Understanding insurance premiums is crucial for responsible financial planning. The cost of insurance, often a significant household expense, varies dramatically based on numerous factors. This guide delves into the intricacies of insurance premium calculations, exploring the key elements that influence the final price you pay. From age and driving history to the type of coverage and your location, we’ll unravel the complexities and empower you to make informed decisions.

We will examine various insurance types, comparing premiums across different categories and age groups. We’ll also provide practical strategies for reducing your premium costs, including tips on improving your driving habits, bundling policies, and maintaining a good credit score. By the end of this guide, you’ll have a solid understanding of how much an insurance premium might cost you and how to navigate the process of securing affordable, adequate coverage.

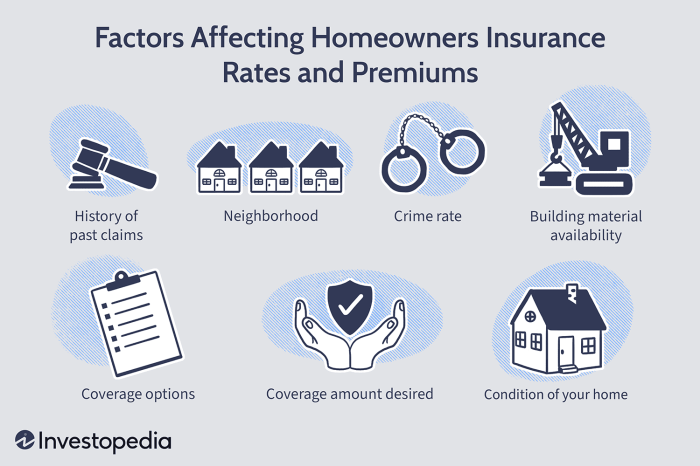

Factors Influencing Insurance Premiums

Insurance premiums, the cost you pay for coverage, aren’t arbitrary numbers. Several interconnected factors influence the final price, creating a personalized calculation for each policyholder. Understanding these factors can help you make informed decisions about your insurance choices and potentially lower your costs.

Age and Insurance Premiums

Age significantly impacts insurance premiums, particularly for car insurance. Younger drivers, typically those under 25, are statistically more likely to be involved in accidents due to inexperience and risk-taking behavior. Insurance companies reflect this increased risk by charging higher premiums. As drivers age and gain experience, their premiums generally decrease, reaching their lowest point in middle age. This reflects the lower accident probability associated with more experienced drivers. However, premiums may slightly increase again in later years due to potential health concerns affecting driving ability.

Driving History and Premium Calculations

Your driving history is a critical factor in determining your insurance premium. A clean driving record with no accidents or traffic violations will result in lower premiums. Conversely, accidents, speeding tickets, or DUI convictions significantly increase your premiums. The severity of the offense and the frequency of incidents directly correlate with the premium increase. Insurance companies use a points system to track these infractions, leading to higher premiums for those with more points.

Car Model and Premium Differences

The make and model of your vehicle significantly influence your insurance premium. Luxury cars and high-performance vehicles are generally more expensive to repair and replace, resulting in higher insurance costs. Conversely, smaller, less expensive cars typically attract lower premiums. Safety features also play a role; cars with advanced safety technologies, such as anti-lock brakes and airbags, may qualify for discounts. The theft rate of a particular model is another factor considered by insurance companies.

Location and Premium Determination

Your location plays a significant role in determining your insurance premiums. Areas with high crime rates, a greater number of accidents, or higher rates of vehicle theft will typically have higher insurance premiums. This is because insurance companies assess the risk of insuring vehicles in these areas as being greater. Urban areas generally have higher premiums than rural areas, reflecting the increased density of vehicles and the higher probability of accidents.

Other Significant Factors Influencing Premiums

Beyond the factors already mentioned, several others influence premium costs. These include your credit score (in some states), the type of coverage you choose (comprehensive versus liability), your driving habits (miles driven, commute distance), and even your marital status (married individuals sometimes receive lower rates). Discounts are often available for bundling insurance policies (home and auto), completing defensive driving courses, or installing anti-theft devices.

| Factor | Impact on Premium | Example | Mitigation Strategies |

|---|---|---|---|

| Age | Higher for younger drivers, lower for middle-aged drivers, potentially higher again in later years. | A 20-year-old driver pays significantly more than a 40-year-old driver. | Maintain a clean driving record, consider waiting until older to purchase a high-performance vehicle. |

| Driving History | Accidents and violations increase premiums. | A speeding ticket can lead to a 15-20% premium increase. | Drive safely and defensively, avoid traffic violations. |

| Car Model | Expensive or high-performance cars have higher premiums. | A sports car will cost more to insure than a compact car. | Choose a car with good safety ratings and a lower theft rate. |

| Location | Higher premiums in high-risk areas. | Urban areas often have higher premiums than rural areas. | Consider the risk associated with the location when purchasing a home. |

Types of Insurance and Premium Costs

Insurance premiums, the amounts paid for coverage, vary significantly depending on the type of insurance and several individual factors. Understanding these variations is crucial for making informed decisions about your insurance needs and budget. This section will explore the cost differences across various insurance types, providing examples to illustrate the range of premiums you might encounter.

Car Insurance Premium Costs

Car insurance premiums are highly dependent on the type of coverage selected. Liability insurance, which covers damages caused to others, typically has lower premiums than collision coverage (covering damage to your own vehicle in an accident) or comprehensive coverage (covering damage from events like theft or hail). For example, a young driver with a clean record might pay $500 annually for liability-only coverage, while adding collision and comprehensive could increase that to $1500 or more. Factors like vehicle type, driving history, and location also heavily influence the cost. A high-performance sports car will generally command higher premiums than an economical sedan.

Homeowners and Renters Insurance Premium Costs

Homeowners insurance protects your home and belongings against various perils, while renters insurance covers your personal property within a rented dwelling. Homeowners insurance premiums are influenced by factors such as the value of the home, its location (areas prone to natural disasters will have higher premiums), and the level of coverage selected. Renters insurance, typically less expensive, is determined by the value of your possessions and the chosen coverage level. A homeowner in a low-risk area with a modest home might pay $1000 annually, while a renter with limited possessions might pay around $200 annually. The cost difference reflects the higher value of assets protected by homeowners insurance.

Health Insurance Premium Costs

Health insurance premiums vary dramatically based on the plan’s coverage. Plans with lower monthly premiums often have higher deductibles and out-of-pocket maximums, meaning you pay more upfront before insurance kicks in. Conversely, plans with higher premiums typically offer lower deductibles and out-of-pocket costs. For instance, a bronze plan (lowest premium, highest out-of-pocket costs) might cost $300 per month, while a gold plan (higher premium, lower out-of-pocket costs) might cost $700 per month. Age, location, and health status also significantly impact health insurance premiums.

Average Premiums Across Age Groups

The following table illustrates estimated average annual premiums for three common insurance types across different age groups. These are illustrative examples and actual premiums will vary based on individual circumstances.

| Insurance Type | 25-34 | 35-44 | 45-54 | 55-64 |

|---|---|---|---|---|

| Car Insurance (Liability & Collision) | $1200 | $1000 | $1100 | $1400 |

| Homeowners Insurance | $1100 | $1050 | $1200 | $1350 |

| Health Insurance (Gold Plan) | $7500 | $8000 | $9000 | $11000 |

Understanding Insurance Quotes and Calculations

Receiving an insurance quote can feel like deciphering a secret code. However, understanding the process behind these quotes empowers you to make informed decisions and potentially save money. This section breaks down the mechanics of insurance quote generation and provides practical advice for comparing offers.

The Premium Calculation Process

Insurance companies employ sophisticated actuarial models to assess risk and determine premiums. These models consider a multitude of factors, including the type of coverage, the insured’s demographic information (age, location, driving history, credit score, etc.), and the statistical probability of claims within a specific risk pool. The process involves analyzing historical claims data, applying statistical modeling techniques, and incorporating current market conditions. Ultimately, the goal is to create a premium that accurately reflects the level of risk associated with insuring a particular individual or property. A higher risk profile translates to a higher premium, while a lower risk profile results in a lower premium. For example, a young driver with a history of accidents will generally pay more for car insurance than an older driver with a clean driving record.

Components of an Insurance Premium Quote

Several key components contribute to the final insurance premium quote. These typically include:

- Base Rate: This is the starting point, reflecting the average cost of insurance for a specific type of coverage in a given area. It’s determined based on broad statistical data.

- Risk Factors: This is where individual characteristics come into play. Factors like age, driving history (for auto insurance), credit score (often for home and auto), and location significantly influence the premium. For example, living in a high-crime area may increase home insurance costs.

- Coverage Limits and Deductibles: The amount of coverage you choose (e.g., liability limits for car insurance or coverage limits for homeowner’s insurance) directly impacts the premium. Higher coverage limits generally mean higher premiums. Similarly, a higher deductible (the amount you pay out-of-pocket before insurance kicks in) results in a lower premium.

- Policy Features: Additional features or endorsements (e.g., roadside assistance for auto insurance, earthquake coverage for home insurance) will increase the overall premium.

- Administrative Fees and Taxes: These are additional costs associated with processing the policy and applicable taxes levied by the state or local government.

Discounts that Reduce Premium Costs

Many insurance companies offer discounts to incentivize safe behavior and loyalty. Common discounts include:

- Safe Driving Discounts: For auto insurance, these reward drivers with clean driving records and completion of defensive driving courses.

- Bundling Discounts: Insuring multiple types of coverage (e.g., home and auto) with the same company often results in a discount.

- Good Student Discounts: For auto insurance, students with good grades may qualify for a reduced premium.

- Home Security Discounts: For home insurance, having security systems (alarm systems, security cameras) can lead to lower premiums.

- Loyalty Discounts: Long-term policyholders often receive discounts for their continued business.

Comparing Insurance Quotes from Different Providers

Comparing quotes is crucial for securing the best possible rate. Follow these steps:

- Gather Information: Compile information about your vehicle(s), property, and personal details (age, driving history, etc.).

- Obtain Quotes: Request quotes from multiple insurance providers online or by phone, ensuring you use consistent information across all requests.

- Analyze Coverage: Carefully compare the coverage offered by each provider. Don’t just focus on price; ensure the coverage adequately meets your needs.

- Review the Fine Print: Thoroughly examine the policy documents to understand exclusions, limitations, and other important details.

- Consider Customer Service: Research the reputation and customer service of each provider. A low premium isn’t worth much if claims are difficult to process.

Interpreting Key Information in an Insurance Quote

A typical insurance quote will detail the coverage amounts, premium cost, deductibles, and any applicable discounts. Pay close attention to the specific coverage offered, ensuring it aligns with your needs. Compare the total annual cost across different providers, taking into account the deductibles and coverage levels. Look for clear explanations of any fees or surcharges. Finally, confirm the renewal terms and conditions. Understanding these aspects allows you to make a fully informed decision.

Saving Money on Insurance Premiums

Lowering your insurance premiums doesn’t have to be a complex process. By implementing a few strategic changes and adopting responsible habits, you can significantly reduce your annual costs. This section explores various methods to achieve substantial savings on your insurance payments.

Bundling Insurance Policies

Bundling your insurance policies, such as home and auto insurance, with the same provider often results in significant discounts. Insurance companies incentivize bundling because it simplifies their administrative processes and reduces the risk of losing a customer to a competitor. The discount offered varies depending on the insurer and the specific policies bundled, but it can range from 5% to 25% or more. For example, a family bundling their home, auto, and umbrella liability insurance could save hundreds of dollars annually. This strategy is particularly effective for individuals with multiple insurance needs.

Impact of Credit Score on Premiums

Your credit score plays a surprisingly significant role in determining your insurance premiums. Insurers use credit-based insurance scores to assess risk. A higher credit score generally indicates greater financial responsibility, leading to lower premiums. Conversely, a lower credit score suggests a higher risk of claims, resulting in higher premiums. Improving your credit score through responsible credit management—paying bills on time, maintaining low credit utilization, and avoiding new credit applications—can lead to considerable savings on your insurance. For instance, a consumer with an excellent credit score might qualify for a discount of 10-20% compared to someone with a poor credit history.

Improving Driving Habits to Reduce Costs

Safe driving habits are directly correlated with lower insurance premiums. Insurance companies reward responsible drivers with lower rates. Strategies to improve driving habits include defensive driving courses (which often lead to discounts), maintaining a clean driving record (avoiding accidents and traffic violations), and opting for safety features in your vehicle (such as anti-lock brakes and airbags). For example, completing a defensive driving course could earn you a 10% discount, while avoiding accidents for several years could lead to even greater savings in the long run. Consistent safe driving is a proactive approach to long-term cost reduction.

Actionable Steps to Lower Insurance Premiums

Several concrete actions can help reduce your insurance costs. These strategies range from simple adjustments to more involved changes.

- Shop around and compare quotes from multiple insurers. Different companies use different rating systems, resulting in varying premiums for the same coverage.

- Increase your deductible. A higher deductible means lower premiums, but you’ll pay more out-of-pocket if you make a claim.

- Maintain a clean driving record. Avoid accidents and traffic violations to keep your premiums low.

- Consider taking a defensive driving course. Many insurers offer discounts for completing these courses.

- Bundle your insurance policies (home, auto, etc.). This often leads to significant discounts.

- Improve your credit score. A higher credit score typically results in lower insurance premiums.

- Install security systems in your home. This can lower your homeowner’s insurance premiums.

- Review your coverage periodically. Ensure you have the right amount of coverage without paying for unnecessary extras.

Illustrative Examples of Premium Costs

Understanding insurance premium costs requires looking at real-world examples. The price you pay depends on many factors, and seeing these in action helps clarify the process. The following examples illustrate how different factors influence the final premium.

Sample Premium Quote for a Young Driver

Let’s consider a 20-year-old driver, Sarah, in a medium-sized city, applying for a standard liability car insurance policy. She has a clean driving record and drives a relatively inexpensive, fuel-efficient sedan. She chooses a $500 deductible. Her insurer might offer a policy with bodily injury liability coverage of $100,000 per person/$300,000 per accident and property damage liability coverage of $50,000. In this scenario, her annual premium might be approximately $1,800. This price reflects her age (a higher-risk demographic), the type of car, and the chosen coverage levels and deductible. A higher deductible would lower the premium, but would mean Sarah would pay more out-of-pocket in the event of an accident.

Impact of a Changed Driving Record on Premiums

Now, imagine Sarah receives a speeding ticket a year later. This impacts her driving record, increasing her risk profile in the eyes of the insurance company. When she renews her policy, her insurer might assess a surcharge, resulting in a higher premium. For example, her annual premium could increase to $2,200, a $400 increase (22%) solely due to the speeding ticket. Further incidents, like accidents or more serious traffic violations, would likely lead to even steeper premium increases. Conversely, maintaining a clean driving record for several years could lead to premium discounts.

Cost Differences Between High and Low-Risk Profiles for Homeowners Insurance

Let’s compare the annual premiums for homeowners insurance for two individuals with different risk profiles, both owning similar homes in the same neighborhood.

Low-Risk Profile High-Risk Profile

-----------------------------------------------------------------------------

Age 45 25

Claim History None Two claims in past 5 years

Credit Score 750 600

Home Security System Yes No

Annual Premium (Estimate) $1,200 $1,800

This table illustrates that the low-risk profile (older, good credit, no claims, security system) enjoys a significantly lower premium compared to the high-risk profile (younger, poor credit, multiple claims, no security system). The difference of $600 represents the insurer’s assessment of increased risk associated with the high-risk profile. These numbers are estimates and would vary depending on the specific insurer and location.

Ending Remarks

Ultimately, the cost of an insurance premium is a personalized equation, influenced by a multitude of interconnected factors. While there’s no single answer to “how much is an insurance premium?”, understanding the key variables—age, driving history, location, coverage type, and credit score—allows for informed decision-making. By proactively managing these factors and employing the cost-saving strategies discussed, you can significantly impact your insurance costs and secure the coverage you need without breaking the bank. Remember to shop around and compare quotes to find the best deal.

Common Queries

What is a deductible?

A deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. Higher deductibles typically result in lower premiums.

How often are insurance premiums reviewed?

Premium reviews vary by insurer and policy type, but they are often annual. Your premium may adjust based on changes in your risk profile.

Can I cancel my insurance policy early?

Yes, but you may incur penalties or fees depending on your policy terms and the reason for cancellation.

What is the difference between liability and collision coverage?

Liability coverage protects you financially if you cause an accident, while collision coverage pays for repairs to your vehicle regardless of fault.