Insurance premiums: the price we pay for peace of mind. But what exactly determines the cost of this crucial financial safeguard? This guide delves into the complexities of insurance insurance premiums, exploring the factors that influence their calculation, comparing offerings from different providers, and offering strategies for managing and potentially reducing your costs. From understanding policy structures to navigating the intricacies of coverage levels, we aim to empower you with the knowledge needed to make informed decisions about your insurance protection.

We’ll examine the various components that make up an insurance premium, including administrative costs, claims payouts, and profit margins. We will also analyze how factors like age, driving history (for auto insurance), health status (for health insurance), and even credit score can significantly impact the premium you pay. By understanding these influences, you can better anticipate and potentially manage your insurance expenses.

Defining Insurance Premiums

Insurance premiums are the recurring payments you make to an insurance company in exchange for coverage against potential financial losses. Understanding the components and factors that influence these premiums is crucial for making informed decisions about your insurance needs.

Components of an Insurance Premium

An insurance premium is comprised of several key elements. The primary components include the cost of claims anticipated by the insurer, the insurer’s operating expenses, and the desired profit margin. The insurer uses actuarial science to predict the likelihood and cost of future claims based on historical data and statistical modeling. Operating expenses encompass administrative costs, marketing, and salaries. Finally, a profit margin is included to ensure the insurer’s financial viability.

Factors Influencing Premium Calculation

Numerous factors influence the calculation of insurance premiums. These factors vary depending on the type of insurance. Common factors include age, health status (for health insurance), driving history (for auto insurance), the value of the insured item (for home or auto insurance), and the coverage level selected. For example, a younger, healthier individual will generally pay less for health insurance than an older person with pre-existing conditions. Similarly, a driver with a clean driving record will typically receive lower auto insurance premiums compared to someone with multiple accidents or traffic violations. The level of coverage selected – higher coverage amounts generally mean higher premiums – also plays a significant role.

Examples of Different Types of Insurance Premiums

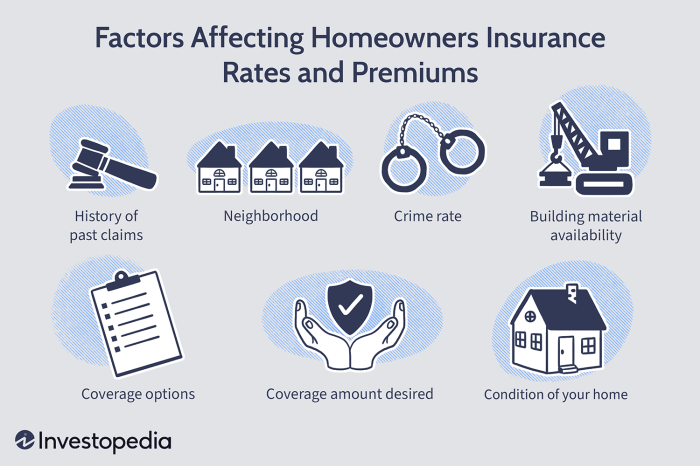

Different types of insurance have varying premium structures. Health insurance premiums often depend on factors such as age, location, chosen plan, and family size. Auto insurance premiums are heavily influenced by driving history, vehicle type, and location. Life insurance premiums are typically based on age, health, the amount of coverage, and the type of policy (term or whole life). Homeowners insurance premiums are determined by factors such as location, home value, and coverage amount.

Comparison of Premiums Across Providers

The following table illustrates a comparison of annual premiums for a standard auto insurance policy (Liability coverage of $100,000/$300,000 Bodily Injury and $50,000 Property Damage) for a 35-year-old driver with a clean driving record in a mid-sized city in the United States. Note that these are illustrative examples and actual premiums can vary significantly based on individual circumstances and specific policy details. It’s crucial to obtain personalized quotes from multiple insurers for accurate pricing.

| Insurance Provider | Annual Premium | Deductible | Additional Features |

|---|---|---|---|

| Provider A | $1200 | $500 | Roadside assistance |

| Provider B | $1050 | $1000 | Accident forgiveness |

| Provider C | $1350 | $250 | Rental car reimbursement |

| Provider D | $1100 | $750 | New car replacement |

Comparing Insurance Providers and Policies

Choosing the right insurance policy involves careful consideration of various factors beyond just the premium amount. Understanding the differences between providers and policies is crucial for securing the best value and appropriate coverage for your needs. This section will explore key aspects of comparing insurance providers and policies to help you make an informed decision.

Premium Offerings of Major Insurance Providers

Several major insurance providers offer a range of insurance products, each with varying premium structures. For illustrative purposes, let’s consider three hypothetical providers: InsureCo, SecureGuard, and ProtectAll. InsureCo typically offers competitive premiums for standard coverage but may charge higher rates for add-ons or specialized coverage. SecureGuard might have slightly higher base premiums but often includes more comprehensive standard coverage. ProtectAll may position itself as a budget-friendly option, offering lower base premiums but potentially limiting coverage options and increasing deductibles. It’s important to note that these are generalized examples, and actual pricing and coverage will vary significantly based on individual circumstances, location, and specific policy details. Direct comparison of quotes from these and other providers is essential for a personalized assessment.

Coverage Differences Between Insurance Providers

Insurance providers differ significantly in the scope of coverage they offer. For instance, InsureCo might provide a broader range of optional add-ons, such as roadside assistance or identity theft protection, while SecureGuard might excel in its comprehensive liability coverage. ProtectAll, focusing on affordability, may offer more basic coverage with fewer add-on options. Furthermore, the definition of coverage can vary. One provider might offer a higher payout limit for a specific type of claim compared to another. Scrutinizing policy documents to understand the specific inclusions and exclusions of each coverage element is crucial for a fair comparison. For example, flood damage might be excluded from basic coverage by one provider but offered as an add-on by another.

Hidden Costs and Fees in Insurance Policies

Beyond the stated premium, several hidden costs or fees can significantly impact the overall cost of an insurance policy. These might include administrative fees, processing fees, cancellation fees, or penalties for late payments. Some policies might have clauses that limit payouts or impose additional deductibles under specific circumstances. Reading the fine print of the policy document is vital to uncovering these potential hidden costs. For instance, a seemingly low premium might be accompanied by a high deductible or restrictions on claim filing. Comparing policies solely on the basis of premium without considering these additional factors can lead to unexpected expenses.

Analyzing Policy Documents for Best Value

Analyzing policy documents effectively requires a systematic approach. Begin by comparing the premium amounts and coverage limits for similar types of policies across different providers. Pay close attention to the deductibles, co-pays, and any limitations on coverage. Identify any exclusions or conditions that might limit your ability to file a claim. Look for details on how claims are processed and the provider’s customer service reputation. Finally, calculate the total cost of the policy, including all fees and potential deductibles, to determine the best value for your specific needs and risk tolerance. A higher premium might be justified if it offers significantly broader coverage or lower out-of-pocket expenses in the event of a claim.

Summary of Key Features and Pricing

| Provider | Premium (Example) | Coverage Highlights | Deductible (Example) |

|---|---|---|---|

| InsureCo | $100/month | Comprehensive liability, optional add-ons | $500 |

| SecureGuard | $120/month | Broader liability coverage, robust standard features | $250 |

| ProtectAll | $80/month | Basic coverage, limited add-ons | $1000 |

Summary

Navigating the world of insurance premiums can feel daunting, but with a clear understanding of the underlying factors and available strategies, you can gain control over your insurance costs. Remember that comparing providers, understanding your policy, and adopting proactive measures can lead to significant savings and a more secure financial future. By utilizing the information presented in this guide, you are better equipped to make informed decisions that protect your assets and your well-being.

Helpful Answers

What happens if I make a claim on my insurance?

Filing a claim will typically result in a premium increase in the following renewal period, although the extent of the increase varies based on the claim’s severity and your insurer’s policies.

Can I change my deductible to lower my premium?

Yes, choosing a higher deductible generally results in a lower premium. However, this means you’ll pay more out-of-pocket if you do need to file a claim.

How often are insurance premiums reviewed?

Premiums are typically reviewed annually at renewal time. Your insurer will assess your risk profile and adjust the premium accordingly.

What is a lapse in insurance coverage?

A lapse occurs when your policy expires and you fail to renew it within the grace period. This can impact your ability to obtain insurance in the future and may lead to higher premiums.