Securing your family’s financial future through life insurance is a crucial step in responsible financial planning. Understanding how life insurance premiums are calculated empowers you to make informed decisions and choose a policy that best suits your needs and budget. This guide delves into the intricate factors that influence premium calculations, providing a clear and concise explanation of the process.

From age and health status to policy type and coverage amount, numerous variables contribute to the final premium. We’ll explore each of these factors in detail, offering practical examples and comparisons to help you navigate the complexities of life insurance pricing. By the end of this guide, you’ll possess a comprehensive understanding of how your individual circumstances impact your life insurance costs, enabling you to make confident and well-informed choices.

Factors Influencing Life Insurance Premiums

Several key factors determine the cost of your life insurance premium. Understanding these factors can help you make informed decisions when choosing a policy. These factors interact in complex ways, so it’s always best to get a personalized quote from an insurance provider.

Age

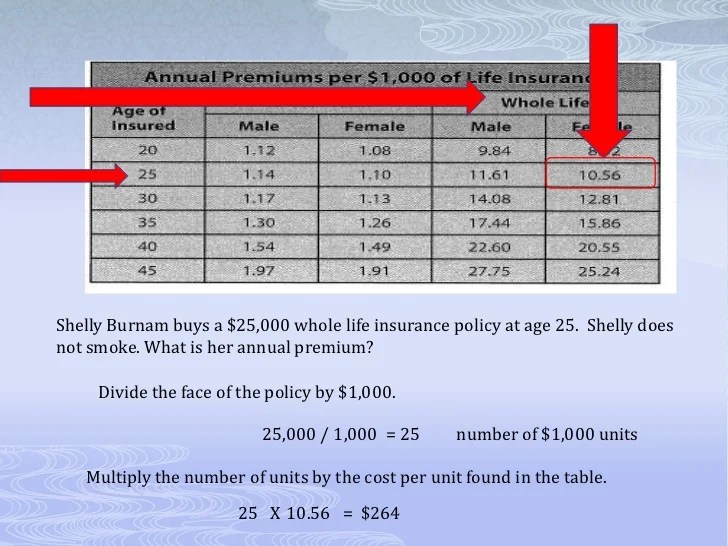

Age is a significant factor influencing life insurance premiums. Statistically, the older you are, the higher your risk of death, leading to increased premiums. Younger individuals generally receive lower premiums because they have a longer life expectancy.

| Age | Premium Amount (USD) | Policy Type | Gender |

|---|---|---|---|

| 30 | 25 | 10-Year Term | Male |

| 30 | 20 | 10-Year Term | Female |

| 40 | 45 | 10-Year Term | Male |

| 40 | 35 | 10-Year Term | Female |

| 50 | 80 | 10-Year Term | Male |

| 50 | 65 | 10-Year Term | Female |

*Note: These are sample premiums and will vary significantly based on other factors such as health, smoking status, and the specific policy details.*

Health Conditions

Pre-existing health conditions significantly impact life insurance premium calculations. Insurers assess the risk associated with these conditions, and higher risks generally translate to higher premiums.

The following are examples of health conditions that can affect premiums:

- Heart disease: Conditions like coronary artery disease or heart failure increase the risk of mortality, leading to higher premiums.

- Diabetes: Type 1 and Type 2 diabetes increase the risk of various complications and shorten life expectancy, resulting in higher premiums.

- Cancer: A history of cancer, particularly if it is recurrent or aggressive, will significantly increase premiums.

- High blood pressure: Untreated or poorly managed high blood pressure increases the risk of heart disease and stroke, impacting premium costs.

- High cholesterol: High cholesterol levels increase the risk of heart disease, potentially leading to higher premiums.

Smoking and Lifestyle Choices

Smoking is a major factor influencing life insurance premiums. Smokers face significantly higher premiums than non-smokers due to the increased risk of lung cancer, heart disease, and other smoking-related illnesses. Other lifestyle choices, such as excessive alcohol consumption or lack of exercise, can also affect premiums, although typically to a lesser extent than smoking.

For example, a 35-year-old non-smoker with a healthy lifestyle might receive a significantly lower premium than a 35-year-old smoker with a history of heart problems.

Policy Type

The type of life insurance policy you choose (term, whole life, or universal life) directly impacts your premium. Term life insurance offers coverage for a specific period (e.g., 10, 20, or 30 years) and typically has lower premiums than permanent policies. Whole life and universal life insurance offer lifelong coverage, but their premiums are generally higher.

| Policy Type | Premium Amount (USD) per year for $500,000 coverage |

|---|---|

| 10-Year Term Life | 500 |

| 20-Year Term Life | 700 |

| Whole Life | 2000 |

| Universal Life | 1500 |

*Note: These are sample premiums and will vary significantly based on age, health, and other factors.*

Understanding Policy Coverage and its Relation to Premiums

The cost of your life insurance premium is directly tied to the level of coverage you choose and the features you include in your policy. Understanding this relationship is crucial for making informed decisions about your financial protection. Several key factors influence the premium, and it’s important to consider them carefully.

Death Benefit Amount and Premium

The death benefit, the amount paid to your beneficiaries upon your death, is the most significant factor influencing your premium. A higher death benefit means a higher premium because the insurance company assumes a greater financial risk. Conversely, a lower death benefit results in a lower premium. For example, a $500,000 death benefit policy will typically cost more than a $250,000 policy, all other factors being equal. Similarly, reducing your death benefit from $1,000,000 to $750,000 would likely result in a noticeable decrease in your monthly or annual premium. The exact impact will vary based on factors such as your age, health, and the type of policy.

Impact of Riders and Add-ons

Riders and add-ons are optional features that can enhance your policy’s coverage but will increase your premium. These additions provide extra protection beyond the basic death benefit.

The following is a list of common riders and their associated cost implications:

- Accidental Death Benefit Rider: This rider pays an additional sum if death is caused by an accident. The cost is typically a small percentage increase to your base premium.

- Critical Illness Rider: Provides a lump-sum payment if you’re diagnosed with a specified critical illness, such as cancer or heart attack. This rider significantly increases the premium due to the added risk the insurer assumes.

- Waiver of Premium Rider: If you become disabled and unable to work, this rider waives your premium payments. The added cost is usually moderate.

- Long-Term Care Rider: Covers long-term care expenses, such as nursing home care. This rider can substantially increase your premiums due to the potential for high payouts.

Policy Term Length and Premiums

The length of your policy term significantly affects the premium. Shorter-term policies, such as 10-year term life insurance, generally have lower premiums than longer-term policies like 20-year or 30-year term life insurance. This is because the insurance company’s risk is lower over a shorter period. For instance, a 10-year term policy for a 35-year-old will have a significantly lower annual premium than a 30-year term policy for the same individual, although the total premium paid over the life of the policy will be less for the shorter-term policy.

Premium Comparison Across Coverage Levels

The following table illustrates how premiums vary for different coverage amounts with a fixed 20-year term policy for a hypothetical 35-year-old male in good health. These are illustrative examples only and actual premiums will vary depending on the insurer and individual circumstances.

| Coverage Amount | Premium (Annual) | Policy Type | Premium per Thousand |

|---|---|---|---|

| $250,000 | $500 | 20-Year Term | $2.00 |

| $500,000 | $900 | 20-Year Term | $1.80 |

| $750,000 | $1300 | 20-Year Term | $1.73 |

| $1,000,000 | $1700 | 20-Year Term | $1.70 |

The Role of the Insurer and its Underwriting Process

Insurance companies play a crucial role in determining life insurance premiums. Their processes, driven by risk assessment and financial stability, directly impact the cost of your policy. Understanding these processes is key to making informed decisions about your life insurance needs.

Different insurance companies employ varying methodologies for assessing risk and calculating premiums. These methodologies consider a multitude of factors, ranging from actuarial tables reflecting mortality rates to sophisticated statistical models incorporating lifestyle choices and health data. Financial stability is paramount; a company’s ability to meet its obligations, including paying out death benefits, significantly influences the premium it can offer. A financially stronger insurer, demonstrated through robust reserves and consistent profitability, often offers more competitive premiums, reflecting lower risk to the policyholder.

Insurer Risk Assessment Methodologies

Insurers utilize complex actuarial models to predict the likelihood of a claim. These models consider factors like age, gender, health history (including pre-existing conditions and family medical history), lifestyle (smoking, occupation, hobbies), and geographic location. The more risk an individual presents, the higher the premium. For example, a smoker will generally pay a higher premium than a non-smoker due to increased mortality risk. These models are regularly updated to reflect changes in mortality rates and other relevant data. Sophisticated algorithms are also employed to assess the interplay of various risk factors, creating a more nuanced and accurate assessment.

The Underwriting Process and its Impact on Premium Calculation

The underwriting process is a systematic evaluation of an applicant’s risk profile. It’s a multi-step procedure designed to ensure the insurer accurately assesses the risk associated with insuring the applicant.

- Application and Initial Assessment: The process begins with the applicant completing a detailed application form, providing information about their health, lifestyle, and financial situation. This information undergoes an initial assessment to identify any immediate red flags.

- Medical Information Gathering: Depending on the policy type and the information provided in the application, the insurer may request additional medical information. This can include medical records, lab results, or a paramedical exam (a brief physical examination conducted by a nurse or paramedic).

- Risk Assessment and Classification: Underwriters analyze the collected information to assess the applicant’s risk profile. This involves assigning a risk classification, which determines the premium level. Higher risk classifications result in higher premiums.

- Premium Determination: Based on the risk classification, the insurer calculates the premium using actuarial models and considering factors like the policy’s death benefit, term length, and any riders (additional benefits).

- Policy Issuance: Once the underwriting process is complete and the premium is determined, the insurer issues the life insurance policy.

Comparison of Premium Quotes from Different Insurers

Comparing quotes from several insurers is crucial for finding the best value. Below is a hypothetical comparison for a standardized $500,000 term life insurance policy for a 35-year-old male non-smoker in good health. Note that actual premiums vary greatly depending on the specific insurer, policy details, and the applicant’s individual risk profile.

| Insurer Name | Annual Premium | Policy Details | Financial Strength Rating (Hypothetical) |

|---|---|---|---|

| Insurer A | $1,200 | 20-year term, level premium | A+ |

| Insurer B | $1,350 | 20-year term, level premium | A- |

| Insurer C | $1,100 | 20-year term, level premium | A |

| Insurer D | $1,400 | 20-year term, level premium, additional rider | B+ |

Influence of Insurer’s Financial Strength Rating on Premiums

An insurer’s financial strength rating reflects its ability to pay claims. These ratings, provided by independent rating agencies like A.M. Best, Moody’s, and Standard & Poor’s, assess the insurer’s financial stability, claims-paying ability, and overall financial health. A higher rating generally indicates a lower risk of the insurer failing to pay out death benefits, leading to potentially lower premiums. Conversely, insurers with lower ratings may charge higher premiums to compensate for the increased risk they represent to policyholders. While a lower premium might seem attractive, it’s crucial to consider the insurer’s financial stability to ensure your beneficiaries will receive the promised death benefit.

Closing Notes

Calculating life insurance premiums involves a multifaceted process, influenced by a range of personal and policy-specific factors. While the details can seem intricate, understanding the key variables—age, health, lifestyle, policy type, and coverage amount—provides a solid foundation for making informed decisions. By comparing quotes from multiple insurers and carefully considering your individual circumstances, you can secure the life insurance coverage that best protects your family’s financial well-being at a price that aligns with your budget.

Expert Answers

What is the difference between term and whole life insurance?

Term life insurance provides coverage for a specific period (term), typically 10, 20, or 30 years, at a fixed premium. Whole life insurance provides lifelong coverage with a cash value component that grows over time, but premiums are generally higher.

Can I lower my premium by improving my health?

Possibly. Some insurers offer premium discounts or allow for policy adjustments based on improved health conditions. You might need to provide updated medical information.

How often are life insurance premiums adjusted?

For term life insurance, premiums are usually fixed for the policy term. For whole life insurance, premiums are typically fixed but may be subject to adjustments in certain circumstances Artikeld in the policy contract.

What happens if I miss a premium payment?

Missing a premium payment can lead to a lapse in coverage. Most insurers offer a grace period, but if payment isn’t received within that period, your policy may be cancelled.

Do I need a medical exam to get life insurance?

This depends on the insurer and the amount of coverage you seek. Some insurers may offer simplified issue policies that don’t require a medical exam, while others may require a full medical examination for larger coverage amounts.