Understanding how insurance premiums are calculated can feel like navigating a maze. This guide demystifies the process, revealing the factors that influence the cost of your insurance and empowering you to make informed decisions. From understanding the base rate to the impact of your individual risk profile, we’ll break down the complexities of premium calculation, making it accessible to everyone.

We’ll explore the various components of an insurance premium, including base rates, risk factors, and administrative fees, and how these contribute to the final cost. Different insurance types, such as auto, home, and health, have unique calculation methods, which we will examine in detail. We will also show you how factors like your age, location, driving history, and even credit score can significantly impact your premium.

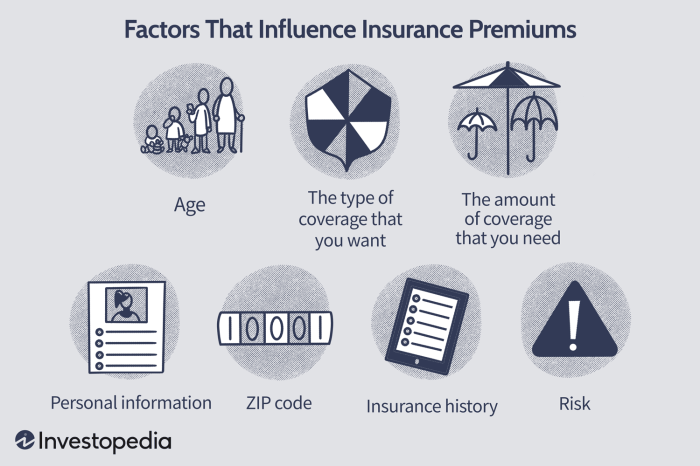

Factors Influencing Insurance Premiums

Insurance premiums, the price you pay for coverage, aren’t arbitrary figures. They’re carefully calculated based on a complex assessment of risk, aiming to balance the insurer’s potential payouts with the premiums collected. Understanding these factors can help you make informed decisions about your insurance choices.

Risk Assessment and Premium Calculation

The core of premium calculation is risk assessment. Insurers analyze various factors to determine the likelihood of a claim and the potential cost of that claim. Higher risk translates to higher premiums. This assessment involves statistical modeling, historical data analysis, and actuarial expertise to predict future claims. For example, a car model with a history of frequent accidents will likely have higher insurance premiums than a model with a strong safety record. The more likely an insurer is to pay out a claim, the higher the premium needs to be to cover those potential costs.

Demographic Factors Affecting Premiums

Demographics play a significant role in premium determination. Age is a key factor; younger drivers often pay more for car insurance due to higher accident rates, while older drivers may see premiums increase due to age-related health concerns. Location influences premiums due to variations in crime rates, weather patterns (e.g., higher premiums for homeowners in hurricane-prone areas), and the cost of healthcare. For instance, someone living in a high-crime urban area might pay more for home insurance than someone in a rural area with lower crime rates.

Lifestyle Choices and Insurance Premiums

Lifestyle choices can significantly impact insurance premiums across various types. For auto insurance, a history of speeding tickets or accidents leads to higher premiums. Similarly, smokers often pay higher health insurance premiums due to increased health risks. For home insurance, factors such as having a swimming pool (increasing liability risk) or owning certain breeds of dogs (potentially higher liability in case of bites) can influence premium costs. Safe driving habits, a healthy lifestyle, and home security measures can lead to lower premiums.

Premium Calculation Methods Across Insurance Types

Premium calculation methods vary across insurance types. Auto insurance premiums often consider factors like vehicle type, driving history, and location. Home insurance premiums take into account the value of the property, its location, and the level of coverage desired. Health insurance premiums are influenced by factors like age, health status, location, and the chosen plan. While the underlying principle of risk assessment remains consistent, the specific factors and weighting given to each factor differ significantly depending on the type of insurance.

Factors Influencing Insurance Premiums

| Factor | Auto Insurance | Home Insurance | Health Insurance |

|---|---|---|---|

| Age | Higher for younger drivers, potentially higher for older drivers | Generally lower for older homeowners with established credit | Significantly impacts premiums; generally increases with age |

| Location | Higher in areas with high accident rates or theft | Higher in high-risk areas (e.g., flood zones, areas prone to wildfires) | Premiums vary based on regional healthcare costs and provider networks |

| Driving/Health History | Accidents and violations increase premiums | Claims history impacts premiums | Pre-existing conditions and health history significantly impact premiums |

| Lifestyle Choices | Speeding tickets, DUI convictions | Pool ownership, dog breed | Smoking, unhealthy habits |

Understanding the Components of an Insurance Premium

An insurance premium, the amount you pay for coverage, isn’t a single, monolithic figure. It’s comprised of several key elements, each contributing to the final cost. Understanding these components allows for a more informed assessment of your insurance policy and its value.

The total premium is a culmination of various factors, primarily base rate calculations, individual risk assessments, and the insurer’s administrative overhead. These components interact to determine the price you ultimately pay.

Base Rates and Coverage Levels

Base rates represent the fundamental cost of insurance for a specific type of coverage. Insurers calculate these rates using statistical models that analyze historical claims data, considering factors such as the type of coverage (e.g., liability, collision, comprehensive), the insured item’s value (e.g., car value for auto insurance, home value for homeowner’s insurance), and the geographic location (considering factors like crime rates and weather patterns). For example, a base rate for liability coverage on a standard sedan in a low-risk area might be significantly lower than the base rate for a high-performance sports car in a high-risk urban area. Insurers also adjust base rates for different coverage levels. Higher coverage limits (e.g., higher liability limits) will generally result in higher base rates, reflecting the increased potential for larger payouts.

Risk Factors and Their Impact

Individual risk factors significantly influence the final premium. These factors are specific to the insured individual or item and can substantially modify the base rate. For auto insurance, factors such as age, driving history (accidents, tickets), credit score, and even the type of vehicle owned are considered. For homeowner’s insurance, factors like the age and condition of the home, security systems, and location all contribute to risk assessment. A driver with multiple accidents will likely face a higher premium than a driver with a clean record, reflecting the higher likelihood of future claims. Similarly, a home in a high-crime area may command a higher premium due to an increased risk of theft or damage.

Visual Representation of Premium Components

Imagine a pie chart. The largest slice represents the base rate, the fundamental cost of the insurance. A moderately sized slice represents the adjustments based on individual risk factors. The remaining, smaller slice represents administrative costs and other expenses. The sizes of these slices will vary depending on the type of insurance and the individual’s risk profile. For a low-risk individual with a standard policy, the base rate might be the largest portion. Conversely, for a high-risk individual, the risk factor portion could be more significant.

Administrative Costs and Expenses

The administrative portion of the premium covers the insurer’s operational expenses. This includes salaries for employees, marketing and advertising costs, claims processing fees, IT infrastructure maintenance, and regulatory compliance expenses. The size of this component is influenced by the insurer’s efficiency and operational structure. A highly efficient insurer might have a smaller administrative component compared to an insurer with higher operational costs.

Methods for Calculating Insurance Premiums

Insurance premium calculation is a complex process, relying heavily on actuarial science to balance risk assessment with affordability. Actuaries employ various statistical methods and models to predict future claims and set premiums accordingly. This ensures the insurer can meet its financial obligations while remaining competitive in the market.

Several actuarial methods are used, each with its strengths and weaknesses depending on the type of insurance and the data available. The choice of method often involves a combination of approaches to achieve the most accurate and reliable premium calculation.

Actuarial Methods Used in Premium Calculation

Actuarial methods aim to estimate the expected cost of claims for a specific group of insured individuals or objects. These methods utilize historical data, statistical modeling, and assumptions about future trends to project future claims. Common approaches include the chain ladder method for reserving, generalized linear models (GLMs) for analyzing claim frequency and severity, and various survival models to analyze the timing of claims. More sophisticated techniques incorporate machine learning algorithms to identify patterns and predict risk more accurately. The selection of the most appropriate method depends on factors such as data availability, the complexity of the risk, and the insurer’s specific needs.

A Simplified Premium Calculation Process for Auto Insurance

Let’s consider a simplified example of calculating an auto insurance premium. This example omits many factors for clarity, but it illustrates the fundamental principles involved.

We will assume a simplified model that considers only the driver’s age and driving history (accident claims in the past three years). This model ignores other significant factors such as vehicle type, location, and coverage levels.

- Determine Base Rate: The insurer starts with a base rate for a standard driver profile (e.g., a 30-year-old driver with a clean driving record). Let’s assume this base rate is $500 per year.

- Apply Age Factor: Younger drivers are statistically more likely to be involved in accidents, so an age factor is applied. For example, a 20-year-old driver might have an age factor of 1.5, increasing their base rate by 50% ($500 * 1.5 = $750).

- Apply Claims Factor: Drivers with a history of accidents will face a higher premium. If a driver has had one accident in the past three years, a claims factor of 1.2 might be applied, further increasing the premium ($750 * 1.2 = $900).

- Add Administrative Costs and Profit Margin: The insurer adds a percentage to cover administrative expenses, marketing, and profit. Let’s assume this adds 20% to the premium ($900 * 1.20 = $1080).

- Final Premium: The final calculated premium for this simplified example would be $1080 per year.

Comparison of Actuarial Models

Several actuarial models exist, each with its own strengths and weaknesses. For instance, GLMs are relatively easy to interpret and implement, making them suitable for many insurance applications. However, they may not capture complex interactions between risk factors as effectively as more sophisticated models. More advanced models like neural networks or Bayesian networks can capture non-linear relationships and interactions between variables, leading to more accurate predictions but at the cost of increased complexity and interpretability. The choice of model depends on the specific needs of the insurer, the data available, and the level of complexity that can be managed.

Discounts and Rate Adjustments

Insurance premiums aren’t static; they’re influenced by a variety of factors, and insurers frequently offer discounts or adjust rates based on individual circumstances. Understanding these adjustments is crucial for securing the most favorable premium possible. This section will explore common discounts, the impact of claims history and credit scores, and illustrate how these factors are incorporated into the final premium calculation.

Common Insurance Discounts

Many insurers offer discounts to incentivize safe driving and responsible behavior. These discounts can significantly reduce the overall cost of insurance. The availability and specifics of these discounts vary by insurer and policy.

- Safe Driving Discounts: These are often based on driving records, with a clean record resulting in substantial savings. For example, a driver with no accidents or moving violations in the past three to five years might qualify for a 10-20% discount. Some insurers even utilize telematics programs, which track driving habits via a device installed in the vehicle, offering discounts for safe driving behaviors like avoiding hard braking or speeding.

- Bundling Discounts: Insurers frequently provide discounts for bundling multiple insurance policies, such as auto and homeowners insurance, under a single provider. The discount can range from 5% to 25%, depending on the insurer and the policies bundled.

- Good Student Discounts: Students maintaining a certain GPA often qualify for discounts, reflecting the lower risk associated with responsible students.

- Anti-theft Device Discounts: Installing anti-theft devices in your vehicle can lead to a discount, as it reduces the risk of theft.

- Multi-car Discounts: Insuring multiple vehicles under the same policy often results in a discount for each additional vehicle.

Claims History Impact on Rates

An individual’s claims history is a significant factor in determining insurance premiums. A history of filing claims, especially for at-fault accidents, will generally lead to higher premiums. Conversely, a clean claims history often results in lower premiums. Insurers use sophisticated actuarial models to assess risk based on claims frequency and severity.

For example, a driver with two at-fault accidents in the past three years might see their premiums increase by 25-50%, or more, compared to a driver with a clean record. The increase is typically more significant for more severe accidents involving substantial damage or injuries. Conversely, a driver with no claims for five years might receive a significant discount.

Credit Score Influence on Premiums

In many states, insurance companies consider credit scores when determining premiums. The rationale is that individuals with better credit scores tend to be more responsible and less likely to file claims. This is a controversial practice, with some arguing that it unfairly penalizes individuals with poor credit unrelated to driving ability.

However, the practice is widespread. A lower credit score can result in significantly higher premiums, sometimes exceeding the cost savings from other discounts. For instance, a driver with a poor credit score might pay 20-40% more than a driver with excellent credit, even if their driving records are identical. The specific impact of credit scores varies by state and insurer.

Examples of Discount and Adjustment Calculations

Let’s consider an example: Assume a base premium of $1000. A driver receives a 10% safe driving discount, a 15% bundling discount, and a 5% good student discount. The calculations would be as follows:

Safe driving discount: $1000 * 0.10 = $100

Bundling discount: $1000 * 0.15 = $150

Good student discount: $1000 * 0.05 = $50

Total discount: $100 + $150 + $50 = $300

Final premium: $1000 – $300 = $700

Now, let’s say the same driver has a minor at-fault accident. The insurer might add a 15% surcharge. This would be calculated as:

Surcharge: $700 * 0.15 = $105

Revised premium: $700 + $105 = $805

This example demonstrates how multiple discounts and adjustments can interact to determine the final premium. The specific discounts and surcharges will vary depending on the insurer, policy, and individual circumstances.

Wrap-Up

Calculating insurance premiums is a multifaceted process, but understanding the key factors involved allows for better financial planning and informed choices. By understanding the influence of risk assessment, demographic factors, lifestyle choices, and policy details, you can actively work towards securing the most suitable and affordable insurance coverage. This guide serves as a foundation for navigating the complexities of insurance pricing, empowering you to make informed decisions that align with your individual needs and financial situation. Remember to always compare quotes from multiple insurers to ensure you’re getting the best value for your money.

Key Questions Answered

What is a base rate in insurance?

The base rate is the starting point for calculating your insurance premium. It’s determined by the insurer based on factors like the type of coverage and the average risk for a specific demographic group.

How do insurers use my credit score?

In many jurisdictions, insurers use credit scores as an indicator of risk. A higher credit score often correlates with a lower premium, reflecting a lower likelihood of claims.

Can I negotiate my insurance premium?

While you can’t directly negotiate the base rate, you can often negotiate discounts by bundling policies or by highlighting risk-reducing factors.

What is the difference between a deductible and a premium?

A premium is the regular payment you make to maintain your insurance coverage. A deductible is the amount you pay out-of-pocket before your insurance coverage kicks in.

How often are insurance premiums reviewed?

Insurance premiums are typically reviewed annually, and adjustments are made based on factors like claims history, changes in risk assessment, and market conditions.