Homeowners insurance is a crucial expense, but its cost can often feel overwhelming. Understanding the factors that contribute to your premium is the first step towards significant savings. This guide explores practical strategies to lower your homeowners insurance costs, from enhancing your home’s security to negotiating with your provider. We’ll delve into the intricacies of policy components, maintenance practices, and smart shopping techniques, empowering you to take control of your insurance budget.

By implementing the strategies Artikeld here, you can significantly reduce your annual homeowners insurance premium without compromising necessary coverage. This guide provides actionable steps and clear explanations, allowing you to confidently navigate the complexities of insurance and achieve long-term financial benefits.

Understanding Your Homeowners Insurance Premium

Understanding your homeowners insurance premium is crucial for managing your finances and ensuring adequate coverage. Several interconnected factors determine the cost of your policy, and a clear understanding of these elements allows for informed decision-making and potential cost savings. This section will break down the key components influencing your premium.

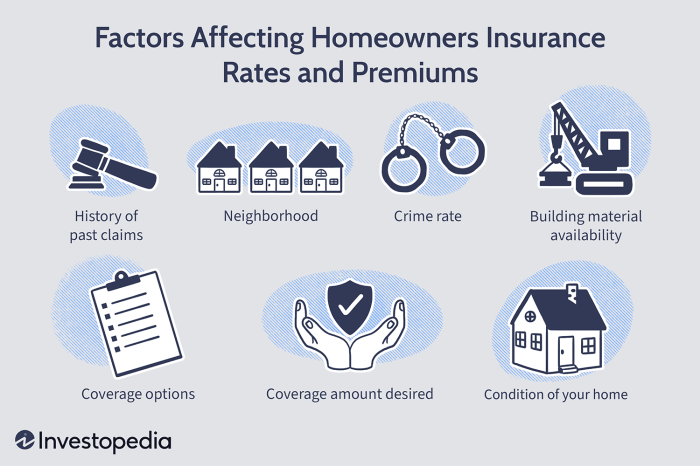

Factors Influencing Homeowners Insurance Costs

Numerous factors contribute to the final cost of your homeowners insurance. Insurance companies assess risk meticulously, and your premium reflects this assessment. These factors are considered individually and cumulatively.

- Location: Your home’s location significantly impacts your premium. Areas prone to natural disasters (hurricanes, earthquakes, wildfires) command higher premiums due to increased risk. For example, a home in a coastal area with a history of hurricanes will typically cost more to insure than a similar home in a less disaster-prone inland location.

- Home Value: The replacement cost of your home is a major factor. A more expensive home requires a larger payout in case of damage, leading to a higher premium. This cost is usually determined by an appraisal or the insurance company’s own assessment.

- Coverage Amount: The level of coverage you choose directly affects your premium. Higher coverage amounts mean higher premiums, but also greater financial protection in the event of a significant loss. Choosing the right coverage level requires careful consideration of your home’s value and your financial capacity.

- Deductible: Your deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. A higher deductible generally results in a lower premium, as you are accepting more financial responsibility. However, a higher deductible also means a larger upfront cost in the event of a claim.

- Home Features: Certain home features can influence your premium. For instance, a home with a security system or fire-resistant materials may qualify for discounts, reflecting a reduced risk profile. Similarly, the age and condition of your roof, plumbing, and electrical systems are all considered.

- Credit Score: In many states, your credit score is a factor in determining your insurance premium. A higher credit score generally correlates with a lower premium, reflecting a lower perceived risk of non-payment.

Components of a Homeowners Insurance Premium

Your homeowners insurance premium is comprised of several key components, each contributing to the overall cost. Understanding these components helps you understand why your premium is what it is.

- Building Coverage: This covers the cost of repairing or rebuilding your home in case of damage from covered perils (e.g., fire, wind, hail). This is usually the largest component of your premium.

- Personal Property Coverage: This protects your belongings inside your home from damage or theft. The value of your possessions influences this portion of your premium.

- Liability Coverage: This protects you from financial liability if someone is injured on your property or you cause damage to someone else’s property. This coverage is crucial for protecting your assets.

- Additional Living Expenses (ALE): This covers temporary living expenses if your home becomes uninhabitable due to a covered event. This might include hotel costs or rental expenses.

- Other Coverages: This can include coverage for things like detached structures (sheds, garages), trees, and other specific items that you want insured.

Contribution of Components to Overall Cost

The relative contribution of each component to your overall premium varies depending on your specific circumstances and coverage choices. For example, someone living in a high-risk area for hurricanes will likely have a higher building coverage premium compared to someone in a low-risk area. Similarly, someone with valuable collectibles will have a higher personal property premium. The insurer carefully calculates each component based on your risk profile and the coverage you’ve selected, resulting in your final premium.

Increasing Your Deductible

Raising your deductible is a straightforward way to lower your homeowners insurance premiums. The fundamental relationship between your deductible and your premium is inverse: a higher deductible typically results in a lower premium. This is because a higher deductible means the insurance company pays out less frequently, reducing their overall risk and allowing them to offer you a lower price.

The primary trade-off, however, lies in the potential financial implications of a higher deductible. Choosing a higher deductible means you’ll be responsible for a larger out-of-pocket expense should you need to file a claim. This could create a significant financial burden if you experience a substantial loss. Careful consideration of your personal financial situation and risk tolerance is crucial before making this decision.

Deductible Amount and Premium Comparison

Let’s consider a hypothetical scenario to illustrate the impact of different deductible amounts on your premium. Imagine you’re currently paying $1,200 annually for homeowners insurance with a $500 deductible. If you increase your deductible to $1,000, your annual premium might decrease to $1,000, saving you $200 per year. However, if you increase it further to $2,500, your annual premium might drop to $850, saving you $350 annually. The savings become more substantial with a higher deductible, but so does your potential out-of-pocket expense in the event of a claim. It’s essential to weigh the potential savings against the increased risk of a large upfront cost if you need to file a claim. This requires careful assessment of your personal finances and risk tolerance. Consider how easily you could cover a $1,000 or $2,500 expense without significant hardship. If you have a robust emergency fund, a higher deductible might be a worthwhile risk. If your finances are tighter, a lower deductible might offer greater peace of mind, even if it means paying a slightly higher premium.

Improving Your Credit Score

Your credit score plays a surprisingly significant role in determining your homeowners insurance premium. Insurance companies use your credit history as an indicator of your risk profile. A higher credit score generally suggests a lower risk of claims, leading to lower premiums. Conversely, a lower credit score often translates to higher premiums, as insurers perceive a greater likelihood of claims.

Insurers don’t use your credit score as the sole determinant of your premium, but it’s a significant factor considered alongside other risk assessments. Understanding this connection empowers you to proactively manage your credit score and potentially save money on your insurance.

Credit Score Impact on Insurance Premiums

A higher credit score typically results in lower insurance premiums. The exact impact varies by insurer and location, but the general trend is consistent. For example, someone with an excellent credit score (750 or above) might qualify for significantly lower rates compared to someone with a poor credit score (below 600). This difference can amount to hundreds of dollars annually. The relationship isn’t linear; the biggest improvements in rates usually occur when moving from a poor to a fair credit score. Subsequent increases in score yield diminishing returns in premium reduction.

Strategies for Improving Credit Score

Improving your credit score involves consistent effort and attention to detail. The following strategies can help you achieve a better score and potentially lower your insurance premiums.

Improving your credit score is a multi-faceted process that requires consistent effort and attention to detail. The following strategies can help you achieve a better score and, consequently, lower your insurance premiums.

- Pay Bills on Time: This is the single most important factor influencing your credit score. Consistent on-time payments demonstrate responsible financial behavior to lenders and insurers alike. Even a single late payment can negatively impact your score.

- Keep Credit Utilization Low: Credit utilization refers to the percentage of your available credit you’re using. Aim to keep this below 30%, ideally closer to 10%. Using a significant portion of your available credit suggests higher risk to lenders.

- Maintain a Healthy Credit Mix: Having a variety of credit accounts (credit cards, loans, etc.) in good standing can positively influence your credit score. However, avoid opening numerous accounts in a short period, as this can be perceived as risky behavior.

- Address Negative Items on Your Report: Review your credit report regularly for errors or negative marks. Dispute any inaccuracies with the credit bureaus. If you have legitimate negative items, work towards improving your credit behavior to mitigate their impact over time.

- Don’t Close Old Accounts: While tempting to close old accounts, especially those with high interest rates, doing so can negatively impact your credit score. The length of your credit history is a significant factor, so keeping older accounts open (even if you don’t use them) can be beneficial.

Improving Credit Score Flowchart

Imagine a flowchart. The starting point is “Current Credit Score.” This leads to a decision point: “Is my credit score below 700?” If yes, the flow continues to “Implement Credit Improvement Strategies” (as detailed above). If no, the flow proceeds to “Maintain Good Credit Habits.” Both paths eventually lead to “Improved Credit Score,” which then flows to “Lower Homeowners Insurance Premiums.” The flowchart visually represents the process of improving your credit score and its direct positive impact on insurance costs. Each step in the improvement strategies is a sub-process within “Implement Credit Improvement Strategies,” highlighting the iterative nature of credit score improvement.

Reviewing Your Coverage

Regularly reviewing your homeowners insurance policy is crucial for ensuring you’re adequately protected without paying for unnecessary coverage. Over time, your needs and circumstances may change, impacting the level of coverage you require. A thorough review allows you to optimize your policy and potentially lower your premiums.

Understanding your current coverage is the first step in this process. This involves carefully examining your policy documents, paying close attention to the coverage limits for different aspects of your home and belongings. Comparing these limits to the actual value of your assets will highlight potential gaps or excesses in coverage.

Coverage Limits and Their Impact on Premiums

Adjusting your coverage levels can significantly affect your premiums. Higher coverage limits generally result in higher premiums because the insurance company is assuming greater financial risk. Conversely, lowering coverage limits, if appropriate, can reduce your premiums. However, it’s crucial to strike a balance: underinsuring your home or belongings could leave you financially vulnerable in the event of a significant loss. For example, if you’ve recently made significant renovations or purchased valuable items, your existing coverage might be insufficient. Similarly, if your home’s market value has decreased, you may be overinsured. Carefully assessing your assets and their replacement cost is vital to determining the appropriate coverage levels.

Assessing Current Coverage Needs

Accurately assessing your current coverage needs involves a multi-step process. First, you need to determine the replacement cost of your home. This isn’t just the current market value; it’s the cost to rebuild your home from the ground up, considering current construction costs and materials. Many online tools and resources can help you estimate this cost, or you can consult with a qualified appraiser. Second, you should create a detailed inventory of your personal belongings, including valuable items like jewelry, electronics, and collectibles. Consider the replacement cost for each item, not just its purchase price. Finally, compare your existing coverage limits for your home’s structure, personal belongings, and liability to the replacement costs you’ve estimated. If there’s a significant discrepancy, adjusting your coverage limits might be beneficial, either by increasing or decreasing them, depending on your findings. For instance, if your home’s replacement cost is significantly higher than your coverage limit, increasing your coverage, despite the higher premium, is a prudent step to protect yourself from financial hardship in case of a major event.

Ultimate Conclusion

Lowering your homeowners insurance premium doesn’t require complex financial maneuvers; it’s about proactive planning and informed decision-making. By combining home improvements, smart shopping practices, and effective communication with your insurer, you can achieve substantial savings year after year. Remember, understanding your policy and actively managing your risk profile are key to securing the best possible rate. Take charge of your insurance costs and enjoy the peace of mind that comes with knowing you’re financially protected at a reasonable price.

Clarifying Questions

What if I have a claim on my record? Will that always increase my premium?

While a claim can impact your premium, it doesn’t automatically guarantee a significant increase. The severity of the claim and your claims history will be considered. Some insurers may offer forgiveness programs for minor claims.

Can I get a discount for having a security system even if it’s not professionally monitored?

Many insurers offer discounts for security systems, even if they’re not professionally monitored. The discount amount may vary, but having any security system is better than none.

How often should I review my homeowners insurance policy?

It’s recommended to review your policy annually, or at least every two years, to ensure your coverage still meets your needs and that you’re taking advantage of available discounts. Significant life changes, such as home renovations or additions, necessitate a policy review.

Does paying my premium annually instead of monthly save me money?

Yes, most insurers offer a discount for paying your premium annually, as it simplifies their administrative processes.