Navigating the complex landscape of health insurance can be daunting, especially when considering its intricate relationship with taxes. Understanding how health insurance premiums impact your tax liability is crucial for both individuals and employers. This exploration delves into the tax deductibility of premiums, the influence of tax laws on affordability, the tax advantages of Health Savings Accounts (HSAs), the role of employer-sponsored plans, and the variations in state and federal regulations. We aim to provide clarity on this often-confusing subject, empowering you to make informed financial decisions.

From the tax benefits of employer-sponsored plans to the potential savings offered by HSAs, the implications are far-reaching and affect a significant portion of the population. This discussion will examine various scenarios, offering practical examples and insights to help you understand how these factors can impact your personal finances and overall tax burden.

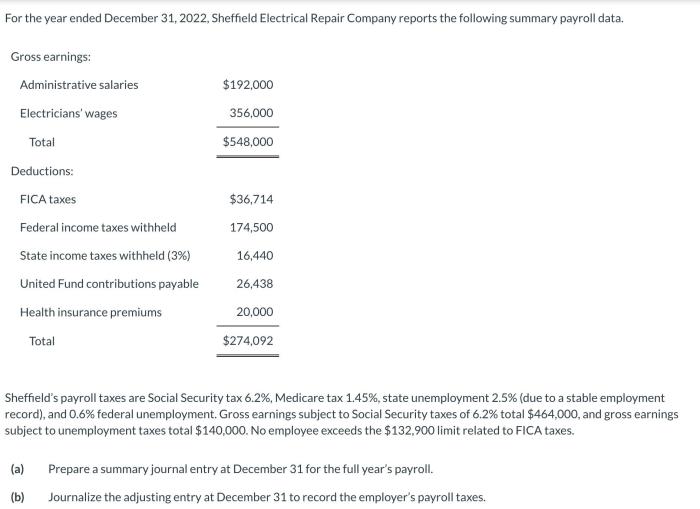

Tax Deductibility of Health Insurance Premiums

Understanding the tax implications of health insurance premiums is crucial for both individuals and employers. The deductibility of these premiums can significantly impact your overall tax liability, offering potential savings. This section Artikels the various ways health insurance premiums can be deducted and the conditions that must be met.

Ways to Deduct Health Insurance Premiums

Several avenues exist for deducting health insurance premiums from your taxable income. The most common methods depend on whether your insurance is employer-sponsored or self-purchased. For self-employed individuals or those without employer-sponsored coverage, deductions may be claimed through itemized deductions on Schedule A of Form 1040. Employer-sponsored plans, while not directly deductible by the employee, offer tax advantages through pre-tax contributions.

Eligibility Requirements for Deducting Health Insurance Premiums

Eligibility for deducting health insurance premiums hinges on several factors. For self-employed individuals, the premiums are deductible as a business expense, provided the insurance covers medical care. The self-employed must meet specific criteria to be eligible, including being considered self-employed by the IRS and actively participating in their business. For individuals not self-employed, the ability to deduct premiums is significantly more limited. Generally, only those with certain qualifying medical expenses exceeding a certain percentage of their adjusted gross income (AGI) can itemize these deductions. The specific percentage threshold changes yearly.

Examples of Deductible and Non-Deductible Premiums

Consider these scenarios: A self-employed consultant pays premiums for health insurance; these premiums are deductible as a business expense. Conversely, an employee receiving employer-sponsored health insurance cannot directly deduct the premiums paid by their employer. However, the employee benefits from the pre-tax nature of employer contributions. If an individual is not self-employed and their medical expenses do not exceed the AGI threshold for itemized deductions, their health insurance premiums are not deductible. Another example of a non-deductible situation is paying premiums for health insurance on a dependent who is not considered a qualifying child or other dependent under IRS rules.

Tax Benefits of Employer-Sponsored vs. Individually Purchased Plans

Employer-sponsored health insurance offers significant tax advantages over individually purchased plans. Employer contributions are often made pre-tax, reducing the employee’s taxable income. Additionally, the employer’s share of the premiums is not included in the employee’s taxable income. Individually purchased plans, on the other hand, may offer deductions only under specific circumstances (as Artikeld above), typically requiring itemized deductions and exceeding the AGI threshold for medical expenses. This means that the tax benefits are generally less significant for those with individually purchased plans.

Tax Implications of Different Health Insurance Premium Scenarios

| Scenario | Premium Payment Method | Tax Deductibility | Tax Impact |

|---|---|---|---|

| Self-Employed Individual | Direct Payment | Deductible as a business expense | Reduces taxable income |

| Employee with Employer-Sponsored Plan | Employer pays portion, employee may pay portion | Employer’s portion not taxable to employee; employee portion may be deductible as part of itemized medical expenses if exceeding AGI threshold | Reduces taxable income (employer portion); potential reduction with itemized deductions (employee portion) |

| Individual with Individually Purchased Plan | Direct Payment | Potentially deductible if medical expenses exceed AGI threshold | May reduce taxable income through itemized deductions |

| Individual with High Medical Expenses | Direct Payment | Potentially deductible even without exceeding AGI threshold if the expenses qualify as medical expenses | Reduces taxable income through itemized deductions |

Impact of Tax Laws on Health Insurance Costs

Tax laws significantly influence the affordability and accessibility of health insurance. Changes in tax policies, particularly those affecting tax credits, subsidies, and deductions, directly impact the premiums individuals and employers pay, and consequently, the overall health insurance coverage rates within a nation. Understanding these impacts is crucial for policymakers and individuals alike.

Tax Credits and Subsidies Influence on Premiums

Tax credits and subsidies are government programs designed to make health insurance more affordable. These programs typically reduce the cost of premiums for eligible individuals and families, often based on income level. The Affordable Care Act (ACA) in the United States, for example, significantly expanded the availability of tax credits to help individuals purchase insurance through the marketplaces. A larger tax credit directly translates to a lower out-of-pocket premium for the insured. Conversely, reductions or eliminations of these subsidies can lead to a substantial increase in premiums, making health insurance inaccessible to many. The impact varies greatly depending on the design of the credit (e.g., whether it’s a fixed amount or a percentage of premium) and the income thresholds that qualify individuals for the subsidy.

Examples of Tax Policies Impacting Health Insurance Coverage Rates

The implementation of the ACA in the United States demonstrates a clear example of how tax policies can impact health insurance coverage rates. The ACA’s expansion of Medicaid eligibility, coupled with the introduction of tax credits and subsidies for marketplace plans, led to a substantial increase in the number of Americans with health insurance. Conversely, attempts to repeal or significantly alter the ACA have been associated with projections of millions losing coverage due to the loss of these tax-based financial supports. This highlights the critical role tax policies play in determining who can afford health insurance.

Potential Unintended Consequences of Tax Policies Related to Health Insurance

Changes in tax laws related to health insurance can have unintended consequences. For instance, altering tax deductions for employer-sponsored health insurance could lead to employers reducing their contributions, ultimately increasing the cost burden on employees. Similarly, modifications to tax credits could inadvertently incentivize individuals to choose less comprehensive plans, potentially leading to poorer health outcomes due to limited coverage. Furthermore, tax policies that favor certain types of insurance plans might lead to market distortions, potentially reducing competition and increasing costs overall. A thorough cost-benefit analysis, considering both direct and indirect effects, is crucial before implementing any significant changes.

Hypothetical Scenario: Tax Increase and Health Insurance Costs

Let’s imagine a scenario where a new 5% tax is imposed on all health insurance premiums. This would directly increase the cost of premiums for every insured individual and employer. For example, an individual currently paying a $500 monthly premium would see their premium rise by $25. This seemingly small increase could be significant for individuals with limited disposable income, potentially forcing some to forgo coverage entirely. For employers, this additional cost might lead to reduced employee benefits or even job losses, particularly in smaller businesses with tighter budgets. This example underscores the far-reaching effects of seemingly small changes in tax policy on healthcare access and affordability.

The Role of Employer-Sponsored Health Insurance and Taxes

Employer-sponsored health insurance represents a significant intersection of healthcare and tax policy in the United States. The system offers considerable tax advantages to both employers and employees, shaping healthcare access and affordability for a substantial portion of the population. Understanding these tax implications is crucial for both individuals and businesses.

Employer contributions to health insurance plans are generally treated favorably under the tax code. This preferential treatment significantly reduces the overall cost of health insurance for both the employer and the employee.

Tax Implications for Employers Offering Health Insurance

The cost of providing health insurance to employees is generally deductible as a business expense for the employer. This means the amount the employer pays towards employee health insurance premiums can be subtracted from their taxable income, thus lowering their overall tax liability. This deduction applies to both the employer’s contribution towards the employee’s premium and the employer’s portion of any associated administrative costs. For example, if a company spends $10,000 on employee health insurance premiums, they can deduct that $10,000 from their taxable income, resulting in a lower tax bill. The specifics of deductibility may vary depending on the type of plan and the structure of the business, so it is always advisable to consult with a tax professional for specific guidance.

Tax Treatment of Employer Contributions to Health Insurance Plans

Employer contributions towards employee health insurance premiums are not considered taxable income to the employee. This is a significant benefit, as it effectively increases the employee’s take-home pay without increasing their taxable income. This non-taxable status applies to the employer’s contribution, but not to any amounts the employee contributes themselves. For instance, if an employer pays $500 per month towards an employee’s health insurance premium, the employee does not need to report that $500 as income. This is in contrast to other forms of compensation, such as salary or bonuses, which are fully taxable.

Examples of How Employer-Sponsored Health Insurance Reduces an Employee’s Tax Burden

Consider two scenarios: Employee A receives a $6,000 annual salary increase, while Employee B receives a $6,000 annual contribution towards their health insurance from their employer. Employee A will see a significant portion of that $6,000 reduced by taxes. Employee B, however, will see the full $6,000 contribute to their disposable income, because the employer’s contribution is tax-free. This demonstrates how employer-sponsored health insurance can significantly reduce an employee’s overall tax burden compared to a direct salary increase of equivalent value.

Potential Tax Advantages and Disadvantages for Employers and Employees

For employers, the primary advantage is the tax deductibility of premiums, reducing their tax liability. A potential disadvantage could be the significant cost of providing comprehensive health insurance, especially for larger companies. For employees, the primary advantage is the tax-free nature of employer contributions, leading to increased disposable income. A potential disadvantage is the limited choice of plans often offered under employer-sponsored schemes, which may not perfectly align with an individual’s specific healthcare needs.

Impact of Different Employer Contribution Levels on Employee Taxes

The level of employer contribution directly impacts the employee’s tax liability, although the employee’s tax liability is not directly affected by the amount the employer contributes. A higher employer contribution translates to a larger portion of the employee’s healthcare costs being covered without any tax consequences. Conversely, a lower employer contribution means the employee will need to pay more out of pocket, and any personal contributions will be subject to taxation. This highlights the importance of understanding the employer’s contribution level when evaluating the overall cost and tax implications of health insurance.

State and Federal Tax Regulations on Health Insurance Premiums

Navigating the landscape of health insurance premiums often involves understanding a complex interplay between state and federal tax regulations. These regulations significantly influence the affordability and accessibility of health insurance for individuals and employers. While the federal government sets a broad framework, states retain considerable autonomy in implementing their own tax policies related to health insurance, leading to variations in costs and benefits across different regions.

The federal government’s influence primarily centers on the Affordable Care Act (ACA), which established tax credits to subsidize health insurance premiums for eligible individuals and families. Additionally, employer-sponsored health insurance plans receive favorable tax treatment, with premiums paid by employers being tax-deductible, and employee contributions often pre-tax. However, the specifics of how these federal provisions interact with state tax codes create a patchwork of regulations affecting the final cost of health insurance.

Variations in State and Federal Tax Laws and Their Impact on Health Insurance Costs

State tax laws introduce additional layers of complexity. Some states offer tax credits or deductions for health insurance premiums, supplementing the federal subsidies. Others may impose taxes on certain health insurance transactions or benefits. These variations can substantially affect the net cost of health insurance for individuals and families. For example, a state with a high premium tax could make insurance significantly more expensive than in a state with no such tax, even if the underlying health insurance plan is the same. The interaction between state and federal tax laws can lead to situations where the total tax burden on an individual varies widely depending on their state of residence. For instance, a low-income individual in a state with generous state tax credits might pay far less in net premiums than a similar individual in a state with no such credits, despite both being eligible for the same federal tax credits.

Examples of Specific State Tax Laws Impacting Health Insurance Premiums

Several states have implemented specific tax laws that directly affect health insurance premiums. For example, some states allow a deduction for health insurance premiums paid by self-employed individuals, reducing their taxable income. Others may offer tax credits targeted at specific populations, such as low-income families or those with pre-existing conditions. Conversely, some states might impose taxes on certain health insurance benefits, such as those related to long-term care or specific types of coverage. California, for instance, has a tax on certain health insurance plans, which can add to the overall cost. Conversely, some states like New York offer tax credits for health insurance purchased through the state marketplace. These examples highlight the significant variability in state-level tax policies impacting the cost of health insurance.

Discrepancies and Inconsistencies Between State and Federal Regulations

Inconsistencies between state and federal regulations can create complexities for individuals and employers navigating the health insurance system. For instance, a state might offer a tax credit that overlaps or conflicts with a federal tax credit, leading to uncertainty about eligibility and the amount of the benefit. Discrepancies in definitions of eligible expenses or qualifying individuals can also cause confusion and potentially limit access to tax benefits. The lack of uniform standards across states makes it challenging to compare the effective cost of health insurance across different jurisdictions.

Illustrative Representation of Tax Treatment Across States

Imagine a bar graph. The horizontal axis lists each state’s abbreviation (e.g., CA, NY, TX, FL). The vertical axis represents the effective tax rate on health insurance premiums (combining state and federal taxes), expressed as a percentage. Each bar’s height represents the effective tax rate in that particular state. States with higher bars indicate higher overall tax burdens on health insurance premiums, reflecting a combination of state and federal tax laws. Some bars might be relatively short, representing states with favorable tax policies, while others would be tall, indicating states with higher overall taxation on health insurance. The graph would visually illustrate the wide range of tax treatments across different states, highlighting the significant variations in the final cost of health insurance for individuals and employers. This visualization would clearly show the substantial impact of state-level tax policies on the overall cost of health insurance across the United States.

Conclusion

Ultimately, understanding the interplay between health insurance premiums and taxes is essential for responsible financial planning. By carefully considering the deductibility of premiums, the impact of tax laws and policies, and the potential advantages of HSAs and employer-sponsored plans, individuals and businesses can optimize their tax situations and ensure affordable healthcare access. While the complexities remain, this overview provides a solid foundation for navigating this critical aspect of personal and corporate finance.

FAQs

Can I deduct health insurance premiums even if I’m not self-employed?

Generally, no. Deductions are primarily available for self-employed individuals or those with specific qualifying health conditions under certain circumstances. Employer-sponsored plans typically handle tax implications differently.

What happens if I overcontribute to my HSA?

Overcontributions to an HSA are subject to penalties. It’s crucial to understand the annual contribution limits set by the IRS to avoid these penalties.

Are there penalties for early withdrawals from an HSA?

Yes, withdrawals for non-qualified medical expenses are subject to income tax and a 20% penalty, unless you are over age 65 or meet specific exceptions.

How do state taxes affect my overall health insurance costs?

State taxes can vary significantly, impacting the overall cost of health insurance through different premium taxes, subsidies, or mandates. It’s important to research your specific state’s regulations.