Navigating the complexities of tax season can feel daunting, but understanding how to leverage insurance premiums for tax deductions can significantly impact your financial well-being. This guide explores the intricacies of claiming these deductions, offering a clear and concise overview of eligibility criteria, documentation requirements, and potential tax savings. We’ll examine various insurance types, compare international tax regulations, and provide practical strategies to maximize your deductions.

From health and life insurance to home and auto coverage, we delve into the specifics of which premiums qualify for deductions in different countries. We’ll also address common pitfalls and offer practical tips to ensure a smooth and successful tax filing process. Whether you’re a seasoned taxpayer or just starting out, this guide will empower you to confidently navigate the world of insurance premium tax deductions.

Types of Insurance Premiums Eligible for Deduction

Understanding which insurance premiums are eligible for tax deductions can significantly reduce your tax burden. The specific types of insurance that qualify vary depending on your location and tax laws, so it’s crucial to consult your tax advisor or relevant government resources for the most up-to-date and accurate information. Generally, however, certain categories of insurance premiums are commonly recognized.

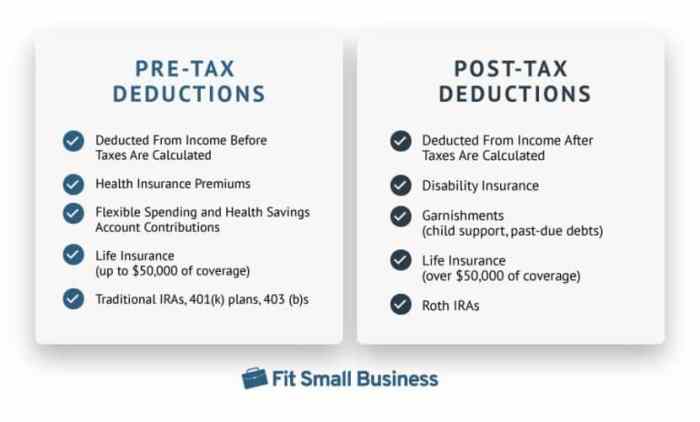

Eligibility for deductions often hinges on the purpose of the insurance and the insured entity. Premiums paid for personal insurance policies generally have different deduction rules compared to premiums for business-related insurance. Furthermore, limitations may exist regarding the amount of premiums deductible in a given tax year.

Health Insurance Premiums

Health insurance premiums are frequently eligible for tax deductions, particularly in situations where the individual or family is not covered by an employer-sponsored plan or where the employer’s contribution is insufficient. The specific rules and deductibility limits for health insurance premiums vary significantly depending on the country and the type of health insurance plan. Some countries offer tax credits or deductions for premiums paid under specific health insurance programs. For example, in the United States, individuals may be able to deduct medical expenses exceeding a certain percentage of their adjusted gross income, including health insurance premiums. This deduction can significantly reduce the tax liability for individuals with high medical expenses.

Disability Insurance Premiums

Premiums paid for disability insurance policies can often be deducted under certain circumstances. Typically, this applies when the insurance is obtained to protect against loss of income due to disability. Self-employed individuals or those with specific business needs may be able to deduct a portion or all of the disability insurance premiums as a business expense. For instance, a freelancer relying on their physical ability for work might deduct premiums as a business expense to safeguard against income loss due to injury or illness. However, deductions are usually limited to the portion directly related to business activities. Personal disability insurance premiums are generally not deductible.

Life Insurance Premiums

Deductibility of life insurance premiums is generally limited. While the premiums themselves are typically not deductible, certain exceptions might exist. For instance, in some cases, premiums paid on life insurance policies taken out as part of a business arrangement (such as key-person insurance) might be deductible as a business expense. This requires a clear connection between the policy and the business’s financial stability or the replacement of a key employee. However, life insurance premiums paid on personal policies are usually not considered tax-deductible.

Examples of Eligible and Ineligible Insurance Premiums

It’s crucial to remember that tax laws are complex and vary across jurisdictions. The following examples are for illustrative purposes only and should not be considered definitive legal advice. Always consult with a tax professional for personalized guidance.

- Eligible: Premiums for health insurance purchased on a health insurance marketplace under the Affordable Care Act (in the US context).

- Eligible: Premiums for disability insurance for a self-employed individual directly related to their business income.

- Eligible: Premiums for workers’ compensation insurance (a business expense).

- Ineligible: Premiums for a personal life insurance policy.

- Ineligible: Premiums for long-term care insurance unless specific requirements are met (often related to business needs).

- Ineligible: Premiums for pet insurance.

Impact of Different Tax Systems on Deductions

The effectiveness of insurance premium tax deductions is significantly influenced by the structure of a nation’s tax system. Progressive, regressive, and proportional tax systems all interact differently with these deductions, impacting their overall benefit to taxpayers. Understanding these interactions is crucial for both individuals planning their finances and policymakers designing tax legislation.

The impact of a tax system on insurance premium deductions stems from how marginal tax rates affect the value of the deduction. A deduction provides a greater financial benefit to higher-income individuals under a progressive tax system because their marginal tax rate is higher. Conversely, under a regressive system, the benefit is relatively greater for lower-income individuals, although the absolute amount of the deduction might be smaller. Proportional systems offer a consistent level of benefit regardless of income level, although the relative impact will still vary depending on the overall tax burden.

Progressive Tax Systems and Insurance Premium Deductions

In a progressive tax system, higher earners pay a larger percentage of their income in taxes. Therefore, a tax deduction for insurance premiums offers a more substantial financial advantage to high-income individuals. For example, a $1,000 deduction saves a taxpayer in the 35% tax bracket $350, while a taxpayer in the 15% bracket only saves $150. This disparity underscores the inherent progressive nature of the deduction itself, further amplifying income inequality if not carefully managed. The benefit is proportionally greater for higher earners, effectively making the deduction more valuable to them.

Regressive Tax Systems and Insurance Premium Deductions

A regressive tax system imposes a higher tax burden on lower-income individuals as a percentage of their income. While a deduction still provides a financial benefit, its impact is lessened for those in lower tax brackets. For instance, a $500 deduction would yield a smaller absolute savings for a low-income individual compared to a high-income individual in a progressive system. However, the *relative* impact (the percentage of their income saved) could be greater for the low-income individual, potentially mitigating some of the regressive effects of the tax system itself. This makes the design and application of such deductions complex in the context of social equity.

Changes in Tax Laws and Deduction Availability

Changes in tax laws can dramatically alter the availability and amount of deductions for insurance premiums. For instance, a government might introduce or expand a tax credit specifically for health insurance premiums, making it more accessible to a broader population. Alternatively, they might limit the amount of deductible premiums or even eliminate the deduction entirely as part of broader tax reform. These changes often reflect shifts in government priorities and economic conditions. The introduction of the Affordable Care Act in the United States, for example, significantly altered the landscape of health insurance deductions and tax credits.

Challenges in Claiming Deductions Under Different Tax Regimes

Claiming insurance premium deductions can be complex, varying across different tax regimes. Different countries have different rules regarding eligible premiums, documentation requirements, and methods of claiming deductions. Furthermore, navigating the intricacies of tax laws can be challenging for individuals, often necessitating professional assistance. For example, the definition of “qualifying” insurance premiums can differ widely, leading to discrepancies in eligibility and creating confusion for taxpayers. The complexity increases significantly for individuals with multiple insurance policies or those who operate across different tax jurisdictions.

Summary

Claiming deductions on insurance premiums offers a tangible pathway to reducing your tax burden and increasing your financial flexibility. By understanding the eligibility criteria, gathering the necessary documentation, and employing strategic planning, you can effectively leverage these deductions to your advantage. Remember to consult with a tax professional for personalized guidance tailored to your specific circumstances and country of residence. Proper planning and informed decision-making can unlock significant tax savings, allowing you to retain more of your hard-earned money.

User Queries

Can I deduct premiums for pet insurance?

Generally, pet insurance premiums are not deductible in most countries. Eligibility varies depending on specific tax laws.

What happens if I overestimate my deductions?

Overestimating deductions can result in an underpayment of taxes, potentially leading to penalties and interest charges. Accurate record-keeping is crucial.

Are there income limits for claiming these deductions?

Yes, many countries have income limits that determine eligibility for insurance premium tax deductions. These limits vary depending on the type of insurance and the country’s tax laws. Consult your country’s tax regulations for specific details.

What if I don’t have all the required documentation?

Submitting an incomplete application may delay or prevent the processing of your tax return. It’s best to gather all necessary documentation before filing.