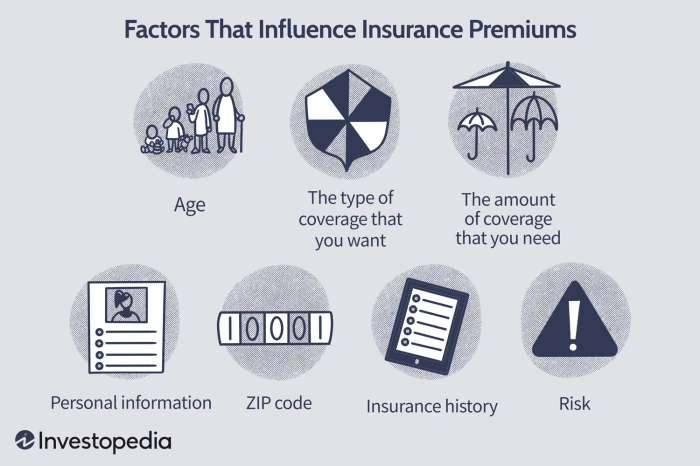

Understanding how insurance premiums are calculated can seem daunting, a complex interplay of statistics, risk assessment, and market forces. However, deconstructing this process reveals a fascinating blend of actuarial science and practical application. This guide will demystify the process, providing a clear understanding of the fundamental principles, key influencing factors, and simplified calculation methods. We’ll explore both the theoretical underpinnings and practical examples to empower you with a deeper understanding of insurance premium determination.

From the basic components of a premium to the sophisticated models employed by actuaries, we will navigate the intricacies of this critical aspect of the insurance industry. We will examine how individual characteristics, location, coverage choices, and claims history all contribute to the final premium amount. Through illustrative examples and case studies, you will gain a practical understanding of how these factors interact to determine the cost of your insurance.

Understanding the Fundamentals of Insurance Premiums

Insurance premiums are the payments you make to an insurance company in exchange for coverage against potential financial losses. Understanding how these premiums are calculated is crucial for making informed decisions about your insurance needs. This section will break down the core components and factors involved.

Core Components of Premium Calculation

The calculation of an insurance premium is a complex process, but it fundamentally involves balancing the insurer’s expected payouts with the need to maintain profitability. Several key factors are considered. These include the likelihood of a claim (risk assessment), the potential severity of the claim, the administrative costs of the insurance company, and the desired profit margin. The insurer uses statistical models and historical data to estimate the probability and cost of future claims. A higher likelihood of claims or higher claim costs naturally lead to higher premiums.

Risk Assessment and Premium Determination

Risk assessment is the cornerstone of premium determination. Insurers meticulously analyze various factors to determine the level of risk associated with insuring a particular individual or property. This involves assessing factors specific to the insured, such as age, health (for life insurance), driving history (for auto insurance), credit score (for various types of insurance), and location (for home and auto insurance). The higher the assessed risk, the higher the premium. For example, a person with a history of speeding tickets will likely pay a higher auto insurance premium than someone with a clean driving record.

Examples of Insurance Types and Premium Factors

Different types of insurance policies consider distinct factors when determining premiums.

Life insurance premiums are heavily influenced by factors like age, health status, smoking habits, occupation, and the amount and type of coverage. A younger, healthier, non-smoking individual will typically receive a lower premium than an older person with pre-existing health conditions.

Auto insurance premiums are affected by factors such as driving history (accidents, tickets), age, location (urban areas tend to have higher rates due to increased accident frequency), vehicle type (sports cars often have higher premiums), and coverage level. A driver with multiple accidents will see a significant increase in their premium.

Home insurance premiums are influenced by factors like the location of the property (risk of natural disasters, crime rates), the value of the home, the age and condition of the home, and the level of coverage. A home in a high-risk area with an older structure will generally command a higher premium than a newer home in a low-risk area.

Key Variables Affecting Insurance Premiums

The following table compares key variables affecting premiums across three common insurance types:

| Variable | Life Insurance | Auto Insurance | Home Insurance |

|---|---|---|---|

| Age | Significant (older = higher) | Significant (younger and older drivers often pay more) | Less significant |

| Health Status | Extremely significant | Less significant | Less significant |

| Location | Minor influence | Significant (higher risk areas = higher premiums) | Extremely significant (risk of natural disasters, crime) |

| Driving History | Not applicable | Extremely significant (accidents, tickets) | Not applicable |

| Property Value | Not applicable | Minor influence (vehicle value) | Extremely significant |

| Credit Score | Increasingly significant | Significant in some states | Significant in some states |

Illustrative Examples and Case Studies

Understanding how insurance premiums are calculated becomes clearer with real-world examples. This section will detail a specific case study, illustrating the various factors that contribute to the final premium and how policyholder actions can influence the cost.

Let’s consider a hypothetical case of a 35-year-old individual, Sarah, purchasing comprehensive car insurance for a 2020 Honda Civic. Several factors will influence her premium. These include her age, driving history (accident-free for 5 years), location (a suburb with a relatively low crime rate), the vehicle’s make and model (Honda Civic known for its safety features and reliability), and the chosen coverage level (comprehensive, including collision and liability).

A Detailed Case Study of Sarah’s Car Insurance Premium

To illustrate, let’s assume the base premium for Sarah’s profile is $800 annually. This base reflects the average cost for similar drivers and vehicles in her area. However, several factors will adjust this base rate. Her clean driving record reduces the premium by 15%, bringing it down to $680. Her location in a low-risk area provides a further 10% discount, resulting in a premium of $612. The Honda Civic’s safety features and lower repair costs contribute to a 5% reduction, lowering the premium to $581.40. Finally, choosing comprehensive coverage adds $200 to the premium, resulting in a final annual premium of $781.40.

Visual Representation of Premium Components

Imagine a pie chart representing Sarah’s premium. The largest slice, approximately 45%, represents the base premium reflecting the average risk profile. The next largest slice, approximately 20%, shows the impact of her clean driving record. A smaller slice, around 15%, represents the location-based discount. Another slice, about 10%, illustrates the reduction due to the vehicle’s safety features. The remaining slice, approximately 10%, shows the increase due to the comprehensive coverage option. This visual clearly shows the relative contribution of each factor to the overall premium. The colors used could be consistent with common risk representation (e.g., green for discounts, red for increases).

Impact of Customer Actions on Premiums

Now, let’s consider a scenario where Sarah decides to install a security system in her car. Many insurance companies offer discounts for such safety enhancements. Let’s assume a 5% discount for installing an approved security system. This would reduce Sarah’s final premium from $781.40 by $39.07, resulting in a new annual premium of $742.33. This example demonstrates how proactive measures taken by policyholders can directly influence their insurance costs.

Last Word

Calculating insurance premiums is a multifaceted process, blending actuarial science, statistical modeling, and market dynamics. While simplified formulas offer a basic understanding, real-world calculations rely on sophisticated models that account for numerous variables. This guide has provided a foundation in understanding the key components and influencing factors. By grasping these principles, individuals can become more informed consumers of insurance, better equipped to understand and negotiate their policy costs. Remember that consulting with an insurance professional remains crucial for personalized advice and accurate premium estimations.

Top FAQs

What is the difference between a deductible and a premium?

A premium is the regular payment you make to maintain your insurance coverage. A deductible is the amount you pay out-of-pocket before your insurance coverage kicks in.

How often are insurance premiums typically reviewed and adjusted?

This varies by insurer and policy type. Some policies have annual reviews, while others might adjust premiums less frequently. Changes often reflect risk assessments and market conditions.

Can I negotiate my insurance premium?

While you can’t always directly negotiate the base premium, you can often influence the final cost by increasing your deductible, bundling policies, or improving your risk profile (e.g., installing security systems).

What factors influence the cost of life insurance premiums besides age and health?

Factors such as smoking habits, family history of certain diseases, occupation, and the type and amount of coverage desired significantly impact life insurance premiums.