Navigating the complexities of tax deductions can be daunting, especially when it comes to healthcare expenses. Many individuals and business owners are unaware of the potential tax savings available through deductions on health insurance premiums. This guide will unravel the intricacies of this often-overlooked tax benefit, providing clarity on eligibility, documentation, and the overall impact on your tax liability. We’ll explore various scenarios and offer practical advice to help you maximize your tax advantages.

Understanding whether your health insurance premiums are tax deductible hinges on several factors, including your employment status (self-employed versus employed), the type of health insurance plan, and your income level. The rules governing these deductions can be intricate, and even a minor oversight can result in penalties. This guide aims to simplify the process, providing a comprehensive overview and practical examples to guide you through the complexities of claiming this valuable deduction.

Eligibility for Deduction

Understanding the eligibility criteria for deducting health insurance premiums is crucial for maximizing tax benefits. This section details the requirements for both individuals and businesses, clarifying the nuances of self-employment and employer-sponsored plans.

Deductibility of health insurance premiums hinges primarily on your employment status and the type of health insurance plan. For individuals, the rules differ significantly compared to those for businesses or self-employed individuals. The Internal Revenue Service (IRS) provides specific guidelines that must be followed to ensure the deduction is valid.

Deductibility for Self-Employed Individuals

Self-employed individuals can deduct the amount they paid in health insurance premiums as a business expense. This deduction is taken on Schedule C (Profit or Loss from Business) of Form 1040. However, there are limitations. The premiums must be for health insurance covering the self-employed individual, their spouse, and their dependents. The deduction is limited to the amount of net earnings from self-employment. For example, if your net earnings from self-employment were $50,000 and you paid $10,000 in health insurance premiums, you can deduct the full $10,000. But if your net earnings were only $7,000, you could only deduct $7,000. It’s important to maintain detailed records of all premium payments.

Qualifying Health Insurance Plans

A wide range of health insurance plans typically qualify for the premium deduction, including plans purchased through the Health Insurance Marketplace (often referred to as Obamacare), plans obtained directly from insurance companies, and those offered through professional organizations or associations. Medicare Part B and Medigap premiums are generally not deductible, although certain other Medicare-related expenses might be. The key is that the plan must provide medical care coverage. Specific examples include HMOs, PPOs, EPOs, and other comprehensive plans. It is always best to consult with a tax professional or refer to the IRS guidelines for the most up-to-date information.

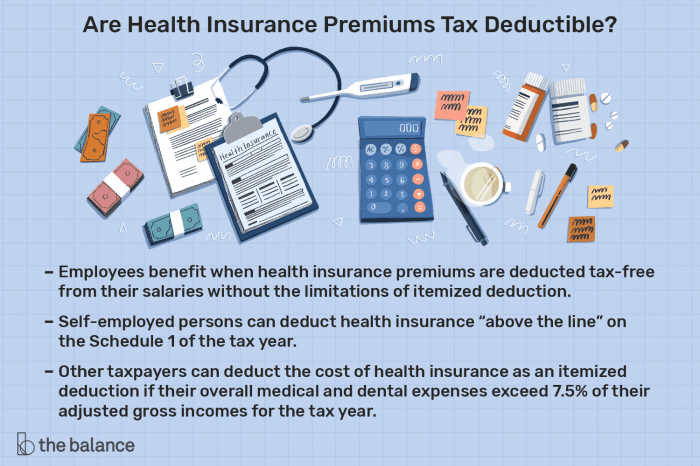

Deductibility Rules: Individual vs. Employer-Sponsored Plans

The deductibility rules differ significantly between individual and employer-sponsored plans. For employer-sponsored plans, the premiums are typically paid by the employer, and the employee doesn’t directly deduct them. The employer’s contribution is not considered taxable income to the employee. However, if an employee pays a portion of the premium through payroll deductions, this amount is not typically deductible on their personal income tax return. In contrast, self-employed individuals or those without employer-sponsored insurance can deduct the full amount of their premiums, subject to the limitations mentioned earlier. Individuals purchasing insurance on the marketplace may also be eligible for subsidies or tax credits that reduce the cost of their coverage, which are different from a direct deduction of the premium.

Eligibility Based on Income and Employment Status

| Plan Type | Eligibility Criteria | Income Limits | Documentation Needed |

|---|---|---|---|

| Employer-Sponsored | Employee of a company offering health insurance | N/A | W-2 form, pay stubs showing premium deductions (if any) |

| Self-Employed | Self-employed individual with net earnings from self-employment | Limited to net earnings from self-employment | Schedule C (Form 1040), 1099 forms, bank statements showing premium payments |

| Individually Purchased | Individual purchasing health insurance without employer sponsorship | No specific income limits for deduction, but may affect eligibility for subsidies/tax credits | Insurance policy documents, payment receipts |

| COBRA Continuation | Continuation of coverage under COBRA; eligibility depends on previous employer coverage | N/A | COBRA documentation, previous employer’s health insurance information |

Types of Deductible Premiums

Understanding which health insurance premiums are tax-deductible can significantly reduce your tax burden. The rules surrounding deductibility can be complex, so it’s crucial to understand the different categories of premiums and their eligibility for deduction. This section will clarify which premiums qualify and which do not.

The deductibility of health insurance premiums hinges primarily on whether the insurance is for medical care. Generally, premiums paid for self-employment health insurance or for coverage under a qualified health plan obtained through the Health Insurance Marketplace (or a similar state-based exchange) are deductible. However, the specific rules and limitations can vary depending on your income, filing status, and the type of health insurance plan.

Self-Employed Health Insurance Premiums

Self-employed individuals can deduct the amount they paid in health insurance premiums for themselves, their spouse, and their dependents. This deduction is taken above the line, meaning it reduces your adjusted gross income (AGI) before other deductions are calculated. The amount you can deduct is limited to the amount of your net earnings from self-employment. For example, if your net earnings from self-employment were $50,000 and you paid $7,000 in health insurance premiums, you can deduct the full $7,000. However, if your net earnings were only $4,000, you could only deduct $4,000.

Premiums for Qualified Health Plans

Premiums paid for health insurance purchased through the Health Insurance Marketplace are also deductible, although the rules are more nuanced and often tied to the individual’s income level and whether they receive a premium tax credit. Individuals who receive a premium tax credit will see a reduction in their taxable income reflecting the credit received. Those who don’t receive a credit may be able to deduct the premiums paid, depending on their modified adjusted gross income (MAGI).

Non-Deductible Premiums

Several types of health insurance premiums are generally not deductible. These include premiums for:

* Supplemental health insurance: Policies that cover specific expenses not covered by your primary health insurance, such as vision or dental insurance, are usually not deductible.

* Life insurance premiums: Premiums paid for life insurance policies are never tax-deductible, regardless of the policy type.

* Disability insurance premiums: While disability insurance can provide valuable financial protection, premiums paid are generally not tax deductible unless the disability is work-related and the premiums are paid by the employer.

Long-Term Care Insurance Premiums

The deductibility of long-term care insurance premiums is complex and depends on several factors, including your age and the policy’s structure. Generally, you may be able to deduct the premiums if you are age 50 or older, and the policy meets certain requirements. However, there are limitations on the amount you can deduct. It’s advisable to consult a tax professional for guidance on this specific type of insurance.

Premiums for Dependent Coverage

Premiums paid for dependent coverage are generally deductible as part of the overall health insurance premium deduction. Whether your dependent is a spouse, child, or other qualifying relative, the premiums paid for their coverage are included in the total deductible amount. However, remember that the total deduction is still limited by your net self-employment income (for self-employed individuals) or your modified adjusted gross income (for those obtaining insurance through the Marketplace).

Deductible vs. Non-Deductible Premium Components

It’s important to distinguish between deductible and non-deductible components within your health insurance premiums. This often comes into play with policies that bundle various types of coverage.

- Deductible: Premiums for medical care coverage obtained through a qualified plan or self-employment insurance. This typically includes hospitalization, doctor visits, and other medical services.

- Non-Deductible: Premiums for non-medical coverage such as vision, dental, long-term care (unless meeting specific criteria), and life insurance. These are usually considered supplemental and are not directly related to the treatment or prevention of illness or injury.

Impact of Tax Laws and Regulations

The deductibility of health insurance premiums is not static; it’s influenced by the ever-changing landscape of tax laws and regulations. Understanding these fluctuations is crucial for accurately calculating tax liabilities and planning for healthcare expenses. Changes in tax policy can significantly impact the amount of tax savings individuals and families realize from this deduction.

Changes in tax laws can alter the deductibility of health insurance premiums in several ways. For example, modifications to the definition of “qualified medical expenses” could affect what types of premiums are eligible for deduction. Similarly, adjustments to income thresholds or tax brackets could impact the overall tax benefit derived from the deduction. A decrease in the standard deduction, for instance, could make the premium deduction more valuable to a larger segment of the population. Conversely, an increase in the standard deduction could reduce the number of people who benefit from itemizing deductions, including the health insurance premium deduction. Legislative changes could also introduce new limitations or phase-outs for the deduction, reducing its effectiveness for higher-income individuals.

Tax Benefits Compared to Other Credits and Deductions

The tax benefits of deducting health insurance premiums must be considered alongside other tax credits or deductions related to healthcare. A direct comparison is essential to determine the most advantageous approach for maximizing tax savings. For instance, the premium tax credit offered through the Affordable Care Act (ACA) provides a direct reduction in the cost of insurance, whereas the deduction for premiums reduces taxable income. The most beneficial option depends on individual circumstances, income level, and the specific details of each tax break. Someone eligible for both might find a combination offers the greatest tax advantage.

Scenarios Limiting or Disallowing the Deduction

Several situations can limit or entirely disallow the deduction of health insurance premiums. For example, if premiums are paid with pre-tax dollars through a health savings account (HSA) or flexible spending account (FSA), the premiums themselves are not deductible again. Additionally, if an individual is claimed as a dependent on someone else’s tax return, they may not be able to deduct health insurance premiums. Self-employed individuals, while generally able to deduct premiums, must adhere to specific guidelines and documentation requirements to ensure eligibility. Failure to meet these requirements could result in the disallowance of the deduction. Furthermore, specific types of health insurance plans might not qualify for the deduction, depending on the plan’s design and features.

Interaction with Other Healthcare Tax Benefits

The deduction for health insurance premiums interacts with other healthcare tax benefits in complex ways. For example, individuals contributing to an HSA can deduct these contributions while also potentially deducting medical expenses, including some health insurance premiums, provided they meet the eligibility requirements. The interplay between these benefits necessitates careful planning to maximize tax advantages. Using a tax professional’s services can help navigate the complexities of these interactions and ensure compliance.

Timeline of Major Changes in Tax Regulations

The deductibility of health insurance premiums has not remained constant throughout history. A timeline illustrating major changes in relevant tax regulations would provide valuable context. For example, the Tax Reform Act of 1986 significantly altered the landscape of itemized deductions, potentially affecting the deductibility of premiums. Subsequent legislative changes, including those related to the Affordable Care Act, have further impacted the rules governing premium deductibility. A comprehensive timeline would need to trace these shifts, noting key legislative acts and their impact on the availability and scope of the deduction. This timeline would require extensive research into tax law history and would be best represented visually in a chart format, detailing the year of the change and a brief description of its impact on premium deductibility. Such a timeline would provide a valuable resource for understanding the historical context of this tax benefit.

Summary

Successfully navigating the tax implications of health insurance premiums requires a thorough understanding of eligibility criteria, documentation requirements, and the potential impact on your overall tax liability. While the rules surrounding deductibility can seem complex, this guide has provided a clear framework for understanding how to claim this valuable deduction. By carefully reviewing your specific circumstances and following the guidelines Artikeld, you can confidently maximize your tax benefits and minimize your tax burden related to healthcare expenses. Remember to consult with a qualified tax professional for personalized advice tailored to your individual situation.

Top FAQs

Can I deduct premiums for my spouse’s health insurance?

Yes, if your spouse is your dependent and you are paying for their health insurance premiums, you may be able to deduct the premiums under certain conditions. The eligibility depends on your filing status and other factors.

What if I overpaid my premiums and received a refund?

The refund treatment depends on when the overpayment occurred. Consult a tax professional for specific guidance, as it may impact your deduction.

Are COBRA premiums deductible?

Generally, COBRA premiums are not deductible unless you meet specific requirements related to self-employment or other qualifying situations. It’s crucial to verify your eligibility.

What forms do I need to report this deduction?

You’ll typically use Form 1040, Schedule A (Itemized Deductions), and may need supporting documentation such as Form 1099-MISC or receipts from your insurance provider.