Choosing a health insurance plan can feel like navigating a maze. Two key elements, the premium and the deductible, often leave individuals confused. Understanding the interplay between these two crucial components is essential for making informed decisions about your healthcare coverage and managing your out-of-pocket expenses. This guide will demystify health insurance premiums and deductibles, helping you choose a plan that best aligns with your needs and financial situation.

This exploration will cover the factors influencing premium costs, including age, location, and health status. We’ll delve into the mechanics of deductibles, comparing high-deductible and low-deductible plans, and illustrate how these factors interact to determine your overall healthcare costs. By understanding the relationship between premiums and deductibles, you can make a more informed choice and avoid unexpected financial burdens when facing medical expenses.

Factors Influencing Plan Selection

Choosing the right health insurance plan involves carefully considering your individual needs and circumstances. The interplay between premiums and deductibles is central to this decision, and understanding the factors that influence your selection is crucial for making a financially sound and health-conscious choice. This section explores several key aspects to guide you through the process.

Individual Health Needs and Plan Choice

Your personal health status significantly impacts the optimal balance between premiums and deductibles. Individuals with pre-existing conditions or anticipated high healthcare utilization might find a plan with a lower deductible, even at a higher premium, more beneficial. This minimizes out-of-pocket expenses during periods of significant healthcare need. Conversely, healthy individuals with a lower anticipated need for medical services might opt for a higher deductible plan with lower premiums, saving money in the long run. For example, a young, healthy individual might prefer a high-deductible plan to save on monthly premiums, knowing that the likelihood of needing extensive medical care is lower. In contrast, someone with diabetes requiring regular medication and monitoring would likely prioritize a plan with a lower deductible, even if it means paying a higher premium.

Anticipated Healthcare Utilization and Plan Selection

Forecasting your likely healthcare needs is essential. Consider factors like the frequency of doctor visits, prescription medications, and potential need for specialized care or procedures. If you anticipate needing frequent medical attention, a plan with a lower deductible and higher premium might be more cost-effective in the long run. Conversely, if your healthcare needs are minimal, a high-deductible plan with lower premiums could be more financially advantageous. For instance, a pregnant woman anticipating prenatal care, delivery, and postpartum visits would likely benefit from a plan with lower out-of-pocket costs, even with a higher premium. Conversely, a person with no known health issues and a healthy lifestyle might opt for a higher deductible plan to save money.

Assessing Personal Risk Tolerance

Risk tolerance plays a significant role in plan selection. Individuals with a higher risk tolerance might be comfortable with a higher deductible and lower premium, accepting the potential for larger out-of-pocket expenses in exchange for lower monthly payments. Those with lower risk tolerance might prefer a lower deductible and higher premium, prioritizing financial protection against unexpected healthcare costs. This decision requires a careful assessment of your personal financial situation and your comfort level with potential financial risk. Consider the impact of a large unexpected medical bill on your finances. Can you comfortably absorb such a cost, or would it create significant financial hardship? This self-assessment is crucial in determining your appropriate risk tolerance.

Calculating Potential Cost Savings or Losses

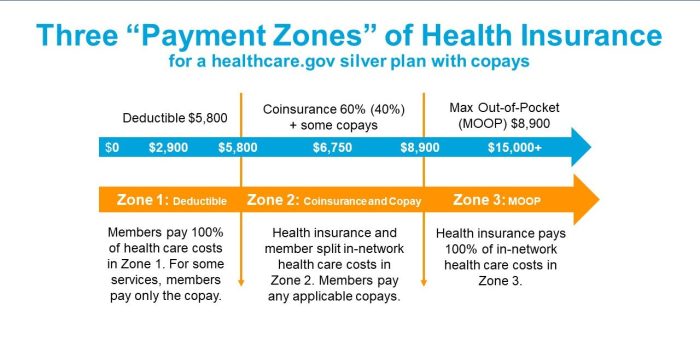

To compare different plan options effectively, you need to calculate the potential cost savings or losses associated with each. This involves considering not only the monthly premium but also the deductible, co-pays, and out-of-pocket maximum. For example, let’s compare two plans: Plan A with a $50 monthly premium and a $5,000 deductible versus Plan B with a $150 monthly premium and a $1,000 deductible. If you anticipate minimal healthcare needs, Plan A might be cheaper overall. However, if you anticipate needing significant care exceeding the $5,000 deductible, Plan B might be more cost-effective despite the higher premium. A simple calculation comparing total annual costs (premium + anticipated out-of-pocket expenses) under each scenario can help you make an informed decision.

Total Annual Cost = (Monthly Premium x 12) + Anticipated Out-of-Pocket Expenses

Remember to factor in all relevant costs, including co-pays and prescription drug costs, for a comprehensive comparison.

Additional Considerations

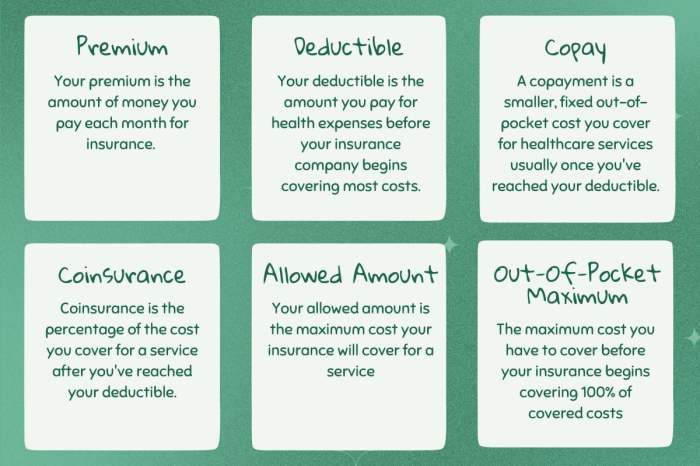

Choosing a health insurance plan involves more than just comparing premiums and deductibles. Understanding the nuances of co-pays, co-insurance, and the policy’s terms and conditions is crucial for managing healthcare costs and ensuring you receive the coverage you need. Failing to fully grasp these aspects can lead to unexpected out-of-pocket expenses and frustration.

Understanding the impact of co-pays and co-insurance on overall healthcare costs is vital for budgeting and financial planning. These cost-sharing mechanisms influence how much you pay out-of-pocket for medical services.

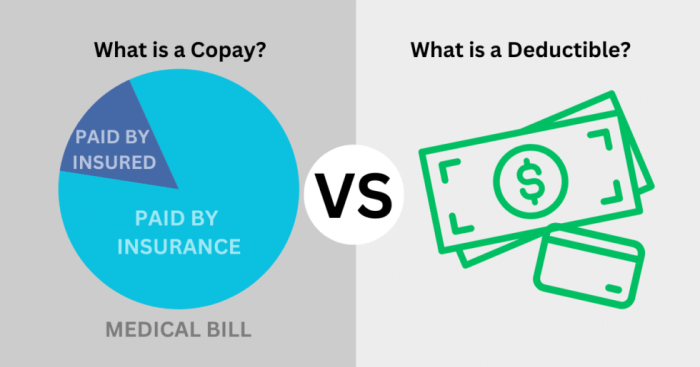

Co-pays and Co-insurance Explained

Co-pays are fixed fees you pay for a medical service, such as a doctor’s visit. Co-insurance, on the other hand, is a percentage of the cost of covered services you pay after you’ve met your deductible. For example, a plan might have a 20% co-insurance rate. If a procedure costs $1000 after the deductible is met, you would pay $200 and your insurance would pay $800. The higher your co-pay and co-insurance, the more you’ll pay out-of-pocket. A high deductible plan with low co-pays and co-insurance might seem appealing initially, but significant medical expenses could still lead to substantial out-of-pocket costs. Conversely, a low deductible plan with high co-pays and co-insurance could result in smaller out-of-pocket expenses for routine care but higher costs for major medical events. Careful consideration of your typical healthcare needs is crucial in determining the best balance.

The Importance of Policy Terms and Conditions

Thoroughly reviewing your health insurance policy’s terms and conditions is paramount. This document Artikels your coverage details, including what’s covered, what’s excluded, limitations on benefits, and procedures for filing claims. Understanding these details prevents misunderstandings and disputes later. For example, a policy might exclude pre-existing conditions for a specified period, or it might have limitations on the number of visits to specialists per year. Ignoring these terms can lead to unexpected bills and disputes with your insurance provider. Take the time to understand your policy’s network of providers, authorization requirements for procedures, and the appeals process for denied claims.

Resources for Further Information

Accessing reliable information is essential for making informed decisions about health insurance. Several resources can assist in this process.

The HealthCare.gov website provides comprehensive information on the Affordable Care Act (ACA) marketplace, including plan comparisons and enrollment assistance. State insurance departments also offer valuable resources and assistance with understanding your state’s regulations and available plans. Independent consumer advocacy groups, such as the Kaiser Family Foundation, publish research and analysis on health insurance trends and consumer protection. Finally, consulting with a qualified insurance broker or financial advisor can provide personalized guidance based on your individual needs and circumstances.

Closing Summary

Ultimately, the best health insurance plan depends on your individual circumstances, anticipated healthcare needs, and risk tolerance. While a lower premium might seem appealing, it could lead to higher out-of-pocket expenses if your deductible is high. Conversely, a higher premium with a lower deductible provides greater protection against unexpected medical bills. By carefully considering your personal health needs, anticipated healthcare utilization, and financial capabilities, you can confidently select a plan that offers the right balance between cost and coverage.

FAQ Section

What is co-insurance?

Co-insurance is the percentage of costs you pay after you’ve met your deductible. For example, 80/20 co-insurance means your insurance pays 80% and you pay 20% of covered expenses after your deductible is met.

What is a co-pay?

A co-pay is a fixed amount you pay for a covered healthcare service, like a doctor’s visit, regardless of your deductible or co-insurance.

Can I change my health insurance plan during the year?

Generally, you can only change your health insurance plan during open enrollment periods, unless you experience a qualifying life event (like marriage, divorce, or job loss) that allows for a special enrollment period.

How do I find out more about my specific plan’s details?

Your insurance company’s website or member services department is the best resource for detailed information about your specific plan’s coverage, benefits, and cost-sharing details. Your policy documents will also contain this information.