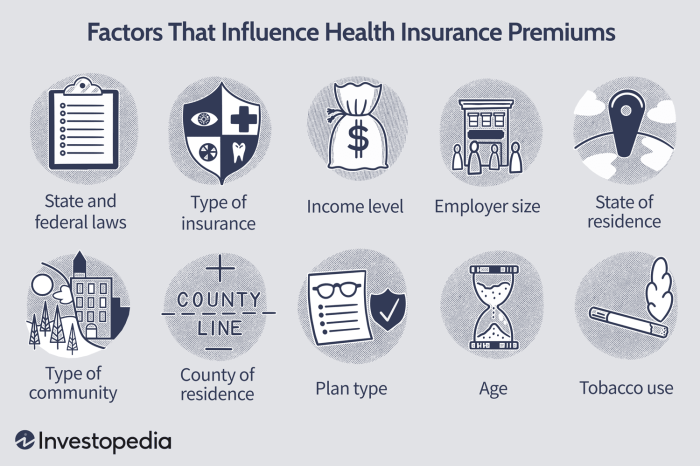

Understanding the cost of health insurance is crucial for making informed decisions about your healthcare. Premiums, the monthly payments for coverage, vary significantly based on a multitude of factors. This guide will delve into the intricacies of health insurance premiums, helping you navigate the complexities and make the best choice for your individual circumstances.

From the influence of age and location to the impact of your health status and chosen plan type, we’ll explore the key elements that determine your premium cost. We’ll also provide practical tips for comparing plans, understanding additional costs, and ultimately, finding affordable and suitable health insurance coverage.

Types of Health Insurance Plans and Their Costs

Understanding the different types of health insurance plans and their associated costs is crucial for making informed decisions about your healthcare coverage. The variations in premiums are influenced by several factors, including the type of plan, your location, age, and the level of coverage you choose. This section will delve into the cost differences between various plan types and coverage levels.

Premium Costs for HMO, PPO, and EPO Plans

HMOs (Health Maintenance Organizations), PPOs (Preferred Provider Organizations), and EPOs (Exclusive Provider Organizations) represent the most common types of health insurance plans. They differ significantly in their network structures and cost-sharing mechanisms, which directly impact premiums. Generally, HMOs tend to have the lowest premiums because they restrict access to care within their network. PPOs offer more flexibility with out-of-network access, but this comes at a higher premium cost. EPOs fall somewhere in between, offering a wider network than HMOs but less flexibility than PPOs, resulting in premiums that are typically higher than HMOs but lower than PPOs. Specific premium amounts will vary widely depending on location, age, and the insurer. For example, a 30-year-old in a major city might pay $300 per month for an HMO, $450 for an EPO, and $600 for a PPO, but these are illustrative figures and may differ greatly depending on the specific plan and insurer.

High-Deductible Health Plans and Their Premiums

High-deductible health plans (HDHPs) are designed to offer lower premiums in exchange for higher out-of-pocket costs before insurance coverage kicks in. These plans typically have a high deductible (e.g., $5,000 or more for an individual) and a lower monthly premium. The lower premium is attractive to individuals who are healthy and anticipate few medical expenses. However, if significant medical care is needed, the high deductible can represent a substantial financial burden. For example, a young, healthy individual might find a $200 monthly premium for an HDHP appealing, compared to a $400 monthly premium for a plan with a lower deductible. But, if this individual experiences a serious illness, they would need to pay a large amount out-of-pocket before insurance benefits apply. HDHPs often come with a Health Savings Account (HSA) option, allowing pre-tax contributions to help cover medical expenses.

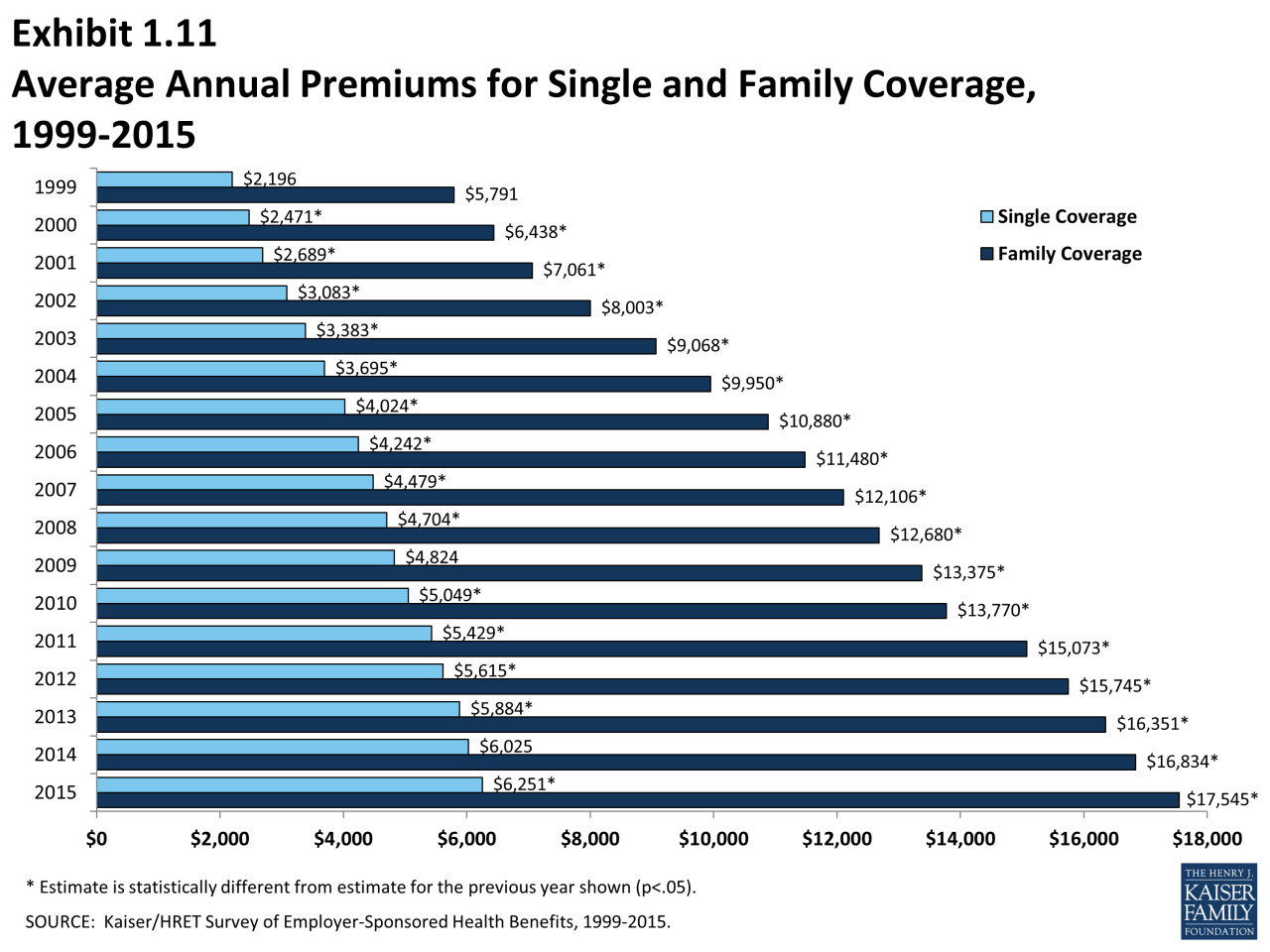

Cost Differences Between Individual and Family Plans

Family health insurance plans naturally cost more than individual plans. The increased cost reflects the coverage for multiple individuals. The exact difference varies depending on the insurer, plan type, and the number of family members covered. A family plan covering a couple and two children could cost significantly more than twice the price of an individual plan. For instance, an individual plan might cost $400 per month, while a family plan covering the same individual plus spouse and two children could cost $1200 or more per month.

Premium Variations Based on Plan Coverage Levels (Bronze, Silver, Gold, Platinum)

Health insurance plans are often categorized by metal tiers: Bronze, Silver, Gold, and Platinum. These tiers represent different levels of cost-sharing. Bronze plans have the lowest monthly premiums but the highest out-of-pocket costs. Platinum plans have the highest premiums but the lowest out-of-pocket costs. Silver and Gold plans fall in between. For example, a Bronze plan might have a monthly premium of $250, a Silver plan $350, a Gold plan $450, and a Platinum plan $600. These are merely illustrative examples; actual costs vary considerably based on location, age, and the specific insurer.

Summary of Cost Variations

- HMOs: Generally lowest premiums, limited network access.

- EPOs: Premiums higher than HMOs, wider network than HMOs but less than PPOs.

- PPOs: Generally highest premiums, broadest network access.

- HDHPs: Low premiums, high deductibles.

- Family Plans: Significantly higher premiums than individual plans.

- Plan Metal Tiers (Bronze, Silver, Gold, Platinum): Premiums increase with higher levels of coverage (Platinum being the highest premium and lowest out-of-pocket costs).

Navigating the Health Insurance Marketplace

Understanding the health insurance marketplace can seem daunting, but with a systematic approach, finding a suitable plan becomes manageable. This section will guide you through the process, focusing on the impact of subsidies and tax credits, comparing plans, and selecting the best fit for your individual circumstances.

Subsidies and Tax Credits Impact on Premium Costs

Government subsidies and tax credits significantly reduce the cost of health insurance premiums for many individuals and families. Eligibility is based on income, household size, and location. These financial aids are applied directly to your monthly premium, making coverage more affordable. For example, a family earning $60,000 annually might see their monthly premium reduced by several hundred dollars thanks to a subsidy, potentially making a plan with better benefits financially feasible. The amount of the subsidy or tax credit varies depending on your income and the cost of plans in your area. It’s crucial to accurately report your income to ensure you receive the correct amount of assistance.

Comparing Plans on the Marketplace

The health insurance marketplace offers a wide range of plans from different insurers, each with varying levels of coverage and costs. Comparing these plans effectively involves considering several key factors. These factors include the monthly premium, the deductible, the out-of-pocket maximum, and the copay amounts for doctor visits and other services. The marketplace website typically provides tools to compare plans side-by-side, allowing you to easily see the differences in coverage and cost. You can filter plans based on your needs, such as preferred doctors or specific medical conditions.

Step-by-Step Guide to Selecting a Plan

Selecting a suitable health insurance plan involves a careful evaluation of your budget and healthcare needs. Follow these steps for a structured approach:

- Determine your budget: Establish a realistic monthly premium you can comfortably afford.

- Assess your healthcare needs: Consider your current health status, anticipated healthcare needs (e.g., regular checkups, prescription medications, potential hospitalizations), and any pre-existing conditions.

- Compare plans on the marketplace: Use the marketplace’s comparison tools to identify plans that meet your needs and budget. Pay close attention to the deductible, out-of-pocket maximum, and copay amounts.

- Review the provider network: Ensure that your preferred doctors and specialists are included in the plan’s network.

- Check the formulary (for prescription drugs): If you take prescription medications, verify that your medications are covered by the plan’s formulary.

- Enroll in the chosen plan: Once you’ve selected a plan, complete the enrollment process through the marketplace website.

Decision-Making Flowchart for Choosing a Health Insurance Plan

The following flowchart visually represents the decision-making process:

[A detailed description of a flowchart is provided below, replacing the visual element which cannot be rendered here. The flowchart would start with a “Start” box, branching to “Determine Budget” and “Assess Healthcare Needs”. These would then converge into “Compare Plans on Marketplace,” which branches to “Plan Meets Needs & Budget?” A “Yes” answer leads to “Enroll in Plan” and “End,” while a “No” answer loops back to “Compare Plans on Marketplace.” The flowchart visually emphasizes the iterative nature of the plan selection process.]

Additional Costs Associated with Health Insurance

Beyond the monthly premiums, several other costs can significantly impact your overall healthcare spending. Understanding these additional expenses is crucial for budgeting and choosing the right health insurance plan. Failing to account for these costs can lead to unexpected financial burdens.

Out-of-Pocket Expenses

Many health insurance plans require individuals to pay a portion of their healthcare costs directly. These out-of-pocket expenses include co-pays, deductibles, and coinsurance. The amounts vary significantly depending on the plan’s design and the type of services received. For example, a high-deductible plan might require you to pay several thousand dollars before your insurance coverage kicks in significantly, while a low-deductible plan will have you paying less upfront but likely higher premiums.

Co-pays, Deductibles, and Coinsurance Explained

A co-pay is a fixed amount you pay for a medical service, such as a doctor’s visit. A deductible is the amount you must pay out-of-pocket before your insurance company begins to cover your expenses. Coinsurance is the percentage of costs you share with your insurer after you’ve met your deductible. For instance, if your coinsurance is 20%, you’ll pay 20% of the bill, and your insurance company will pay the remaining 80%. Consider a scenario where your deductible is $1,000, your coinsurance is 20%, and you have a $5,000 medical bill. You would first pay the $1,000 deductible, then 20% of the remaining $4,000 ($800), resulting in a total out-of-pocket cost of $1,800.

Prescription Drug Costs

Prescription drug costs can substantially increase overall healthcare spending. The cost of medications varies widely depending on the drug, dosage, and whether it’s a brand-name or generic drug. Many plans have formularies – lists of approved medications – that may influence the cost of your prescriptions. Some plans may require you to use mail-order pharmacies or to try a less expensive generic drug before covering a more expensive brand-name medication. For example, a common medication like insulin can cost hundreds of dollars per month without insurance, or significantly less with good coverage.

Supplemental Insurance Options

Supplemental insurance policies can help cover expenses not included in your primary health insurance plan. These policies often cover gaps in coverage, such as co-pays, deductibles, or specific services not included in your primary plan. Common examples include dental insurance, vision insurance, and supplemental health insurance that helps cover high out-of-pocket costs.

Cost Comparison of Supplemental Insurance

| Supplemental Insurance Type | Average Annual Premium (Estimate) | Typical Coverage | Example Cost Savings |

|---|---|---|---|

| Dental Insurance | $500 – $1500 | Preventive care, fillings, extractions | Could save hundreds on a single major dental procedure |

| Vision Insurance | $100 – $400 | Eye exams, glasses, contact lenses | Could save $200-$500 on new glasses and exam |

| Supplemental Health Insurance (Gap Coverage) | $200 – $800 | Copays, deductibles, coinsurance | Could reduce out-of-pocket costs by hundreds or thousands depending on claims |

| Long-Term Care Insurance | Highly Variable (depends on age and coverage) | Nursing home care, home healthcare | Could cover tens of thousands of dollars in long-term care costs |

Final Summary

Choosing a health insurance plan can feel overwhelming, but by understanding the factors that influence premiums and carefully considering your individual needs and budget, you can make an informed decision. Remember to compare plans thoroughly, explore available subsidies, and don’t hesitate to seek professional guidance if needed. Taking control of your healthcare costs starts with understanding how much your premiums will be.

Query Resolution

What is a deductible?

A deductible is the amount you pay out-of-pocket for healthcare services before your insurance coverage kicks in.

What is coinsurance?

Coinsurance is the percentage of costs you share with your insurance company after you’ve met your deductible.

Can I change my health insurance plan during the year?

Generally, you can only change your health insurance plan during open enrollment periods, unless you experience a qualifying life event (like marriage, divorce, or job loss).

What is a Health Savings Account (HSA)?

An HSA is a tax-advantaged savings account used to pay for eligible medical expenses. It’s often paired with high-deductible health plans.

How do I find out if I qualify for subsidies?

You can determine your eligibility for subsidies and tax credits through the HealthCare.gov website or your state’s marketplace.