Navigating the world of home insurance can feel like deciphering a complex code. Understanding your premiums is crucial for securing adequate coverage without overspending. This guide demystifies the process by exploring the functionality of house insurance premium calculators, the factors influencing your costs, and how to effectively use these tools to find the best policy for your needs.

We’ll delve into the intricacies of various coverage types, compare different online calculators, and highlight potential pitfalls to avoid. By the end, you’ll be equipped with the knowledge to confidently utilize these calculators and make informed decisions about your home insurance.

Understanding House Insurance Premium Calculators

House insurance premium calculators are invaluable tools for homeowners seeking to understand the cost of protecting their property. They provide a quick and convenient way to estimate premiums based on various factors, allowing for informed decision-making before committing to a policy. These calculators streamline the process of obtaining a preliminary cost estimate, eliminating the need for multiple individual inquiries to insurance providers.

Core Functionality of House Insurance Premium Calculators

At their core, house insurance premium calculators use algorithms to process user-supplied information and generate an estimated premium. This process involves comparing the input data against a database of risk factors and applying pre-determined pricing models to arrive at a projected cost. The calculators typically do not provide a binding quote; instead, they offer a reasonable approximation to help users budget and compare potential insurance costs.

Input Parameters for House Insurance Premium Calculators

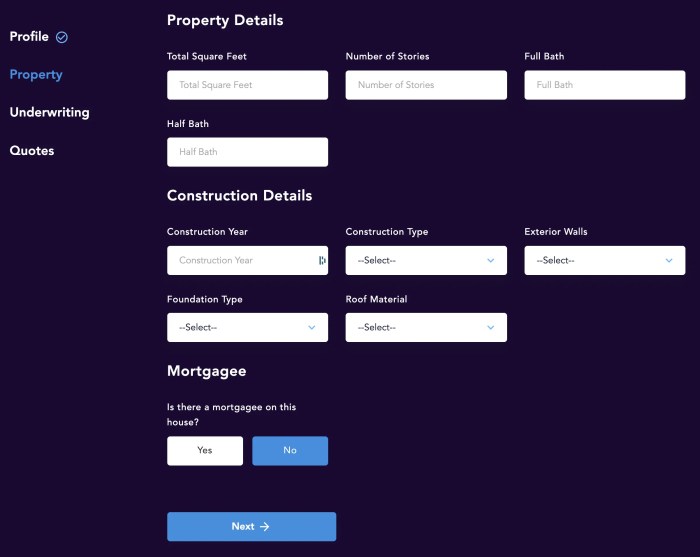

Several key pieces of information are typically required to generate an accurate premium estimate. These inputs allow the calculator to assess the level of risk associated with insuring a particular property. The more detailed the input, the more accurate the estimate will likely be.

User Interaction with a House Insurance Premium Calculator

Using a house insurance premium calculator is generally straightforward. The process typically involves a series of steps, guiding the user through the necessary input fields. First, the user will be prompted to provide basic details about their property, such as its address and value. Then, they will specify the type and level of coverage desired. Finally, the calculator processes the information and displays the estimated premium. Users can then adjust various parameters to see how changes in coverage or risk factors affect the final cost.

Key Features of House Insurance Premium Calculators

| Feature | Description | Importance | Example |

|---|---|---|---|

| Property Value | The estimated market value of the house. | High | $350,000 |

| Location | The address of the property, used to assess risk factors like crime rates and natural disaster probability. | High | 123 Main Street, Anytown, CA 91234 |

| Coverage Levels | The amount of coverage desired for different aspects of the property (e.g., dwelling, personal belongings, liability). | High | $300,000 dwelling coverage, $50,000 personal property coverage, $1,000,000 liability coverage |

| Deductible | The amount the homeowner pays out-of-pocket before the insurance coverage kicks in. | Medium | $1,000 |

| Policy Type | The specific type of insurance policy being considered (e.g., HO-3, HO-4). | High | HO-3 (Special Form) |

| Year Built | The year the house was constructed, influencing the assessment of its condition and potential maintenance needs. | Medium | 1985 |

| Security Features | Presence of security systems (alarm, security cameras) that may reduce risk. | Medium | Security system with monitoring |

Factors Influencing House Insurance Premiums

Several key factors contribute to the final cost of your house insurance premium. Insurance companies meticulously assess these elements to determine the level of risk associated with insuring your property, ultimately influencing the price you pay. Understanding these factors can help you make informed decisions about your insurance coverage and potentially lower your premiums.

Location and Risk Assessment

Your home’s location significantly impacts your insurance premium. Insurance companies conduct detailed risk assessments considering factors like proximity to fire hydrants, the prevalence of natural disasters (earthquakes, floods, wildfires), and crime rates. Areas prone to frequent natural disasters or high crime will generally command higher premiums due to the increased likelihood of claims. For example, a home located in a wildfire-prone region of California will likely have a higher premium than a similar home in a low-risk area of Iowa. Coastal properties, particularly those in hurricane-prone zones, often face significantly higher premiums due to the substantial risk of wind damage and flooding. The specific address of the property is crucial; even within the same city, premiums can vary considerably based on micro-location specifics.

Home Features and Construction

The characteristics of your home itself play a crucial role in premium calculation. The age of the house, its construction materials (brick, wood, etc.), and the presence of safety features like fire alarms, smoke detectors, and security systems all influence the assessed risk. Homes built with fire-resistant materials generally receive lower premiums than those constructed with more flammable materials. Similarly, the presence of a modern security system, including monitored alarms, can lead to significant premium discounts as it mitigates the risk of burglary. The overall condition of the house, as determined by inspections, also influences the premium; well-maintained homes are considered lower risk and attract more favorable rates.

Coverage Amount and Deductible

The amount of coverage you choose directly affects your premium. Higher coverage amounts naturally result in higher premiums, as the insurance company assumes greater financial responsibility in the event of a claim. Conversely, a higher deductible—the amount you pay out-of-pocket before the insurance coverage kicks in—will typically result in a lower premium. This is because a higher deductible reduces the likelihood of smaller claims being filed, lowering the insurer’s overall payout risk. For example, choosing a $1,000 deductible instead of a $500 deductible might reduce your premium by a noticeable amount.

Insurer’s Pricing Models

Different insurance providers utilize varying pricing models and algorithms to calculate premiums. While all consider the factors discussed above, the weighting given to each factor and the specific algorithms used can differ significantly. Some insurers might prioritize location risk more heavily than others, while others might give more weight to the age and condition of the home. This variation in methodologies explains why premiums can differ substantially between providers even for the same property. It is therefore advisable to obtain quotes from multiple insurers to compare pricing and coverage options before making a decision.

Claim History

Your past claim history, both on your home and other insurance policies, can impact your premiums. Filing multiple claims in the past might suggest a higher risk profile, leading to increased premiums. Insurance companies carefully analyze your claim history to assess the likelihood of future claims. Maintaining a clean claim history is essential for securing favorable rates. Conversely, a history of no claims can often result in significant discounts.

Illustrative Examples of Premium Calculations

Understanding how house insurance premiums are calculated can seem complex, but breaking down examples clarifies the process. The following scenarios illustrate how different property characteristics and risk factors influence the final premium. Remember that these are simplified examples and actual calculations involve many more variables and may differ depending on the insurer.

Example 1: A Standard Suburban Home

This example features a 2,000 square foot, single-family home in a suburban neighborhood with a good fire rating. The home is valued at $300,000, and the homeowner requests $250,000 in dwelling coverage. The homeowner has a good credit score and no prior claims. Let’s assume a base premium of $500 annually. Because of the low risk profile, the premium remains close to the base rate. Additional coverage for personal belongings, liability, and other optional add-ons would increase the premium, potentially by 10-20%, resulting in a total annual premium of approximately $600-$650.

Example 2: A Coastal Property with High Wind Risk

Consider a similar-sized home (2,000 sq ft, $300,000 value) located in a coastal area prone to hurricanes. The dwelling coverage is also $250,000. The higher risk associated with hurricane exposure significantly increases the premium. Starting with the same base premium of $500, the coastal location and wind risk might add a surcharge of 50-100%, resulting in a total annual premium ranging from $750 to $1000 or more. This illustrates how location significantly impacts premiums.

Example 3: Impact of Increased Coverage

Let’s revisit the suburban home (Example 1). Suppose the homeowner decides to increase their dwelling coverage from $250,000 to $300,000 (the full value of the home). This increased coverage directly translates to a higher premium. The increase might be proportional, say, 20%, leading to a new premium of approximately $720 – $780. This demonstrates that a higher coverage amount results in a higher premium.

Illustrative Premium Impact Visualization

Imagine a bar graph. The horizontal axis represents different risk factors (e.g., location, coverage amount, credit score, claims history). The vertical axis represents the premium cost. For the suburban home (Example 1), the bar would be relatively short. For the coastal home (Example 2), the bar would be significantly taller, reflecting the higher premium due to hurricane risk. Increasing coverage (Example 3) would lengthen the bar for the suburban home, showing the direct relationship between coverage and cost. A lower credit score or a history of claims would also increase the bar’s height, representing a higher premium. This visual representation highlights how various factors interact to determine the final premium.

Potential Pitfalls and Considerations

While online house insurance premium calculators offer a convenient way to estimate costs, it’s crucial to understand their limitations. These tools provide estimates based on the information you input, and inaccuracies in that input can lead to significant discrepancies between the calculated premium and the final quote from an insurer. Furthermore, these calculators may not account for all the nuanced factors that influence premiums.

Online calculators simplify a complex process. They often rely on averages and generalized data, potentially overlooking specific features of your property or your individual circumstances. This simplification can result in an inaccurate premium estimate, leading to either underinsurance or unnecessary overspending. Therefore, while helpful for initial exploration, they should not be considered the final word on your insurance needs.

Limitations of Online Calculators

Online calculators typically rely on simplified algorithms and may not capture the full complexity of individual risk profiles. For instance, a calculator might not accurately reflect the impact of specific building materials, the presence of security systems, or the precise location of your property within a given risk zone. These factors can significantly influence the final premium, and their omission from the calculation can lead to a misleading estimate. The specific features considered also vary widely between calculators, further complicating accurate comparisons.

The Importance of Professional Advice

Seeking professional advice from an insurance broker is strongly recommended. Brokers have access to a wider range of insurers and products, enabling them to find the most suitable and cost-effective policy for your specific needs. They can also navigate the complexities of insurance jargon and policy details, ensuring you understand the coverage you’re purchasing and its associated costs. Their expertise ensures you’re not only getting a competitive price but also appropriate protection. A broker can also help you identify potential gaps in your coverage that an online calculator might miss.

Ensuring Accurate and Comprehensive Quotes

To obtain the most accurate and comprehensive house insurance quotes, users should meticulously provide all relevant information to both online calculators and, crucially, to insurance brokers. This includes details about the property’s construction, age, location, security features, and any potential risks (e.g., proximity to floodplains or wildfire-prone areas). Be precise with measurements and dates, and don’t hesitate to contact the calculator’s support or your broker if you’re unsure about any input field. Comparing quotes from multiple sources, both through online calculators and directly from insurers or brokers, is also essential for a well-rounded understanding of the market.

Warnings and Best Practices for Using House Insurance Premium Calculators

It’s essential to approach online house insurance premium calculators with a critical eye. Here are some warnings and best practices to ensure you obtain a realistic estimate and avoid potential pitfalls:

- Treat online calculator results as estimates only, not definitive quotes.

- Input all information accurately and completely. Minor inaccuracies can significantly affect the outcome.

- Compare quotes from multiple calculators and insurers to identify the best options.

- Consult with an insurance broker to discuss your specific needs and obtain personalized advice.

- Review the policy documents carefully before accepting any offer to fully understand the coverage and exclusions.

- Don’t solely rely on price; consider the level of coverage offered.

- Be aware that some calculators may prioritize certain insurers or products, potentially biasing results.

- Regularly review your insurance needs and update your policy as your circumstances change (e.g., renovations, additions).

Ultimate Conclusion

Ultimately, understanding your house insurance premium is key to responsible homeownership. While online calculators offer a convenient starting point, remember that they provide estimates. Always consult with an insurance professional to ensure you have the right coverage for your specific circumstances and to refine your understanding of the potential costs involved. Empowered with knowledge, you can navigate the insurance landscape with confidence and secure the best possible protection for your home.

FAQ Guide

What information do I need to use a house insurance premium calculator?

Typically, you’ll need your property’s address, value, square footage, age, type of construction, desired coverage levels (building, contents, liability), and details about any security systems.

Are online house insurance premium calculators accurate?

Online calculators provide estimates. They are useful for comparison shopping, but the final premium from an insurance company might vary due to factors not included in the calculator.

Can I use a house insurance premium calculator to compare different insurers?

Yes, you can use different online calculators from various insurers to compare estimates. This helps you identify potential savings and suitable coverage options.

What if my home has unique features not covered by the calculator?

Contact the insurance company directly. Unique features may require a more detailed assessment by an insurance professional.