Navigating the complexities of tax deductions can be daunting, especially when it comes to healthcare costs. This guide delves into the often-overlooked yet potentially significant tax benefits associated with health insurance premiums. Whether you’re self-employed, a freelancer, or simply curious about maximizing your tax savings, understanding the deductibility of your health insurance premiums is crucial for responsible financial planning.

This exploration will cover the fundamental rules governing premium deductibility, clarifying the requirements for claiming this deduction and illustrating its impact on your adjusted gross income (AGI). We’ll examine various health insurance plan types, their respective deductibility rules, and how your filing status influences the potential tax advantages. Furthermore, we’ll consider the effects of recent and potential future tax law changes on this important deduction.

Deductibility of Health Insurance Premiums

Self-employed individuals often face unique tax situations, and understanding the deductibility of health insurance premiums is crucial for minimizing their tax burden. This section Artikels the general rules, requirements, and examples related to deducting health insurance premiums. We will also compare this to the situation for those employed by a company.

Deductibility Rules for Self-Employed Individuals

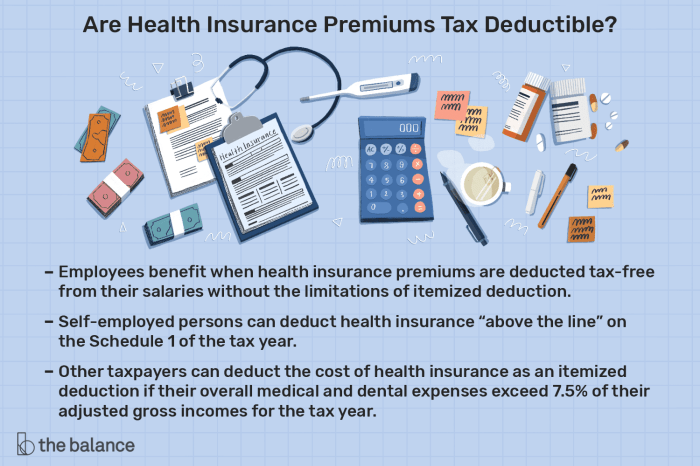

Generally, self-employed individuals can deduct the amount they pay for health insurance premiums as a business expense. This deduction is taken on Schedule C (Profit or Loss from Business) of Form 1040. This allows them to reduce their taxable income and, consequently, their tax liability. However, there are specific requirements that must be met to claim this deduction.

Requirements for Claiming the Deduction

To claim the deduction, you must be self-employed, be considered a sole proprietor, independent contractor, or partner in a partnership, and have paid the health insurance premiums. Crucially, you must not be eligible to participate in an employer-sponsored health plan. You will need to keep records of all premium payments, including receipts, bank statements, or canceled checks. These documents are essential for substantiating your deduction during an audit. Accurate record-keeping is paramount.

Examples of Deductible and Non-Deductible Premiums

Premiums paid for health insurance coverage for yourself, your spouse, and your dependents are generally deductible if you meet the above criteria. However, premiums paid for supplemental insurance policies, such as long-term care insurance, are generally not deductible as medical expenses. If you are employed part-time and also self-employed, the deductibility depends on the specifics of your employment situation and whether you are eligible for an employer-sponsored health plan. In such cases, careful review of IRS guidelines is necessary.

Comparison of Deductibility Rules: Self-Employed vs. Employed

For those employed by a company, health insurance premiums are often paid through pre-tax deductions from their paycheck. This reduces their taxable income, although the amount of reduction may vary depending on the employer’s contribution. Self-employed individuals, on the other hand, pay the premiums directly and deduct them as a business expense. The key difference lies in the method of payment and the timing of the tax benefit. For the employed, the reduction is built into the payroll system; for the self-employed, it’s a deduction claimed during tax filing.

Tax Benefits of Different Health Insurance Plans

The tax benefits associated with health insurance plans are largely dependent on the deductibility of premiums, as described above. The actual dollar amount saved varies depending on your tax bracket and the cost of the plan. The following table illustrates a simplified comparison:

| Plan Type | Monthly Premium | Annual Premium | Approximate Tax Savings (25% tax bracket) |

|---|---|---|---|

| High Deductible Plan | $200 | $2400 | $600 |

| Mid-Range Plan | $500 | $6000 | $1500 |

| Comprehensive Plan | $800 | $9600 | $2400 |

Impact of Health Insurance Premiums on Taxable Income

Deductible health insurance premiums directly influence your taxable income, ultimately affecting your tax liability. Understanding this impact is crucial for effective tax planning. This section will explore how these deductions affect your Adjusted Gross Income (AGI) and potentially other tax benefits, providing illustrative examples to clarify the process.

Adjusted Gross Income (AGI) and Health Insurance Premiums

The deduction for health insurance premiums reduces your Adjusted Gross Income (AGI). AGI is your gross income less certain deductions, and it’s a key figure in determining your eligibility for various tax benefits and credits. Lowering your AGI through the deduction for health insurance premiums can impact your eligibility for tax credits based on AGI, such as the Child Tax Credit or the Earned Income Tax Credit. The amount of your premium deduction directly translates to a lower AGI, potentially resulting in a lower tax burden.

Impact on Other Tax Benefits

The deduction for health insurance premiums can indirectly affect other tax benefits. For example, some tax credits are phased out as your AGI increases. By reducing your AGI, the deduction for health insurance premiums may help you maintain eligibility for these credits or receive a larger credit amount. Conversely, deductions are limited for higher-income taxpayers. A significant reduction in AGI, from a substantial health insurance premium deduction, could affect other deductions which might be limited based on AGI.

Calculating Tax Savings from Health Insurance Premium Deductions

Calculating the tax savings from deducting health insurance premiums involves determining the amount of the deduction and then multiplying it by your marginal tax rate. For example, if you deduct $5,000 in health insurance premiums and your marginal tax rate is 22%, your tax savings would be $1,100 ($5,000 x 0.22). This calculation assumes the entire premium is deductible; eligibility rules vary depending on individual circumstances and the type of health insurance plan.

Tax Savings = (Deductible Health Insurance Premiums) x (Marginal Tax Rate)

Examples of Changes in Health Insurance Premiums and Tax Liability

Consider two scenarios:

Scenario 1: An individual’s health insurance premiums increase by $2,000. Assuming a 25% marginal tax rate, this would result in an additional tax savings of $500 ($2,000 x 0.25), partially offsetting the increased premium cost.

Scenario 2: An individual’s health insurance premiums decrease by $1,000. With a 22% marginal tax rate, this would lead to a reduction in tax savings of $220 ($1,000 x 0.22). This means they would have a lower tax refund or potentially owe more in taxes.

Hypothetical Scenario Illustrating Tax Implications

Let’s imagine Sarah, a single filer, has a gross income of $60,000. Her health insurance premiums are $4,000, fully deductible. Her marginal tax rate is 22%.

* Scenario A: Sarah deducts her full $4,000 in premiums. Her AGI is reduced to $56,000, and her tax savings are $880 ($4,000 x 0.22).

* Scenario B: Due to a change in her plan, Sarah’s premiums increase to $6,000. Her AGI is reduced to $54,000, and her tax savings increase to $1,320 ($6,000 x 0.22). While her premiums increased by $2,000, her tax savings only increased by $440, highlighting the importance of understanding the relationship between premium costs and tax benefits.

Tax Implications for Different Filing Statuses

The deductibility of health insurance premiums, while generally beneficial, is influenced significantly by your filing status. Understanding how your marital status and other factors affect this deduction is crucial for accurate tax preparation and maximizing your tax benefits. The IRS offers different guidelines depending on whether you’re single, married filing jointly, married filing separately, head of household, or qualifying widow(er).

Deductibility of Health Insurance Premiums Based on Filing Status

The basic rule is that self-employed individuals and those not covered by an employer-sponsored plan can deduct the amount they paid in health insurance premiums. However, the *way* you deduct it and the overall impact on your taxable income varies depending on your filing status. For those itemizing deductions, health insurance premiums are deducted as part of medical expenses. The amount you can deduct is limited to the amount exceeding 7.5% of your adjusted gross income (AGI). This AGI calculation itself can be affected by your filing status. For instance, a married couple filing jointly will generally have a higher AGI than a single filer, potentially resulting in a smaller deductible amount.

Specific Rules and Limitations by Filing Status

- Single: Single filers follow the standard rules for itemized deductions, including the 7.5% AGI threshold for medical expenses. They can only deduct premiums if they itemize.

- Married Filing Jointly: Married couples filing jointly combine their incomes and expenses. The combined AGI is used to calculate the 7.5% threshold. They benefit from a potentially higher deduction due to a larger AGI, but also a higher AGI means a higher overall tax liability. The deduction is only beneficial if the total medical expenses exceed 7.5% of their combined AGI.

- Married Filing Separately: Each spouse files a separate return, using their individual income and expenses. The 7.5% AGI threshold is calculated separately for each spouse. This can lead to less advantageous deductions compared to filing jointly.

- Head of Household: This status offers a slightly lower tax rate than single filers, and the 7.5% AGI threshold is calculated based on their individual income. The deduction is subject to the same limitations as single filers.

- Qualifying Widow(er): This status is similar to married filing jointly in terms of the deduction, using the combined income to calculate the AGI and the 7.5% threshold. The tax benefits are similar to married filing jointly.

Examples of Tax Implications for Different Filing Statuses

Let’s consider two scenarios: a single individual and a married couple filing jointly.

Scenario 1: Single Filer

John is single, has an AGI of $50,000, and paid $5,000 in health insurance premiums. His 7.5% AGI threshold is $3,750 ($50,000 * 0.075). He can deduct $1,250 ($5,000 – $3,750).

Scenario 2: Married Filing Jointly

Jane and David are married, filing jointly. Their combined AGI is $100,000, and they paid a total of $8,000 in health insurance premiums. Their 7.5% AGI threshold is $7,500 ($100,000 * 0.075). They can deduct $500 ($8,000 – $7,500).

Comparison of Tax Benefits

While the married couple in Scenario 2 paid significantly more in premiums than John, their deductible amount is much lower due to their higher AGI. This highlights how the AGI significantly impacts the actual tax benefit of the deduction, regardless of filing status.

Detailed Illustration of Tax Calculation for a Married Couple Filing Jointly

Let’s assume Sarah and Tom are married, filing jointly, with a combined AGI of $80,000 before considering the health insurance premium deduction. They paid $6,000 in health insurance premiums.

1. Calculate the 7.5% AGI threshold: $80,000 * 0.075 = $6,000

2. Determine the deductible amount: $6,000 (Premiums) – $6,000 (7.5% AGI threshold) = $0

3. Adjusted Gross Income (AGI) after deduction: In this case, the health insurance premium deduction is $0, so their AGI remains $80,000.

4. Calculate taxable income: This step depends on other deductions and credits. Let’s assume their taxable income after all deductions and credits is $65,000.

5. Determine the tax liability: Using the appropriate tax brackets for their filing status, they calculate their tax liability. (Note: Tax brackets and rates change yearly and are not included here for simplification. This would require referencing current IRS tax tables.)

The key takeaway is that while the deduction is available, its actual benefit is highly dependent on the taxpayer’s AGI, which is in turn influenced by their filing status.

Changes in Tax Laws and Their Impact

The deductibility of health insurance premiums, a significant aspect of tax planning for many individuals and families, has been subject to various changes over the years. Understanding these alterations is crucial for accurately calculating tax liabilities and making informed financial decisions. These changes often reflect shifts in healthcare policy and broader economic considerations.

Historical Overview of Tax Law Changes Affecting Health Insurance Premium Deductibility

The deductibility of health insurance premiums has not remained static. Prior to the Affordable Care Act (ACA), the rules surrounding deductibility were often more complex and varied based on factors such as self-employment status and the type of health plan. The ACA introduced significant changes, impacting both the eligibility for and the manner of claiming deductions. Subsequent tax legislation, such as the Tax Cuts and Jobs Act (TCJA) of 2017, further modified these rules, creating a dynamic landscape for taxpayers to navigate. Tracking these changes chronologically is vital for comprehending their cumulative impact.

Impact of the Affordable Care Act (ACA)

The ACA, enacted in 2010, significantly altered the landscape of health insurance and its tax implications. While it expanded access to health insurance through the establishment of health insurance marketplaces and subsidies, it also modified the deductibility of health insurance premiums. For many individuals, the ACA led to a decrease in the out-of-pocket cost of health insurance through subsidies and tax credits, which effectively reduced their need to rely on premium deductions as a primary means of tax relief. However, the specifics of how the ACA affected deductibility depended heavily on an individual’s income level and eligibility for subsidies. For self-employed individuals, the ACA maintained the ability to deduct health insurance premiums as a business expense, although the rules surrounding this deduction remained largely unchanged from previous years.

Impact of the Tax Cuts and Jobs Act (TCJA) of 2017

The TCJA, while primarily focused on corporate tax rates and individual income tax brackets, indirectly affected the deductibility of health insurance premiums. The changes were not direct alterations to the deduction itself, but rather changes to related tax provisions, such as standard deduction amounts and itemized deduction thresholds. The increased standard deduction, for instance, resulted in fewer taxpayers itemizing their deductions, including health insurance premiums. This meant that the benefit of deducting premiums was diminished for a larger segment of the population. The impact was felt more acutely by those with higher medical expenses who previously relied on itemizing to reduce their overall tax burden.

Potential Future Changes and Their Implications

Predicting future changes in tax laws related to health insurance premiums is inherently speculative. However, potential changes could involve further adjustments to the standard deduction, modifications to the definition of “qualified medical expenses,” or even the introduction of new tax credits or subsidies related to health insurance. These changes could significantly impact the tax burden for various income groups and could influence the decision-making process for individuals choosing health insurance plans. For example, a reduction in the standard deduction could lead to more taxpayers itemizing deductions, potentially increasing the value of deducting health insurance premiums. Conversely, the introduction of a new tax credit could diminish the incentive to itemize health insurance premiums. Such changes would require careful monitoring and adaptation by taxpayers and their tax advisors.

Examples of How Tax Law Changes Affect Individuals in Different Situations

Consider two individuals: Sarah, a self-employed consultant, and Mark, a salaried employee. Before the TCJA, both might have itemized, deducting their health insurance premiums. After the TCJA’s increase to the standard deduction, Sarah, with higher medical expenses, might still itemize and benefit from the deduction. However, Mark, with fewer medical expenses, may now find the standard deduction more advantageous, negating the benefit of itemizing his health insurance premiums. This highlights how changes in tax laws affect individuals differently depending on their specific circumstances and financial situations.

Ending Remarks

Successfully navigating the landscape of health insurance premium tax deductions requires a clear understanding of the applicable rules and regulations. By carefully considering your specific circumstances – your employment status, the type of health insurance plan you hold, and your filing status – you can effectively leverage this deduction to reduce your tax burden. Remember to maintain meticulous records and consult with a tax professional for personalized guidance to ensure you’re maximizing your tax benefits and remaining compliant with all relevant tax laws. Proper planning can significantly impact your overall tax liability and contribute to improved financial health.

Detailed FAQs

Can I deduct health insurance premiums if I’m employed by a company and have employer-sponsored insurance?

Generally, no. Premiums paid by your employer are not deductible by you. However, if you pay for supplemental insurance above and beyond your employer’s plan, that portion *might* be deductible under certain circumstances.

What documentation do I need to claim the deduction?

You’ll need Form 1095-B (or similar) from your insurance provider, showing the premiums paid, and proof of self-employment income (like a Schedule C).

What if I have a health savings account (HSA)? Does that affect the deductibility of my premiums?

If you have a high-deductible health plan (HDHP) and contribute to an HSA, you may be able to deduct contributions to the HSA, but this is separate from the deductibility of your health insurance premiums.

Are there any income limitations for deducting health insurance premiums?

There are no specific income limitations for deducting health insurance premiums for self-employed individuals. However, your deduction is limited to the amount of your self-employment income.