Securing your home is a significant investment, and understanding the intricacies of your home insurance premium is crucial for responsible financial planning. This guide delves into the factors that influence the cost of your home insurance, providing a clear and concise overview of the process. From location and property condition to coverage levels and individual risk factors, we’ll explore the key elements that shape your premium, empowering you to make informed decisions.

We’ll compare different insurance providers and policy types, helping you navigate the complexities of choosing the right coverage. We’ll also explore strategies to potentially reduce your premiums, ensuring you get the best value for your money while safeguarding your most valuable asset – your home.

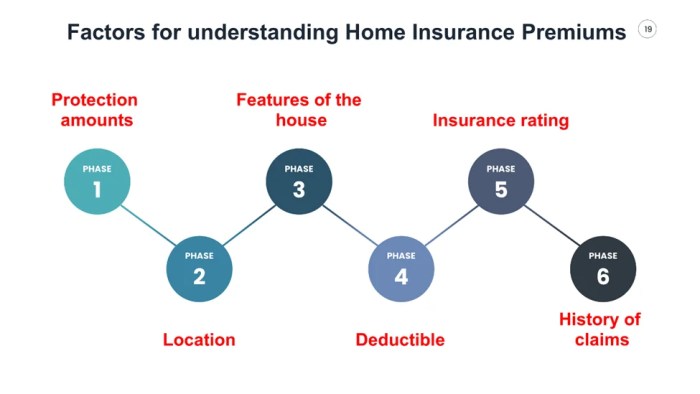

Factors Influencing Home Insurance Premiums

Understanding the factors that determine your home insurance premium is crucial for securing the right coverage at a competitive price. Several key elements contribute to the final cost, and being aware of these can help you make informed decisions about your policy.

Location’s Impact on Home Insurance Costs

Your home’s location significantly impacts your insurance premium. Insurers assess risk based on factors like crime rates, the frequency of natural disasters (hurricanes, wildfires, earthquakes), and the proximity to fire hydrants or other emergency services. High-risk areas, such as those prone to flooding or wildfires (e.g., coastal regions in hurricane-prone states or mountainous areas with dry brush), typically command higher premiums due to the increased likelihood of claims. Conversely, low-risk areas with lower crime rates and minimal natural disaster threats (e.g., certain inland suburban communities) generally enjoy lower premiums. The specific risk profile of your neighborhood is a major factor in determining your rate.

Age and Condition of the Home

The age and condition of your home directly influence your insurance premium. Older homes, especially those lacking modern safety features and updated building materials, are often considered higher risk due to increased vulnerability to damage or deterioration. Conversely, newer homes, built with modern building codes and materials, tend to be less expensive to insure. Regular maintenance and upgrades can also positively impact your premium.

| Age | Condition | Estimated Premium | Risk Factor |

|---|---|---|---|

| New (less than 5 years) | Excellent | $1,000 | Low |

| 10-20 years old | Good (minor repairs needed) | $1,200 | Medium |

| 30-40 years old | Fair (significant repairs needed) | $1,500 | High |

| Over 50 years old | Poor (major repairs/updates needed) | $1,800 | Very High |

*Note: These are hypothetical examples and actual premiums will vary based on many other factors.*

Coverage Amounts and Premiums

The amount of coverage you choose for your home and personal belongings directly affects your premium. Higher coverage limits for dwelling, liability, and personal property will result in higher premiums. For example, a $500,000 dwelling coverage will cost more than a $300,000 dwelling coverage. Similarly, higher liability coverage (protecting you against lawsuits) will increase your premium. It’s essential to balance the desired level of protection with your budget. Consider carefully the replacement cost of your home and belongings when determining your coverage amounts.

Individual Risk Factors and Premiums

Your personal risk profile significantly impacts your insurance premium. A history of claims, even minor ones, can increase your rates. Similarly, a poor credit score might be seen as an indicator of higher risk by some insurers. Conversely, having security systems, such as alarms and security cameras, can reduce your premium because they deter theft and vandalism. Furthermore, factors like the presence of a swimming pool or a dog breed considered dangerous can also influence your premium.

Let’s consider a hypothetical scenario: Sarah, a homeowner with excellent credit and a security system, has a $400,000 home and chooses a standard coverage package. Her estimated premium is $1,100. John, with a similar home and coverage, but a poor credit score and no security system, and a history of two minor claims, might face a premium of $1,500. This illustrates how individual risk factors can substantially impact the cost of home insurance.

Comparing Home Insurance Providers and Policies

Choosing the right home insurance policy can significantly impact your financial security. Understanding the nuances of different providers and policy types is crucial to making an informed decision. This section will compare pricing strategies of major providers, analyze key policy differences, and explore the financial implications of adjusting deductibles.

Home Insurance Provider Pricing Strategies

Different insurers employ various pricing strategies, influenced by factors like risk assessment models, market competition, and operational costs. A comparison of three major providers (hypothetical examples for illustrative purposes) reveals interesting differences.

- Provider A (Hypothetical): This provider emphasizes a broad risk assessment, incorporating factors like credit score, location, and home features to generate a highly personalized premium. They tend to offer competitive rates for low-risk profiles but may charge higher premiums for properties deemed higher risk.

- Provider B (Hypothetical): Provider B focuses on bundling discounts and loyalty programs, offering competitive rates for customers who bundle their home and auto insurance. Their pricing is generally more consistent across risk profiles, with less emphasis on individual risk factors.

- Provider C (Hypothetical): This provider utilizes a more streamlined approach, focusing on simpler underwriting processes and standardized pricing models. Their premiums tend to fall in the middle range, offering a balance between affordability and comprehensive coverage.

Comparison of Home Insurance Policy Types

Several types of home insurance policies cater to diverse needs and budgets. Understanding the differences in coverage and cost is essential for selecting the appropriate policy.

| Policy Type | Coverage Details | Premium Range (Hypothetical Annual) | Pros and Cons |

|---|---|---|---|

| Basic Coverage | Covers damage from fire, wind, and other specified perils. Limited liability coverage. | $500 – $1000 | Pros: Affordable. Cons: Limited protection; additional coverage often needed. |

| Comprehensive Coverage | Covers a wider range of perils, including theft, vandalism, and liability for accidents on your property. Higher coverage limits. | $1000 – $2500 | Pros: Extensive protection. Cons: Higher premiums. |

| Bundled Package (Home & Auto) | Combines home and auto insurance into a single policy, often offering discounts. | $1500 – $4000 (combined) | Pros: Cost savings, convenience. Cons: May require bundling unwanted services. |

Impact of Deductibles on Premiums

Increasing your deductible, the amount you pay out-of-pocket before your insurance coverage kicks in, can significantly reduce your premiums. However, this means you’ll bear more financial responsibility in case of a claim.

For example, let’s consider a hypothetical scenario: A homeowner has a potential annual premium of $1500 with a $500 deductible. Increasing the deductible to $1000 could lower the annual premium to $1200, saving $300 annually. However, if a $800 claim arises, the homeowner with the $1000 deductible would pay the entire amount out-of-pocket, whereas the homeowner with the $500 deductible would only pay $500. The financial implications depend on your risk tolerance and financial capacity to handle a larger out-of-pocket expense in the event of a claim.

Choosing the right deductible involves balancing the cost savings with your ability to absorb potential out-of-pocket expenses in case of a claim.

Saving Money on Home Insurance Premiums

Reducing your home insurance premiums doesn’t require sacrificing coverage. Several strategies can help you lower your costs while maintaining adequate protection for your property. By understanding these strategies and making informed choices, you can significantly reduce your annual expenditure on home insurance.

Many factors influence your home insurance premium. Understanding these factors allows you to take proactive steps to lower your costs. This involves both making changes to your home and shopping around for the best policy.

Strategies for Reducing Home Insurance Premiums

Implementing these strategies can lead to significant savings on your annual home insurance bill. Consider these options as part of a comprehensive approach to managing your insurance costs.

- Increase your deductible: A higher deductible means you pay more out-of-pocket in the event of a claim, but it will typically result in a lower premium. Carefully weigh the potential cost of a higher deductible against the premium savings.

- Improve your credit score: Insurance companies often consider credit scores when determining premiums. A higher credit score can lead to lower rates. Focus on responsible credit management to improve your score.

- Shop around and compare quotes: Different insurers offer varying rates. Obtain quotes from multiple companies to find the most competitive price for comparable coverage.

- Bundle your home and auto insurance: Many insurers offer discounts for bundling home and auto insurance policies. This can result in substantial savings compared to purchasing separate policies.

- Maintain a well-maintained home: Regular maintenance reduces the risk of damage and claims, potentially leading to lower premiums. Keep up with repairs and preventative measures.

- Install security systems and safety devices: These improvements demonstrate a commitment to reducing risk, often resulting in premium discounts. Examples include smoke detectors, burglar alarms, and security cameras.

Impact of Home Improvements on Premium Costs

Investing in home improvements that enhance safety and security can lead to a reduction in your home insurance premiums. This is because these improvements lower the insurer’s risk of having to pay out on claims.

For example, installing a monitored security system can significantly reduce the risk of burglary, leading to a lower premium. Similarly, smoke detectors and fire sprinklers can mitigate fire damage, resulting in potential savings. However, it’s crucial to perform a cost-benefit analysis. While the initial investment in these improvements might be substantial, the long-term savings on premiums can outweigh the initial cost over time. Consider the potential reduction in premiums against the upfront cost of the improvements and their expected lifespan.

Impact of Bundling Home and Auto Insurance

Bundling your home and auto insurance policies with the same insurer often results in significant savings. Insurers incentivize bundling by offering discounts to customers who consolidate their policies. This is beneficial for both the insurer (reduced administrative costs) and the insured (lower premiums).

Hypothetical Example: Let’s say your annual home insurance premium is $1200 and your auto insurance premium is $800. Separately, this totals $2000. If you bundle these policies, you might receive a 15% discount, resulting in a total annual premium of $1700 (2000 * 0.15 = 300; 2000 – 300 = 1700). This represents a saving of $300 annually.

Ultimate Conclusion

Ultimately, understanding your home insurance premium is about more than just the numbers; it’s about protecting your investment and securing your peace of mind. By carefully considering the factors Artikeld in this guide, and by actively engaging with your insurance provider, you can ensure you have the right coverage at a price that works for you. Remember, proactive planning and informed decision-making are key to managing your home insurance effectively and responsibly.

Query Resolution

What happens if I make a claim?

Filing a claim will typically impact your future premiums. The extent of the impact depends on the nature and frequency of claims.

Can I pay my premium monthly?

Most insurers offer monthly payment options, although some may charge a small fee for this convenience.

How often are premiums reviewed?

Premiums are typically reviewed annually, sometimes more frequently depending on your policy and any changes in your circumstances or risk factors.

What if my circumstances change (e.g., new security system)?

Inform your insurer of any changes that might affect your risk profile, such as installing a security system or making significant home improvements. This could lead to a premium reduction.

What is the difference between actual cash value and replacement cost?

Actual cash value considers depreciation, while replacement cost covers the full cost of replacing damaged property without considering depreciation.