Securing your family’s financial future through life insurance is a crucial step, but understanding the often-opaque world of premium calculations can feel daunting. This guide demystifies the process, providing a clear and accessible explanation of how life insurance companies determine your premium. We’ll explore the key factors influencing your cost, from age and health to policy type and lifestyle choices, and offer a simplified look at the underlying formula. Understanding these elements empowers you to make informed decisions when choosing life insurance coverage.

From the fundamental components of the premium calculation—mortality rates and interest rates—to the more nuanced aspects like riders and underwriting practices, we’ll navigate the complexities together. We’ll examine how different policy types (term, whole, universal) affect premiums and provide illustrative examples to clarify the concepts. By the end, you’ll have a solid grasp of the factors driving your life insurance costs and be better equipped to choose a policy that suits your needs and budget.

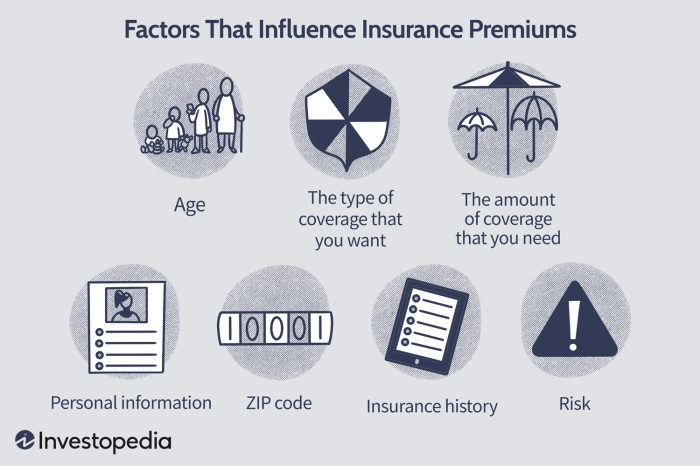

Factors Influencing Life Insurance Premiums

Calculating life insurance premiums is a complex process, involving numerous factors that insurers carefully consider to assess risk and determine appropriate pricing. Understanding these factors can help you make informed decisions when purchasing a policy.

Age

Age is a primary determinant of life insurance premiums. As you age, your risk of mortality increases. Statistically, older individuals are more likely to pass away within the policy term than younger individuals. Therefore, insurers charge higher premiums to reflect this increased risk. For example, a 30-year-old might receive a significantly lower premium than a 50-year-old applying for the same coverage amount. This difference reflects the actuarial tables used by insurance companies, which predict mortality rates based on age group.

Health Status

An applicant’s health status significantly impacts premium costs. Individuals with pre-existing conditions, such as heart disease, diabetes, or cancer, typically face higher premiums. Insurers assess medical history, current health conditions, and results from medical examinations (if required) to evaluate the risk associated with insuring the applicant. A person with excellent health and a clean medical history will generally receive more favorable rates. Conversely, those with significant health concerns might face higher premiums or even be denied coverage altogether.

Smoking Habits

Smoking is a major health risk factor, significantly increasing the likelihood of developing various life-threatening illnesses. As a result, smokers consistently pay substantially higher premiums than non-smokers. Insurers recognize the increased mortality risk associated with smoking and adjust premiums accordingly. The extent of the surcharge can vary depending on the insurer and the applicant’s smoking history. Quitting smoking can lead to lower premiums in the future, sometimes after a specified period of abstinence.

Occupation

The nature of an applicant’s occupation can also influence premium costs. High-risk occupations, such as those involving dangerous machinery, hazardous materials, or extensive travel, are often associated with higher premiums. Insurers assess the inherent risks associated with various professions and adjust premiums to reflect the increased likelihood of accidents or premature death. Conversely, individuals in less hazardous occupations may receive more favorable rates.

Policy Type

Different types of life insurance policies carry varying premium structures. Term life insurance, which provides coverage for a specific period, generally has lower premiums than permanent policies like whole life or universal life insurance. Whole life insurance offers lifelong coverage and builds cash value, resulting in higher premiums. Universal life insurance provides flexibility in premium payments and coverage amounts, but premiums can fluctuate based on market conditions and the policy’s performance.

Relative Impact of Factors on Premium Cost

| Factor | Impact on Premium Cost | Example | Relative Impact (High/Medium/Low) |

|---|---|---|---|

| Age | Increases with age | A 60-year-old will pay more than a 30-year-old. | High |

| Health Status | Higher premiums for pre-existing conditions | Diabetes or heart disease can significantly increase premiums. | High |

| Smoking Habits | Smokers pay significantly more | A smoker might pay double the premium of a non-smoker. | High |

| Occupation | Higher premiums for high-risk jobs | A construction worker might pay more than an office worker. | Medium |

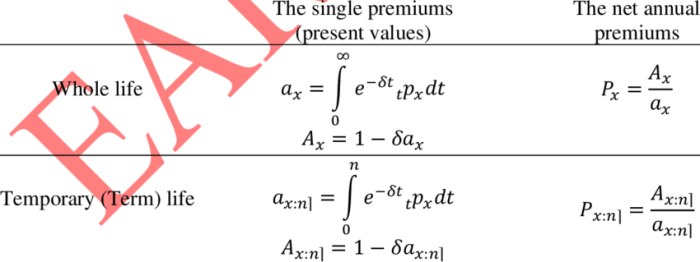

Understanding the Basic Premium Calculation Formula

Life insurance premium calculation isn’t as mysterious as it might seem. At its core, it’s a careful balancing act between the risk the insurer takes and the cost of providing that coverage. Several key factors feed into the final premium amount, ensuring the insurance company can meet its obligations while remaining financially viable.

The core components of a life insurance premium calculation revolve around assessing risk and ensuring profitability. This involves considering the likelihood of a claim (mortality), the time value of money (interest), and the insurer’s operational costs. These factors are interwoven to arrive at a premium that is both fair to the policyholder and sustainable for the insurance company.

Mortality Rate and Premium Costs

The mortality rate is a crucial factor, representing the probability of death within a specific age group and time period. Actuaries use extensive mortality tables, based on historical data and demographic trends, to estimate this probability. Higher mortality rates, indicating a greater likelihood of death within a particular age group, directly translate to higher premiums. This is because the insurer anticipates a higher number of payouts, requiring a larger pool of premiums to cover those claims. For example, a 50-year-old smoker will generally have a higher premium than a 50-year-old non-smoker due to the increased mortality risk associated with smoking.

Interest Rate and Premium Calculation

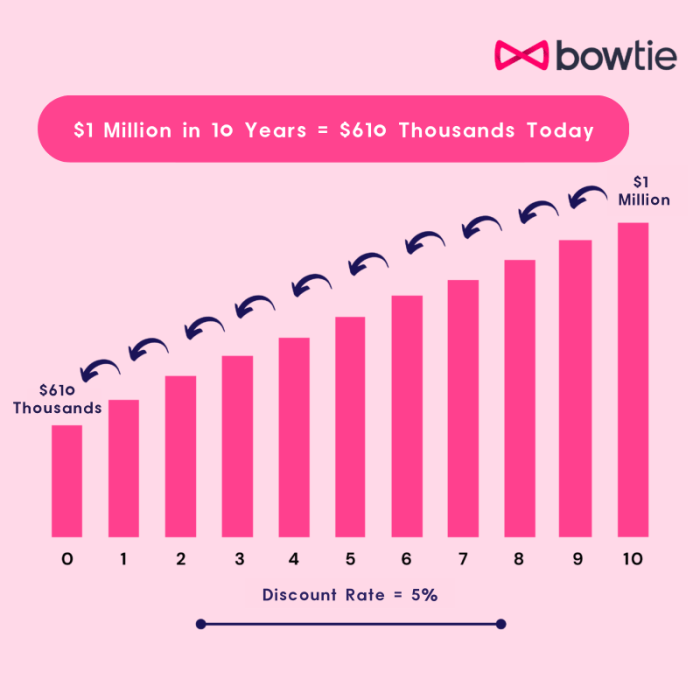

The interest rate plays a vital role, reflecting the time value of money. Insurance companies invest the premiums they collect, earning interest over the policy’s term. This interest income helps offset the cost of future payouts. A higher interest rate allows the insurer to collect a smaller premium upfront, as the investment returns contribute more significantly to covering future claims. Conversely, lower interest rates necessitate higher premiums to compensate for reduced investment income. The insurer’s investment strategy and the prevailing market interest rates significantly influence the premium calculation.

Simplified Premium Calculation Example

Let’s consider a simplified example. Assume an insurer wants to calculate the annual premium for a $100,000 term life insurance policy for a 35-year-old male. Suppose the mortality rate for this group is estimated at 0.1% (0.001), the desired interest rate is 5% (0.05), and the insurer’s operational costs are estimated at $50 per policy.

1. Expected Claims Cost: Mortality rate * policy value = 0.001 * $100,000 = $100

2. Present Value of Expected Claims: Expected Claims Cost / (1 + Interest Rate) = $100 / (1 + 0.05) = $95.24 (This discounts the future claim to its present value).

3. Total Cost per Policy: Present Value of Expected Claims + Operational Costs = $95.24 + $50 = $145.24

4. Annual Premium: Total Cost per Policy = $145.24

This is a highly simplified illustration, omitting many real-world factors like expenses, profit margins, and policy duration. Actual premium calculations are significantly more complex.

Premium Calculation Flowchart

A flowchart visualizing the process might look like this:

[Start] –> [Gather Policyholder Data (Age, Health, etc.)] –> [Determine Mortality Rate] –> [Determine Interest Rate] –> [Calculate Expected Claims Cost] –> [Calculate Present Value of Expected Claims] –> [Calculate Operational Costs] –> [Sum Costs] –> [Determine Profit Margin] –> [Calculate Annual Premium] –> [End]

Note that this flowchart omits many steps involved in a real-world calculation, serving as a simplified representation of the core process. The actual calculation involves far more intricate steps and considerations.

Advanced Factors and Adjustments in Premium Calculations

Calculating life insurance premiums involves more than just a basic formula. Several nuanced factors and adjustments significantly influence the final cost. Understanding these complexities is crucial for both insurers and policyholders to ensure fair and accurate pricing. This section delves into these advanced considerations.

Impact of Additional Riders and Benefits on Premiums

Adding riders, such as accidental death benefits, critical illness coverage, or waiver of premium options, increases the overall premium. These additional benefits represent a higher risk for the insurance company, necessitating a higher premium to offset the increased payout potential. For example, a rider that doubles the death benefit will naturally increase the premium significantly more than a policy without such a rider. The cost of each rider varies depending on the specific terms and conditions, the insured’s age and health, and the insurer’s risk assessment. The premium increase is usually presented as a percentage or a fixed amount added to the base premium.

Influence of Underwriting Practices on Premiums

Different insurance companies employ varying underwriting practices, leading to differences in premium calculations. Stricter underwriting, involving more extensive medical examinations and risk assessments, may result in higher premiums for individuals deemed higher risk. Conversely, insurers with more lenient underwriting practices might offer lower premiums, but potentially accept more risk. For example, one insurer might require extensive medical testing for applicants over 50, leading to higher premiums for those applicants compared to an insurer with less stringent requirements. Another example is the impact of lifestyle factors: smokers generally face higher premiums across all insurers due to increased health risks, but the precise increase may differ based on the insurer’s specific risk assessment models.

Factors Leading to Premium Adjustments During the Policy Term

Premiums aren’t always fixed throughout the policy term. Several factors can trigger adjustments. For instance, with some policies, premiums may increase annually as the insured ages and the risk of death increases. Also, significant changes in the insured’s health status after policy issuance might lead to premium adjustments, especially in policies with guaranteed renewability clauses. Furthermore, economic factors such as changes in interest rates can affect the insurer’s investment returns and, consequently, premium calculations. Finally, regulatory changes or changes in the insurer’s risk assessment models can also result in premium adjustments.

Cash Value and its Impact on Premiums (Whole Life Policies)

Whole life insurance policies accumulate cash value over time. This cash value, built from a portion of the premiums paid, grows tax-deferred and can be borrowed against or withdrawn. The inclusion of this cash value component increases the premium compared to term life insurance, which doesn’t offer cash value accumulation. The premium reflects both the death benefit and the cost of building the cash value. The higher the death benefit and the faster the desired cash value accumulation, the higher the premium will be. For example, a whole life policy with a high death benefit and a rapid cash value growth rate will have a considerably higher premium than a policy with a lower death benefit and slower cash value growth.

Comparison of Premium Calculation Methods Used by Different Insurance Companies

Insurance companies employ various methods for calculating premiums, reflecting differences in their risk assessment models, investment strategies, and operating costs.

Different approaches include:

- Actuarial Tables: Most insurers rely on actuarial tables, which provide statistical data on mortality rates based on age, gender, and health status. These tables are constantly updated to reflect changes in longevity and health trends.

- Proprietary Algorithms: Many insurers utilize proprietary algorithms that incorporate additional factors beyond standard actuarial tables. These algorithms may include lifestyle factors, genetic predispositions (where permitted), and other risk assessments.

- Competitive Benchmarking: Insurers often benchmark their premiums against competitors to maintain competitiveness in the market. This practice can lead to similarities in pricing, although variations still exist based on risk assessment and company profitability targets.

Illustrative Examples of Premium Calculations

Understanding the theoretical framework of life insurance premium calculation is crucial, but applying it to real-world scenarios provides a clearer picture. The following examples illustrate how various factors influence premium costs, demonstrating the practical application of the formulas discussed previously. Note that these examples use simplified calculations for illustrative purposes; actual premiums are determined by far more complex actuarial models.

Premium Calculation for a 30-Year-Old Non-Smoker

This example considers a 30-year-old non-smoking male with a healthy lifestyle and a standard occupation, seeking a $500,000 term life insurance policy for 20 years. Using simplified assumptions (a mortality rate based on actuarial tables for his age and health profile, a modest expense loading, and a reasonable interest rate), we can estimate the annual premium. Let’s assume, for the sake of illustration, a mortality rate of 0.1% for this profile and an expense loading of 15%. A simplified calculation might involve dividing the death benefit ($500,000) by the expected number of years until death (based on the mortality rate), adding the expense loading, and then dividing the total by the number of years in the policy term. This simplified calculation would ignore crucial elements such as the time value of money and the impact of investment returns. A more realistic calculation, employing the proper actuarial techniques, would result in a significantly more accurate (and higher) premium. For this simplified example, let’s assume an annual premium of approximately $500.

Premium Calculation for a 50-Year-Old Smoker with a High-Risk Occupation

Now, let’s consider a 50-year-old male smoker with a high-risk occupation (e.g., construction worker) seeking the same $500,000 term life insurance policy for 20 years. His higher mortality risk due to smoking and occupation will significantly increase his premium. Actuarial tables would reflect substantially higher mortality rates for his age, smoking status, and occupation. Additionally, the expense loading might also be higher due to the increased risk. Using simplified assumptions again, let’s assume a mortality rate of 1% (ten times higher than the previous example), and an expense loading of 25%. Applying a similar (though highly simplified) calculation as above, his annual premium would be significantly higher, perhaps around $5,000. This highlights the considerable impact of lifestyle and occupation on insurance costs.

Premium Comparison: Term Life vs. Whole Life

A 40-year-old individual is considering both term life and whole life insurance policies with a $250,000 death benefit. A 20-year term life policy would offer coverage for a specific period, after which the coverage expires. The premium for this policy would likely be considerably lower, reflecting the limited duration of the coverage. Let’s assume a simplified annual premium of $600. In contrast, a whole life policy provides lifelong coverage, and therefore its premiums are significantly higher to account for the extended coverage period. The annual premium for a comparable whole life policy might be around $2,000, representing a substantial difference. The premium difference is a direct reflection of the longer coverage period and the guaranteed lifelong protection offered by the whole life policy.

Impact of Health Improvement on Premiums

This example demonstrates how improving health can lead to lower premiums. A 45-year-old individual with a BMI of 32 (obese) initially receives a life insurance quote with an annual premium of $1,200. After six months of lifestyle changes, including diet and exercise, the individual reduces their BMI to 25 (normal weight). This improvement would result in a lower risk assessment by the insurer.

| Before Health Improvement | After Health Improvement |

|---|---|

| BMI: 32 (Obese) | BMI: 25 (Normal Weight) |

| Annual Premium: $1200 | Annual Premium: $800 |

The lower BMI results in a revised premium of $800, showcasing a significant reduction in cost due to improved health.

Actuarial Tables in Premium Calculation

Insurers rely heavily on actuarial tables to determine the likelihood of death within specific age groups, considering factors like gender, smoking status, occupation, and health conditions. These tables are essentially statistical databases containing vast amounts of mortality data. Actuaries use sophisticated statistical models and these tables to project the probability of death for various population segments. This probability is a critical input in calculating life insurance premiums, as it directly impacts the insurer’s expected payouts. The higher the projected probability of death for a particular group, the higher the premiums will be for that group to offset the increased risk for the insurance company. The data used in these tables is regularly updated to reflect changes in mortality rates, reflecting advancements in healthcare and changes in lifestyle factors.

Resources for Further Exploration

Understanding life insurance premiums goes beyond the formulas; accessing reliable information and seeking professional advice are crucial steps in securing the right coverage. This section Artikels valuable resources to deepen your understanding and guide your decision-making process.

This section details reputable sources for further learning, emphasizes the importance of professional financial guidance, and provides information on readily available online premium calculators. Utilizing these resources empowers you to make informed choices about your life insurance needs.

Reputable Sources for Further Learning

Several organizations and publications offer comprehensive information on life insurance. These resources provide detailed explanations of various policy types, factors influencing premiums, and best practices for purchasing coverage. Consulting these resources can significantly enhance your understanding of the complexities involved in life insurance.

- The National Association of Insurance Commissioners (NAIC): The NAIC is a valuable resource for information on insurance regulations and consumer protection. Their website offers educational materials and resources to help consumers understand insurance products and make informed decisions.

- The Insurance Information Institute (III): The III provides objective information about insurance issues, including life insurance. They offer publications, articles, and fact sheets that address various aspects of life insurance.

- Consumer Reports: Consumer Reports publishes independent reviews and ratings of insurance companies and products, providing consumers with valuable insights into the performance and reliability of different insurers.

- Your State’s Department of Insurance: Each state has a department of insurance that regulates insurance companies operating within its borders. These departments provide consumer resources, complaint handling mechanisms, and information on licensed insurers.

The Importance of Consulting a Financial Advisor

Before purchasing a life insurance policy, consulting a qualified financial advisor is highly recommended. A financial advisor can assess your individual needs, risk tolerance, and financial goals to recommend a policy that aligns with your circumstances. They can also provide guidance on the various policy types, features, and riders available, helping you select the most suitable option. Furthermore, a financial advisor can help you understand the complexities of the policy documents and ensure you are making an informed decision. This professional guidance can save you time, money, and potential future headaches.

Locating Life Insurance Premium Calculators Online

Many insurance companies and independent websites offer online life insurance premium calculators. These calculators allow you to estimate your premiums based on your age, health status, desired coverage amount, and other relevant factors. While these calculators provide a helpful starting point, it’s important to remember that the results are only estimates. The actual premium you receive from an insurance company may vary depending on their underwriting process and specific policy terms. Using multiple calculators from different sources can provide a range of potential premiums, offering a more comprehensive understanding of your options. Remember to always verify the information obtained from online calculators with a licensed insurance professional.

Final Review

Calculating life insurance premiums involves a complex interplay of factors, but understanding the basics empowers you to make informed decisions about your financial protection. While the process may seem intricate, breaking it down into its core components—age, health, lifestyle, policy type, and the underlying actuarial calculations—makes it significantly more manageable. Remember, consulting with a financial advisor can provide personalized guidance and help you navigate the intricacies of choosing the right life insurance policy for your specific circumstances. Don’t hesitate to seek professional advice to ensure you’re making the best choice for your family’s future.

FAQ Section

What is the difference between term life and whole life insurance premiums?

Term life insurance premiums are generally lower than whole life insurance premiums because term life only provides coverage for a specific period. Whole life insurance provides lifelong coverage and builds cash value, resulting in higher premiums.

How often are life insurance premiums adjusted?

This depends on the policy type. Term life premiums typically remain level for the policy term. Whole life premiums usually remain level for life, though some policies may allow for premium adjustments based on the policy’s cash value.

Can I reduce my life insurance premium after improving my health?

Possibly. Some insurers allow for premium reductions if you demonstrate significant health improvements, such as quitting smoking or achieving a healthy weight. You would need to contact your insurer to inquire about this possibility and provide supporting medical documentation.

What is an actuarial table, and how does it relate to premium calculation?

An actuarial table is a statistical table that shows the probability of death at different ages. Insurers use these tables to estimate the risk of paying out a death benefit and factor this risk into premium calculations.