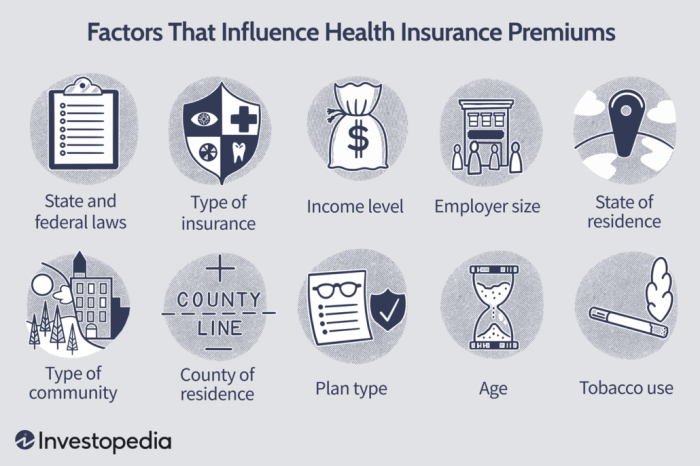

Navigating the complexities of health insurance can feel like deciphering a secret code. Understanding health insurance premiums is crucial for securing adequate coverage without breaking the bank. This guide unravels the mysteries behind premium costs, exploring the various factors that influence them and offering practical strategies for managing your expenses.

From the impact of age and pre-existing conditions to the role of geographic location and lifestyle choices, we’ll delve into the intricate details that shape your monthly premium. We’ll also examine the components of your premium, shedding light on administrative costs and profit margins. Ultimately, this guide empowers you to make informed decisions about your health insurance, ensuring you receive the best possible coverage at a price you can afford.

Future Trends in Health Insurance Premiums

Predicting the future of health insurance premiums requires considering several interconnected factors. These factors, ranging from technological advancements to demographic shifts, will significantly shape the cost of health coverage in the coming years. Understanding these trends is crucial for both individuals and policymakers to prepare for potential changes in affordability and accessibility.

Technological Advancements and Premium Costs

Technological advancements have the potential to both increase and decrease health insurance premiums. While innovative treatments and procedures can drive up costs initially, long-term effects might lead to cost savings. For example, the development of more effective and less invasive surgical techniques, combined with telemedicine and remote patient monitoring, could potentially reduce the overall cost of care, thereby influencing premium rates downward. However, the high initial investment required for new technologies and their adoption by healthcare providers may initially increase premiums. The widespread use of sophisticated diagnostic tools, while improving healthcare outcomes, also contributes to higher initial expenses.

The Impact of an Aging Population

The aging global population presents a significant challenge to the sustainability of health insurance systems. As the proportion of older individuals increases, the demand for healthcare services, particularly chronic disease management and long-term care, rises proportionally. This increased demand places upward pressure on healthcare costs, directly translating to higher premiums. For instance, the rising number of individuals requiring treatment for conditions like Alzheimer’s disease and other age-related illnesses significantly impacts healthcare expenditures and consequently, premium rates. This effect is amplified by the longer life expectancies associated with modern healthcare, meaning individuals require coverage for a longer period.

Factors Influencing Premium Increases and Decreases

Several factors can influence significant fluctuations in health insurance premiums. Increased utilization of healthcare services due to lifestyle factors (e.g., rising obesity rates) and the escalating costs of prescription drugs are significant contributors to premium increases. Conversely, government regulations aimed at controlling drug prices or promoting preventative care could lead to a decrease in premiums. Furthermore, competition among insurance providers, coupled with the adoption of more efficient administrative practices, can also mitigate premium growth. For example, the Affordable Care Act (ACA) in the United States, while aiming to increase access, has also impacted premiums through its regulatory framework. The effect of this framework on premium rates has been a complex and often debated topic.

Closure

Successfully managing health insurance premiums requires a proactive approach encompassing careful planning and informed decision-making. By understanding the factors that influence premium costs, and employing the strategies Artikeld in this guide, individuals can effectively control their healthcare expenses and secure the coverage they need. Remember, a little understanding goes a long way in navigating the often-confusing world of health insurance.

Questions and Answers

What is a deductible?

A deductible is the amount you pay out-of-pocket for covered healthcare services before your insurance begins to pay.

How do I compare different health insurance plans?

Use online comparison tools or consult with an insurance broker. Consider factors like premium cost, deductible, copay, and network of doctors.

Can I change my health insurance plan during the year?

Generally, you can only change plans during the annual open enrollment period, unless you experience a qualifying life event (e.g., marriage, job loss).

What is a copay?

A copay is a fixed amount you pay for a covered healthcare service, such as a doctor’s visit, at the time of service.

What are out-of-pocket maximums?

This is the most you will pay out-of-pocket in a plan year. Once you reach this limit, your insurance company covers 100% of your costs for covered services.