Navigating the world of health insurance can feel like deciphering a complex code. Premiums, deductibles, co-pays – the terminology alone can be daunting. This guide aims to demystify the relationship between health insurance premiums and deductibles, providing a clear understanding of how these key components interact to determine your overall healthcare costs. We’ll explore the factors influencing these costs, strategies for managing expenses, and ultimately, help you make informed decisions about your health insurance coverage.

Understanding your health insurance plan is crucial for effective financial planning and managing healthcare expenses. This guide will walk you through the intricacies of premiums and deductibles, enabling you to choose a plan that best suits your individual needs and budget. We will explore various plan designs, highlighting the trade-offs between premium payments and out-of-pocket expenses. By the end, you will possess a stronger understanding of how to optimize your health insurance coverage and minimize your financial risk.

Premium and Deductible Interactions

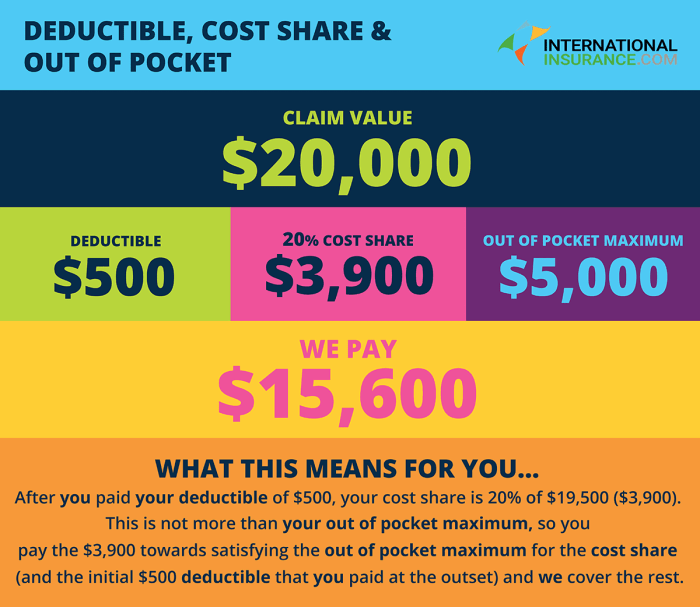

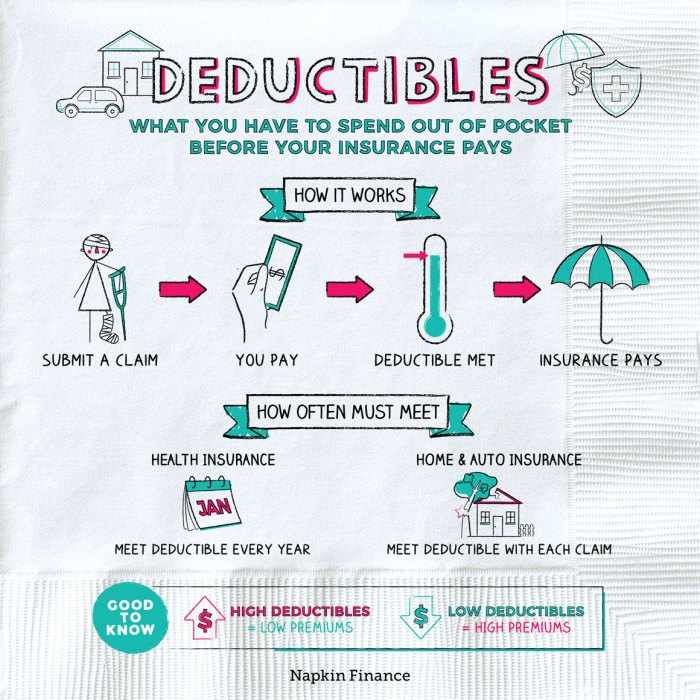

Understanding the interplay between health insurance premiums and deductibles is crucial for selecting a plan that aligns with your individual needs and budget. The relationship is inverse: higher premiums often mean lower deductibles, and vice-versa. This means you’re essentially trading upfront cost (premium) for potential out-of-pocket expenses later (deductible).

Choosing the right balance depends on your health status, risk tolerance, and predicted healthcare utilization.

Comparison of Health Insurance Plan Designs

Different health insurance plans offer a wide spectrum of premium and deductible combinations. High-deductible health plans (HDHPs) typically have lower monthly premiums but higher out-of-pocket maximums and deductibles. Conversely, low-deductible plans boast lower deductibles and out-of-pocket maximums but come with significantly higher monthly premiums. Plans in between offer a middle ground, balancing premium costs and out-of-pocket expenses. Consider a Bronze plan, which typically has the lowest premium but the highest out-of-pocket costs, versus a Gold plan, which offers a balance between premium and out-of-pocket costs. A Platinum plan, while expensive in premiums, minimizes out-of-pocket costs.

Factors Influencing Plan Selection

Several factors significantly influence the choice of a specific premium and deductible combination. These include:

* Expected Healthcare Utilization: Individuals anticipating frequent medical visits or procedures might find a lower-deductible plan more cost-effective in the long run, despite the higher premium. Conversely, healthy individuals with low healthcare needs might prefer a high-deductible plan to save on monthly premiums.

* Financial Risk Tolerance: A high-deductible plan presents a higher financial risk, as you’ll need to cover significant costs upfront before insurance coverage kicks in. Individuals with a lower risk tolerance might opt for a lower-deductible plan to mitigate this risk.

* Health Savings Account (HSA) Eligibility: High-deductible health plans often qualify for Health Savings Accounts (HSAs). HSAs allow pre-tax contributions to be used for qualified medical expenses, potentially offsetting some of the higher deductible costs.

* Employer Contributions: If your employer contributes to your health insurance premiums, the net cost of a higher-premium, lower-deductible plan might be more manageable.

Total Cost of Care Under Different Plan Types

The total cost of care under different plan types involves considering both premium payments and potential out-of-pocket expenses. The following table illustrates a simplified comparison:

| Plan Type | Monthly Premium | Annual Deductible | Out-of-Pocket Maximum |

|---|---|---|---|

| High Deductible (HDHP) | $200 | $6,000 | $7,000 |

| Medium Deductible | $400 | $2,000 | $4,000 |

| Low Deductible | $600 | $500 | $2,000 |

Note: These figures are illustrative examples and vary widely based on location, insurer, and plan specifics. The “Out-of-Pocket Maximum” represents the most you would pay out-of-pocket in a given year. After reaching this limit, your insurance covers 100% of covered expenses.

Epilogue

Choosing the right health insurance plan requires careful consideration of premiums and deductibles. By understanding the interplay between these factors, and by employing strategies to manage costs, you can gain control over your healthcare finances. Remember to consider your individual health needs, budget constraints, and potential out-of-pocket expenses when making your selection. Armed with the knowledge presented here, you can confidently navigate the complexities of health insurance and secure the coverage that best protects your health and financial well-being.

FAQ Explained

What happens if I reach my deductible but still have out-of-pocket expenses?

Even after meeting your deductible, you may still have out-of-pocket expenses like co-pays, coinsurance, and prescription drug costs, depending on your plan.

Can I change my health insurance plan during the year?

Generally, you can only change your health insurance plan during open enrollment periods, unless you experience a qualifying life event (e.g., marriage, job loss).

How do pre-existing conditions affect my premiums and deductibles?

The Affordable Care Act (ACA) generally prevents insurers from denying coverage or charging higher premiums based on pre-existing conditions. However, some plans may have higher premiums overall.

What is coinsurance, and how does it differ from a copay?

Coinsurance is your share of the costs of a covered healthcare service, calculated as a percentage (e.g., 20%). A copay is a fixed amount you pay for a covered healthcare service.