Car accidents are stressful enough without the added complexity of determining liability. When fault is shared, as in a 50/50 claim, the impact on your insurance premiums can be significant. This exploration delves into the mechanics of shared liability car accidents, examining how a 50/50 claim differs from situations where you are solely at fault or completely blameless. We will unravel the factors influencing premium increases, offering strategies to mitigate the financial consequences and providing insights into how insurance companies handle these nuanced situations.

Understanding the intricacies of 50/50 claims is crucial for every driver. This involves not only comprehending how shared liability is determined but also how it translates into tangible changes in your insurance costs. We’ll examine real-world examples to illustrate the variability in premium increases depending on factors such as accident severity, driving history, and the specific insurance provider.

Understanding 50/50 Claims

A 50/50 liability claim in car insurance means both drivers involved in an accident are deemed equally responsible for the collision. This differs from scenarios where one driver is solely at fault (100% at-fault) or where fault is not determined (no-fault). Understanding the mechanics of shared liability is crucial for navigating the insurance claims process and its impact on your premiums.

Understanding the mechanics of a 50/50 liability claim involves a thorough investigation by the insurance companies involved. Both parties’ insurance providers will assess the evidence – police reports, witness statements, and damage assessments – to determine the degree of fault. In a 50/50 scenario, both drivers contributed equally to the accident. This means each driver’s insurance company will cover half of the other driver’s damages, and potentially a portion of their own damages depending on policy coverage.

Scenarios Resulting in Shared Fault

Several situations can lead to a 50/50 liability determination. These typically involve instances where both drivers made errors in judgment or failed to take necessary precautions. The precise circumstances vary, but common examples include:

Both drivers failing to yield the right of way at an intersection, resulting in a collision. Each driver might have had a reasonable opportunity to avoid the accident, but neither did.

A rear-end collision where both drivers were traveling at unsafe speeds or maintaining insufficient following distance. The leading driver may have braked suddenly, but the following driver may not have maintained a safe following distance.

A sideswipe collision where both drivers were partially in the wrong lane or failed to maintain proper lane position. Both drivers might have contributed to the encroachment into each other’s lanes.

Comparison of Liability Scenarios

The following table illustrates the differences between a 50/50 claim and other liability scenarios, focusing on the impact on insurance premiums:

| Scenario | Percentage of Fault | Impact on Premiums | Example |

|---|---|---|---|

| 100% At-Fault | 100% | Significant increase; you are responsible for all damages. | Running a red light and causing a collision. |

| 50/50 | 50% | Moderate increase; you are responsible for half the damages. | A collision at an intersection where both drivers failed to yield. |

| No-Fault | 0% (or undetermined) | Minimal or no increase; your own insurance covers your damages regardless of fault. (Note: this depends on state laws.) | Your car is damaged in a parking lot due to an unknown cause. |

Impact on Insurance Premiums

A 50/50 claim, where both drivers share equal responsibility for an accident, will generally impact your insurance premiums, although not as severely as being 100% at fault. The exact effect depends on several factors specific to your insurance policy and the circumstances of the accident. Understanding this impact is crucial for managing your insurance costs.

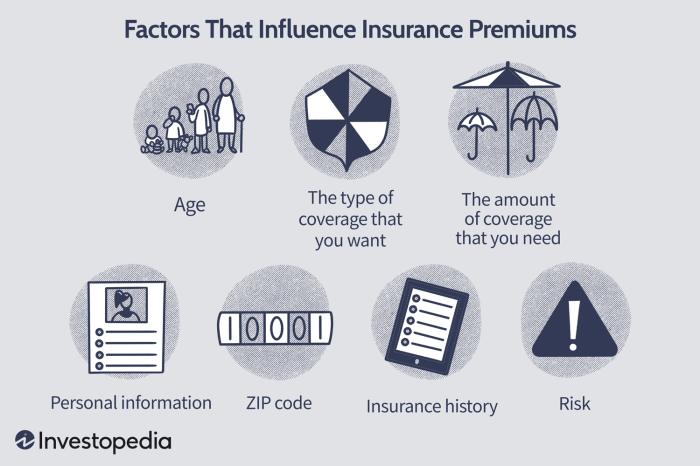

The increase in your premium after a 50/50 claim is influenced by a variety of factors. Your insurance company considers the severity of the accident (damage costs), your driving history (prior claims and violations), your policy type (liability only or comprehensive), and your insurance score (a rating reflecting your risk profile). Even seemingly minor accidents can lead to premium adjustments because of the administrative costs associated with processing the claim, regardless of fault percentage. Furthermore, the fact that you were involved in an accident at all suggests a higher risk profile in the eyes of your insurer.

Premium Increase Compared to 100% Fault

A 50/50 claim typically results in a smaller premium increase than a claim where you are deemed 100% at fault. In a 100% at-fault scenario, you bear the full responsibility for the damages, significantly impacting your risk profile and leading to a substantial premium hike. With a 50/50 claim, the impact is lessened because the responsibility, and therefore the associated financial burden, is shared. However, it’s important to note that the premium increase is not necessarily halved. Insurance companies utilize complex algorithms to calculate premiums, and the shared responsibility may not translate to a precisely proportional reduction in the premium increase. For instance, a 100% at-fault claim might lead to a 30% premium increase, while a 50/50 claim might result in a 15-20% increase, depending on the other factors mentioned.

Examples of Insurance Company Practices

Different insurance companies have varying approaches to handling 50/50 claims and their effect on premiums. Some insurers might use a points-based system, where each claim adds points to your driving record, affecting your premium. A 50/50 claim might add fewer points than a 100% at-fault claim. Other companies may use more nuanced algorithms that consider multiple factors, making it difficult to predict the exact premium increase. For example, Company A might increase premiums by 10% for a 50/50 claim involving minor damage, while Company B might only increase premiums by 5%, but increase it by 25% for a 100% at-fault claim involving similar damage. This variability underscores the importance of carefully reviewing your insurance policy and understanding your insurer’s specific claims handling procedures.

Illustrative Examples

Understanding the impact of a 50/50 claim on your insurance premiums requires looking at specific scenarios. While the exact effect varies depending on several factors, these examples illustrate the potential consequences.

Scenario 1: Minor Collision, Increased Premiums

Minor Collision Resulting in Increased Premiums

Imagine Sarah, a careful driver with a clean driving record, is involved in a minor collision at a low speed. Both drivers are deemed equally at fault (50/50). The damage to Sarah’s car consists of a dented bumper and a scratched fender, totaling $1,500 in repairs. Her insurance company pays its share ($750), but because she was partially at fault, her premiums increase. The increase might be modest, perhaps 10-15%, resulting in an extra $50-$75 per year on her previously $500 annual premium. This is because insurance companies view even minor at-fault accidents as indicators of increased risk.

Scenario 2: Significant Accident, Substantial Premium Increase

Significant Accident and Substantial Premium Increase

Consider a different scenario involving John, who has a less-than-perfect driving record. He’s involved in a more significant accident, again a 50/50 fault determination. The accident results in $10,000 in damages to his vehicle, requiring extensive repairs. His insurance covers its $5,000 share, but the impact on his premiums is considerably more severe. Given his driving history and the severity of the accident, his insurance company might increase his premiums by 25-40%, adding a significant amount to his annual cost. This illustrates how pre-existing factors, combined with the severity of the accident, can lead to substantial premium increases even with a 50/50 liability assessment. For instance, if his previous annual premium was $800, a 30% increase would result in an additional $240 annually.

Summary

Navigating the aftermath of a 50/50 car accident requires a clear understanding of liability and its financial repercussions. While a shared-fault claim will inevitably impact your insurance premiums, the magnitude of the increase is influenced by several factors. By proactively managing your driving record, communicating effectively with your insurer, and choosing a suitable policy, you can minimize the long-term effects on your insurance costs. Remember, being informed and prepared is the best defense against unexpected expenses following a car accident.

Q&A

What constitutes a 50/50 claim in a car accident?

A 50/50 claim means both drivers involved in the accident are deemed equally responsible for the collision. This often occurs in situations like intersection accidents where both drivers failed to yield the right of way.

Will my insurance still cover my damages in a 50/50 claim?

Yes, but your coverage will likely only cover your portion of the damages (50%). Your insurance company will likely pursue recovery from the other driver’s insurance for your remaining costs.

How long will a 50/50 claim stay on my driving record?

The length of time a 50/50 claim remains on your record varies by state and insurance company. It typically ranges from three to seven years and can significantly impact future premiums.

Can I negotiate the percentage of fault in a 50/50 claim?

It’s possible, but challenging. You would need strong evidence to support your argument that the other driver was more at fault. Consult with an attorney if you believe a misallocation of fault has occurred.