Navigating the world of insurance can be complex, but understanding the possibility of an insurance premium refund adds another layer. This guide unravels the intricacies of securing a refund, exploring various scenarios, legal aspects, and practical tips to help you successfully claim what you’re owed. From understanding the different reasons for refunds to mastering the calculation process, we’ll equip you with the knowledge to confidently navigate this often-overlooked aspect of insurance.

We’ll delve into the specific refund policies of different insurance types—auto, home, health, and life—highlighting the factors that influence the refund amount and the processes involved in claiming your money back. We’ll also address the legal rights of policyholders and the responsibilities of insurance companies, ensuring you’re fully informed and empowered throughout the process.

Understanding Insurance Premium Refunds

Receiving a refund on your insurance premium can be a pleasant surprise, but understanding why it happens is crucial. This section explains the various reasons for premium refunds, providing clarity on the process and typical scenarios.

Insurance premium refunds arise from several factors, primarily related to overpayment, policy cancellations, or adjustments based on policy terms. These refunds can be partial or full, depending on the circumstances.

Reasons for Insurance Premium Refunds

Several factors can lead to a refund of your insurance premiums. Understanding these reasons will help you navigate the process more effectively.

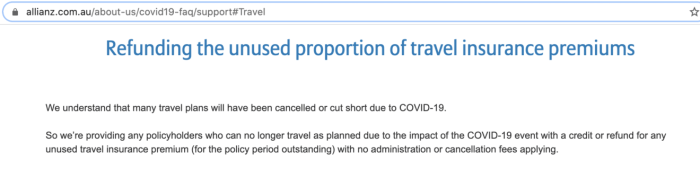

- Policy Cancellation: If you cancel your insurance policy before its renewal date, you’re typically entitled to a refund of the unearned portion of your premium. For example, if you paid for a year-long policy and cancel after six months, you’ll receive a refund for the remaining six months, minus any cancellation fees.

- Overpayment: Errors in payment processing can sometimes result in overpayment. For instance, if you accidentally pay twice for the same policy period, you’ll be refunded the duplicate payment amount.

- Premium Adjustment: In some cases, your insurance premium might be adjusted due to changes in your risk profile. For example, if you’ve added security features to your home (like a security system), your insurer might reduce your premium for the remaining policy period, resulting in a partial refund.

- Rate Reductions: Insurers may sometimes reduce rates due to market changes or improved company performance. This reduction might be applied retrospectively, leading to a refund of the difference.

- Miscalculation: Occasionally, premiums are miscalculated by the insurer, leading to an overcharge. This can happen due to errors in data entry or incorrect application of discounts.

Examples of Partial and Full Refunds

Let’s illustrate with specific scenarios to better understand how partial and full refunds work.

- Full Refund Example: John cancels his car insurance policy after one month, having paid for a six-month policy upfront. He receives a full refund for the remaining five months, less any cancellation fees specified in his policy documents.

- Partial Refund Example: Jane’s home insurance premium is recalculated after she installs a security system. Her insurer reduces her premium for the remainder of the policy year, resulting in a partial refund reflecting the difference between the original premium and the adjusted, lower premium.

Receiving a Refund: The Typical Process

The process for receiving an insurance premium refund typically involves several steps. While specifics may vary depending on the insurer, the general flow is consistent.

The following flowchart illustrates the typical steps involved:

Flowchart:

[Start] –> [Request Refund (Cancellation, Overpayment, etc.)] –> [Insurer Verifies Request] –> [Insurer Processes Refund] –> [Refund Sent (Check, Direct Deposit, etc.)] –> [End]

This simple flowchart demonstrates the fundamental steps. The duration of each step varies depending on the insurer’s processing times and the complexity of the refund request.

Types of Insurance and Refund Policies

Insurance premium refunds are governed by specific policies that vary considerably depending on the type of insurance. Understanding these variations is crucial for policyholders to know what to expect in different circumstances. This section will explore the refund policies associated with common insurance types, highlighting key factors and triggering events.

Auto Insurance Refund Policies

Auto insurance refund policies typically center around changes in coverage, policy cancellation, or overpayment. Refunds may be pro-rated, meaning you receive a portion of the premium based on the unused portion of the policy term. Factors influencing the refund amount include the policy’s cancellation date, the method of cancellation (e.g., initiated by the insurer or the policyholder), and any applicable fees or penalties. A refund might be triggered by canceling a policy before its expiration, switching to a different insurer, or correcting an overpayment made by the policyholder.

Home Insurance Refund Policies

Similar to auto insurance, home insurance refunds are often pro-rated based on the remaining coverage period. Factors affecting the refund include the length of the policy, the date of cancellation, and any outstanding claims. Circumstances triggering a refund might involve selling a property, moving to a different location, canceling a policy due to a change in circumstances (e.g., moving to a location not covered by the policy), or identifying an overpayment.

Health Insurance Refund Policies

Health insurance refund policies are more complex and less likely to result in a significant refund compared to other types. Premiums are typically paid monthly, and refunds are less common. Factors that might influence a potential refund include overpayment or errors in billing. A refund might occur if the insurer makes a billing error or if an overpayment is detected. Many health insurance plans operate on a yearly basis with no pro-rated refunds for mid-year cancellations.

Life Insurance Refund Policies

Life insurance refund policies vary significantly depending on the type of policy (e.g., term life, whole life). Some policies, like term life insurance, may offer no refund after a certain period. Others, such as whole life insurance, might have cash value components that can be accessed, but this is not a simple refund of the premium. Factors influencing potential refunds relate to the policy’s specific terms and conditions. Circumstances triggering a partial return of funds might involve surrendering a cash-value policy or receiving a dividend payout, which is not strictly a refund but a return of a portion of the premium.

Comparison of Insurance Refund Policies

| Insurance Type | Typical Refund Scenario | Factors Influencing Refund Amount | Refund Triggering Circumstances |

|---|---|---|---|

| Auto | Pro-rated refund upon cancellation | Cancellation date, method of cancellation, applicable fees | Policy cancellation, change of insurer, overpayment |

| Home | Pro-rated refund upon cancellation | Policy length, cancellation date, outstanding claims | Property sale, relocation, policy cancellation, overpayment |

| Health | Rare, typically due to billing errors | Billing errors, overpayments | Billing errors, overpayment |

| Life | Varies greatly by policy type | Policy terms and conditions, cash value (if applicable) | Policy surrender (cash value policies), dividend payouts |

Calculating Insurance Premium Refunds

Calculating insurance premium refunds can seem complex, but understanding the methods and factors involved simplifies the process. Insurance companies utilize various methods to determine the amount refunded, often dependent on the reason for the refund and the specific policy terms.

Methods Used to Calculate Refunds

Insurance companies primarily use two methods for calculating refunds: pro-rata and short-rate. The pro-rata method calculates the refund based on the unused portion of the policy period. The short-rate method, however, applies a penalty for early cancellation, resulting in a smaller refund. The chosen method is usually stipulated within the policy documents.

Factors Considered in Determining Refund Amounts

Several factors influence the final refund amount. These include the original premium paid, the length of the policy period, the date of cancellation, the reason for cancellation, and any applicable fees or penalties. For instance, a policy cancelled due to a move might receive a pro-rata refund, while a cancellation due to non-payment may incur penalties, reducing the refund. Specific policy terms and conditions always supersede general guidelines.

Examples of Refund Calculations

Let’s consider a few scenarios.

Scenario 1: Pro-rata refund. A one-year car insurance policy costing $1200 is cancelled after six months. The pro-rata refund would be $600 ($1200/12 months * 6 months).

Scenario 2: Short-rate refund. The same policy, cancelled after six months due to non-payment, might incur a 10% penalty. The refund would then be $540 ($600 – ($600 * 0.10)).

Scenario 3: Refund for Overpayment. A homeowner mistakenly paid $2000 instead of $1800. The refund would simply be $200 ($2000 – $1800).

Step-by-Step Guide to Manual Refund Calculation

To manually calculate a potential refund, follow these steps:

1. Identify the original premium: Determine the total premium paid for the insurance policy.

2. Determine the policy period: Note the start and end dates of the policy.

3. Calculate the unused portion: Subtract the number of days (or months) the policy was in effect from the total policy period.

4. Calculate the pro-rata refund: Divide the unused portion by the total policy period and multiply by the original premium.

5. Account for any penalties: If a short-rate method applies, deduct any applicable penalties from the pro-rata refund.

6. Determine the final refund amount: The result of step 5 is the final refund amount.

For a pro-rata refund: Refund = (Unused policy period / Total policy period) * Original Premium

For a short-rate refund: Refund = Pro-rata refund – (Pro-rata refund * Penalty Percentage)

Legal Aspects of Insurance Premium Refunds

Securing a premium refund often involves navigating legal intricacies. Understanding your rights as a policyholder and the insurer’s obligations is crucial for a smooth process. This section details the legal frameworks and dispute resolution methods relevant to insurance premium refunds.

Policyholder Rights Regarding Refunds

Policyholders possess specific rights concerning premium refunds, varying depending on the type of insurance and the reason for the refund request. These rights are often enshrined in the insurance policy itself, as well as broader consumer protection laws. For instance, if a policy is canceled early, the policyholder is generally entitled to a prorated refund, minus any applicable cancellation fees. Similarly, if an insurer is found to have overcharged a policyholder, they have the right to demand a refund of the overpayment. This right is often supported by regulations that prevent unfair business practices by insurance companies. Ignoring these rights could lead to legal action by the policyholder.

Insurance Company Responsibilities Concerning Refunds

Insurance companies have a legal and ethical responsibility to process refund requests promptly and fairly. This includes providing clear and concise information about their refund policies, accurately calculating the refund amount, and issuing the refund within a reasonable timeframe. Failure to meet these obligations can lead to penalties, fines, and reputational damage. Furthermore, insurance companies are required to maintain transparent and accessible records of all transactions related to premium payments and refunds. This is essential for ensuring accountability and resolving any disputes that may arise.

Potential Disputes and Resolution Methods

Disputes regarding insurance premium refunds can arise from various factors, such as disagreements over the calculation of the refund amount, delays in processing the refund, or the insurer’s refusal to issue a refund. Methods for resolving these disputes include direct communication with the insurance company, mediation, arbitration, and litigation. Mediation involves a neutral third party helping both parties reach a mutually acceptable agreement. Arbitration involves a neutral third party making a binding decision. Litigation, as a last resort, involves filing a lawsuit in court. The specific resolution method employed often depends on the nature of the dispute and the applicable legal framework. For example, some jurisdictions have established insurance regulatory bodies that can mediate disputes between policyholders and insurers.

Relevant Legal Frameworks Governing Insurance Premium Refunds

Insurance premium refunds are governed by a complex interplay of federal and state laws, regulations, and case law. These laws vary significantly across jurisdictions and often include provisions related to consumer protection, unfair business practices, and the specific regulations governing different types of insurance. For example, the McCarran-Ferguson Act in the United States grants states primary regulatory authority over the insurance industry, meaning state laws often play a significant role in determining the specifics of insurance premium refunds. Understanding the relevant legal framework is crucial for both policyholders and insurance companies to ensure compliance and avoid legal challenges. Consulting with legal professionals specializing in insurance law can provide valuable guidance in navigating these complexities.

Impact of Insurance Premium Refunds

Insurance premium refunds, while seemingly straightforward, have a significant ripple effect on both the policyholder and the insurance company. Understanding this impact is crucial for effective financial planning and responsible insurance management. This section will explore the financial consequences of refunds for both parties, examining their influence on future premiums and providing practical examples of how these refunds can affect personal budgets.

Financial Impact on Policyholders

A premium refund directly increases a policyholder’s disposable income. This influx of cash can be used for various purposes, from paying down debt to investing or making a significant purchase. The size of the impact depends on the amount refunded and the policyholder’s overall financial situation. For example, a $500 refund might be a minor adjustment for a high-income earner but a significant boost for someone with a tight budget. This unexpected income can provide financial breathing room, allowing for flexibility in managing expenses and potentially reducing financial stress. Conversely, a smaller refund may not significantly impact financial planning but still offers a welcome addition to personal finances.

Financial Impact on Insurance Companies

From the insurer’s perspective, a refund represents a reduction in revenue. This impacts their profitability and potentially their ability to invest in areas such as claims processing, risk management, or new product development. The magnitude of the impact depends on the volume of refunds issued and the company’s overall financial health. Large-scale refunds due to, for example, a significant overestimation of risk, can strain a company’s financial resources and affect their future pricing strategies. Conversely, small, infrequent refunds are likely to have a minimal effect on the company’s bottom line.

Implications for Future Insurance Premiums

The impact of a refund on future premiums is complex and not always directly correlated. While a refund itself doesn’t directly reduce future premiums, the circumstances leading to the refund can. For instance, if a refund is issued due to a lower-than-anticipated risk profile within a particular group of policyholders, the insurer might adjust future premiums downwards for that group to reflect the improved risk assessment. Conversely, if refunds are frequent and substantial due to consistent miscalculation, the insurer may adjust future premiums upwards to offset losses and maintain profitability. The relationship is therefore indirect and dependent on various factors, including the reason for the refund and the insurer’s risk assessment models.

Examples of Refunds Affecting Financial Planning

Consider two scenarios: A young professional receives a $1000 refund on their car insurance. They could allocate this towards their emergency fund, increasing their financial security. Alternatively, they might choose to invest it, potentially generating future returns. In contrast, a family facing unexpected medical expenses receives a $2000 refund on their home insurance. This refund could significantly alleviate their financial burden, preventing them from incurring further debt or delaying necessary medical treatments. These examples highlight the versatility of how refunds can influence financial decisions based on individual circumstances and priorities.

Visual Representation of Refund Impact on a Policyholder’s Budget

Imagine a pie chart representing a policyholder’s monthly budget. Before the refund, segments might show allocations for housing, transportation, food, entertainment, and savings. After receiving a $500 refund, a new segment representing the refund is added. This could either increase the savings segment or partially offset spending in other areas, depending on the policyholder’s priorities. The visual representation clearly shows the positive impact of the additional funds, illustrating how it provides greater flexibility and potentially reduces financial strain. The size of the “refund” segment would be proportional to the amount received, demonstrating the varying degrees of impact based on the refund amount. The overall size of the pie chart would remain consistent, representing the total monthly budget, while the relative size of the segments would change to reflect the allocation of the refunded amount.

Last Word

Successfully navigating an insurance premium refund requires understanding the nuances of your policy, the applicable laws, and the specific procedures of your insurance provider. By carefully reviewing your policy documents, maintaining accurate records, and following the steps Artikeld in this guide, you can significantly increase your chances of receiving a fair and timely refund. Remember, proactive engagement and thorough documentation are key to a successful claim. This guide serves as a starting point; consulting with legal or financial professionals may be beneficial in complex situations.

FAQ Summary

What happens if my insurance company denies my refund request?

If your request is denied, review your policy carefully and gather all supporting documentation. You may need to escalate the issue through the company’s internal appeals process or consider seeking legal counsel.

Are there time limits for claiming a refund?

Yes, most insurance policies have specific timeframes for filing refund claims. Check your policy documents for details. Acting promptly is crucial.

Can I get a refund if I cancel my policy mid-term?

The possibility of a refund upon mid-term cancellation varies significantly by policy type and insurer. Your policy’s terms and conditions will specify the refund amount, if any.

What documentation do I need to support my refund claim?

Typically, you’ll need your policy documents, proof of payment, and any documentation supporting the reason for your refund request (e.g., proof of cancellation, medical records, etc.).