Navigating the world of homeowners insurance can feel like deciphering a complex code. Understanding your premiums is crucial for responsible homeownership, and a homeowners insurance premium calculator can be your key to unlocking clarity. This guide demystifies the process, empowering you to make informed decisions about protecting your most valuable asset.

We’ll explore how these calculators work, the factors influencing your premiums, and how to interpret the results effectively. Learn to navigate the complexities of coverage options, compare quotes from different insurers, and ultimately, secure the best possible homeowners insurance policy for your needs and budget. By the end, you’ll be confident in your ability to utilize these valuable tools to safeguard your home and finances.

Understanding Homeowners Insurance Premiums

Homeowners insurance protects your most valuable asset – your home. Understanding how premiums are calculated is crucial for securing adequate coverage at a price you can afford. Several factors interact to determine your final premium, and knowing these factors allows you to make informed decisions about your policy.

Factors Influencing Homeowners Insurance Costs

Numerous factors contribute to the cost of your homeowners insurance. These factors are analyzed by insurance companies to assess the risk associated with insuring your property. A higher risk generally translates to a higher premium.

Coverage Options in a Homeowners Insurance Policy

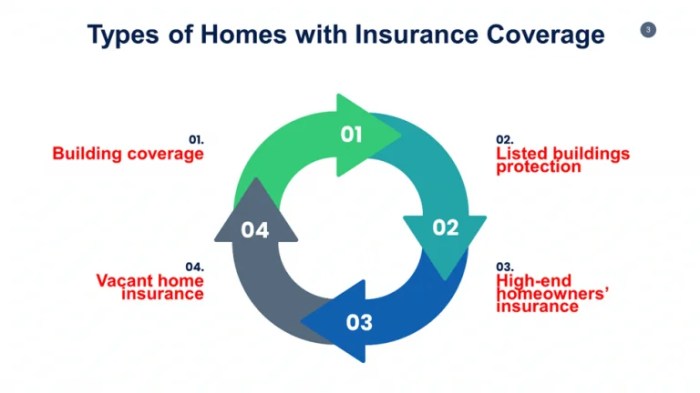

A typical homeowners insurance policy offers several types of coverage. Understanding these options is essential to ensure you have the right protection. These coverages often fall under different sections of your policy, each with its own limits and conditions.

Impact of Factors on Homeowners Insurance Premiums

Each factor influencing your premium plays a specific role in determining the final cost. Some factors have a more significant impact than others, and understanding this interplay is vital for effective cost management.

| Factor | Impact on Premium | Example | Mitigation Strategy |

|---|---|---|---|

| Location | Higher risk areas (prone to natural disasters, high crime rates) result in higher premiums. | A home in a hurricane-prone coastal area will have a higher premium than a similar home in a less risky inland location. | Consider purchasing additional coverage for specific perils, such as flood or earthquake insurance. |

| Home Value | Higher home value means higher replacement cost, leading to a higher premium. | A $500,000 home will generally have a higher premium than a $250,000 home. | Consider the cost of insurance when making decisions about home improvements or renovations. |

| Coverage Amount | Higher coverage amounts lead to higher premiums, but also provide greater protection. | Choosing a higher dwelling coverage limit will increase your premium, but offer more financial protection in case of a major loss. | Carefully assess your home’s replacement cost and choose a coverage amount that adequately reflects it, avoiding over or under insurance. |

| Deductible | A higher deductible reduces your premium, but you pay more out-of-pocket in case of a claim. | A $1,000 deductible will generally result in a lower premium than a $500 deductible. | Weigh the trade-off between a lower premium and higher out-of-pocket expenses in case of a claim. |

| Credit Score | In many states, insurers use credit-based insurance scores to assess risk, with lower scores resulting in higher premiums. | An individual with a poor credit score may face significantly higher premiums compared to someone with excellent credit. | Improve your credit score through responsible financial management. |

| Claim History | A history of claims can lead to higher premiums, as it suggests a higher risk profile. | Filing multiple claims in a short period may result in a significant premium increase. | Take preventative measures to minimize the risk of claims. |

| Home Security Features | Security features like alarms and security systems can reduce premiums by lowering the risk of theft or damage. | Homes with monitored security systems often receive discounts on homeowners insurance. | Invest in home security features to reduce your risk and potentially lower your premium. |

How Homeowners Insurance Premium Calculators Work

Online homeowners insurance premium calculators provide a quick estimate of your potential insurance costs. They achieve this by using sophisticated algorithms that process the information you provide to generate a price. While not perfectly accurate, these tools offer valuable insight into the factors influencing your premiums and allow for comparison shopping across different insurers.

These calculators employ algorithms that essentially assess your risk profile. This risk assessment is based on a statistical model that considers numerous factors and assigns weights to each based on historical claims data and actuarial analysis. The model then uses these weighted factors to calculate a predicted premium. The specific algorithms are proprietary to each insurance company or calculator provider, and details are not usually publicly available.

Data Points Used in Premium Calculation

The accuracy of the premium estimate heavily relies on the completeness and accuracy of the data you input. Calculators typically request a range of information to create a comprehensive risk profile. Inaccurate or incomplete data will result in a less reliable estimate.

- Property Details: This includes the address of the property, year built, square footage, number of bedrooms and bathrooms, type of construction (e.g., brick, wood), and any recent renovations or upgrades. The location is particularly crucial, as areas prone to natural disasters (hurricanes, earthquakes, wildfires) will command higher premiums.

- Coverage Details: The level of coverage desired (e.g., dwelling coverage, personal liability coverage) significantly influences the premium. Higher coverage amounts mean higher premiums. Deductible selection also plays a significant role; a higher deductible generally leads to a lower premium.

- Personal Information: Calculators may ask for information such as your credit score (as it’s often a factor in determining risk), claims history, and the presence of security systems (alarms, security cameras). A good credit score typically correlates with lower premiums.

Accuracy Limitations of Online Premium Calculators

It’s crucial to understand that online premium calculators provide estimates, not exact quotes. Several factors contribute to the limitations of their accuracy:

- Simplified Algorithms: The algorithms used are simplified versions of the more complex models employed by insurance companies for final pricing. They may not account for all the nuances that a full underwriting process considers.

- Data Input Limitations: The user’s input is critical. Inaccurate or incomplete information leads to inaccurate estimates. For instance, omitting a past claim could significantly skew the result.

- Lack of Property Inspection: Unlike a full insurance quote, online calculators don’t include a physical inspection of the property. This inspection can reveal hidden risks that affect the final premium.

- Variations Between Insurers: Different insurers use different algorithms and underwriting criteria, leading to varying premium estimates even with the same input data. A calculator may provide an average, but the actual quote from an individual insurer may differ.

Types of Online Homeowners Insurance Premium Calculators

Several types of online calculators exist, each with its strengths and weaknesses.

- General Calculators: These provide a broad estimate based on general information. They are useful for initial comparisons but lack the specificity of other types.

- Insurer-Specific Calculators: Offered directly by insurance companies, these provide estimates tailored to that specific insurer’s pricing model. They often offer a more accurate estimate than general calculators, but are limited to a single insurer.

- Comparison Websites: These aggregate estimates from multiple insurers, allowing for side-by-side comparisons. They provide a convenient way to shop around, but the accuracy of each individual estimate still depends on the underlying algorithms of each insurer.

Using a Homeowners Insurance Premium Calculator Effectively

Homeowners insurance premium calculators are valuable tools for estimating the cost of coverage. Understanding how to use them effectively can save you time and money, helping you find the best policy for your needs. By following a structured approach and understanding potential pitfalls, you can obtain more accurate and reliable premium estimates.

A Step-by-Step Guide to Using a Homeowners Insurance Premium Calculator

Most online calculators follow a similar process. First, you’ll be asked to provide information about your property and yourself. Then, the calculator uses this data to generate a premium estimate. Accuracy depends heavily on the completeness and accuracy of the information provided.

- Property Information: Enter details such as your home’s address, square footage, year built, construction materials (e.g., brick, wood), and the number of bedrooms and bathrooms. Accurate measurements are crucial for accurate estimations.

- Coverage Details: Specify the desired coverage amount for your dwelling, other structures (like a detached garage), personal property, and liability. Understanding different coverage options is essential before inputting values.

- Personal Information: You’ll typically need to provide information like your age, credit score (as it often impacts premiums), and claims history. Be truthful and accurate; inaccuracies will skew the results.

- Additional Features: Many calculators allow you to add optional coverages, such as flood insurance or earthquake insurance. Including these options will give you a more comprehensive premium estimate.

- Review and Compare: Once you’ve entered all the necessary information, review it carefully for accuracy before submitting. The calculator will then provide a premium estimate. Compare quotes from multiple calculators and insurers for a comprehensive understanding of pricing.

Scenarios Where a Calculator is Particularly Useful

Homeowners insurance premium calculators prove particularly beneficial in several situations. For instance, when comparing different coverage levels, exploring the impact of various deductibles, or assessing the cost of adding optional coverages.

- Comparing Coverage Levels: A calculator allows you to quickly see how increasing or decreasing your coverage limits affects your premium. For example, increasing dwelling coverage from $250,000 to $300,000 will likely increase the premium, but it also offers greater protection.

- Exploring Deductible Options: Higher deductibles typically lead to lower premiums. A calculator helps determine the optimal balance between affordability and out-of-pocket expenses in the event of a claim. A $1,000 deductible might result in a lower premium than a $500 deductible.

- Assessing Optional Coverages: Calculators allow you to see the cost of adding optional coverages like flood or earthquake insurance, enabling informed decisions based on your risk assessment and budget. Living in a flood zone would necessitate evaluating flood insurance costs.

Potential Pitfalls to Avoid When Using Homeowners Insurance Premium Calculators

While useful, calculators have limitations. It’s important to be aware of potential inaccuracies.

- Oversimplification: Calculators may not account for all factors that influence premiums, such as the specific location of your home within a zip code or unique features of your property.

- Inaccurate Input: Errors in the inputted information will directly affect the accuracy of the estimate. Double-check all details before submitting.

- Lack of Personalized Advice: Calculators provide estimates, not personalized recommendations. Consult with an insurance agent for tailored advice.

Tips for Obtaining the Most Accurate Premium Estimates

Several strategies can improve the accuracy of your estimates.

- Gather Accurate Information: Before using a calculator, gather all necessary information about your property and coverage needs. This includes detailed property information, such as square footage and construction materials.

- Use Multiple Calculators: Compare estimates from several different insurers to get a broader range of potential premiums. This helps account for variations in underwriting practices.

- Consult an Insurance Agent: While calculators provide valuable estimates, consulting an insurance agent ensures you receive personalized advice and a comprehensive policy that meets your specific needs.

- Understand Your Credit Score’s Impact: Your credit score often plays a significant role in determining your premium. Improving your credit score can potentially lower your insurance costs.

Comparison Shopping for Homeowners Insurance

Finding the best homeowners insurance policy involves more than just looking at the first quote you receive. A thorough comparison across multiple providers is crucial to securing the right coverage at the most competitive price. This process requires a strategic approach, considering various factors and employing effective negotiation techniques.

Comparing quotes from different insurance providers requires a systematic approach. Don’t just focus on the premium; examine the coverage details carefully. Understanding the nuances of different policies is key to making an informed decision. A lower premium might mean inadequate coverage, leaving you vulnerable in the event of a significant loss.

Key Factors in Policy Selection

Several key factors should guide your selection process. Prioritizing these aspects ensures you choose a policy that aligns with your specific needs and budget.

- Coverage Amounts: Ensure the coverage limits (dwelling, personal property, liability) are sufficient to rebuild your home and replace your belongings in case of damage or loss. Consider factors like inflation and the current market value of your home and possessions.

- Deductibles: Higher deductibles typically result in lower premiums, but you’ll pay more out-of-pocket in the event of a claim. Carefully weigh this trade-off based on your risk tolerance and financial situation. A $1,000 deductible will likely result in a lower premium than a $500 deductible, for example.

- Discounts: Many insurers offer discounts for various factors, such as security systems, fire alarms, bundling policies (home and auto), and claims-free history. Actively inquire about all available discounts to potentially reduce your premium.

- Policy Exclusions: Carefully review what events or damages are *not* covered by the policy. Some policies might exclude flood damage or earthquakes, requiring separate coverage. Understanding these exclusions is vital to avoid unexpected costs.

- Customer Service and Claims Process: Research the insurer’s reputation for handling claims efficiently and fairly. Look for online reviews and ratings to gauge their responsiveness and customer service quality. A quick and easy claims process can save you significant stress and time during a difficult situation.

Negotiating Lower Premiums

Negotiating with insurance companies can lead to significant savings. A proactive and informed approach can often result in a more favorable premium.

- Shop Around: Obtain quotes from multiple insurers to leverage competition. This demonstrates your willingness to switch providers, potentially encouraging a better offer.

- Bundle Policies: Bundling your home and auto insurance with the same company often results in significant discounts. This is a straightforward way to lower your overall insurance costs.

- Improve Your Home’s Security: Installing security systems, smoke detectors, and other safety features can qualify you for discounts. These improvements demonstrate a reduced risk profile to the insurer.

- Maintain a Good Credit History: In many states, your credit score impacts your insurance premiums. A good credit score often translates to lower premiums. For example, a score above 700 might result in significantly lower premiums compared to a score below 600.

- Ask for a Review: Periodically review your policy and request a premium adjustment based on any changes in your risk profile (e.g., home improvements, updated security systems).

Questions to Ask Insurance Agents

Asking the right questions during the comparison process is crucial for making an informed decision. These questions help you understand the policy details and the insurer’s practices.

- Specific coverage details for different perils: Inquire about the specific coverage amounts for different types of damage (e.g., fire, wind, water). This ensures you understand the extent of protection offered.

- Claims process timelines and procedures: Understanding the claims process, including the required documentation and estimated processing time, is crucial. This allows you to anticipate and plan for potential claims.

- Details about policy exclusions and limitations: Ask for clarification on any exclusions or limitations mentioned in the policy documents. This helps avoid surprises and ensures you are fully aware of what is and isn’t covered.

- Availability of discounts and premium reduction strategies: Inquire about all available discounts and explore potential strategies for reducing premiums, such as bundling policies or making home improvements.

- The insurer’s financial stability and customer service ratings: Assess the insurer’s financial strength and customer service reputation through independent rating agencies and online reviews. This provides insights into the insurer’s reliability and responsiveness.

Illustrative Examples of Premium Calculations

Understanding how various factors influence homeowners insurance premiums is crucial for accurate estimations. The following examples illustrate how different home characteristics and risk profiles impact the final cost. Remember that these are illustrative and actual premiums will vary based on the specific insurer and their underwriting guidelines.

High-Value Home Premium Implications

A large, custom-built home in an affluent neighborhood valued at $2 million will generally command a significantly higher premium than a more modest home. This is due to the increased replacement cost of the structure and its contents. The insurer’s potential payout in the event of a total loss is substantially greater, leading to a higher premium to cover that risk. Additional factors like high-end finishes and specialized systems will also contribute to a higher premium.

Low-Value Home Premium Implications

Conversely, a smaller, older home valued at $150,000 in a less desirable area may have a lower premium. The lower replacement cost translates to a lower potential payout for the insurer, resulting in a lower premium. However, this doesn’t necessarily mean it’s always cheaper; factors like the home’s age and condition, as well as the area’s crime rate, can still influence the final cost. Older homes may require more maintenance and have a higher risk of needing repairs.

Multiple Risk Factors and Premium Implications

Consider a home located in a high-risk hurricane zone, built with outdated electrical wiring, and situated near a wildfire-prone area. This scenario combines several risk factors that significantly increase the likelihood of claims. The insurer will assess each factor individually and cumulatively. The increased risk will result in a considerably higher premium to offset the potential for multiple and substantial claims. This illustrates how accumulating risk factors can exponentially increase the premium.

Few Risk Factors and Premium Implications

Imagine a newly built home in a safe neighborhood with updated safety features, such as a modern electrical system and fire-resistant roofing materials. Located in a low-risk area with a low crime rate, this home presents a significantly lower risk to the insurer. Consequently, the premium will reflect this lower risk profile, resulting in a more affordable insurance cost. The combination of modern construction, safety features, and location significantly reduces the likelihood of costly claims.

Concluding Remarks

Ultimately, understanding your homeowners insurance premiums is about more than just a number; it’s about securing your financial future and protecting your investment. By leveraging the power of a homeowners insurance premium calculator and employing the strategies Artikeld in this guide, you can confidently navigate the insurance landscape, securing the best coverage at a price that works for you. Remember that proactive planning and informed decision-making are your greatest allies in this process.

Helpful Answers

What data do I need to use a homeowners insurance premium calculator?

Typically, you’ll need information about your home (address, square footage, age, construction materials), coverage preferences, and personal details (credit score, claims history).

Are online homeowners insurance premium calculators always accurate?

No, online calculators provide estimates. They may not capture all nuances of your specific situation. Always get a formal quote from an insurer.

Can I use a calculator to compare different insurance providers?

Yes, but it’s best to use several calculators and compare the results to different insurers’ actual quotes. Don’t solely rely on calculator estimates for comparison shopping.

What should I do after getting a premium estimate from a calculator?

Contact multiple insurance providers to get formal quotes, compare coverage options, and negotiate premiums. Don’t automatically accept the first offer.