Navigating the world of health insurance can feel like deciphering a complex code. Understanding how much a health insurance premium will cost is crucial, yet the factors influencing this price can seem overwhelming. This guide unravels the mystery, providing a clear picture of the various components and considerations involved in determining your premium, ultimately empowering you to make informed decisions about your healthcare coverage.

From the impact of age and health conditions to the role of location and lifestyle choices, we’ll explore the multifaceted nature of health insurance premiums. We’ll also delve into the different plan types, the significance of employer-sponsored insurance, and the importance of understanding deductibles, co-pays, and out-of-pocket maximums. By the end, you’ll possess a comprehensive understanding of what influences your premium and how to find affordable options.

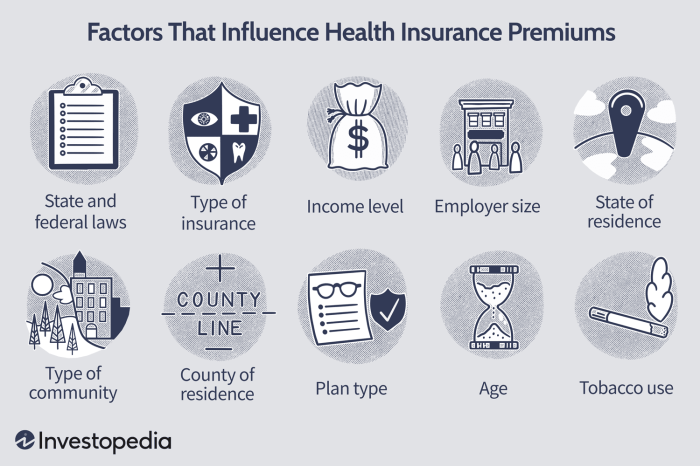

Factors Influencing Health Insurance Premiums

Several key factors interact to determine the cost of your health insurance premium. Understanding these elements can help you make informed decisions about your coverage and budget. These factors range from personal characteristics to the specifics of your chosen plan.

Age and Premium Costs

Age significantly impacts health insurance premiums. Generally, older individuals pay more than younger individuals. This is because the risk of developing health problems increases with age, leading to higher healthcare utilization and costs for insurers. For example, a 60-year-old might pay significantly more than a 30-year-old for the same plan, reflecting the increased likelihood of needing more extensive medical care.

Individual Health Conditions and Premium Pricing

Pre-existing health conditions are a major factor influencing premium costs. Individuals with conditions requiring ongoing treatment, such as diabetes, heart disease, or cancer, will typically pay higher premiums. Insurers assess the potential cost of managing these conditions when setting rates. Someone with a history of heart disease, for instance, might face higher premiums due to the anticipated need for medications, specialist visits, and potential hospitalizations.

Coverage Levels and Premium Differences

Health insurance plans are categorized into different metal tiers: Bronze, Silver, Gold, and Platinum. These tiers represent different levels of cost-sharing. Bronze plans have the lowest monthly premiums but higher out-of-pocket costs, while Platinum plans have the highest premiums but the lowest out-of-pocket costs. Silver plans fall between Bronze and Gold, offering a balance between premium and out-of-pocket expenses. The choice depends on individual risk tolerance and financial capacity.

Location and Premium Rates

Geographic location plays a crucial role in determining premium rates. The cost of healthcare varies considerably across regions, impacting insurance premiums. Areas with high healthcare costs, such as major metropolitan areas, typically have higher premiums than those in rural areas with lower healthcare expenses. For example, premiums in New York City might be considerably higher than those in a rural town in the Midwest.

Lifestyle Choices and Premium Influence

Lifestyle choices such as smoking and exercise habits can influence premium costs. Smokers typically pay higher premiums than non-smokers due to the increased risk of smoking-related illnesses. Conversely, individuals who maintain a healthy lifestyle through regular exercise and a balanced diet may qualify for discounts or lower premiums, reflecting their lower risk profile. Some insurers offer wellness programs and incentives to encourage healthy behaviors.

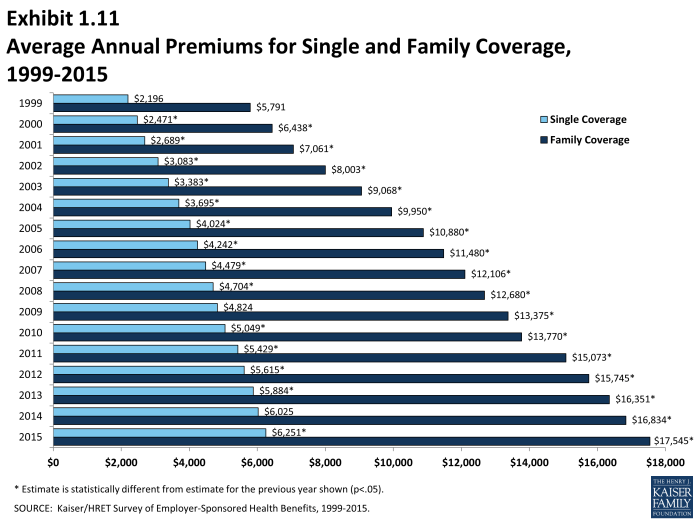

Premium Differences Based on Family Size

The following table illustrates how premiums can vary based on family size, assuming a similar plan and location. These are illustrative examples and actual premiums will vary based on the factors discussed above.

| Plan Type | Individual | Couple | Family of Four | Family of Five |

|---|---|---|---|---|

| Bronze | $300 | $600 | $900 | $1100 |

| Silver | $450 | $900 | $1350 | $1650 |

| Gold | $600 | $1200 | $1800 | $2200 |

| Platinum | $750 | $1500 | $2250 | $2750 |

Understanding Health Insurance Premium Components

Your health insurance premium isn’t a single, monolithic cost. It’s actually comprised of several key elements, each contributing to the overall price you pay for coverage. Understanding these components can help you make informed decisions about your health insurance plan and budget accordingly. This section will break down the various factors that influence your premium.

Premium Component Breakdown

A health insurance premium is built upon several key components. These components vary depending on the plan, but generally include costs associated with claims, administrative expenses, and profits. The exact proportions will fluctuate based on the insurer, the specific plan features, and the risk profile of the insured population. For instance, a plan covering a younger, healthier population will likely have a lower claims component compared to a plan covering an older population with more pre-existing conditions.

Administrative Costs in Health Insurance Premiums

A portion of your premium goes towards administrative costs. This includes expenses related to running the insurance company, such as salaries for employees, marketing and advertising, IT infrastructure, and regulatory compliance. While the exact percentage varies greatly between insurers and plans, it is typically a significant portion of the overall premium. For example, a large national insurer might allocate 15-20% of premiums to administrative costs, while a smaller, more regional company might have a higher percentage due to different cost structures.

Cost Breakdown of Coverage Elements

The largest part of your premium typically covers the cost of medical services. This is broken down further into several categories. A substantial portion covers hospital stays, including inpatient care, surgeries, and use of facilities. Another significant portion covers physician visits, including consultations, routine check-ups, and specialist appointments. Prescription drug costs form another major component, especially for plans with comprehensive drug coverage. Other significant elements include emergency room visits, diagnostic testing (like X-rays and blood work), and mental health services. The specific cost allocation to each element varies based on the plan’s benefits and the insured population’s utilization patterns. For example, a plan with a high deductible might allocate a smaller percentage to routine doctor visits while prioritizing hospital care coverage.

Infographic Illustrating Premium Components

Imagine a pie chart. The largest slice (perhaps 60%) represents the cost of claims (hospital stays, doctor visits, prescription drugs, etc.). A moderate-sized slice (around 20%) represents administrative costs. A smaller slice (around 10%) represents the insurer’s profit margin. The remaining 10% could represent taxes and other miscellaneous fees. This is a sample illustration, and the actual proportions will vary considerably based on factors already mentioned.

Common Add-ons and Their Impact on Premium Cost

Adding optional benefits significantly impacts your premium. Common add-ons include dental and vision coverage. These add-ons increase your monthly premium because they expand the scope of covered services and increase the potential for claims. Other common add-ons might include coverage for alternative therapies, wellness programs, or international emergency services. Each add-on increases your premium, reflecting the additional risk the insurer assumes and the increased administrative costs involved in managing these expanded benefits. For example, adding dental coverage might increase your premium by 10-15%, while vision coverage might add another 5-10%. The precise increase depends on the insurer and the specific details of the add-on.

The Role of Deductibles, Co-pays, and Out-of-Pocket Maximums

Understanding deductibles, co-pays, and out-of-pocket maximums is crucial for navigating the complexities of health insurance and managing healthcare costs effectively. These three components represent different aspects of cost-sharing between the insured individual and the insurance company. Knowing how they interact is key to making informed decisions about healthcare utilization and financial planning.

Deductibles, co-pays, and out-of-pocket maximums are all cost-sharing mechanisms designed to share the financial burden of healthcare between the insured and the insurer. They work together to determine how much you’ll pay out-of-pocket before your insurance plan begins to cover a larger portion of your medical expenses. Understanding the differences between them is essential for budgeting and making informed choices regarding healthcare services.

Deductible, Co-pay, and Out-of-Pocket Maximum Definitions

A deductible is the amount you must pay out-of-pocket for covered healthcare services before your health insurance begins to pay. For example, if your deductible is $1,000, you will be responsible for the first $1,000 in medical expenses before your insurance company starts covering costs. This applies annually, resetting at the beginning of each plan year. A co-pay is a fixed amount you pay for a covered healthcare service, such as a doctor’s visit. Co-pays are typically due at the time of service, regardless of whether you’ve met your deductible. Finally, an out-of-pocket maximum is the most you will pay out-of-pocket for covered healthcare services in a plan year. Once you reach this limit, your health insurance will cover 100% of your covered medical expenses for the remainder of the year.

Impact of Cost-Sharing Components on Healthcare Costs

These cost-sharing elements significantly influence the overall cost of healthcare. High deductibles can lead to substantial out-of-pocket expenses before insurance coverage kicks in, potentially deterring individuals from seeking necessary care. Conversely, low co-pays can encourage more frequent visits, potentially increasing overall healthcare utilization (and costs, although the per-visit cost is lower). The out-of-pocket maximum provides a safety net, limiting the financial risk to the insured individual. However, reaching this maximum can still represent a considerable financial burden, depending on the plan’s design.

Examples of Cost-Sharing Impact in Different Scenarios

Consider three scenarios: Scenario 1: A patient with a $2,000 deductible, $50 co-pay, and a $5,000 out-of-pocket maximum needs a series of tests costing $3,000. They will pay $2,000 (deductible) + $50 (co-pay) = $2,050. Scenario 2: The same patient requires a $7,000 surgery. They will pay $5,000 (out-of-pocket maximum). Scenario 3: A patient with a $500 deductible, $25 co-pay, and a $2,000 out-of-pocket maximum has several routine doctor visits, totaling $1,500 in costs. They will pay $500 (deductible) + (multiple $25 co-pays). In this scenario, they may not reach their out-of-pocket maximum.

Cost-Sharing Components Across Different Plan Types

| Plan Type | Deductible | Co-pay | Out-of-Pocket Maximum |

|---|---|---|---|

| High Deductible Health Plan (HDHP) | High (e.g., $5,000 or more) | Low (e.g., $25-$50) | Relatively Low (e.g., $5,000-$7,000) |

| Preferred Provider Organization (PPO) | Moderate (e.g., $1,000-$3,000) | Moderate (e.g., $50-$100) | Moderate (e.g., $5,000-$10,000) |

| Health Maintenance Organization (HMO) | Low (e.g., $0-$1,000) | Low (e.g., $25-$50) | Moderate to High (e.g., $5,000-$10,000) |

Influence on Patient Healthcare Decision-Making

These cost-sharing components significantly influence a patient’s decision-making process. High deductibles and co-pays can deter individuals from seeking preventative care or necessary treatment, potentially leading to worse health outcomes in the long run. The out-of-pocket maximum provides a sense of financial security, but the potential for reaching this limit can still be a significant factor when considering healthcare options. Patients often weigh the potential cost of care against the perceived benefit, and understanding these financial parameters is crucial for making informed decisions.

Last Point

Securing affordable and appropriate health insurance is a critical aspect of financial planning and overall well-being. While the initial process might seem daunting, understanding the key factors influencing premium costs – age, health status, location, plan type, and employer contributions – empowers you to make informed choices. By carefully comparing plans, exploring available subsidies, and understanding the nuances of deductibles and co-pays, you can find a policy that aligns with your needs and budget, providing you with the peace of mind that comes with comprehensive healthcare coverage.

Clarifying Questions

What is a health insurance premium?

A health insurance premium is the recurring payment you make to maintain your health insurance coverage. It’s essentially the price you pay for the protection and access to healthcare services offered by your plan.

Can I change my health insurance plan during the year?

Generally, you can only change your health insurance plan during the annual open enrollment period, unless you qualify for a special enrollment period due to a life event like marriage, birth, or job loss.

What happens if I don’t pay my health insurance premium?

Failure to pay your premium can lead to your coverage being canceled, leaving you without healthcare protection. It’s crucial to maintain consistent payments.

How often are health insurance premiums paid?

Premiums are typically paid monthly, but some insurers may offer options for quarterly or annual payments.

Where can I find more information about health insurance subsidies?

Information about government subsidies and assistance programs can usually be found on the website of your country’s health insurance marketplace or by contacting your state’s insurance department.