Understanding your homeowner’s insurance premium is crucial for responsible homeownership. This guide delves into the multifaceted factors influencing premium costs, from location-specific risks to the condition of your property and the level of coverage you choose. We’ll explore various policy types, strategies for reducing premiums, and the intricacies of navigating the claims process. By the end, you’ll be equipped with the knowledge to make informed decisions about protecting your most valuable asset.

This comprehensive overview aims to demystify the complexities of homeowner’s insurance, empowering you to secure the best possible coverage at a price that aligns with your budget. We’ll examine the various components that contribute to your premium, offering practical advice and actionable strategies to optimize your insurance plan.

Factors Influencing Homeowner’s Insurance Premiums

Several key factors influence the cost of homeowner’s insurance. Understanding these factors can help you make informed decisions about your coverage and potentially reduce your premiums. This section will detail the most significant contributors to premium calculations.

Location’s Impact on Home Insurance Premiums

Your home’s location significantly impacts your insurance premium. Insurers assess risk based on geographic factors, primarily focusing on the likelihood of natural disasters and crime rates. Areas prone to hurricanes, earthquakes, wildfires, or flooding command higher premiums due to the increased risk of damage. Similarly, neighborhoods with high crime rates lead to elevated premiums because of the increased risk of theft or vandalism.

| Location Factor | Impact on Premium | Example | Mitigation Strategy |

|---|---|---|---|

| Natural Disaster Risk (e.g., hurricanes, wildfires) | Higher premiums | A home located in a coastal area prone to hurricanes will have a significantly higher premium than a home in a landlocked area. | Consider purchasing supplemental flood or windstorm insurance. Implement home hardening measures (e.g., hurricane shutters, fire-resistant roofing). |

| Crime Rate | Higher premiums | A home in a neighborhood with a high rate of burglaries will have a higher premium than a home in a safer area. | Install security systems, exterior lighting, and consider a neighborhood watch program. |

| Distance to Fire Hydrants and Fire Stations | Lower premiums (if closer) | Homes closer to fire protection services generally have lower premiums due to reduced fire damage risk. | This is a factor largely determined by location and is difficult to mitigate. |

| Proximity to Water Bodies | Higher premiums (if closer) | Homes located near rivers or lakes may face higher premiums due to flood risk. | Consider purchasing flood insurance. Elevate the home or implement flood mitigation measures. |

Home Age and Condition’s Influence on Premiums

The age and condition of your home are critical factors in determining your insurance premium. Older homes, particularly those lacking modern safety features, tend to have higher premiums due to an increased risk of damage or failure of systems. Conversely, well-maintained homes with updated features may qualify for discounts.

For example, a home with outdated electrical wiring or a leaky roof will likely have a higher premium than a similar home with modern, well-maintained systems. Features such as updated plumbing, a newer roof, and fire-resistant materials can lower premiums. Conversely, features like a swimming pool (increased liability) or a detached garage (increased risk of theft) may increase premiums.

Coverage Amounts and Premium Costs

The amount of coverage you choose for your dwelling, liability, and personal property directly impacts your premium. Higher coverage amounts mean higher premiums, as the insurer assumes greater financial responsibility in case of a loss. However, underinsuring your property can leave you financially vulnerable in the event of a significant loss.

For example, a homeowner with $300,000 dwelling coverage will likely pay less than a homeowner with $500,000 dwelling coverage, all other factors being equal. Similarly, increasing liability coverage from $100,000 to $300,000 will increase the premium, but provides greater protection against lawsuits. Adequate personal property coverage protects your belongings in case of theft or damage; insufficient coverage could lead to significant out-of-pocket expenses after a loss.

Credit Score’s Role in Determining Premiums

Many insurance companies use credit scores as a factor in determining homeowner’s insurance premiums. Individuals with excellent credit scores generally receive lower premiums than those with poor credit scores. This is because individuals with good credit history are statistically less likely to file claims.

Scenario: Consider three individuals with identical homes and coverage amounts.

* Excellent Credit: Receives a premium of $1,200 annually.

* Good Credit: Receives a premium of $1,400 annually.

* Poor Credit: Receives a premium of $1,800 annually.

This scenario illustrates how credit scores can significantly influence the cost of homeowner’s insurance. Improving your credit score can lead to considerable savings on your premiums.

Types of Homeowner’s Insurance Coverage

Choosing the right homeowner’s insurance policy is crucial for protecting your most valuable asset. Understanding the different types of coverage available and their nuances is essential to ensure you have adequate protection against unforeseen events. This section will Artikel the key differences between common policy types and highlight the importance of considering supplemental coverages.

Homeowner’s insurance policies are categorized into several types, each offering varying levels of protection. The most common types are HO-3, HO-4, and HO-6. These designations reflect the specific coverage provided and the types of properties they are designed to insure.

Comparison of Homeowner’s Insurance Policy Types

The following bullet points compare and contrast the key features of HO-3, HO-4, and HO-6 policies. Understanding these differences is critical in selecting the appropriate coverage for your specific needs and property type.

- HO-3 (Special Form): This is the most common type of homeowner’s insurance policy. It provides open perils coverage for your dwelling and other structures (meaning it covers damage from most causes, except those specifically excluded), and named perils coverage for your personal property (meaning it covers damage only from specific, listed causes). This means your house is covered for a broader range of events than your belongings.

- HO-4 (Contents Broad Form): This policy is designed for renters and covers personal property against named perils. It does not provide coverage for the dwelling itself, as renters do not own the building.

- HO-6 (Condominium Owner’s Coverage): This policy is specifically designed for condominium owners. It covers the interior of the condo unit for named perils and provides liability coverage. It typically does *not* cover the building’s structure or common areas, which are typically insured by the condominium association.

Perils Covered Under Standard Homeowner’s Insurance Policies

Standard homeowner’s insurance policies typically cover a range of perils, but exclusions are also common. Understanding both covered and excluded events is vital to managing your risk effectively.

Covered Perils: Examples of events typically covered under a standard policy include fire, wind damage, hail, theft, vandalism, and liability for injuries occurring on your property. For instance, if a tree falls on your house during a storm (assuming it’s not due to neglect on your part), the damage would likely be covered under your HO-3 policy. Similarly, if someone slips and falls on your icy driveway and sues you, your liability coverage would typically kick in.

Excluded Perils: Common exclusions often include floods, earthquakes, and acts of war. Damage caused by gradual wear and tear, normal maintenance issues, or intentional acts by the homeowner are also generally not covered. For example, damage caused by a flood would not be covered under a standard homeowner’s insurance policy, and neither would damage from a war or a deliberate act of arson by the homeowner.

Importance of Additional Coverage Options

While standard homeowner’s insurance provides essential protection, additional coverage options are often necessary to address specific risks. Flood insurance and earthquake insurance are prime examples.

Flood Insurance: Flood damage is a significant risk, especially in areas prone to flooding. Standard homeowner’s insurance policies typically exclude flood damage, making flood insurance a critical supplement. A severe flood, like the one experienced in [mention a specific location and year with a notable flood], can cause catastrophic damage, highlighting the importance of this protection. Flood insurance is usually obtained separately through the National Flood Insurance Program (NFIP) or private insurers.

Earthquake Insurance: Similarly, earthquake insurance is essential in earthquake-prone regions. Earthquake damage can be extensive and costly to repair, and standard homeowner’s policies typically do not cover it. The devastating impact of a major earthquake, like the one in [mention a specific location and year with a notable earthquake], underscores the need for this additional coverage.

Understanding Your Homeowner’s Insurance Policy

Having the right homeowner’s insurance is crucial for protecting your most valuable asset. Understanding the details of your policy is just as important as having the coverage itself. This section will guide you through the key components of a typical policy, the claims process, and the importance of regular review and updates.

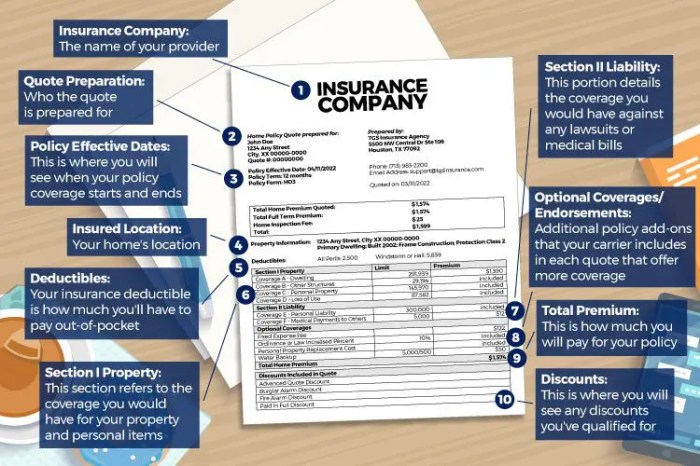

Key Components of a Homeowner’s Insurance Policy

A homeowner’s insurance policy is a legally binding contract. Understanding its various parts is essential for effectively utilizing your coverage. Two primary sections deserve special attention: the declarations page and the policy conditions.

The declarations page summarizes the key details of your insurance coverage. It includes your name and address, the policy number, the covered property’s address and description, the coverage limits (e.g., dwelling coverage, personal property coverage, liability coverage), the policy period, and the premium amount. For example, the declarations page might state that your dwelling is insured for $300,000, your personal property for $150,000, and your liability coverage is $500,000. It also specifies the deductible you’ve chosen, which is the amount you pay out-of-pocket before your insurance coverage kicks in.

The policy conditions Artikel the terms and responsibilities of both you and the insurance company. This section details what events are covered, what is excluded, your responsibilities in case of a claim, and the process for filing a claim. For instance, policy conditions may specify that you must take reasonable steps to mitigate damage after an event, such as covering a broken window to prevent further water damage. They may also Artikel specific situations where coverage is excluded, such as damage caused by intentional acts or from events listed as exclusions in the policy.

The Claims Process

Filing a claim can be stressful, but understanding the process can make it smoother. Here’s a step-by-step guide:

- Report the Damage: Contact your insurance company immediately after an incident causing damage to your property. Provide details about the event and the extent of the damage.

- File a Claim: Follow your insurer’s instructions to formally file a claim. This often involves completing a claim form and providing supporting documentation, such as photos and videos of the damage.

- Claim Investigation: The insurance company will investigate the claim to verify the damage and determine the cause. This may involve an adjuster visiting your property to assess the damage.

- Damage Assessment and Valuation: The adjuster will determine the extent of the damage and its cost to repair or replace. They will consider factors like the age and condition of the damaged items.

- Settlement: Once the assessment is complete, the insurance company will offer a settlement. This may be in the form of a check to cover repairs or replacement costs, minus your deductible.

For example, if a tree falls on your roof during a storm, you would immediately contact your insurer, take photos of the damage, and then file a claim. The adjuster would assess the roof damage, determine the cost of repair or replacement, and then the insurance company would issue a settlement based on your policy’s coverage and deductible.

Regular Policy Review and Updates

Your life circumstances and property value can change over time, requiring adjustments to your homeowner’s insurance coverage. Regularly reviewing your policy ensures you have adequate protection.

For example, if you renovate your home, significantly increasing its value, you’ll need to update your dwelling coverage to reflect the increased value. Similarly, if you acquire valuable items such as jewelry or artwork, you might need to increase your personal property coverage. Conversely, if you downsize your home or reduce the value of your possessions, you might consider adjusting your coverage to avoid paying for unnecessary insurance. Significant changes like a major home improvement project, the purchase of high-value items, or a change in your family structure (e.g., children moving out) are all reasons to review your policy.

Closure

Securing adequate homeowner’s insurance is a cornerstone of responsible homeownership. By understanding the factors influencing your premium, exploring different coverage options, and implementing cost-saving strategies, you can protect your investment while managing your expenses effectively. Remember that regular policy review and proactive engagement with your insurer are key to maintaining optimal coverage and minimizing potential financial burdens.

Question Bank

What is the difference between actual cash value (ACV) and replacement cost coverage?

ACV coverage pays for the current value of your damaged property, minus depreciation. Replacement cost coverage pays for the cost of replacing your damaged property with new, similar items, regardless of depreciation.

How often can I expect my homeowner’s insurance premium to change?

Premiums can change annually, often based on factors like claims history, changes in your property, or adjustments to the insurer’s risk assessment. You’ll typically receive notice of any premium adjustments before your renewal date.

What happens if I have a claim denied?

If a claim is denied, you have the right to appeal the decision. Review your policy carefully, gather supporting documentation, and contact your insurer to understand the reasoning behind the denial and explore options for appealing the decision.

Can I get a discount for having multiple policies with the same insurer?

Yes, many insurers offer discounts for bundling homeowner’s insurance with other policies, such as auto insurance or umbrella liability coverage. This is often referred to as a multi-policy discount.