The cost of insurance is a significant financial consideration for most individuals and businesses. Understanding how much your insurance premium will be involves navigating a complex web of factors, from your age and driving history to the type of coverage you choose and even your location. This guide aims to demystify the process, providing you with the knowledge to make informed decisions about your insurance needs and secure the best possible rates.

We’ll explore the key elements influencing premium calculations, providing practical examples and actionable strategies to help you manage your insurance costs effectively. From obtaining quotes and understanding policy components to saving money and selecting convenient payment options, we’ll cover all the essential aspects of determining and controlling your insurance premium expenses.

Factors Influencing Insurance Premiums

Understanding the factors that determine your insurance premiums is crucial for making informed decisions about your coverage. Several key elements contribute to the final cost, and being aware of them can help you manage your expenses effectively. This section will explore these factors in detail, providing examples and strategies for mitigation.

Age and Insurance Premiums

Age significantly impacts insurance premiums across various types. For car insurance, younger drivers (typically under 25) generally pay higher premiums due to statistically higher accident rates. As drivers age and gain experience, their premiums usually decrease. Similarly, health insurance premiums often increase with age, reflecting the higher likelihood of needing medical care. Life insurance premiums are typically lowest for younger, healthier individuals and increase with age due to increased risk of mortality. Conversely, long-term care insurance premiums are usually lower for younger individuals and increase substantially with age, reflecting the rising probability of needing care.

Driving History and Car Insurance

A clean driving record translates to lower car insurance premiums. Accidents, traffic violations (speeding tickets, reckless driving), and DUI convictions significantly increase premiums. Insurance companies use a points system to assess risk, with more points leading to higher premiums. For example, a single at-fault accident could increase premiums by 20-40%, while multiple incidents can lead to even steeper increases or policy cancellation. Maintaining a clean driving record is the most effective mitigation strategy.

Coverage Levels and Premium Differences

Different coverage levels directly impact insurance costs. Liability-only coverage, which protects against claims from others involved in an accident, is generally the cheapest. Adding collision coverage (which covers damage to your vehicle in an accident regardless of fault) and comprehensive coverage (which covers damage from events other than collisions, such as theft or weather) increases premiums significantly. For instance, a policy with only liability coverage might cost $500 annually, while adding collision and comprehensive could increase the cost to $1200 or more, depending on factors like the vehicle’s value and location.

Health Conditions and Health Insurance Premiums

Pre-existing health conditions can significantly influence health insurance premiums. Individuals with conditions requiring ongoing treatment or medication may face higher premiums compared to those in good health. For example, someone with diabetes or heart disease might pay more than someone without these conditions. The Affordable Care Act (ACA) in the United States aims to mitigate this impact by preventing insurers from denying coverage based solely on pre-existing conditions, although premiums may still reflect the higher risk.

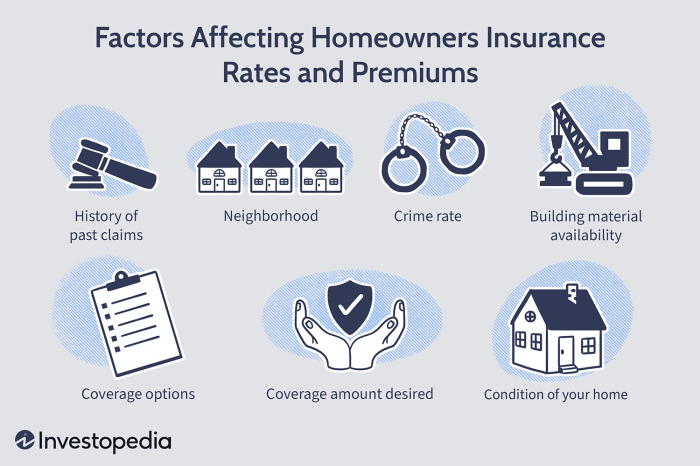

Location and Insurance Premium Rates

Geographic location plays a considerable role in determining insurance premiums. Areas with high crime rates, frequent accidents, or natural disaster risks usually have higher premiums for various types of insurance. For example, car insurance in a densely populated urban area with a high accident rate will generally be more expensive than in a rural area with fewer accidents. Similarly, homeowners insurance in areas prone to hurricanes or wildfires will be more expensive than in areas with lower risk.

Factors Influencing Insurance Premiums

| Factor | Impact on Premium | Example | Mitigation Strategies |

|---|---|---|---|

| Age | Generally increases with age for some types (health, long-term care), decreases with age for others (car). | A 20-year-old driver pays more for car insurance than a 50-year-old; a 65-year-old pays more for health insurance than a 30-year-old. | Maintain good health, shop around for different policies, consider bundled insurance. |

| Driving History | Accidents and violations increase premiums. | An at-fault accident can increase car insurance premiums by 20-40%. | Safe driving practices, defensive driving courses. |

| Coverage Levels | Higher coverage levels mean higher premiums. | Liability-only coverage is cheaper than liability plus collision and comprehensive. | Carefully evaluate your needs and choose the appropriate coverage level. |

| Health Conditions | Pre-existing conditions can increase health insurance premiums. | Individuals with diabetes may pay higher premiums than those without. | Maintain a healthy lifestyle, explore different health insurance plans. |

| Location | High-risk areas have higher premiums. | Car insurance in a city with high accident rates is more expensive than in a rural area. | Consider moving to a lower-risk area (if possible). |

Obtaining Insurance Premium Quotes

Securing the best insurance premium involves understanding the quoting process and effectively comparing offers from various providers. This section details how to obtain quotes for car and life insurance, compares different methods, and offers tips for a successful comparison.

Getting Car Insurance Quotes Online

The online process for obtaining a car insurance quote is generally straightforward. Most major insurers have user-friendly websites. Typically, you’ll begin by entering basic information about yourself, your vehicle, and your driving history. This might include your age, address, driving license number, vehicle details (make, model, year), and your claims history. The system will then generate a preliminary quote based on this information. You may be asked further questions to refine the quote, such as your preferred coverage levels (liability, collision, comprehensive) and any discounts you might be eligible for (e.g., good driver discount, multi-car discount). Remember to thoroughly review the details of the quote before proceeding.

Information Requested for Life Insurance Quotes

Obtaining a life insurance quote requires providing more comprehensive personal information than car insurance. Insurers need a detailed picture of your health and lifestyle to assess your risk. Expect to provide details such as your age, gender, health history (including pre-existing conditions), occupation, lifestyle habits (smoking, alcohol consumption), and family medical history. You may also be asked to complete a medical questionnaire or undergo a medical examination, depending on the policy amount and type of life insurance. The insurer uses this information to determine your risk profile and calculate your premium.

Comparing Quotes from Different Insurance Providers

Several methods exist for obtaining quotes from different insurers. You can visit each insurer’s website individually, call them directly, or use an online comparison tool. Online comparison tools aggregate quotes from multiple providers, allowing you to easily compare prices and coverage options side-by-side. However, it’s crucial to verify the information provided by these tools with the insurers themselves, as some details might be simplified or omitted. Directly contacting insurers allows for personalized attention and the opportunity to clarify any uncertainties. A combination of online comparison tools and direct contact can be the most effective approach.

Tips for Comparing Insurance Quotes Effectively

Comparing insurance quotes effectively requires careful attention to detail. Don’t solely focus on the premium amount; ensure you understand the coverage provided. Compare similar coverage levels across different providers. Read the policy documents carefully to understand exclusions and limitations. Consider factors beyond price, such as the insurer’s reputation, customer service, and claims handling process. Look for reviews and ratings from independent sources. Remember that the cheapest quote isn’t always the best option if the coverage is insufficient or the insurer’s reputation is questionable.

Securing the Most Competitive Insurance Premium: A Step-by-Step Guide

- Gather Your Information: Compile all necessary personal and vehicle information (for car insurance) or personal and health information (for life insurance).

- Use Online Comparison Tools: Leverage online comparison websites to get preliminary quotes from multiple insurers.

- Contact Insurers Directly: Follow up with insurers whose quotes interest you to clarify details and discuss specific coverage needs.

- Compare Coverage and Premiums: Carefully compare the coverage offered by each insurer, not just the premium amount. Look for exclusions and limitations.

- Review Policy Documents: Thoroughly read the policy documents before making a decision. Understand what is and isn’t covered.

- Check Insurer Ratings and Reviews: Research the insurer’s reputation and customer service record.

- Negotiate: Don’t hesitate to negotiate with insurers, particularly if you have a clean driving record or good health history.

- Consider Bundling: Explore bundling options if you need multiple types of insurance (e.g., car and home insurance).

- Choose the Best Fit: Select the policy that offers the best balance of coverage, price, and insurer reputation.

Saving Money on Insurance Premiums

Securing affordable insurance is a priority for many. This section explores various strategies to significantly reduce your insurance premiums, whether for your car or home, ultimately saving you money. By understanding the factors influencing premiums and implementing smart choices, you can tailor your insurance coverage to fit your budget without compromising essential protection.

Lowering Car Insurance Premiums for Young Drivers

Young drivers often face higher insurance premiums due to perceived higher risk. However, several strategies can help mitigate these costs. Maintaining a clean driving record is paramount; accidents and traffic violations significantly increase premiums. Consider taking a defensive driving course; many insurers offer discounts for completing such programs, demonstrating a commitment to safe driving practices. Choosing a less powerful car can also lead to lower premiums, as insurers assess risk based on vehicle type and performance capabilities. Finally, opting for a higher deductible can result in lower premiums, though it means a larger out-of-pocket expense in the event of a claim. Remember to compare quotes from multiple insurers to find the most competitive rates.

Reducing Home Insurance Costs Through Preventative Measures

Home insurance premiums are influenced by factors within your control. Implementing preventative measures can significantly reduce your risk profile and, consequently, your premiums. Installing security systems, such as alarms and security cameras, often qualifies for discounts. Regular maintenance, including roof inspections and plumbing checks, demonstrates responsible homeownership and minimizes the likelihood of costly claims. Upgrading to fire-resistant roofing materials can also lower premiums, as it reduces the risk of fire damage. Similarly, installing smoke detectors and carbon monoxide detectors is crucial for safety and can result in lower premiums. Finally, keeping detailed records of your home’s improvements and valuable possessions can help in the event of a claim and might influence premium calculations.

Comparing Different Insurance Policy Options

Different insurance policies offer varying levels of coverage and consequently, different premiums. Understanding the nuances of each policy type is key to finding the most cost-effective option. A higher deductible, while increasing your out-of-pocket expense in case of a claim, generally leads to lower premiums. Conversely, comprehensive coverage, offering broader protection, typically comes with a higher premium. Liability-only coverage, offering the minimum legal protection, is the least expensive but leaves you vulnerable to significant financial losses in case of an accident. Carefully weigh the benefits of each policy type against your financial capabilities and risk tolerance. Consider your individual needs and circumstances to determine the optimal balance between coverage and cost. For example, a driver with an older car might opt for lower liability coverage, while someone with a newer, more expensive car would benefit from comprehensive coverage despite the higher premium.

Benefits of Bundling Insurance Policies

Bundling your home and auto insurance policies with the same insurer often results in significant savings. Insurers frequently offer discounts for bundling, recognizing the reduced administrative costs and increased customer loyalty. This strategy streamlines the payment process and simplifies policy management, making it a convenient and cost-effective option. The specific discount offered varies by insurer and policy type, but it can amount to a substantial reduction in your overall insurance costs. For example, a family bundling their home, auto, and even renter’s insurance might see a combined discount of 15-25%, resulting in hundreds of dollars saved annually.

Increasing Your Deductible’s Effect on Your Premium

Your deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. Increasing your deductible, even by a small amount, can significantly lower your premium. This is because a higher deductible shifts more of the financial risk to you, reducing the insurer’s potential payout. However, it’s crucial to carefully consider your financial situation before increasing your deductible. Ensure you can comfortably afford the higher out-of-pocket expense in case of a claim. For instance, increasing your car insurance deductible from $500 to $1000 might result in a 10-15% reduction in your premium, a substantial saving over the long term, provided you can manage the higher deductible.

Insurance Premium Payment Options

Choosing the right payment method for your insurance premiums can significantly impact your financial planning and overall experience. Understanding the various options and their associated advantages and disadvantages is crucial for efficient and stress-free premium management. This section Artikels several common payment methods, highlighting their pros and cons and addressing the implications of late payments.

Available Payment Methods

Several methods are typically available for paying insurance premiums, each with its own set of benefits and drawbacks. These commonly include:

- Mail: This traditional method involves sending a check or money order through the postal service. It’s simple for those who prefer physical transactions but can be slow and lacks immediate confirmation of payment.

- Online Payment Portals: Many insurers offer secure online portals where you can pay using a debit card, credit card, or electronic bank transfer. This method is generally convenient, fast, and provides immediate confirmation.

- Phone Payments: Some insurers allow premium payments over the phone using a credit or debit card. This is convenient for those who prefer not to use online portals, but it might require additional security verification.

- In-Person Payments: Certain insurers allow in-person payments at their offices or designated payment locations. This option provides immediate confirmation and can be useful for those who are uncomfortable with online or phone transactions. However, it requires travelling to a physical location.

- Automatic Payments (Electronic Funds Transfer): This method involves setting up recurring automatic payments from your bank account. It’s highly convenient, ensuring timely payments and avoiding late fees.

Comparison of Payment Methods

The table below summarizes the advantages and disadvantages of each payment method:

| Payment Method | Advantages | Disadvantages |

|---|---|---|

| Simple, familiar | Slow, no immediate confirmation, risk of lost mail | |

| Online Portal | Convenient, fast, immediate confirmation, secure | Requires internet access |

| Phone Payment | Convenient for those without online access | May require additional security verification |

| In-Person Payment | Immediate confirmation, suitable for those uncomfortable with online transactions | Requires travel to a physical location |

| Automatic Payments | Highly convenient, ensures timely payments, avoids late fees | Requires setting up recurring payments, potential for errors if bank details change |

Consequences of Late or Missed Payments

Late or missed premium payments can result in several serious consequences, including:

- Late Payment Fees: Insurers typically charge late payment fees, adding extra costs to your premiums.

- Policy Cancellation: Repeated late payments can lead to your insurance policy being cancelled, leaving you without coverage.

- Impact on Credit Score: Late payments may be reported to credit bureaus, negatively impacting your credit score.

- Difficulty Obtaining Future Coverage: A poor payment history can make it harder and more expensive to obtain insurance coverage in the future.

Setting Up Automatic Payments

Setting up automatic payments usually involves providing your bank account details and authorizing recurring payments through your insurer’s online portal or by contacting their customer service department. The specific process will vary depending on the insurer, but generally involves verifying your identity and confirming your payment details. It’s essential to regularly review your automatic payment settings to ensure accuracy and prevent any issues. For example, you may need to update your bank account information if you switch banks.

Final Summary

Securing affordable and appropriate insurance coverage is a crucial aspect of financial planning. By understanding the factors that influence premiums, actively comparing quotes, and implementing cost-saving strategies, you can effectively manage your insurance expenses. Remember, proactive planning and informed decision-making are key to obtaining the best value for your insurance needs. Don’t hesitate to seek professional advice if you require further assistance in navigating the complexities of insurance pricing.

FAQ Explained

What is a deductible, and how does it affect my premium?

A deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. A higher deductible generally results in a lower premium, as you’re assuming more of the risk.

Can I get insurance quotes without providing my personal information?

While some basic information is usually required to get a preliminary estimate, you can often obtain a general range of quotes without providing highly sensitive details upfront. Full quotes, however, require more comprehensive information.

What happens if I miss an insurance premium payment?

Missing payments can lead to late fees, suspension of coverage, and even policy cancellation. It’s crucial to establish a reliable payment method and ensure timely payments to maintain continuous coverage.

How often are insurance premiums typically reviewed?

The frequency of premium reviews varies depending on the type of insurance and the insurer. Some policies are reviewed annually, while others may be reviewed less frequently.

Are there any government programs that can help with insurance costs?

Yes, depending on your location and circumstances, government programs such as Medicaid (health insurance) and subsidized housing programs (homeowners insurance) may be available to assist with insurance costs.