Navigating the complexities of health insurance can feel like deciphering a secret code. Understanding your insurance premium is crucial, not just for budgeting, but for making informed decisions about your healthcare coverage. This guide unravels the mysteries behind health insurance premiums, exploring the various factors that influence their cost and offering strategies to potentially lower your expenses. We’ll delve into the components of your premium, the impact of government regulations, and future trends that could affect your healthcare costs.

From the role of age and pre-existing conditions to the influence of lifestyle choices and geographic location, we will examine the multifaceted nature of health insurance premium calculations. We’ll also discuss strategies for managing your premiums, including choosing the right plan and utilizing cost-saving options like HSAs. By the end, you’ll have a clearer understanding of how your premium is determined and how you can navigate this important aspect of your healthcare.

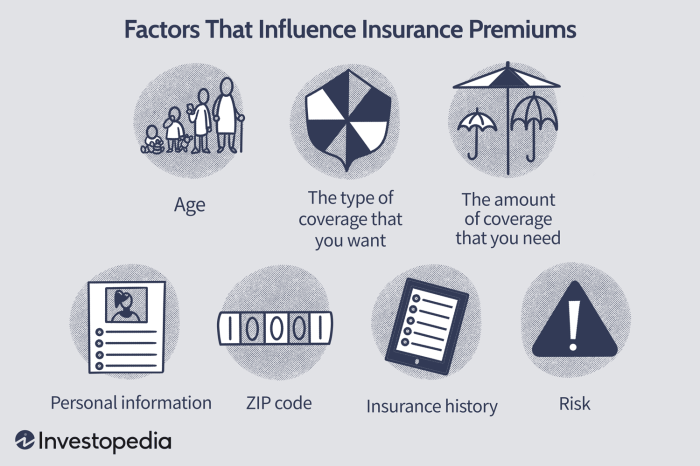

Factors Influencing Health Insurance Premiums

Several key factors interact to determine the cost of your health insurance premiums. Understanding these factors can help you make informed decisions about your coverage and budget. This section will explore the major influences on premium pricing.

Age and Health Insurance Premiums

Age significantly impacts health insurance premiums. Generally, older individuals pay more than younger individuals. This is because the risk of needing more extensive healthcare increases with age. Statistical data consistently shows a higher incidence of chronic illnesses and increased healthcare utilization among older populations. Insurance companies use actuarial data to assess risk, and this data reflects the higher probability of claims from older individuals. For example, a 60-year-old might pay considerably more than a 30-year-old for the same level of coverage, even with identical health profiles.

Pre-existing Conditions and Premium Costs

Pre-existing conditions, which are health issues you had before obtaining insurance, can substantially influence premium costs. Insurance companies consider the potential cost of managing these conditions when setting premiums. Someone with a pre-existing condition like diabetes or heart disease will likely face higher premiums than someone without these conditions. The increased risk of needing costly treatments for these conditions translates directly into higher premium payments. The Affordable Care Act (ACA) in many countries has helped to mitigate the impact of pre-existing conditions, but they still often influence the final premium.

Geographic Location and Premium Variations

The cost of healthcare varies significantly across different geographic locations. Premiums tend to be higher in areas with a higher cost of living, greater demand for healthcare services, and a higher concentration of specialists. For instance, premiums in major metropolitan areas with high concentrations of specialized medical facilities and high physician salaries are typically higher than in rural areas with limited access to healthcare resources. This disparity reflects the underlying cost of providing healthcare services in each location.

Lifestyle Choices and Premium Calculations

Lifestyle choices such as smoking, excessive alcohol consumption, and lack of physical activity can significantly influence premium calculations. Individuals engaging in these habits often face higher premiums due to an increased risk of developing health problems. Insurance companies recognize the correlation between unhealthy lifestyle choices and increased healthcare utilization. For example, smokers often pay more because of the higher risk of lung cancer, heart disease, and other smoking-related illnesses. Conversely, individuals who maintain a healthy lifestyle may qualify for discounts or lower premiums.

Relative Influence of Factors on Premium Costs

| Factor | Relative Influence |

|---|---|

| Age | High |

| Pre-existing Conditions | High |

| Geographic Location | Medium |

| Lifestyle Choices | Medium |

Understanding Health Insurance Premium Components

Your health insurance premium isn’t a single, monolithic fee; it’s comprised of several key components, each contributing to the overall cost. Understanding these components allows for a more informed assessment of your policy and its value. This section will break down the key elements that influence your monthly or annual payment.

Several factors contribute to the final premium calculation. These elements are interconnected and often influence one another, making it crucial to consider them holistically. The interaction between these factors leads to a unique premium for each individual or family plan.

Administrative Costs

Administrative costs represent the expenses incurred by the insurance company in managing the health plan. This includes salaries for administrative staff, IT infrastructure maintenance, marketing and sales expenses, and regulatory compliance costs. For example, a large national insurer might allocate a significant portion of its budget to maintaining a sophisticated claims processing system and a large network of customer service representatives. These expenses are passed on to policyholders as part of their premiums. High administrative costs, such as those associated with extensive marketing campaigns or complex IT systems, can directly increase premiums. Conversely, efficient administrative processes can help keep premiums lower.

Claims Experience

Claims experience reflects the actual healthcare costs incurred by the insured population. This includes payments made for doctor visits, hospital stays, prescription drugs, and other covered medical services. If the insured population files a large number of high-cost claims, the insurer’s expenses increase, necessitating higher premiums to offset these losses. Conversely, a healthier insured population with fewer claims will result in lower premiums. For example, a plan covering a population with a high prevalence of chronic illnesses like diabetes or heart disease will likely have a higher claims experience and therefore higher premiums than a plan covering a healthier population.

Provider Networks

The network of healthcare providers contracted by the insurance company significantly influences premium pricing. Plans with larger, more extensive networks often have higher premiums because the insurer must negotiate higher reimbursement rates with a wider range of providers. Conversely, plans with narrower networks (only including specific hospitals or doctors) usually offer lower premiums. The trade-off is access to care; a narrower network may limit your choices of doctors and hospitals. For example, a plan offering in-network access to all major hospitals in a metropolitan area will typically have a higher premium than a plan with a more limited network.

The following list summarizes the key components of a health insurance premium and their impact:

- Claims Costs: The actual cost of medical services used by policyholders. Higher utilization leads to higher premiums.

- Administrative Costs: Expenses related to running the insurance company (salaries, technology, marketing). Efficient operations can lower premiums.

- Provider Network Costs: Costs associated with negotiating contracts with healthcare providers. Larger networks often mean higher premiums.

- Profit Margin: The insurance company’s desired profit, a percentage of the premiums collected.

- Taxes and Fees: Government-mandated taxes and fees added to the premium.

- Reserves: Funds set aside by the insurer to cover unexpected or catastrophic claims.

Health Insurance Premium Trends and Future Predictions

Predicting the future of health insurance premiums requires considering a complex interplay of factors. While precise figures are impossible, analyzing current trends and anticipated changes allows for reasonable projections of premium costs over the next decade. This analysis will explore key drivers of premium fluctuations, including technological advancements and demographic shifts.

Projected Trends in Health Insurance Premium Costs (2024-2034)

Projected Premium Cost Increases

Over the next 5-10 years, a moderate to significant increase in health insurance premiums is anticipated. Several factors contribute to this projection. The rising cost of healthcare services, including prescription drugs and advanced medical technologies, will undoubtedly exert upward pressure on premiums. Furthermore, an aging population, coupled with increased prevalence of chronic diseases, will further strain the healthcare system and lead to higher insurance payouts. For example, the Kaiser Family Foundation projects that the average family’s health insurance premiums could increase by 5-7% annually, depending on the plan and market conditions. This translates to a substantial increase over the decade, potentially doubling or even tripling the cost in some cases. This projection considers a baseline scenario with moderate economic growth and no significant policy changes. More extreme scenarios, such as a major economic downturn or a drastic shift in healthcare policy, could alter this trajectory considerably.

Technological Advancements’ Impact on Premiums

Technological advancements present a double-edged sword. While innovations like telehealth and remote patient monitoring could potentially lower costs in the long run by improving preventative care and reducing hospital readmissions, the initial investment and integration costs can be substantial. The development and adoption of new drugs and treatments, while beneficial for patient care, can significantly increase healthcare expenses in the short term, influencing premium increases. For instance, the introduction of novel cancer therapies, while life-saving, is often associated with high price tags, which directly impacts insurance costs. The net effect of technological advancements on premiums will depend on the balance between cost-saving innovations and the cost of adopting new technologies and treatments.

Influence of an Aging Population

The aging global population is a significant driver of rising healthcare costs and, consequently, insurance premiums. Older individuals generally require more frequent and extensive healthcare services, leading to increased claims payouts for insurers. The rising prevalence of age-related chronic conditions, such as heart disease, diabetes, and Alzheimer’s disease, further exacerbates this trend. For example, the increasing number of individuals over 65 in many developed countries puts significant pressure on healthcare systems and increases the burden on insurance providers. This is particularly noticeable in countries with aging populations like Japan and Germany, where government initiatives are being implemented to manage the financial strain on the healthcare sector.

Factors Leading to Significant Premium Fluctuations

Several factors could lead to significant increases or decreases in health insurance premiums. Unexpected public health crises, such as pandemics, can dramatically increase healthcare utilization and claims costs, resulting in premium hikes. Conversely, successful public health initiatives aimed at preventing chronic diseases could lead to a decrease in long-term healthcare costs and, subsequently, lower premiums. Government regulations and policies also play a crucial role. Increased government subsidies or regulatory changes that promote competition within the insurance market could lead to lower premiums, while stricter regulations on drug pricing or increased taxes on healthcare services could drive premiums upward. Economic downturns can also significantly impact premium costs as employers may reduce or eliminate health insurance benefits for their employees, leading to a shift towards individual plans and potential price increases.

Timeline of Key Events and Predictions

| Year | Event/Prediction | Impact on Premiums |

|---|---|---|

| 2024-2026 | Continued moderate increase in healthcare costs; gradual adoption of new technologies. | Steady premium increases (3-5% annually). |

| 2027-2029 | Increased prevalence of chronic diseases in aging population; potential economic slowdown. | Accelerated premium increases (5-7% annually). |

| 2030-2034 | Wider adoption of cost-effective technologies; potential policy changes impacting drug pricing. | Premium increase rate may stabilize or slightly decrease, depending on policy effectiveness. |

Epilogue

Ultimately, understanding your health insurance premium isn’t just about the numbers; it’s about taking control of your healthcare finances and ensuring you have the coverage you need. By carefully considering the factors discussed – from your individual circumstances to broader economic trends – you can make informed choices to manage your premiums effectively. Remember, proactive planning and a thorough understanding of your policy are key to navigating the complexities of health insurance and securing the best possible coverage for your needs.

FAQ Corner

What is a deductible?

A deductible is the amount you pay out-of-pocket for covered healthcare services before your insurance begins to pay.

How do I compare different health insurance plans?

Use online comparison tools, consult an insurance broker, or review plan details provided by insurers. Consider factors like premiums, deductibles, co-pays, and network coverage.

What is a copay?

A copay is a fixed amount you pay for a covered healthcare service, such as a doctor’s visit, at the time of service.

Can I change my health insurance plan outside of open enrollment?

Generally, you can only change plans during open enrollment periods unless you qualify for a special enrollment period due to a qualifying life event (e.g., marriage, job loss).

What is a Health Savings Account (HSA)?

An HSA is a tax-advantaged savings account that allows you to save money for qualified medical expenses. It’s typically used in conjunction with a high-deductible health plan.