What happens if my documentation is incomplete?

Incomplete documentation can delay the processing of your tax return and may even lead to a rejection of your claim. It is vital to ensure you have all necessary receipts, statements, and other supporting documents.

Are there any time limits for claiming the deduction?

Yes, there are usually deadlines for filing tax returns, including those claiming insurance premium tax deductions. Missing these deadlines can result in penalties. Check your tax authority’s guidelines for specific deadlines.