Securing adequate insurance coverage is crucial for businesses of all sizes, but the upfront costs can be substantial. This is where insurance premium finance companies step in, offering a vital financial solution. They bridge the gap between the need for robust insurance and the immediate financial capacity to pay premiums, allowing businesses to manage their risk effectively without straining their cash flow. This guide delves into the world of insurance premium finance companies, exploring their operations, regulations, and the benefits they offer.

We will examine how these companies operate, the various types of insurance premiums they finance, and the legal framework governing their activities. We will also analyze the financial implications for businesses, considering both advantages and risks, and explore the customer perspective, focusing on the selection process and the suitability of premium finance for different business needs. Finally, we’ll look towards future trends and technological advancements that are shaping this dynamic industry.

Defining Insurance Premium Finance Companies

Insurance premium finance companies provide a crucial service to businesses and individuals by offering short-term loans to cover the cost of insurance premiums. This allows policyholders to spread out payments over time, rather than needing to make a large, upfront payment. This service is particularly beneficial for policies with high premiums.

Insurance premium finance companies act as intermediaries, facilitating the payment of insurance premiums on behalf of their clients. They essentially lend the money needed to pay the premiums and then collect repayments, typically in installments, from the client over a specified period. This financing option offers flexibility and improved cash flow management for policyholders.

Types of Insurance Premiums Financed

These companies finance a wide range of insurance premiums, encompassing various types of insurance coverage. The specific types of insurance financed will depend on the company’s underwriting criteria and the needs of the client.

- Commercial insurance premiums: This includes various lines such as property, casualty, workers’ compensation, and professional liability insurance for businesses of all sizes.

- Personal lines insurance premiums: This covers individual needs, such as auto, home, health, and life insurance premiums.

- Specialty insurance premiums: This category can encompass more niche areas like marine, aviation, or energy insurance.

Industries Served by Premium Finance Companies

Premium finance companies serve a diverse range of industries, reflecting the broad application of insurance across various sectors.

- Construction: Companies in the construction industry often require substantial insurance coverage, making premium financing a valuable tool for managing cash flow.

- Manufacturing: Similar to construction, manufacturers frequently face high insurance costs, benefitting from the flexibility of premium financing.

- Healthcare: Healthcare providers, including hospitals and medical practices, often have complex insurance needs, and premium financing can help streamline premium payments.

- Retail: Retail businesses, particularly larger chains, often utilize premium finance options to manage their insurance costs effectively.

Premium Finance Companies versus Traditional Lending Institutions

While both premium finance companies and traditional lending institutions offer financing options, there are key distinctions. Traditional lenders, such as banks, typically focus on longer-term loans secured by various assets. Premium finance companies, however, specialize in short-term financing specifically for insurance premiums.

| Feature | Premium Finance Company | Traditional Lending Institution |

|---|---|---|

| Loan Term | Short-term (typically 12 months or less) | Longer-term (months to years) |

| Collateral | Often not required, or the insurance policy itself acts as collateral | Usually requires collateral (e.g., property, equipment) |

| Purpose | Specifically for insurance premium payments | Broad range of purposes (business operations, personal expenses, etc.) |

| Approval Process | Generally faster and simpler | Can be more complex and time-consuming |

How Insurance Premium Finance Companies Operate

Insurance premium finance companies provide a vital service, bridging the gap between policyholders needing to pay substantial insurance premiums and their ability to do so immediately. They essentially act as lenders, offering short-term loans specifically designed to cover the cost of insurance premiums. This allows individuals and businesses to secure necessary insurance coverage without experiencing immediate financial strain.

Securing financing through a premium finance company is a relatively straightforward process. The applicant typically provides basic personal or business information, details of the insurance policy, and proof of income. The company then assesses the application based on pre-defined criteria.

The Financing Process

The process begins with the applicant applying for financing, usually through an online application or via a broker. This application includes details about the insurance policy, the applicant’s financial situation, and the desired repayment plan. Once the application is received, the premium finance company performs an underwriting assessment to determine the risk involved. If approved, the company disburses the funds directly to the insurance company, covering the premium. The applicant then repays the loan to the premium finance company, typically in installments over a set period.

Underwriting and Risk Assessment

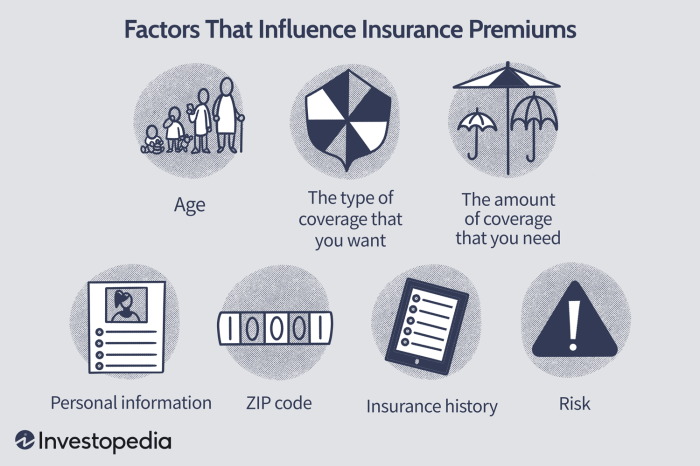

Underwriting involves a thorough evaluation of the applicant’s creditworthiness and the risk associated with lending them the money. This typically includes a credit check, reviewing income verification documents, and assessing the applicant’s debt-to-income ratio. The premium finance company uses sophisticated risk assessment models to quantify the probability of default. These models often incorporate various factors like credit score, payment history, and the size of the loan relative to the applicant’s income. For high-risk applicants, the company may require a higher interest rate or additional collateral.

Repayment Options and Structures

Premium finance companies offer various repayment options tailored to the client’s needs and financial capabilities. Common structures include monthly installments, spread over a period ranging from a few months to a year or more. Some companies may offer flexible repayment schedules, allowing for adjustments based on the client’s circumstances. Interest rates vary depending on the applicant’s creditworthiness and the loan amount. It’s crucial for applicants to carefully review the repayment terms and interest rates before agreeing to the loan. Late payment fees may also apply.

Typical Customer Journey Flowchart

The following describes a typical customer journey with a premium finance company, represented conceptually as a flowchart:

[Imagine a flowchart here. The boxes would be:

1. Applicant needs insurance: The customer needs insurance coverage but lacks immediate funds to pay the premium.

2. Application submitted: The customer applies for premium financing, providing necessary information.

3. Underwriting and assessment: The premium finance company assesses the application’s risk.

4. Approval/Rejection: The application is either approved or rejected based on the assessment.

5. Funds disbursed: If approved, the finance company pays the insurance company the premium.

6. Repayment begins: The customer begins making regular payments to the finance company.

7. Loan completion: The customer completes all payments, concluding the financing agreement.]

Legal and Regulatory Aspects

Premium finance companies operate within a complex regulatory landscape designed to protect consumers and maintain the stability of the financial system. Understanding these regulations is crucial for both the companies themselves and the consumers they serve. Failure to comply can lead to significant penalties and reputational damage.

The legal and regulatory framework governing premium finance companies varies significantly across jurisdictions, reflecting differing approaches to consumer protection and financial regulation. Key considerations include licensing requirements, consumer protection laws, data privacy regulations, and anti-money laundering (AML) compliance. These regulations often overlap and interact, creating a multifaceted compliance challenge.

Key Regulations and Compliance Requirements

Premium finance companies are subject to a range of regulations, often at both the state and federal levels. These regulations typically cover areas such as licensing, disclosure requirements, interest rate caps, and consumer protection. Specific requirements vary widely depending on location. For instance, some jurisdictions may have stricter limits on the interest rates that can be charged, while others may have more stringent requirements for disclosing the terms of the finance agreement. Compliance involves meticulous record-keeping, regular audits, and adherence to specific operational procedures.

Data Privacy and Security Implications

The industry handles sensitive personal and financial data, making data privacy and security paramount. Regulations like the General Data Protection Regulation (GDPR) in Europe and various state-level laws in the United States mandate robust data protection measures. These include implementing strong security protocols, obtaining informed consent for data processing, and ensuring data breaches are reported promptly and appropriately. Failure to comply can result in substantial fines and reputational harm, impacting consumer trust and business viability. For example, a data breach exposing customer’s personal and financial information could lead to significant legal action and damage to the company’s reputation.

Regulatory Comparison Across Jurisdictions

Regulatory frameworks for premium finance companies differ substantially across countries and states. The United States, for example, has a decentralized regulatory system, with individual states often setting their own licensing and operational requirements. In contrast, the European Union has a more harmonized approach through regulations like GDPR and the Payment Services Directive (PSD2), which impact data protection and payment processing. This variation necessitates a thorough understanding of the specific legal requirements in each jurisdiction where a premium finance company operates. Differences in interest rate caps, disclosure requirements, and consumer protection provisions highlight the need for careful consideration of the specific legal landscape in each market.

Key Legal Considerations

| Regulation | Description | Compliance Measures | Potential Penalties |

|---|---|---|---|

| Licensing Requirements | Obtaining and maintaining the necessary licenses to operate as a premium finance company in each jurisdiction. | Application process, background checks, ongoing compliance with licensing conditions. | License revocation, fines, cease-and-desist orders. |

| Consumer Protection Laws | Regulations designed to protect consumers from unfair or deceptive practices, such as Truth in Lending Act (TILA) compliance. | Clear and accurate disclosures, fair lending practices, robust complaint handling procedures. | Fines, legal action, reputational damage. |

| Data Privacy Regulations (e.g., GDPR, CCPA) | Laws governing the collection, processing, and storage of personal data. | Data encryption, access controls, data breach response plans, privacy impact assessments. | Significant fines, legal action, reputational damage. |

| Anti-Money Laundering (AML) Regulations | Regulations aimed at preventing money laundering and terrorist financing. | Know Your Customer (KYC) procedures, suspicious activity reporting, compliance training. | Fines, legal action, reputational damage, potential criminal charges. |

Financial Implications and Risks

Premium financing offers a compelling solution for businesses facing large insurance premiums, but it’s crucial to understand the associated financial implications and risks before committing. While it provides immediate access to necessary coverage, overlooking potential drawbacks can lead to significant financial strain. This section details the benefits, drawbacks, and risks involved in utilizing premium finance options.

Financial Benefits and Drawbacks for Businesses

Utilizing premium finance can offer several key advantages. Primarily, it allows businesses to manage cash flow more effectively by spreading the cost of insurance premiums over time, rather than incurring a large, upfront expense. This improved cash flow can be invaluable for smaller businesses or those facing seasonal fluctuations in revenue. Furthermore, premium finance can enable businesses to secure essential insurance coverage they might otherwise be unable to afford immediately. However, the primary drawback is the added cost of interest and fees, which ultimately increase the total amount paid for the insurance. The convenience of spreading payments comes at a price, and this increased cost needs careful consideration against the benefits of improved cash flow. Businesses should always compare the total cost of premium finance with paying the premium outright to make an informed decision.

Risks Associated with Defaulting on Premium Finance Payments

Defaulting on premium finance payments carries significant consequences. Failure to meet payment obligations can result in the finance company reclaiming the insurance policy. This means the business loses its insurance coverage, leaving it vulnerable to substantial financial losses in the event of an insured incident. Furthermore, defaulting can negatively impact the business’s credit rating, making it more difficult to secure financing in the future. This credit damage can extend beyond simply obtaining loans; it can also affect the business’s ability to lease equipment, purchase inventory on credit, or even secure favorable terms with suppliers. The repercussions of default are far-reaching and can seriously jeopardize the financial health of the business.

Impact of Interest Rates and Fees on Overall Cost

The overall cost of premium finance is significantly influenced by interest rates and fees charged by the financing company. Interest rates are typically variable, meaning they fluctuate based on market conditions. Higher interest rates translate directly to a higher overall cost for the business. In addition to interest, various fees may apply, such as arrangement fees, administration fees, or late payment fees. These fees can add up considerably, further increasing the total cost of the insurance. Businesses should carefully review all associated fees and the interest rate structure before agreeing to a premium finance plan to fully understand the financial commitment. A seemingly small difference in interest rates can accumulate into a substantial amount over the payment term.

Comparison of Financing Options

Understanding the cost implications requires comparing premium finance with other financing options. The following table illustrates a comparison, assuming a $10,000 annual insurance premium:

| Financing Option | Initial Payment | Monthly Payment (12 months) | Total Cost (approx.) |

|---|---|---|---|

| Outright Payment | $10,000 | – | $10,000 |

| Premium Finance (Low Interest) | $1,000 | $850 | $11,000 |

| Premium Finance (High Interest) | $1,000 | $950 | $12,000 |

| Business Line of Credit | Variable | Variable | Variable (dependent on interest rate and repayment terms) |

*Note: These are illustrative examples and actual costs will vary based on individual circumstances, lender terms, and market conditions.*

The Customer Perspective

Understanding the customer perspective is crucial for evaluating the effectiveness and suitability of insurance premium finance. This section explores the types of businesses that benefit, the advantages and disadvantages for small business owners, scenarios where it’s appropriate or not, and the process of selecting a reputable provider.

Businesses that frequently benefit from premium financing often face seasonal fluctuations in revenue or have large insurance premiums relative to their cash flow. This allows them to smooth out their cash flow and avoid large, unexpected expenses that could strain their finances.

Types of Businesses Benefiting from Premium Finance

Premium financing offers significant advantages to businesses with unpredictable income streams or those facing substantial insurance costs. Businesses such as construction companies, seasonal businesses (e.g., tourism, agriculture), and small businesses with limited working capital frequently find premium finance beneficial. Larger businesses with robust cash flow might find it less necessary. For example, a small landscaping company with fluctuating revenue throughout the year might struggle to pay a large annual workers’ compensation premium in a single payment. Premium finance enables them to spread the cost over several months, aligning payments with their income cycles. Conversely, a large, established corporation with consistent cash flow may find it unnecessary.

Advantages and Disadvantages for Small Business Owners

For small business owners, premium finance offers several key advantages. It allows for better cash flow management by spreading premium payments over time, improving working capital availability. This can be crucial for investing in growth opportunities or managing unexpected expenses. However, it’s important to be aware of the potential disadvantages. Interest charges will add to the overall cost of the insurance, increasing the total amount paid. Also, failure to make timely payments can result in penalties and potentially impact credit scores. A well-structured plan, however, can significantly outweigh these disadvantages.

Suitable and Unsuitable Scenarios for Premium Finance

Premium financing is a suitable solution when a business faces a large insurance premium that would create a significant financial strain if paid upfront. For instance, a small bakery needing to pay a substantial commercial property insurance premium might find premium finance a viable option to avoid disrupting operations. Conversely, it might be unsuitable if a business has ample cash reserves to cover the premium without affecting its operations. A large, established retail chain with substantial liquid assets might not need to resort to premium financing. Another unsuitable scenario might be if a business is already facing significant financial difficulties and struggles to manage its existing debt obligations. Adding another layer of debt could worsen their financial situation.

Choosing a Reputable Premium Finance Company

Selecting a reputable premium finance company is critical. Consider factors such as the company’s financial stability, licensing and regulatory compliance, and customer service reputation. Researching online reviews and comparing interest rates and fees from multiple providers is highly recommended. Look for companies with a proven track record and transparent pricing structures. It’s also wise to check if the company is a member of any relevant industry associations, which can indicate a commitment to ethical practices and professional standards. Transparency regarding fees and terms is paramount, and any reputable company should readily provide this information.

Future Trends and Innovations

The insurance premium finance industry, while established, is poised for significant transformation driven by technological advancements and evolving customer expectations. The coming years will see a dynamic interplay of opportunities and challenges, reshaping the landscape of how premiums are financed. Understanding these trends is crucial for companies seeking to maintain competitiveness and profitability.

The role of technology and digitalization is paramount in this evolution. Increased automation, data analytics, and personalized customer experiences are reshaping the industry’s operational efficiency and customer engagement strategies. This shift necessitates adaptation and investment in new technologies to remain relevant and meet the demands of a digitally-savvy clientele.

Technological Advancements Reshaping the Industry

Technological innovation will be a key driver of change in the premium finance sector. Several advancements promise to streamline processes, enhance customer service, and open new avenues for growth.

- Artificial Intelligence (AI) and Machine Learning (ML): AI and ML algorithms can significantly improve risk assessment, automate underwriting processes, and personalize customer interactions. For instance, AI can analyze vast datasets to identify high-risk applicants more accurately, reducing the likelihood of defaults. ML models can personalize communication and offer tailored financing options based on individual customer profiles.

- Blockchain Technology: Blockchain’s secure and transparent nature can revolutionize premium payment processing and record-keeping. This could lead to faster, more efficient transactions and improved security against fraud. Imagine a system where premium payments are automatically tracked and verified on a secure, immutable ledger.

- Open Banking and APIs: Open banking initiatives allow premium finance companies to access customer financial data securely and efficiently, streamlining the application and approval process. APIs facilitate seamless integration with other financial platforms, creating a more connected and efficient ecosystem.

- Robotic Process Automation (RPA): RPA can automate repetitive tasks, such as data entry and document processing, freeing up human resources for more strategic activities. This can lead to significant cost savings and improved operational efficiency. A company could, for example, automate the verification of customer income and employment data, significantly reducing processing times.

Challenges and Opportunities

The industry faces challenges in adapting to new technologies and regulations while simultaneously capitalizing on emerging opportunities. For example, increased competition from fintech companies offering innovative financing solutions requires premium finance companies to invest in technological upgrades and improve customer service. Conversely, the growing demand for insurance and the increasing use of digital channels presents opportunities for expansion and growth. Successfully navigating this complex landscape will require strategic planning, investment in technology, and a focus on customer-centric solutions.

Illustrative Case Study

This case study examines how a hypothetical mid-sized manufacturing company, “Precision Parts Inc.”, utilized insurance premium finance to manage its substantial annual workers’ compensation insurance premium. Precision Parts Inc. faced a challenge in budgeting for this large, upfront expense, which significantly impacted their cash flow.

Precision Parts Inc.’s Workers’ Compensation Insurance

Precision Parts Inc. required substantial workers’ compensation insurance coverage due to the nature of their manufacturing operations. Their annual premium was $50,000, payable in a single lump sum. This presented a significant financial strain on the company’s operating budget, potentially hindering investment in new equipment or expansion plans.

Financial Aspects of Premium Financing

Precision Parts Inc. explored premium financing options. A leading premium finance company offered a 12-month financing plan with a 10% annual interest rate. This meant Precision Parts Inc. would pay monthly installments of approximately $4,375 ($50,000 + 10% interest / 12 months). The total cost over the year would be $52,500, representing a $2,500 increase compared to paying the premium upfront. However, the company analyzed this against the potential benefits.

Decision-Making Process

Precision Parts Inc.’s financial team carefully weighed the costs and benefits. They considered the improved cash flow management afforded by spreading the premium payments over 12 months. This allowed them to maintain sufficient working capital for operational needs and investment opportunities. They also compared the 10% interest rate offered by the premium finance company to their existing borrowing rates, finding it competitive. The potential risks, such as late payment fees, were also factored into the decision. Ultimately, the improved cash flow management outweighed the additional interest cost.

Outcome of the Case Study

Precision Parts Inc. chose to utilize the premium finance option. The result was improved cash flow management, allowing them to pursue strategic investments that otherwise would have been delayed or forgone. The company successfully managed its monthly payments, avoiding late payment fees. While they incurred a higher total cost for the insurance premium, the strategic benefits of improved cash flow and access to capital outweighed this additional expense. This demonstrates how premium finance can be a valuable tool for businesses seeking to optimize their financial resources and manage large, infrequent insurance expenses effectively.

Summary

Insurance premium finance companies play a crucial role in the insurance landscape, providing a flexible and accessible financing option for businesses seeking to secure comprehensive coverage. By understanding the intricacies of their operations, the associated risks, and the regulatory environment, businesses can make informed decisions regarding the utilization of premium finance, ultimately optimizing their risk management strategies and ensuring financial stability. The ongoing evolution of technology promises to further enhance efficiency and transparency within the industry, benefitting both businesses and finance companies alike.

Essential FAQs

What types of insurance premiums do premium finance companies typically finance?

They finance a wide range, including property, casualty, workers’ compensation, commercial auto, and professional liability insurance premiums.

How is the interest rate determined on a premium finance loan?

Interest rates are typically based on several factors, including the creditworthiness of the borrower, the length of the financing term, and prevailing market interest rates.

What happens if a business defaults on its premium finance payments?

Consequences can include cancellation of the insurance policy, damage to credit score, and potential legal action by the finance company.

Are there any hidden fees associated with premium finance?

It’s crucial to carefully review the contract for all fees, including origination fees, late payment penalties, and prepayment charges.

Can I refinance my premium finance loan?

Depending on the terms of your initial agreement and your financial situation, refinancing may be possible. Contact your finance company to explore options.