Insurance, a cornerstone of financial security, operates on a fundamental principle: the assessment and management of risk. Understanding how risk influences the cost of insurance premiums is crucial for both consumers and providers. This exploration delves into the intricate relationship between risk and premium pricing, revealing the factors that determine how much you pay for your coverage.

From the statistical models actuaries employ to the impact of market competition and individual risk profiles, we’ll unravel the complexities of insurance pricing. We’ll examine various risk categories, demonstrating how predictable and unpredictable events contribute to premium calculations, and ultimately, your insurance costs. This comprehensive guide provides clarity on this often-misunderstood aspect of insurance.

The Fundamentals of Insurance Premiums

Insurance premiums are the price you pay for an insurance policy. They represent the cost of transferring risk from yourself to an insurance company. Understanding how these premiums are calculated is crucial for making informed decisions about your insurance coverage. Several key factors contribute to the final premium amount.

Core Components of Insurance Premiums

Insurance premiums are comprised of several key elements. The most significant is the expected cost of claims. This is based on statistical analysis of past claims data and predictions of future claims, considering factors like demographics and risk profiles. Administrative costs, including salaries, technology, and marketing expenses, also contribute to the premium. Finally, a profit margin is included to ensure the insurance company’s financial stability and profitability. The precise weighting of these components varies between insurers and policy types.

Actuarial Risk Assessment

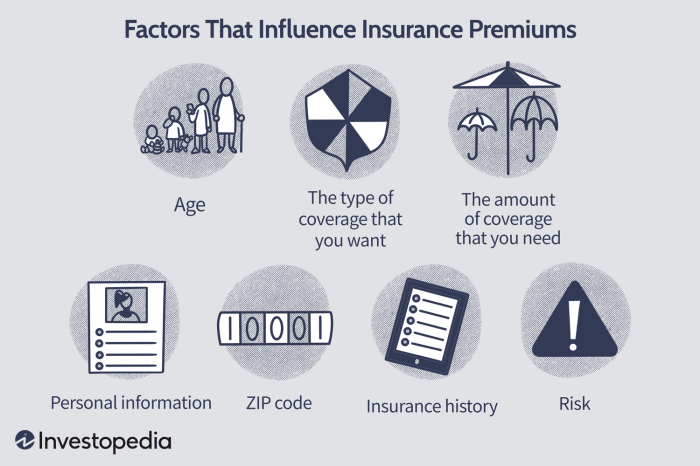

Actuaries are highly trained professionals who specialize in assessing and managing risk. They use sophisticated statistical models and historical data to predict the likelihood and cost of future claims. This involves analyzing a vast array of data points related to the insured item or individual, such as age, location, driving history (for auto insurance), credit score (for various insurance types), and health history (for health insurance). The more risky a profile appears, the higher the predicted cost of claims and therefore, the higher the premium. For example, a young driver with a history of accidents will likely pay significantly more for auto insurance than an older driver with a clean driving record.

Factors Influencing Base Premiums

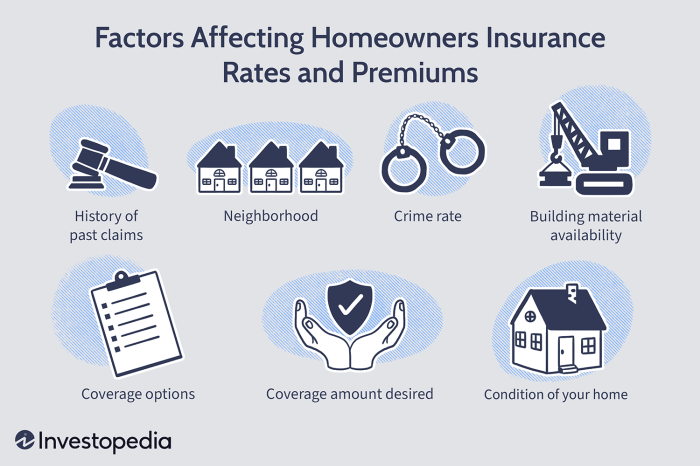

Numerous factors beyond actuarial assessments influence base premiums. These include the type of coverage selected (higher coverage generally means higher premiums), the deductible amount (a higher deductible lowers premiums but increases out-of-pocket expenses), the insurer’s financial strength and reputation (more financially stable insurers might charge slightly higher premiums), and the current economic climate (inflation and market conditions can impact premium costs). Geographic location also plays a crucial role; areas with higher crime rates or a greater frequency of natural disasters will usually have higher premiums.

Comparison of Premiums Across Different Insurance Types

The following table provides a general comparison of average annual premiums for different types of insurance. Note that these are illustrative examples and actual premiums will vary significantly based on individual circumstances and specific policy details.

| Insurance Type | Average Annual Premium (USD) | Factors Affecting Premium | Typical Coverage |

|---|---|---|---|

| Auto Insurance | $1500 – $2500 | Driving record, vehicle type, location | Liability, collision, comprehensive |

| Homeowners Insurance | $1000 – $2000 | Home value, location, coverage amount | Dwelling, liability, personal property |

| Health Insurance | $5000 – $15000 | Age, health status, plan type | Doctor visits, hospital stays, prescription drugs |

| Life Insurance | Varies greatly based on coverage amount and type | Age, health, lifestyle, policy type (term vs. whole life) | Death benefit to beneficiaries |

Types of Risk and Their Impact

Insurance premiums are fundamentally driven by the assessment of risk. Understanding the different types of risk and their predictability is crucial for insurers in determining appropriate pricing. This section will explore various risk categories and their influence on premium calculations.

Insurers categorize risks in several ways to better understand their potential impact. This allows for more accurate premium setting and helps mitigate potential losses.

Systemic Risk

Systemic risk refers to the risk of a widespread market crash or economic downturn impacting a large number of insurance policies simultaneously. This type of risk isn’t specific to an individual or a single insured but rather affects the entire system. For example, a major earthquake affecting a wide geographical area would represent systemic risk, leading to numerous claims and potential significant losses for insurers. Because systemic risks are difficult to predict precisely and can result in massive payouts, insurers may incorporate a systemic risk buffer into their overall premium calculations. This buffer is a small increase in premiums across the board to account for the possibility of such large-scale events.

Idiosyncratic Risk

Idiosyncratic risk, in contrast to systemic risk, is specific to an individual or a small group of individuals. It represents the unique circumstances affecting a single policyholder. For example, a driver with a history of accidents faces higher idiosyncratic risk than a driver with a clean record. Insurers analyze individual risk profiles using various data points to assess idiosyncratic risk. This results in personalized premiums; a driver with a poor driving record will pay significantly more than a driver with a spotless record. The impact on premiums is directly proportional to the assessed level of idiosyncratic risk.

Moral Hazard

Moral hazard refers to the increased risk of loss due to changes in behavior after insurance is obtained. For instance, someone with comprehensive car insurance might be less careful about parking their car in a secure location, knowing that any damage will be covered. Insurers account for moral hazard through various mechanisms, including deductibles, co-pays, and careful underwriting processes. These mechanisms aim to incentivize responsible behavior and reduce the likelihood of increased claims due to moral hazard. The premium will reflect the insurer’s assessment of the potential for moral hazard associated with a particular policy. Higher premiums often reflect a higher perceived moral hazard risk.

Predictable vs. Unpredictable Risks

Predictable risks, such as age-related health issues or the likelihood of property damage in a high-crime area, are relatively easy to quantify and factor into premium calculations. Insurers utilize actuarial data and statistical models to forecast the likelihood of such events and incorporate these predictions into their pricing strategies. Unpredictable risks, such as natural disasters or sudden, unexpected illnesses, are inherently more difficult to predict and often lead to higher premiums to account for the uncertainty involved. The inclusion of a larger safety margin is typical for unpredictable risks to protect the insurer against unforeseen losses.

Examples of Risk Factors Increasing Premiums

Several factors directly influence insurance premiums. Age is a significant factor in health insurance, with older individuals generally paying higher premiums due to increased health risks. Location significantly impacts home and auto insurance; properties in high-crime areas or areas prone to natural disasters command higher premiums. A poor driving record will inevitably lead to increased auto insurance premiums. Similarly, a history of claims or poor credit score can result in higher premiums for various types of insurance. These factors are all quantifiable and directly contribute to the insurer’s assessment of risk and, subsequently, the final premium.

Risk Mitigation and Premium Reduction

Insurance premiums are not set in stone. Proactive steps to reduce risk can significantly lower your premiums. By demonstrating a lower likelihood of claims, you can influence insurers’ risk assessments and enjoy more affordable coverage. This section details strategies to achieve premium reduction through effective risk mitigation.

Understanding that insurance premiums are fundamentally calculated based on assessed risk, it becomes clear that actively mitigating those risks directly impacts the cost of your insurance. Insurers use sophisticated models to evaluate the probability and potential cost of claims. By reducing your risk profile, you essentially improve your “score” in their eyes, leading to lower premiums.

Safety Measures and Preventative Actions Influence Risk Assessment

Implementing safety measures and preventative actions directly influences how insurers assess your risk. For instance, installing a security system in your home reduces the likelihood of burglaries, thus lowering the insurer’s projected payout for theft claims. Similarly, driving defensively and maintaining your car regularly reduces the risk of accidents, leading to lower car insurance premiums. Insurers often reward demonstrable risk reduction through discounts or lower premium tiers. The data they collect, such as claims history and preventative measures taken, directly informs their risk assessment algorithms. A history of safe driving or proactive home maintenance translates into a lower risk profile and, consequently, a lower premium.

Financial Benefits of Risk Mitigation: A Comparative Example

Consider two homeowners, both with identical properties and insurance coverage. Homeowner A neglects home maintenance, leaving the property vulnerable to damage. Homeowner B invests in regular maintenance, including roof inspections, gutter cleaning, and pest control. If a storm damages both properties, Homeowner A is more likely to experience significant damage due to pre-existing vulnerabilities. The insurer will likely assess a higher risk for Homeowner A, resulting in a higher claim payout and potentially higher future premiums. Homeowner B, having proactively mitigated risks, might experience less severe damage and, therefore, a lower claim. Their lower risk profile will likely result in lower premiums in the long term, showcasing the financial advantages of risk mitigation.

Effective Risk Reduction Techniques for Different Insurance Types

Understanding the specific risks associated with different insurance types allows for targeted risk reduction strategies. The following techniques can significantly impact premiums across various insurance categories:

- Home Insurance: Installing security systems, smoke detectors, and fire sprinklers; maintaining the property’s structure and landscaping; regularly scheduling inspections.

- Auto Insurance: Maintaining a clean driving record; taking defensive driving courses; installing anti-theft devices; ensuring regular vehicle maintenance.

- Health Insurance: Maintaining a healthy lifestyle through diet and exercise; regular checkups and preventative screenings; avoiding risky behaviors.

- Life Insurance: Maintaining a healthy lifestyle; undergoing regular health screenings; avoiding risky hobbies or professions.

Illustrative Examples of Risk and Premium Interaction

Understanding how risk profiles directly influence insurance premiums is crucial. This section provides concrete examples illustrating the relationship between individual risk factors and the resulting cost of insurance coverage. We will examine both high and low-risk profiles, highlighting the key differences and their impact on premium calculations.

High-Risk Profile and Premium Implications

Consider a 25-year-old male residing in a high-crime area with a history of reckless driving, resulting in multiple speeding tickets and a prior DUI conviction. He also smokes heavily and has a family history of heart disease. This individual presents a significantly higher risk to insurance companies. His reckless driving history indicates a higher probability of accidents, while his smoking and family history increase the likelihood of health issues. These factors cumulatively contribute to a much higher insurance premium across the board. For example, his auto insurance premium might be three to four times higher than that of a similarly aged driver with a clean driving record and residing in a safer area. His health insurance premium would also reflect the elevated risks associated with his lifestyle and family history. The overall cost of insurance will significantly impact his financial planning.

Low-Risk Profile and Premium Implications

In contrast, consider a 30-year-old female living in a safe suburban neighborhood. She has an impeccable driving record, maintains a healthy lifestyle including regular exercise and a balanced diet, and has no family history of significant health problems. She is a non-smoker and maintains a stable, well-paying job. This individual presents a low risk to insurance companies. Her responsible driving and healthy lifestyle reduce the likelihood of accidents and health issues. As a result, she will enjoy significantly lower premiums for both auto and health insurance. Her responsible behavior translates directly into financial savings. She may even qualify for discounts due to her excellent risk profile.

Comparison of High- and Low-Risk Profiles

The comparison highlights the stark contrast between high and low-risk profiles. The high-risk individual’s behaviors and circumstances significantly increase the probability of claims, leading to substantially higher premiums. Conversely, the low-risk individual’s responsible choices result in lower premiums, reflecting the reduced likelihood of claims. The key differences lie in driving history, lifestyle choices, health history, and geographic location. These factors, assessed through actuarial analysis, determine the individual’s risk score and, consequently, the premium they pay.

Visual Representation of Premium Costs Across Risk Levels

Imagine a bar graph with the horizontal axis representing different risk levels (low, medium, high, very high). The vertical axis represents the corresponding insurance premium cost. The bars would progressively increase in height from left to right, clearly illustrating that higher risk levels directly correlate with significantly higher premium costs. The bar representing “very high” risk would be considerably taller than the “low” risk bar, demonstrating the substantial financial implications of risk assessment in insurance pricing. A clear visual would emphasize the financial incentives of maintaining a low-risk profile.

Conclusion

In conclusion, the interplay between risk and insurance premiums is a dynamic process shaped by numerous factors. While individual risk profiles significantly impact costs, market forces and regulatory changes also play a crucial role. By understanding how risk is assessed and quantified, consumers can take proactive steps to mitigate their risks and potentially secure more favorable premium rates. Ultimately, a thorough comprehension of this relationship empowers informed decision-making when selecting and managing insurance coverage.

Q&A

What is an actuary, and what role do they play in determining premiums?

Actuaries are highly trained professionals who use statistical methods to assess and predict risk. They analyze vast amounts of data to determine the likelihood of insured events and calculate the appropriate premiums to cover potential payouts.

How do insurers handle unpredictable events like natural disasters when setting premiums?

Insurers use historical data and sophisticated models to estimate the probability and potential impact of unpredictable events. They incorporate these estimates into their premium calculations, often using reinsurance to spread the risk of catastrophic losses.

Can my credit score affect my insurance premiums?

In some jurisdictions, credit scores are used as a factor in determining insurance premiums, as they are often correlated with risk. However, this practice is subject to regulations and varies by insurer and type of insurance.

What is the difference between a deductible and a premium?

A premium is the regular payment you make to maintain your insurance coverage. A deductible is the amount you pay out-of-pocket before your insurance coverage begins to pay for claims.