Securing a mortgage can be a daunting process, and understanding the associated costs is crucial. One significant expense for borrowers utilizing an FHA loan is the FHA Mortgage Insurance Premium (MIP). This guide delves into the intricacies of MIP, exploring its calculation, payment structure, and potential for cancellation. We’ll demystify the process, providing you with the knowledge to confidently navigate this aspect of homeownership.

From the upfront premium paid at closing to the ongoing annual premium included in your monthly mortgage payment, we’ll examine the factors influencing MIP costs, including loan amount, credit score, and loan-to-value ratio. We’ll also compare FHA MIP to private mortgage insurance (PMI), helping you make informed decisions about your financing options.

FHA Mortgage Insurance Premium (MIP) Basics

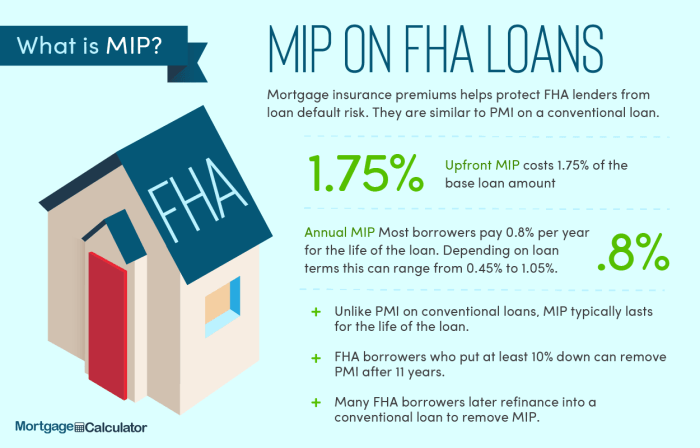

The Federal Housing Administration (FHA) insures mortgages, reducing the risk for lenders and making homeownership more accessible to borrowers who may not otherwise qualify for a conventional loan. A key component of FHA loans is the FHA Mortgage Insurance Premium (MIP), a fee paid by the borrower to protect the lender against potential losses.

FHA MIP Types

FHA MIP consists of two main components: an upfront MIP and an annual MIP. Understanding the difference between these two is crucial for budgeting and planning your home purchase.

Upfront MIP Calculation

The upfront MIP is a one-time fee paid at closing. It’s typically calculated as 1.75% of the base loan amount. For example, on a $300,000 loan, the upfront MIP would be $5,250 ($300,000 x 0.0175). This fee can be financed into the loan, increasing the overall loan amount.

Annual MIP Calculation

Annual MIP is an ongoing insurance payment added to your monthly mortgage payment. The annual MIP rate varies depending on the loan term and other factors, but it’s generally expressed as a percentage of the remaining loan balance. This is paid monthly.

Examples of MIP Amounts

The following table illustrates examples of MIP amounts for different loan amounts and credit scores. Note that these are examples and actual amounts may vary based on specific loan terms and the lender’s policies. A higher credit score may result in slightly different rates in some cases, although the impact is minimal on the upfront MIP.

| Loan Amount | Credit Score (Illustrative) | Upfront MIP (1.75%) | Annual MIP (Example Rate – 0.85% *This is an example and actual rates vary*) |

|---|---|---|---|

| $200,000 | 700 | $3,500 | $141.67 (approx. monthly) |

| $300,000 | 750 | $5,250 | $212.50 (approx. monthly) |

| $400,000 | 680 | $7,000 | $283.33 (approx. monthly) |

| $500,000 | 720 | $8,750 | $354.17 (approx. monthly) |

Factors Affecting FHA MIP Cost

Several key factors influence the cost of FHA mortgage insurance premiums (MIP). Understanding these factors is crucial for borrowers to accurately estimate their overall mortgage costs and make informed decisions. These factors interact to determine the final MIP amount, and changes in any one of them can significantly impact the total cost.

Loan-to-Value Ratio (LTV) Impact on MIP

The loan-to-value ratio (LTV) is a significant determinant of your FHA MIP. The LTV is calculated by dividing the loan amount by the appraised value of the property. A higher LTV indicates a larger loan relative to the property’s value, representing a higher risk for the lender. Consequently, a higher LTV generally results in a higher MIP. For example, a borrower with an 80% LTV will typically pay a lower MIP than a borrower with a 95% LTV. The MIP is typically higher for loans with LTVs above 90%, reflecting the increased risk to the FHA insurance fund.

Loan Term’s Influence on Total MIP Paid

The length of the loan term directly impacts the total MIP paid over the life of the loan. A longer loan term (e.g., 30 years) will naturally result in higher total MIP payments compared to a shorter term (e.g., 15 years), even if the monthly MIP payment remains the same. This is because the MIP is paid for a longer duration. For instance, a borrower with a 30-year loan will pay MIP for 30 years, while a borrower with a 15-year loan will pay for only 15 years, significantly reducing their total MIP costs.

MIP Costs for Different FHA Loan Types

The FHA offers various loan programs, each potentially having different MIP requirements. While the core MIP structure remains similar, specific details may vary depending on the type of loan. For example, a standard FHA loan might have different MIP requirements compared to an FHA 203(k) rehabilitation loan, which is designed for home improvements. Variations might also exist based on the borrower’s credit score or other qualifying factors. It’s crucial to consult current FHA guidelines and work with a mortgage professional to determine the precise MIP for the chosen loan type.

MIP Payment Structure and Timing

Understanding the payment structure and timing of your FHA mortgage insurance premium (MIP) is crucial for budgeting and financial planning. This section details the payment schedule for both the upfront and annual MIP, clarifying how and when these payments are made.

The FHA MIP is comprised of two main components: an upfront MIP paid at closing and an annual MIP paid monthly as part of your mortgage payment. Both components contribute to the overall cost of your FHA loan.

Upfront MIP Payment

The upfront MIP is a one-time payment, typically equal to 1.75% of the base loan amount. This payment can be paid at closing or financed into the loan amount. Choosing to finance the upfront MIP increases your overall loan amount and, consequently, your monthly payments. However, it avoids the need for a larger upfront cash outlay at closing. If financed, the upfront MIP is added to the principal loan balance, meaning you pay interest on this amount over the life of the loan.

Annual MIP Payment

The annual MIP is paid monthly as part of your regular mortgage payment. The exact amount varies depending on factors like the loan amount, loan term, and the type of loan. This is calculated as a percentage of the outstanding loan balance and is included in your total monthly mortgage payment. Unlike the upfront MIP, the annual MIP is ongoing for the life of the loan if you have a loan with a down payment less than 10%. For loans with a down payment of 10% or more, the annual MIP is typically eliminated after 11 years.

Step-by-Step MIP Payment Process

A step-by-step guide to understanding the MIP payment process helps clarify the timeline and financial implications.

- Loan Application and Approval: During the loan application process, the lender will determine your eligibility for an FHA loan and calculate both the upfront and annual MIP amounts.

- Upfront MIP Payment (at Closing or Financed): At closing, you will either pay the upfront MIP directly or choose to finance it into the loan. If financed, this amount will be added to your loan’s principal balance.

- Annual MIP Payment (Monthly): Your monthly mortgage payment will include the annual MIP, which is a percentage of your outstanding loan balance. This is typically paid along with your principal and interest payment.

- Ongoing Payments: Annual MIP payments continue monthly throughout the loan term, unless you have a loan with a down payment of 10% or more. In that case, the annual MIP will be canceled after 11 years.

- Loan Payoff: Upon loan payoff, all MIP payments will have been made, completing the payment process.

MIP Cancellation or Removal

Understanding the conditions under which FHA mortgage insurance premiums (MIP) can be canceled is crucial for homeowners. While MIP is typically a long-term commitment, there are circumstances that allow for its removal or cancellation, potentially saving borrowers significant sums of money over the life of their loan. This section details those conditions and the process involved.

Conditions for MIP Cancellation

FHA MIP cancellation primarily depends on the type of loan and the loan-to-value (LTV) ratio. For loans with a 10% down payment or more, the annual MIP is typically canceled once the borrower reaches 20% equity in the home. This usually occurs through paying down the principal balance, appreciation of the home’s value, or a combination of both. For loans with less than 10% down payment, the annual MIP remains in effect for the entire life of the loan, unless refinancing occurs with a different loan type that does not require MIP. It’s important to note that these are general guidelines, and specific requirements may vary depending on the year the loan was originated.

Process for Removing Annual MIP

Removing annual MIP typically involves reaching the required equity threshold. Once this threshold is met, the borrower should contact their mortgage servicer to initiate the cancellation process. This often requires providing documentation, such as a recent appraisal showing the increased home value, to verify the LTV ratio. The servicer will then process the request and remove the annual MIP from future payments. The exact timeline for processing varies by lender. It is advisable to proactively check in with your lender about the possibility of MIP cancellation and understand the required steps and timeframe.

Examples of Early MIP Cancellation

Several scenarios can lead to early MIP cancellation. For instance, a homeowner who made significant principal payments, perhaps through refinancing or accelerated payments, might reach the 20% equity threshold faster. Alternatively, a rapid increase in home values in a specific market could also boost equity quickly. Consider a homeowner who purchased a home in 2020 with a 10% down payment and a loan amount of $300,000. In 2023, a home appraisal shows the value increased to $400,000. This increased equity may allow them to request MIP cancellation from their lender. Another example would be a homeowner refinancing their FHA loan into a conventional loan, thereby eliminating the FHA requirement for MIP altogether.

Flowchart Illustrating MIP Cancellation Process

The process of MIP cancellation can be visualized in a flowchart:

[Start] –> [Reach 20% Equity (or refinance to a non-FHA loan)] –> [Contact Mortgage Servicer] –> [Provide Documentation (Appraisal, etc.)] –> [Servicer Reviews Documentation] –> [MIP Cancellation Approved/Denied] –> [MIP Removed from Payments/Further Action Required] –> [End]

Final Conclusion

Understanding FHA Mortgage Insurance Premiums is vital for anyone considering an FHA loan. While the initial and ongoing costs may seem complex, this guide has provided a clear framework for comprehension. By understanding the factors influencing MIP and the various payment structures, prospective homeowners can accurately budget for their home purchase and navigate the process with confidence. Remember to consult with a mortgage professional for personalized guidance tailored to your specific financial situation.

Detailed FAQs

What happens if I refinance my FHA loan? Does the MIP go away?

Refinancing an FHA loan may change your MIP. If you refinance into another FHA loan, you’ll likely have a new MIP calculation based on your new loan amount and terms. It won’t automatically disappear.

Can I pay off my FHA loan early to avoid further MIP payments?

Paying off your FHA loan early will stop future annual MIP payments. However, the upfront MIP is generally non-refundable.

Is the annual MIP fixed or does it change over time?

The annual MIP rate can change based on market conditions and FHA guidelines, though it’s usually fixed for the life of the loan unless you refinance.

What if my credit score improves after I get the FHA loan? Can my MIP be adjusted?

Unfortunately, improving your credit score after obtaining the FHA loan generally won’t result in a reduction of your MIP.

How is the upfront MIP calculated, exactly?

The upfront MIP is calculated as a percentage of the loan amount. The percentage varies depending on the loan type and the loan-to-value ratio (LTV).