Navigating the world of insurance can feel like deciphering a complex code, especially when it comes to understanding insurance premiums. This guide unravels the mystery surrounding average insurance premiums, exploring the factors that influence their calculation and the variations seen across different demographics and geographical locations. We’ll delve into the data behind these averages, examining the methods used to collect and interpret information, and ultimately providing you with a clearer picture of what shapes the cost of your insurance.

From the impact of age and driving history on auto insurance to the role of location and health status on health insurance, we’ll explore the multifaceted nature of premium determination. Understanding these factors empowers you to make informed decisions and potentially find ways to manage your insurance costs more effectively. This comprehensive overview aims to demystify the complexities of insurance premium averages, offering insights that can benefit both consumers and industry professionals alike.

Factors Affecting Insurance Premium Averages

Insurance premiums aren’t arbitrary; they’re calculated based on a complex interplay of factors that assess the likelihood of a claim. Understanding these factors can help individuals make informed decisions about their insurance choices and potentially lower their premiums. This section will delve into the key elements that influence average insurance premium costs.

Demographic Factors and Insurance Premiums

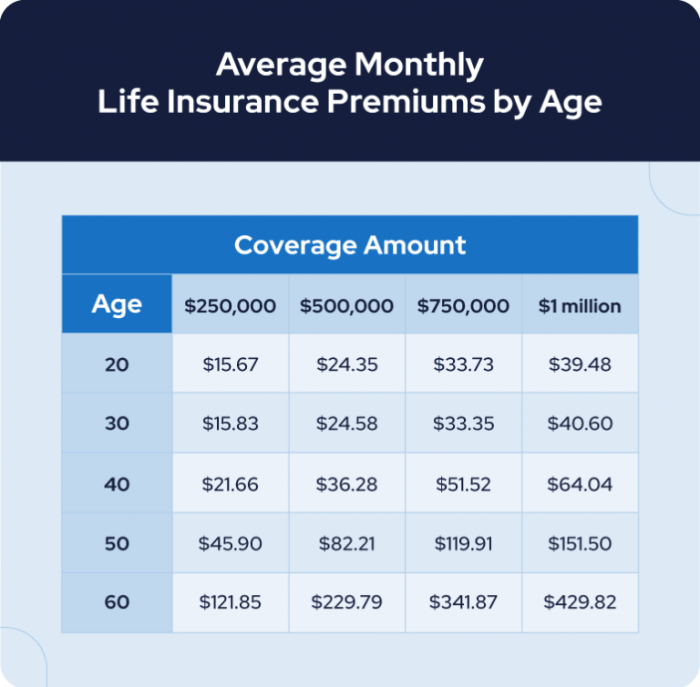

Several demographic characteristics significantly impact average insurance premiums. Age, for instance, is a major factor. Younger drivers, statistically, tend to have higher accident rates, leading to higher auto insurance premiums. Conversely, older individuals often pay less for auto insurance due to their generally safer driving records. Location also plays a critical role. Premiums are typically higher in areas with high crime rates, a greater frequency of accidents, or higher property values (affecting home insurance). Gender can also influence premiums in some regions, though this is becoming increasingly regulated and less prevalent. Finally, health status is a key determinant in health insurance premiums, with pre-existing conditions or a history of illness often leading to higher costs.

Driving History’s Influence on Auto Insurance Premiums

A driver’s history is paramount in determining auto insurance costs. A clean driving record with no accidents or traffic violations translates to lower premiums. Conversely, accidents, speeding tickets, and DUI convictions significantly increase premiums, reflecting the higher risk associated with such events. The severity of the incident further influences the premium increase; a major accident resulting in significant damage or injury will have a more substantial impact than a minor fender bender. Insurance companies use sophisticated scoring systems to assess driving history and its impact on risk.

Claims History and its Impact on Premiums

The frequency and severity of past insurance claims significantly influence future premiums across all insurance types. Filing multiple claims, especially for significant amounts, demonstrates a higher risk profile, leading to premium increases. This is because insurance companies view frequent claims as an indicator of increased likelihood of future claims. Conversely, a clean claims history, characterized by no or few claims, can result in lower premiums and even discounts in some cases. This principle applies consistently to auto, home, and health insurance.

Risk Factor Influence Across Different Insurance Types

The influence of risk factors varies across different insurance types. In auto insurance, driving history and location are paramount. Home insurance premiums are heavily influenced by the value of the property, its location (risk of natural disasters, crime), and the security measures in place. Health insurance premiums are most affected by age, health status, pre-existing conditions, and lifestyle choices. While location plays a role in all three, its significance differs based on the specific type of insurance. For example, location is more critical for home insurance due to natural disaster risks, while in auto insurance, it relates more to accident rates and crime statistics.

Lifestyle Choices and Insurance Premiums

Lifestyle choices can significantly impact insurance premiums.

- Smoking: Smoking increases health insurance premiums due to higher risks of lung cancer and other smoking-related illnesses.

- Diet and Exercise: A healthy lifestyle can lead to lower health insurance premiums, as it reduces the risk of chronic diseases.

- Home Security Systems: Installing security systems can lower home insurance premiums by reducing the risk of burglaries and other property damage.

- Safe Driving Practices: Adopting safe driving habits, such as avoiding speeding and distractions, can reduce auto insurance premiums.

- Risky Hobbies: Engaging in high-risk activities like skydiving or motorcycle racing can increase insurance premiums, as they elevate the likelihood of accidents and injuries.

Data Sources and Methodology for Premium Average Calculation

Calculating average insurance premiums requires a robust methodology and access to reliable data. The accuracy of the average directly impacts its usefulness for analysis, comparison, and forecasting within the insurance industry. This section details the data sources, aggregation techniques, statistical methods, and bias mitigation strategies employed in such calculations.

Data Sources for Insurance Premium Averages

Several sources provide the necessary data for calculating average insurance premiums. These sources vary in scope, detail, and accessibility, often requiring careful selection based on the specific research objective.

- Insurance Company Internal Data: Individual insurance companies possess extensive internal databases containing detailed information on policies sold, premiums charged, and claims paid. This data offers the most granular level of detail but is typically proprietary and not publicly available. Access is often limited to internal analysts and researchers.

- Industry Associations and Regulatory Bodies: Organizations like the National Association of Insurance Commissioners (NAIC) in the US, or equivalent bodies in other countries, often collect and publish aggregated insurance market data, including average premium information. This data is usually summarized at a higher level (e.g., by state, type of insurance) and may not reflect the full spectrum of premium variations.

- Publicly Traded Insurance Company Financial Statements: Publicly traded insurance companies are required to disclose financial information, including premium revenue, in their annual reports (10-K filings in the US). While this data provides a broader market overview, it often lacks the detailed policy-level information necessary for precise average premium calculations.

- Independent Research Firms and Consulting Agencies: Several firms specialize in collecting and analyzing insurance market data, offering comprehensive reports and analyses, often including average premium figures. These reports often come at a cost but provide a valuable source of curated and analyzed data.

Data Aggregation and Analysis

Once data is sourced, the aggregation and analysis process begins. This involves several key steps:

- Data Cleaning and Preprocessing: This crucial step involves handling missing data, identifying and correcting errors, and ensuring data consistency. Techniques like imputation for missing values and outlier detection are commonly employed.

- Data Transformation: Raw data often requires transformation to be suitable for analysis. This might involve standardizing units, converting data types, or creating new variables (e.g., calculating premium per unit of coverage).

- Data Aggregation: The data is then aggregated based on the desired level of detail. For example, average premiums might be calculated for specific demographic groups, geographical regions, or types of insurance coverage.

- Statistical Analysis: Descriptive statistics (mean, median, standard deviation) are calculated to summarize the aggregated data. Inferential statistics might be used to make inferences about the population based on the sample data. Regression analysis could be employed to identify factors that significantly influence premium levels.

Statistical Techniques and Bias Mitigation

Accurate interpretation of insurance premium data requires appropriate statistical techniques and careful consideration of potential biases.

The simple arithmetic mean (average) may be susceptible to outliers. The median, which represents the middle value, is often a more robust measure of central tendency in the presence of extreme values.

Several statistical techniques can help mitigate biases:

- Weighted Averages: Using weighted averages accounts for the varying sizes or importance of different data subsets. For instance, a weighted average could be used to account for the different numbers of policies in various demographic groups.

- Regression Analysis: Regression models can help isolate the effect of specific factors on premiums, controlling for confounding variables and reducing bias. For example, a regression model could analyze the impact of age and driving record on car insurance premiums.

- Robust Statistical Methods: Techniques like trimmed means or winsorization can reduce the influence of outliers on the average premium calculation.

Potential biases in the data include selection bias (e.g., the sample may not be representative of the entire population), information bias (e.g., inaccurate or incomplete data), and confounding variables (e.g., other factors influencing premiums are not accounted for). Careful data collection, rigorous data cleaning, and appropriate statistical techniques are crucial for minimizing these biases.

Concluding Remarks

In conclusion, understanding insurance premium averages requires a multifaceted approach, considering demographic factors, geographic variations, and the methodologies used to calculate these figures. While seemingly complex, grasping the key influences on average premiums allows for a more informed approach to managing insurance costs. By understanding the trends and projections, individuals and businesses can better prepare for future changes and make informed decisions about their insurance needs. This knowledge ultimately contributes to a more empowered and financially responsible relationship with the insurance industry.

FAQ Resource

What are the common reasons for insurance premium increases?

Several factors contribute to premium increases, including rising healthcare costs (for health insurance), increased claims frequency, changes in risk assessment models, and inflation.

How often are insurance premiums reviewed and adjusted?

The frequency of premium adjustments varies by insurer and policy type. Some adjust annually, while others may do so more frequently or less frequently, depending on factors like claims history and market conditions.

Can I negotiate my insurance premium?

While you may not be able to directly negotiate the base rate, you can often find ways to lower your premium by taking steps like improving your credit score (where applicable), bundling policies, or increasing your deductible.

What is the difference between an average premium and my individual premium?

The average premium represents a statistical average across a population. Your individual premium is determined by your specific risk profile, including factors like age, location, driving history (for auto), health status (for health), and claims history.