Health savings accounts (HSAs) offer a powerful tool for managing healthcare costs, but understanding their intricacies, particularly regarding insurance premium payments, is crucial. This guide delves into the complexities of using HSA funds for insurance premiums, exploring eligibility, contribution limits, tax implications, and investment strategies. We’ll unravel the nuances of HSA usage, empowering you to make informed decisions about your healthcare finances.

From HSA eligibility requirements and enrollment procedures to the tax advantages and investment potential, we’ll provide a clear and concise overview. We’ll also address the often-confusing topic of using HSA funds for insurance premiums, outlining permissible uses and limitations. Ultimately, this guide aims to equip you with the knowledge to maximize the benefits of an HSA and effectively manage your healthcare expenses.

HSA Contribution Limits and Tax Advantages

Health Savings Accounts (HSAs) offer a powerful way to save for healthcare expenses while enjoying significant tax benefits. Understanding the contribution limits and tax advantages is crucial to maximizing the HSA’s potential. This section will clarify these aspects, providing a clear picture of how HSAs can benefit your healthcare financial planning.

Annual HSA Contribution Limits

Contribution limits for HSAs are adjusted annually by the IRS and vary based on age and family status. It’s essential to consult the IRS website for the most up-to-date figures, as these limits can change. However, a general understanding of the categories will help in planning. For example, in a given year, the contribution limit might be $3,850 for individuals under age 55 and $7,750 for families under age 55. Individuals age 55 and older typically receive a higher contribution limit, reflecting their potentially increased healthcare needs. Remember that these are illustrative figures and should be verified with the official IRS guidelines.

Tax Advantages of HSA Contributions and Withdrawals

HSAs provide triple tax advantages: contributions are tax-deductible (reducing your taxable income), the money grows tax-deferred (no taxes are paid on investment earnings), and withdrawals for qualified medical expenses are tax-free. This makes HSAs a highly attractive savings vehicle compared to other healthcare savings plans. The tax-free withdrawals are a particularly powerful benefit, allowing you to pay for medical expenses with money that has not been subject to income tax.

Comparison of Tax Implications: HSA vs. Other Healthcare Savings Plans

The table below compares the tax implications of HSAs with other common healthcare savings options, such as Flexible Spending Accounts (FSAs) and Health Reimbursement Arrangements (HRAs).

| Feature | HSA | FSA | HRA |

|---|---|---|---|

| Contributions | Tax-deductible | Pre-tax | Employer-funded, pre-tax |

| Growth | Tax-deferred | No growth | No growth |

| Withdrawals for Qualified Medical Expenses | Tax-free | Tax-free | Tax-free |

| Withdrawals for Non-Qualified Expenses | Taxable + 10% penalty (under age 65) | Taxable + possible penalty | Taxable + possible penalty |

| Carryover | Unlimited | Typically no carryover | Typically no carryover |

Using HSA Funds for Insurance Premiums

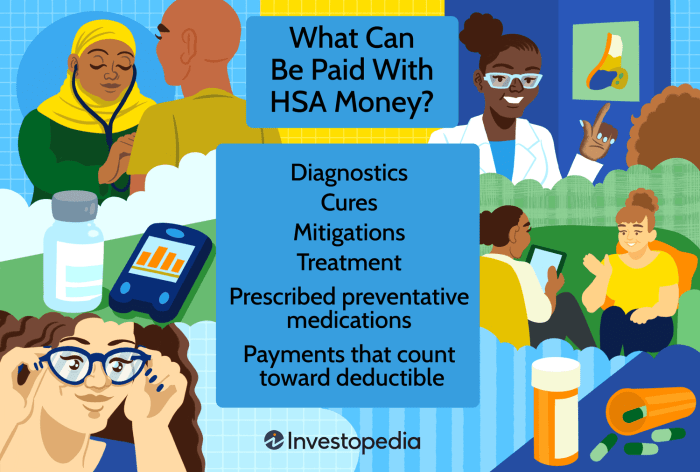

Health Savings Accounts (HSAs) offer a powerful tool for managing healthcare costs, but their utility extends beyond just paying for medical expenses at the point of service. Understanding how HSAs can be used to pay for health insurance premiums is crucial for maximizing their benefits. This section clarifies the rules and provides examples to guide you.

Many people believe HSA funds can only be used for expenses incurred at the doctor’s office or hospital. However, the rules regarding HSA usage are more nuanced, and paying for certain types of health insurance premiums is permissible under specific circumstances. This depends largely on the type of insurance plan and the specific terms of your HSA.

Medicare Premiums and HSA Funds

Generally, HSA funds cannot be used to pay for Medicare Part B premiums. This is because Medicare is considered a government-sponsored insurance program, and HSA funds are primarily intended for expenses associated with qualified health plans. While some individuals may have a Medicare Advantage plan that is considered a qualified high-deductible health plan, this is not universally true, and it’s crucial to check the specifics of your plan and the rules governing your HSA. Using HSA funds for Medicare premiums without proper verification could result in penalties.

COBRA Premiums and HSA Funds

Using HSA funds to pay COBRA premiums is also generally prohibited. COBRA premiums are payments to maintain health coverage after leaving a job, and while these premiums are related to healthcare, they aren’t considered qualified medical expenses under HSA guidelines. The IRS specifically excludes COBRA premiums from the list of eligible HSA expenses.

Allowable and Unallowable HSA Expenses Related to Insurance

The following list summarizes examples of situations where using HSA funds for insurance premiums is either allowed or disallowed. Always consult your HSA provider and the IRS guidelines for the most up-to-date and accurate information.

- Allowable: Premiums for a qualified high-deductible health plan (HDHP) that is part of a comprehensive health insurance policy. This is the most common scenario where HSA funds can be used to pay for insurance premiums. For example, if you have a high-deductible health plan through your employer and have an HSA, you can use HSA funds to pay your monthly premiums.

- Unallowable: Premiums for Medicare Part B, Medicare Part D, or supplemental insurance plans that are not part of a qualified HDHP. These are considered government-sponsored or supplemental insurance plans that do not qualify for HSA reimbursement.

- Unallowable: Premiums for COBRA coverage. COBRA premiums are intended to maintain existing health coverage after leaving employment and are not considered qualified medical expenses.

- Unallowable: Premiums for long-term care insurance. While long-term care is a significant healthcare concern, the premiums are generally not considered eligible expenses under an HSA.

- Allowable (with caveats): Premiums for a short-term health insurance policy *might* be allowable, but this is highly dependent on the specific terms of the policy and whether it meets the requirements of a qualified HDHP. This is an area where careful verification with your HSA provider is essential.

HSA Investment Options and Growth

Harnessing the tax advantages of an HSA extends beyond simply saving for healthcare expenses; strategic investment can significantly boost your long-term savings. Understanding the various investment options available and their associated risks and rewards is crucial for maximizing your HSA’s growth potential.

Choosing the right investment strategy for your HSA depends on your risk tolerance, time horizon, and financial goals. Generally, younger individuals with a longer time horizon may be more comfortable with higher-risk investments, while those closer to retirement might prefer more conservative options.

HSA Investment Options: A Comparison

Several investment options exist for HSA funds, each with varying levels of risk and potential return. The most common include money market accounts and low-cost index funds. Money market accounts offer stability and liquidity, while index funds provide the potential for higher returns, albeit with increased risk.

Money Market Accounts: These accounts are typically low-risk and offer relatively low returns. They are ideal for individuals who prioritize preserving capital and need easy access to their funds. Returns are usually tied to prevailing interest rates and may not keep pace with inflation over the long term. Think of it as a safe, liquid parking spot for your money.

Low-Cost Index Funds: These funds passively track a specific market index, such as the S&P 500. They offer diversification and the potential for higher returns compared to money market accounts, but they also carry greater risk. Market fluctuations can impact the value of your investment. Investing in index funds is like betting on the overall performance of the market, benefiting from its long-term growth potential.

Tax-Free Growth of HSA Funds

One of the most significant advantages of an HSA is the tax-advantaged growth of your investments. Contributions are often tax-deductible (depending on your circumstances), earnings grow tax-free, and withdrawals used for qualified medical expenses are also tax-free. This triple tax advantage can lead to substantial long-term savings compared to traditional savings accounts or taxable investment accounts. This tax-free growth is a powerful tool for wealth accumulation.

Risks and Benefits of Different Investment Strategies

The choice between a conservative approach (money market) and a more aggressive approach (index funds) involves a trade-off between risk and reward.

Conservative Strategy (Money Market): Benefits include low risk and liquidity. The drawback is lower potential returns, which may not outpace inflation. This strategy is suitable for those nearing retirement or those with a low risk tolerance.

Aggressive Strategy (Index Funds): Benefits include higher potential returns and long-term growth. The risk involves potential short-term losses due to market fluctuations. This strategy is generally more suitable for younger individuals with a longer time horizon and a higher risk tolerance.

Hypothetical Long-Term Growth Scenario

Let’s consider a hypothetical scenario: Sarah and John both contribute $3,500 annually to their HSAs for 30 years. Sarah invests conservatively in a money market account averaging a 2% annual return, while John invests in a low-cost S&P 500 index fund averaging a 7% annual return (historical average, not a guaranteed return).

Sarah (Money Market): After 30 years, Sarah’s HSA would likely hold approximately $167,000, assuming consistent contributions and a stable 2% return. This calculation ignores any tax implications of withdrawals for medical expenses.

John (Index Fund): After 30 years, John’s HSA could potentially hold approximately $600,000, assuming consistent contributions and a stable 7% return. This calculation ignores any tax implications of withdrawals for medical expenses. This illustrates the significant impact of investment choices on long-term growth.

Managing and Tracking HSA Expenses

Maintaining meticulous records of your HSA transactions is crucial for ensuring compliance with IRS regulations and maximizing the tax advantages of your HSA. Accurate tracking allows you to monitor your spending, avoid penalties, and easily prepare your tax returns. Failing to do so can lead to unnecessary complications and potential financial repercussions.

Effective tracking methods ensure you stay within HSA guidelines and avoid penalties. This involves diligent record-keeping of all deposits, withdrawals, and investment activity within your HSA. This information is essential for both personal financial planning and for tax reporting purposes.

Methods for Tracking HSA Expenses

Several methods facilitate accurate HSA expense tracking. These include using your HSA provider’s online portal, employing dedicated budgeting apps designed for HSA management, or maintaining a spreadsheet or physical ledger. Each method offers unique advantages depending on individual preferences and technological comfort. The chosen method should provide a clear and organized record of all transactions, including dates, descriptions, and amounts.

Importance of Accurate HSA Records

Accurate records are vital for several reasons. They provide a clear audit trail of all HSA activity, facilitating reconciliation with your bank statements and tax documents. This minimizes the risk of errors and simplifies the tax preparation process. Moreover, accurate records are crucial for demonstrating compliance with IRS rules regarding HSA usage, preventing potential penalties or audits. Should a discrepancy arise, comprehensive records provide irrefutable evidence to support your claims.

Common HSA Management Mistakes

Several common mistakes can jeopardize the effectiveness of your HSA. One frequent error is failing to keep adequate documentation of all expenses. This can lead to difficulties during tax season and potential IRS scrutiny. Another common mistake is using HSA funds for ineligible expenses, such as over-the-counter medications or non-qualified medical services. Careless record-keeping and a lack of understanding of HSA guidelines can result in significant financial penalties. Finally, neglecting to track investment performance within the HSA can lead to missed opportunities for growth and potential financial losses.

Organizing and Categorizing HSA Receipts and Documentation

A well-organized system for managing HSA documentation is essential. A dedicated folder, either physical or digital, can house all relevant receipts, statements, and tax documents. Categorizing documents by year and type of expense simplifies retrieval and analysis. Consider using a labeling system that clearly identifies the purpose of each document (e.g., “2024 – Doctor’s Visit,” “2024 – Prescription Drugs”). For digital records, cloud-based storage offers secure and accessible archiving. Regularly reviewing and updating your records ensures accuracy and facilitates easy access when needed. For example, you might scan paper receipts and store them digitally, or use a dedicated app that automatically categorizes transactions based on merchant information.

Last Word

Mastering the use of a Health Savings Account, particularly in the context of insurance premiums, requires careful planning and understanding. By carefully considering eligibility, contribution limits, tax implications, and investment options, individuals can leverage HSAs to significantly reduce healthcare costs over the long term. This guide has provided a framework for navigating this complex landscape, empowering you to make informed decisions and optimize your financial health.

Answers to Common Questions

Can I use my HSA to pay for my spouse’s insurance premiums?

Generally, no. HSA funds can only be used to pay for your own qualified medical expenses. Your spouse’s premiums would be considered their expense, not yours.

What happens to my HSA funds if I change jobs or health insurance plans?

Your HSA funds remain yours, regardless of employment changes or insurance plan modifications. You can continue to contribute and withdraw funds for qualified medical expenses.

Are there penalties for withdrawing HSA funds for non-qualified expenses?

Yes, withdrawals for non-qualified expenses are subject to income tax plus a 20% penalty, unless you are age 65 or older.

Can I contribute to an HSA after I’ve enrolled in Medicare?

No. You are generally ineligible to contribute to an HSA once you are enrolled in Medicare.

How do I choose the best investment options for my HSA?

Consider your risk tolerance, time horizon, and financial goals. Consult a financial advisor for personalized recommendations. Options generally range from low-risk savings accounts to higher-risk investment funds.