Understanding your monthly insurance premium is crucial for effective financial planning. This guide delves into the multifaceted world of insurance costs, exploring the factors that influence premiums, how to decipher your bill, and strategies to potentially lower your monthly payments. We’ll unpack the complexities of coverage, payment options, and provide practical tips to help you navigate this important aspect of personal finance.

From age and driving history to vehicle type and location, numerous variables impact your monthly insurance outlay. This guide aims to demystify these influences, offering a clear and concise understanding of how your premium is calculated and what you can do to manage it effectively. We will also explore various payment options and highlight the importance of proactive financial management in this area.

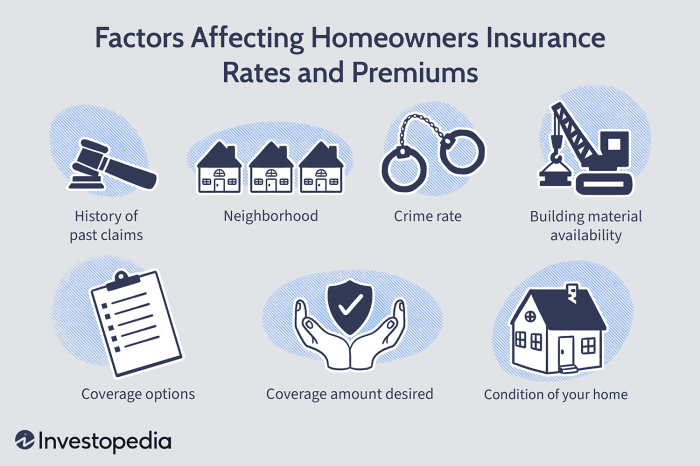

Factors Influencing Monthly Insurance Premiums

Understanding the factors that determine your monthly insurance premium is crucial for making informed decisions about your coverage. Several key elements contribute to the final cost, and it’s important to be aware of how these factors interact to influence your premium. This section will detail some of the most significant influences.

Age

Age is a significant factor in determining insurance premiums. Younger drivers, particularly those under 25, generally pay higher premiums due to statistically higher accident rates in this demographic. Insurance companies assess risk based on historical data, and this age group tends to have more accidents and traffic violations. As drivers age and accumulate a clean driving record, their premiums typically decrease. This reflects the reduced risk associated with increased experience and maturity behind the wheel. For example, a 20-year-old driver with a clean record might pay significantly more than a 40-year-old driver with a similar record.

Driving History

Your driving history significantly impacts your insurance premiums. A clean driving record with no accidents or traffic violations results in lower premiums. Conversely, accidents, speeding tickets, and other moving violations will increase your premiums. The severity of the violation also matters; a DUI, for instance, will have a much more substantial impact on your premium than a minor speeding ticket. Insurance companies use a points system to track driving infractions, and each point translates to a higher premium. For instance, a driver with multiple at-fault accidents might see their premiums double or even triple compared to a driver with a perfect record.

Coverage Levels

Different coverage levels result in varying premium costs. Liability-only insurance, which covers damages you cause to others, is generally the cheapest option. Adding comprehensive coverage, which protects against damage to your own vehicle from events like theft or hail, increases the premium. Collision coverage, which protects against damage to your vehicle in an accident, further increases the cost. The more comprehensive your coverage, the higher your premium will be. For example, liability-only coverage for a standard sedan might cost $50 per month, while adding comprehensive and collision could raise the premium to $150 per month or more, depending on other factors.

Location

Your location plays a significant role in determining your insurance premiums. Areas with higher crime rates, more traffic congestion, and a higher frequency of accidents tend to have higher insurance premiums. Insurance companies consider the risk profile of your geographic area when calculating your premium. Living in a densely populated urban area with a high accident rate will likely result in a higher premium than living in a rural area with lower accident rates. For example, a driver in a large city might pay significantly more than a driver in a small town, even if all other factors are the same.

Vehicle Type and Features

The type and features of your vehicle also influence your premium. Sports cars and luxury vehicles are generally more expensive to insure than economy cars due to their higher repair costs and higher likelihood of theft. Safety features, such as anti-lock brakes and airbags, can sometimes lower your premium, as they reduce the risk of accidents and injuries. For instance, a high-performance sports car will likely command a much higher premium than a fuel-efficient compact car, even if both are driven by the same person with the same driving record.

Understanding Your Insurance Bill

Deciphering your insurance bill can feel like navigating a maze, but understanding its components empowers you to make informed decisions about your coverage. This section will break down the typical elements of an insurance premium, illustrating how various factors contribute to your monthly cost.

Sample Insurance Bill Breakdown

Below is a sample insurance bill, presented in a table format for easy readability. Remember that actual bills may vary depending on your insurer and specific policy details.

| Item | Description | Cost | % of Total Premium |

|---|---|---|---|

| Liability Coverage | Bodily injury and property damage to others | $50 | 25% |

| Collision Coverage | Damage to your vehicle in an accident | $60 | 30% |

| Comprehensive Coverage | Damage to your vehicle from non-accidents (e.g., theft, vandalism) | $40 | 20% |

| Uninsured/Underinsured Motorist Coverage | Protection if involved with an uninsured driver | $30 | 15% |

| Medical Payments Coverage | Covers medical expenses for you and passengers | $20 | 10% |

| Total Premium | $200 | 100% |

Common Add-ons and Their Impact

Adding optional coverages to your policy, often called add-ons, can increase your monthly premium. These additions provide extra protection beyond the basic coverage. For example, roadside assistance, rental car reimbursement, or gap insurance (covering the difference between the actual cash value of your car and what you owe on your loan after an accident) are common add-ons. The cost of these add-ons varies depending on the insurer and the specific features included. Adding roadside assistance might increase your monthly premium by $5-$15, while gap insurance could add $20-$40 or more, depending on the vehicle’s value and loan amount.

Discounts and Their Effect on Monthly Costs

Several discounts can significantly reduce your monthly insurance premium. Bundling your auto and homeowners insurance with the same company often results in a substantial discount, perhaps 10-20% or more. Maintaining a clean driving record (no accidents or traffic violations) is another major factor; insurers often reward safe drivers with discounts ranging from 5% to 25% or more, depending on the insurer and driving history. Other potential discounts include good student discounts, multi-car discounts (insuring multiple vehicles under one policy), and discounts for installing anti-theft devices.

Components of an Insurance Premium

Your insurance premium is calculated based on several key factors. These include your driving history, the type of vehicle you drive, your location, your coverage choices (liability, collision, comprehensive, etc.), and your age and credit score. The insurer assesses your risk profile based on these factors and sets a premium accordingly. The premium is then divided into the various coverage components shown in the sample bill above, representing the cost allocated to each type of protection you have selected. Understanding these components allows you to evaluate the value of your coverage and make adjustments as needed.

Visual Representation of Premium Costs

Visual aids can significantly enhance understanding of complex insurance premium structures. By presenting data graphically, we can quickly grasp trends and comparisons that might be missed in tables of numbers. The following examples illustrate how different visual representations can clarify various aspects of insurance premium costs.

Bar Graph Illustrating Age and Premium Costs

This bar graph displays the relationship between age and monthly insurance premiums for a hypothetical auto insurance policy. The horizontal (x-axis) represents age groups, categorized in five-year intervals (e.g., 18-22, 23-27, 28-32, etc., up to 65+). The vertical (y-axis) represents the average monthly premium cost in US dollars. The bars’ height corresponds to the average premium for each age group. For example, the 18-22 age group might show an average premium of $200, while the 38-42 age group might show $150, reflecting the general trend of higher premiums for younger drivers due to higher risk profiles. The graph clearly shows a decrease in premiums with increasing age until a certain point, after which premiums may level off or even slightly increase in the older age brackets. The data points would be clearly labeled on each bar, and a legend would specify the units (USD) and the type of insurance (auto insurance in this case).

Flowchart of Monthly Insurance Premium Calculation

The flowchart depicts the steps involved in calculating a monthly insurance premium. It begins with the applicant’s information (age, driving history, location, vehicle details, etc.). This information feeds into a risk assessment module, which assigns a risk score based on pre-defined criteria. The risk score, along with the chosen coverage level (e.g., liability, collision, comprehensive), determines a base premium. Next, any applicable discounts (e.g., safe driving discounts, multi-car discounts) are subtracted from the base premium. Finally, taxes and fees are added to arrive at the final monthly premium. Each step in the flowchart would be represented by a distinct shape (e.g., rectangle for processes, diamond for decisions), with connecting arrows indicating the flow of information. A legend would clearly define each shape and its meaning within the flowchart context. For example, a rectangle might represent “Calculate Base Premium,” while a diamond might represent “Apply Discounts?”.

Pie Chart Showing Breakdown of Premium Costs

This pie chart visually represents the proportion of different cost components within a sample monthly premium of $150. Each slice of the pie corresponds to a specific cost element. For example, one slice might represent claims costs (40%), another might show administrative expenses (20%), another might represent marketing and sales (15%), another might be profit (10%), and a final slice might be for taxes and fees (15%). Each slice would be clearly labeled with its corresponding cost element and percentage. This chart offers a clear and concise visualization of how the premium is allocated across various operational and financial aspects of the insurance company.

Summary

Managing your monthly insurance premium effectively requires understanding the various factors influencing its cost and exploring strategies for potential savings. By carefully considering coverage levels, driving habits, payment options, and comparing quotes from different providers, you can gain control over your insurance expenses and ensure you are receiving the best value for your money. Remember, proactive planning and informed decision-making are key to optimizing your insurance costs.

Answers to Common Questions

What happens if I miss a monthly insurance payment?

Late payments often result in late fees and may even lead to policy cancellation.

Can I pay my insurance premium bi-weekly or quarterly?

Some insurers offer payment plans beyond monthly installments, but this varies by provider. Contact your insurer to inquire about alternative payment schedules.

How does my credit score affect my insurance premium?

In many jurisdictions, your credit score can influence your insurance premium. A higher credit score often correlates with lower premiums.

What is the difference between liability and comprehensive coverage?

Liability coverage protects against damage or injury you cause to others. Comprehensive coverage extends to damage to your own vehicle, regardless of fault (e.g., theft, vandalism).