High car insurance premiums can feel like a punch to the gut. Navigating the complex world of insurance rates often feels like deciphering a secret code. But what if we told you there are strategies, readily available and discussed openly on platforms like Reddit, that can help significantly lower your costs? This guide delves into the collective wisdom of online communities, expert advice, and practical techniques to help you understand and potentially reduce your insurance burden.

We’ll explore common reasons for high premiums, examining factors beyond your driving record, and uncovering hidden discounts you might be eligible for. We’ll then dive into the wealth of information shared on Reddit, analyzing successful strategies for negotiation, exploring alternative insurance options, and improving your driving habits to lower your risk profile. By the end, you’ll have a comprehensive toolkit to tackle those high premiums head-on.

Understanding High Insurance Premiums

High car insurance premiums can be frustrating, but understanding the factors involved can help you manage your costs. Several interconnected elements contribute to the final price you see on your policy, and it’s not always simply a reflection of your driving record.

Many factors contribute to the calculation of your car insurance premium. These factors are analyzed by insurance companies using sophisticated algorithms to assess risk. A higher perceived risk translates to a higher premium.

Common Reasons for High Car Insurance Premiums

Several common factors significantly impact the cost of your car insurance. These include your driving history, the type of vehicle you drive, your location, and your age and credit score. Insurance companies use statistical data to identify patterns and trends that predict the likelihood of accidents and claims.

- Driving History: Accidents, tickets, and claims significantly raise premiums. Multiple at-fault accidents, especially those involving serious injuries or property damage, will substantially increase your rates. Similarly, frequent speeding tickets or other moving violations demonstrate a higher risk profile.

- Vehicle Type: The make, model, and year of your car impact insurance costs. Sports cars and luxury vehicles are often more expensive to insure due to their higher repair costs and greater potential for theft. Conversely, older, less expensive vehicles typically have lower premiums. Safety features also play a role; cars with advanced safety technology may receive discounts.

- Location: Where you live significantly influences your premiums. Areas with high crime rates, frequent accidents, or higher rates of theft generally have higher insurance costs. This is because insurance companies assess the risk of claims based on geographical data.

- Age and Credit Score: Younger drivers, statistically, have a higher accident rate, leading to higher premiums. This is often offset by discounts available to those who maintain good grades or complete driver’s education courses. Surprisingly, credit scores are also often considered, as studies suggest a correlation between creditworthiness and insurance claims.

Factors Influencing Insurance Costs Beyond Driver History

While driving history is a major factor, many other aspects contribute to your premium. These factors often go beyond your direct control, but understanding them can help you make informed decisions.

- Coverage Levels: Choosing higher coverage limits (liability, collision, comprehensive) will increase your premium. While this provides greater financial protection, it also increases the insurer’s potential payout.

- Deductibles: A higher deductible (the amount you pay out-of-pocket before your insurance kicks in) will generally lower your premium. However, this means you’ll pay more in the event of a claim.

- Add-on Features: Adding features like roadside assistance or rental car reimbursement will increase your premium, but offer additional benefits.

Insurance Discounts and Qualification

Many insurance companies offer various discounts to reduce premiums. These discounts incentivize safe driving practices and responsible financial behavior.

- Good Student Discount: Maintaining a high GPA often qualifies students for a discount. The specific requirements vary by insurer.

- Defensive Driving Course Discount: Completing a state-approved defensive driving course demonstrates a commitment to safe driving and can lower premiums.

- Bundling Discounts: Insuring multiple vehicles or combining auto and home insurance with the same company often results in discounts.

- Anti-theft Device Discount: Installing anti-theft devices in your vehicle can significantly reduce your premium as it lowers the risk of theft.

- Safe Driver Discount: Many insurers offer discounts for drivers with clean driving records over a specified period, often rewarding accident-free driving.

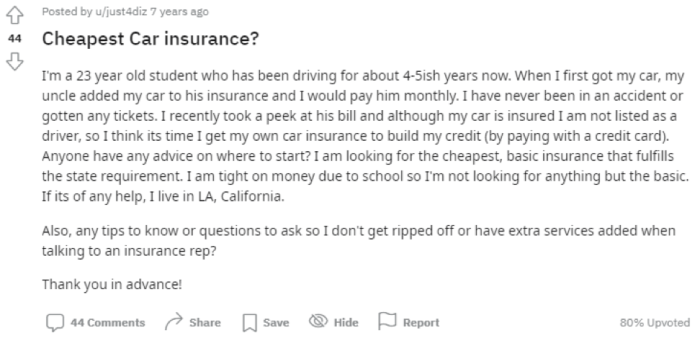

Reddit Discussions on Insurance Savings

Reddit offers a wealth of user-generated content regarding insurance, providing a valuable platform for sharing strategies and experiences related to lowering insurance costs. Many threads delve into practical tips, personal anecdotes, and comparisons of different insurance providers and policies. Analyzing these discussions reveals common themes and successful approaches to reducing premiums.

Reddit users frequently discuss various methods for decreasing insurance premiums. These strategies often involve a combination of proactive steps and careful research. The effectiveness of each method varies depending on individual circumstances and the specific insurance provider.

Common Strategies for Lowering Insurance Costs

Many Reddit threads highlight several common strategies for reducing insurance premiums. These approaches frequently involve increasing deductibles, bundling insurance policies, improving credit scores, and shopping around for better rates. Users often share their experiences with specific companies and policies, allowing for a comparative analysis of different approaches.

Examples of Successful Methods

One frequently cited success story involves a user who significantly lowered their auto insurance premium by bundling their car and home insurance with the same provider. This resulted in a discount of approximately 15%, a considerable saving over the course of a year. Another example showcases a user who improved their credit score, leading to a reduction in their insurance premiums. This illustrates the importance of financial responsibility and its impact on insurance costs. A third example highlights the benefits of shopping around. A user found a significantly lower rate with a different insurer, despite having the same coverage. This underscores the importance of comparing quotes from multiple providers.

Comparison of Different Approaches

While increasing deductibles is a common strategy to lower premiums, it’s crucial to weigh the potential savings against the increased out-of-pocket expenses in the event of a claim. Bundling policies often leads to discounts, but it might limit the flexibility of choosing different providers for different types of insurance. Improving credit scores is a long-term strategy, requiring consistent financial management, but it can lead to substantial savings over time. Finally, actively shopping around requires time and effort, but it can yield the best rates available. The optimal approach depends on individual risk tolerance, financial situation, and priorities.

Improving Driving Habits and Safety

High insurance premiums are often directly linked to driving history. A clean driving record significantly impacts the cost of your insurance, while accidents and violations can lead to substantial increases. Understanding how your driving habits affect your premiums is crucial for saving money.

Your driving record is a major factor in determining your insurance rates. Insurance companies use a points system to assess risk; each accident or moving violation adds points, increasing your premium. Serious offenses like DUI or reckless driving result in the most significant increases. Maintaining a clean record is the most effective way to keep your premiums low. Conversely, a history of accidents or violations demonstrates higher risk to the insurer, resulting in higher premiums.

Defensive Driving Techniques and Lower Insurance Costs

Defensive driving techniques significantly reduce the likelihood of accidents, a key factor in determining insurance rates. By anticipating potential hazards and reacting proactively, defensive drivers minimize risky situations. This proactive approach translates into fewer accidents and claims, leading to lower premiums over time. Examples of defensive driving techniques include maintaining a safe following distance, obeying traffic laws strictly, and being aware of blind spots. Many insurance companies even offer discounts for completing defensive driving courses, further incentivizing safe driving practices.

Safety Features Impacting Insurance Rates

Several vehicle safety features can influence insurance rates. Insurance companies recognize that vehicles equipped with these features pose a lower risk of accidents and injuries. Therefore, incorporating these safety features can lead to lower premiums.

- Anti-lock Braking Systems (ABS): ABS helps prevent wheel lockup during braking, improving vehicle control and reducing the likelihood of accidents.

- Electronic Stability Control (ESC): ESC helps maintain vehicle stability during sudden maneuvers, reducing the risk of skidding and rollovers.

- Airbags: Airbags significantly reduce the severity of injuries in accidents, leading to lower medical costs for insurance companies.

- Backup Cameras: Backup cameras reduce the risk of low-speed collisions, particularly in parking lots.

- Forward Collision Warning (FCW) and Automatic Emergency Braking (AEB): These systems can help prevent or mitigate collisions, significantly reducing accident rates.

Final Summary

Successfully navigating the world of car insurance premiums requires a proactive approach. By understanding the factors that influence your rates, leveraging online resources like Reddit, and employing effective negotiation tactics, you can significantly reduce your costs. Remember, it’s not just about finding the cheapest policy; it’s about finding the right balance of coverage and affordability. This guide equips you with the knowledge and strategies to achieve that balance, empowering you to take control of your insurance spending and secure the best possible rates.

Expert Answers

What if I have multiple violations on my record?

Multiple violations significantly impact premiums. Focus on defensive driving, consider driver’s education courses to potentially reduce future increases, and be transparent with insurers about your driving history during the application process.

Can I get insurance without a driving history?

Yes, but expect higher premiums. Insurers assess risk based on limited data. Consider starting with a high-risk insurer or a policy with limited coverage and building a clean driving record to gradually improve your rates.

How often should I shop around for insurance?

At least annually. Rates change frequently, and your circumstances (marriage, new job, etc.) can affect your eligibility for better deals. Regularly comparing quotes from multiple providers ensures you’re getting the best value.

What is a telematics program and how does it help?

Telematics uses a device in your car to track your driving habits. Safe driving is often rewarded with lower premiums. It’s a way to demonstrate responsible driving and potentially save money.