Securing your home with adequate insurance is a crucial step in responsible homeownership. However, navigating the complexities of house insurance premiums can feel overwhelming. This guide aims to demystify the process, providing a clear understanding of the factors that influence your premium, the components of a typical policy, and strategies for potentially lowering your costs. We’ll explore everything from location risk to individual risk profiles, equipping you with the knowledge to make informed decisions about your home’s protection.

From understanding the impact of your home’s features and location on your premium to exploring different coverage options and comparing insurer policies, we will delve into the intricacies of house insurance pricing. We will also examine how proactive home maintenance and risk mitigation strategies can contribute to lower premiums over time. By the end of this guide, you will have a solid grasp of how your house insurance premium is calculated and how you can effectively manage this essential cost.

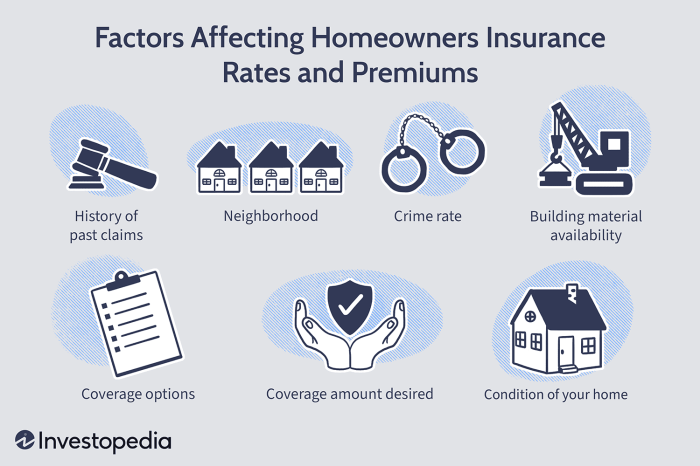

Factors Influencing House Insurance Premiums

Understanding the factors that determine your house insurance premium is crucial for securing the right coverage at a competitive price. Several key elements contribute to the final cost, and being aware of these can help you make informed decisions. This section will detail these influential factors, allowing you to better understand your insurance bill.

Location’s Impact on Premiums

Your home’s location significantly impacts your insurance premium. Insurers assess risk based on factors like crime rates, the frequency of natural disasters (e.g., hurricanes, wildfires, earthquakes), and the proximity to fire hydrants or other emergency services. Areas with higher risks naturally command higher premiums.

| Location | Risk Level | Average Premium | Factors Contributing to Risk |

|---|---|---|---|

| Suburban Area, Low Crime | Low | $1,000 | Low crime rate, proximity to fire station |

| Urban Area, High Crime | Medium-High | $1,500 | High crime rate, higher density of buildings |

| Coastal Area, Hurricane Zone | High | $2,000 | High risk of hurricane damage, proximity to coast |

| Rural Area, Wildfire Prone | Medium | $1,200 | Risk of wildfire, distance from fire services |

Property Features and Premiums

The characteristics of your property directly influence the cost of insurance. Older homes, for instance, might require more extensive repairs following damage, leading to higher premiums. The construction materials also play a role; homes built with fire-resistant materials may receive lower premiums compared to those constructed with more flammable materials. Security systems, such as alarms and security cameras, can significantly reduce premiums as they deter burglaries and reduce the risk of theft.

Coverage Levels and Premium Costs

The amount of coverage you choose directly affects your premium. Higher liability coverage, which protects you against lawsuits related to accidents on your property, will increase your premium. Similarly, increased dwelling coverage (protecting the structure of your house) and personal property coverage (protecting your belongings) will also result in higher premiums. Choosing the appropriate coverage level is a balance between adequate protection and affordability.

Variations in Insurance Company Policies

Different insurance companies use different risk assessment models and offer varying levels of coverage at different price points. For example, one company might offer a lower premium for homes with specific security features, while another might prioritize location as the primary risk factor. Comparing quotes from multiple insurers is crucial to finding the best value for your needs. A home valued at $300,000 might receive a premium of $1,300 from one company and $1,600 from another, even with similar coverage levels, highlighting the importance of comparison shopping.

The Role of Individual Risk Profiles

Your individual characteristics significantly impact your house insurance premium. Insurers assess your risk profile to determine the likelihood of filing a claim, and this assessment directly translates into the cost of your policy. Several key factors contribute to this individualized risk assessment.

Credit Score’s Influence on Premiums

A strong credit score often correlates with responsible financial behavior. Insurers view this as a positive indicator of your likelihood to maintain your property and manage potential risks effectively. A higher credit score typically results in lower premiums, reflecting the lower perceived risk. Conversely, a lower credit score might indicate a higher risk profile, leading to higher premiums or even difficulty securing insurance altogether. This is because individuals with poor credit history may be seen as more likely to default on payments or neglect property maintenance. The specific impact of credit score varies by insurer and location.

Claims History and its Impact

Your past claims history is a significant factor in determining your premium. Filing multiple claims, especially for significant damages, suggests a higher risk to the insurer. This increased risk translates into higher premiums as the insurer anticipates a greater chance of future payouts. Conversely, a clean claims history, demonstrating responsible homeownership and a low likelihood of future claims, often results in lower premiums, rewarding responsible behavior. Some insurers even offer discounts for long periods without claims.

Age and Length of Residence

Age and length of residence are also considered. Younger homeowners, statistically, may have less experience maintaining a home, potentially leading to a higher risk of claims. Similarly, those new to a property might be less familiar with potential risks associated with the location and structure, resulting in a slightly higher premium. However, long-term homeowners with a proven track record of responsible homeownership often benefit from lower premiums as they represent a lower risk profile to insurers.

Premium Differences for Various Homeowner Profiles

First-time homebuyers often face higher premiums compared to long-term homeowners. This difference reflects the lack of established claims history and experience in home maintenance. Long-term homeowners with a solid history of responsible homeownership and no significant claims typically qualify for lower premiums. The premium difference can be substantial, sometimes amounting to hundreds of dollars annually. For example, a first-time homebuyer might pay $1,500 annually, while a long-term homeowner with a clean record might pay only $1,000. These figures are hypothetical and vary widely based on numerous factors.

Hypothetical Scenario Illustrating Premium Variations

Consider two homeowners: Alice, a 30-year-old first-time homebuyer with a fair credit score (680) and no claims history, and Bob, a 55-year-old homeowner with a 20-year history in the same house, an excellent credit score (780), and only one minor claim ten years ago. Alice is likely to receive a higher premium due to her lack of experience and slightly lower credit score. Bob’s established history, excellent credit, and minimal claims history would likely result in a significantly lower premium. This illustrates how individual risk profiles, encompassing credit, claims history, age, and residence duration, substantially impact insurance costs.

Illustrative Examples of Premium Calculations

Understanding how house insurance premiums are calculated can seem complex, but breaking down the process into its constituent parts reveals a logical system based on risk assessment. The following examples illustrate how different property characteristics and risk factors influence the final premium.

Example 1: A Standard Suburban Home

This example considers a typical two-story, 2,000 square foot suburban home located in a low-crime area with a good fire department response time. The home is constructed of brick and has a standard roof. The homeowner has a good credit score and no prior insurance claims.

The following factors contribute to the premium calculation:

- Property Value: $300,000 (This is the primary factor determining coverage amount and, consequently, a significant portion of the premium).

- Location: Low crime rate, proximity to fire station – resulting in a lower risk profile.

- Construction: Brick construction – considered more fire-resistant than wood, leading to a lower premium.

- Coverage Amount: $300,000 (Replacement cost coverage).

- Deductible: $1,000 (Higher deductible chosen by the homeowner, leading to a lower premium).

- Homeowner’s Credit Score: Excellent – resulting in a lower premium.

- Claims History: No prior claims – further reducing the premium.

- Security Systems: Presence of a monitored alarm system (optional add-on, reducing premium).

Estimated Annual Premium: $1,200

Example 2: A High-Value Coastal Property

This example involves a larger, 4,000 square foot home located on the coast, built of wood, with a shingle roof. The home is valued significantly higher, and the area is prone to hurricanes and flooding. The homeowner has a fair credit score and a past claim for wind damage.

The following factors contribute to the premium calculation:

- Property Value: $1,000,000 (High value increases coverage and premium significantly).

- Location: Coastal location, high risk of hurricane and flood damage – significantly increasing premium.

- Construction: Wood construction – more susceptible to fire and wind damage than brick.

- Coverage Amount: $1,000,000 (Replacement cost coverage).

- Deductible: $2,500 (Higher deductible chosen by the homeowner to slightly offset the high premium).

- Homeowner’s Credit Score: Fair – resulting in a higher premium.

- Claims History: Prior wind damage claim – significantly increasing premium.

- Security Systems: No security system installed.

Estimated Annual Premium: $8,000

Comparison of Examples

The significant difference in premiums between the two examples ($1,200 vs. $8,000) highlights the impact of various factors. The coastal property’s higher value, location in a high-risk area, less fire-resistant construction, and the homeowner’s claim history all contribute to a substantially higher premium. Conversely, the suburban home benefits from its lower value, safer location, and the homeowner’s good credit and lack of claims history. The choice of deductible also plays a minor role, but the location and property characteristics are the dominant factors driving the premium disparity.

Last Recap

Ultimately, understanding your house insurance premium is key to responsible homeownership. By carefully considering the factors influencing your premium, selecting appropriate coverage, and implementing proactive risk mitigation strategies, you can ensure your home is adequately protected while managing your insurance costs effectively. Remember to regularly review your policy and shop around for the best rates to ensure you are getting the most value for your investment. Proactive planning and informed decision-making will safeguard both your home and your financial well-being.

FAQ Resource

What is a deductible, and how does it affect my premium?

A deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. Higher deductibles generally lead to lower premiums, as you are accepting more financial responsibility in case of a claim.

How often should I review my house insurance policy?

It’s recommended to review your policy annually, or whenever there are significant changes to your home, such as renovations or additions. This ensures your coverage remains adequate and reflects your current needs.

Can I get discounts on my house insurance premium?

Yes, many insurers offer discounts for various factors, including security systems, fire-resistant materials, bundling policies (home and auto), and claims-free history. Ask your insurer about potential discounts.

What happens if I make a claim and my premium increases?

While some insurers may adjust premiums after a claim, the extent of the increase varies depending on the claim’s severity and your insurer’s policy. It’s important to understand your insurer’s claims process and how it might impact future premiums.